Doug Noland writes

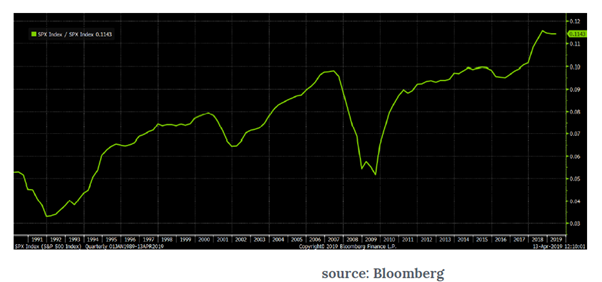

This week saw all-time highs in the S&P500, the Nasdaq Composite, the Nasdaq100, and the Philadelphia Semiconductor Index. Microsoft’s market capitalization reached $1 TN for the first time. First quarter GDP was reported at a stronger-than-expected 3.2% pace.

So why would the market this week increase the probability of a rate cut by the December 11th FOMC meeting to 66.6% from last week’s 44.6%? What’s behind the 10 bps drop in two-year yields to 2.28%? And the eight bps decline in five-year Treasury yields to a one-month low 2.29% (10-yr yields down 6bps to 2.50%)? In Europe, German bund yields declined five bps back into negative territory (-0.02%). Spain’s 10-year yields declined five bps to 1.02% (low since 2016), and Portugal’s yields fell four bps to an all-time low 1.13%. French yields were down to 0.35%. Why would markets be pricing in another round of ECB QE?

In the currencies, king dollar gained 0.6%, trading above 98 for the first time in almost two-years. The Japanese yen outperformed even the dollar, adding 0.3%.

April 22 – Financial Times (Hudson Lockett and Yizhen Jia): “Chinese stocks fell on Monday amid concerns that Beijing may renew a campaign against shadow banking that contributed to a heavy sell-off across the market last year. Analysts pinned much of the blame… on a statement issued late on Friday following a politburo meeting chaired by President Xi Jinping in Beijing. They were particularly alarmed by a term that surfaced in state media reports of the meeting of top Communist party leaders: ‘deleveraging’. That word set off alarm bells among investors still hurting from Beijing’s campaign against leverage in the country’s financial system last year. Those reforms focused largely on so-called shadow banking, which before the clampdown saw lenders channel huge sums of money to fund managers who then invested it in stocks.”

And Tuesday from Bloomberg Intelligence (Qian Wan and Chang Shu): “The Central Financial and Economics Affairs Commission (CFEAC) – the Communist Party’s top policy body headed by President XI Jinping – is focused on ongoing structural reform and deleveraging, citing proactive fiscal policy and prudent monetary policy as key tools. Officials set a pragmatic growth target of 6.0%-6.5% for 2019. The government plan also indicated credit growth in line with that of nominal GDP in 2019, echoing the People’s Bank of China’s statement of ‘maintaining macro leverage.’”

The Shanghai Composite was hammered 5.6% this week. After last year’s scare, markets have good reason to fret the prospect of a return of Chinese “deleveraging” along with the PBOC restricting the “floodgates.” I would add that if Beijing actually plans to manage Credit growth to be in line with nominal GDP, the entire world has a big problem. Over the past year, China’s nominal GDP increased about 7.5%. Meanwhile, Chinese Aggregate Financing expanded at a double-digit annualized rate during Q1. This would imply a meaningful deceleration of Credit growth through the remainder of the year. Don’t expect that to go smoothly.

April 23 – Bloomberg: “The debt pain engulfing some of China’s big conglomerates has intensified in recent days with more bond defaults, asset freezes and payment uncertainties. China Minsheng Investment Group Corp. said last week cross defaults had been triggered on dollar bonds worth $800 million. Lenders to HNA Group Co.’s CWT International Ltd. seized control of assets in Singapore, China and the U.S. after the unit failed to repay a loan… Citic Guoan Group Co., backed by a state-owned company, isn’t certain whether it can pay a bond coupon due on April 27. The increased repayment stress sweeping some of China’s biggest corporations is a sign that the liquidity crunch — induced by a two-year long deleveraging campaign — is far from over despite an improving economy. Bonds from at least 44 Chinese companies totaling $43.7 billion faced repayment pressure as of last week, a 25% jump from the tally at the end of March… ‘The debt crisis at conglomerates can have more of a contagion impact on the corporate bond market compared with an average corporate default because those issuers typically have more creditors and large amount of outstanding debt,’ said Li Kai, a multi-strategy investment director at Genial Flow Asset Management Co.”

Chinese officials surely appreciate the risks associated with rampant debt growth. They have carefully studied the Japanese experience and have surely studied the history of financial crises. Beijing has had ample time to research Bubbles, yet they still have limited actual experience with Credit booms and busts. China has no experience with mortgage finance and housing Bubbles. They have never before managed an economy with a massively leveraged corporate sector – with much of the borrowings via marketable debt issuance. They have no experience with a multi-trillion (US$) money-market complex – and minimal with derivatives. Beijing has zero experience with a banking system that has inflated to about $40 TN – financing a wildly imbalanced and structurally impaired economy (not to mention fraud and malfeasance of epic proportions).

I’m not confident Beijing comprehends how deranged Credit can become late in the cycle. A system dominated by asset Bubbles and malinvestment over time evolves into a crazed Credit glutton. Keeping the historic Chinese apartment Bubble levitated will require enormous ongoing cheap Credit. Keeping the incredibly bloated Chinese corporate sector afloat will require only more ongoing cheap Credit. Ditto for the frighteningly levered local government sector. And the acute and unrelenting pressure on the banking system to support myriad Bubbles with generous lending terms will require massive unending banking balance sheet expansion. Worse yet, at this late “terminal phase” of the cycle it becomes impossible to control the flow of finance. It will instinctively flood into speculation and non-productive purposes. Has China studied the late-twenties U.S. experience?

If Beijing is serious about managing risk, they have no option other than to move to rein in Credit growth. Last year’s market instability, economic weakness and difficult trade negotiations forced officials to back off restraint and instead push forward with stimulus measures. This had characteristics of a short-term gambit.

Chinese officials will not be slamming on the brakes. But if they’re serious about trying to manage Credit and myriad risks, it would be reasonable to expect the imposition of restraint upon the completion of U.S. trade negotiations. Indeed, there are indications this transition has already commenced.

If this analysis has merit, the global market backdrop is near an important inflection point – potentially one of momentous consequence. Chinese Credit growth is about to slow, with negative ramifications for global market liquidity and economic expansion. I would further argue that the synchronized global “Everything Rally” has ensured latent fragilities even beyond those that erupted last year. The conventional view that China is now full speed ahead, with stimulus resolving myriad issues, could prove one of financial history’s great episodes of wishful thinking.

It’s worth recalling the 2018 market backdrop. After beginning the year with a moonshot (emerging markets trading to record highs in late-January), EM turned abruptly lower and trended down throughout much of the year. The Shanghai Composite traded to a high of 3,587 on January 29th, only to reverse sharply for a two-week 14% drop. By July, the Shanghai Composite had dropped 25% from January highs – and was down 31% at October lows (2,449).

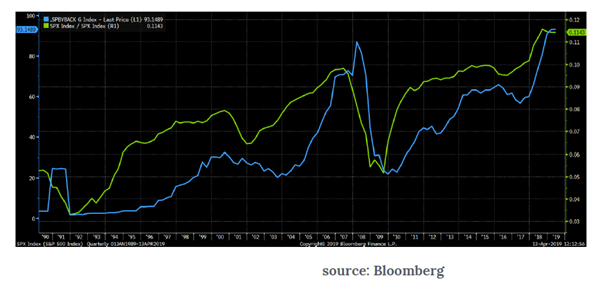

And for much of the year, de-risking/deleveraging at the “Periphery” supported speculative flows to “Core” U.S. securities markets. U.S. equities bounced back from February’s “short vol” blowup and went on a speculative run throughout the summer (in the face of mounting global instability). After trading below 90 for much of April, the Dollar Index had risen to 95 by late-May and 97 in mid-August.

While the Fed raised rates 25 bps in June and again in September, financial conditions remained exceptionally loose. Ten-year Treasury yields traded down to 2.80% (little changed from early-February), held down by global fragilities and the surging dollar. High-yield debt posted positive returns through September. Ignoring rapidly escalating risks, the S&P500 traded right at all-time highs to begin the fourth quarter (10/3). The dam soon broke, with crisis Dynamics coming to fully envelop the “Core.”

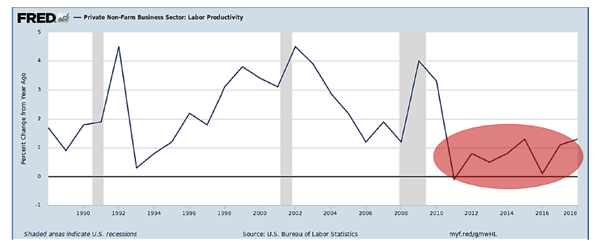

After a several month respite, I’m back on “Crisis Dynamics” watch, carefully monitoring for indications of nascent risk aversion and waning liquidity at the “Periphery.” Last year’s market and economic developments provided important confirmation of the Global Bubble Thesis – including the fundamental proposition that major Bubbles function quite poorly in reverse. Years of zero rates and QE had inflated myriad Bubbles and a highly unbalanced global economy surreptitiously addicted to aggressive monetary stimulus. As tepid as it was, policy “normalization” had engendered latent fragilities – though this predicament remained hidden so long as “risk on” held sway over the markets.

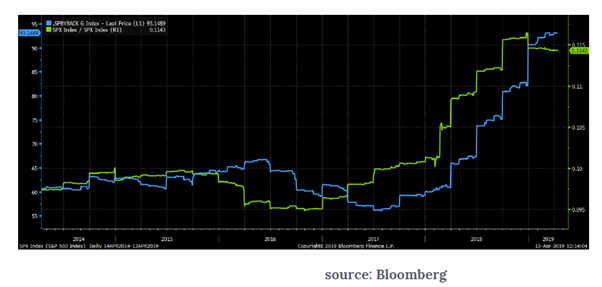

A speculative marketplace gleaned its own 2018-experience thesis confirmation: central bankers won’t tolerate bursting Bubbles. The dovish U-turn sparked a major short squeeze, unwind of bearish hedges and, more generally, a highly speculative market rally. And in global markets dominated by a pool of Trillions of trend-following and performance-chasing finance, rallies tend to take on lives of their own. With 2019’s surging markets and speculative leverage creating self-reinforcing liquidity, last year’s waning liquidity – and December’s illiquidity scare – are long forgotten.

But I’ll offer a warning: Liquidity Risk Lies in Wait. When risk embracement runs its course and risk aversion begins to reappear, it won’t be long before anxious sellers outnumber buyers. When “risk off” De-Risking/Deleveraging Dynamics again attain momentum, there will be a scarcity of players ready to accommodate the unwind of speculator leverage. And when a meaningful portion of the marketplace decides to hedge market risk, there will be a paucity of traders willing to take the other side of such trades.

And there’s an additional important facet to the analysis: Come the next serious “risk off” market dislocation, a further dovish U-turn will not suffice. That trump card was played – surely earlier than central bankers had envisaged. Spoon-fed markets will demand rate cuts. And when rate cuts prove insufficient, markets will impatiently clamor for more QE. In January, Powell’s abrupt inter-meeting termination of policy “normalization” carried quite a punch. Markets were caught off guard – with huge amounts of market hedges in place. These days, with markets already anticipating a rate cut this year, one wouldn’t expect the actual Fed announcement (in the midst of market instability) to elicit a big market reaction.

The Fed is clearly preparing for the next episode where it will be called upon to backstop faltering markets. Our central bankers will undoubtedly point to disinflation risk and consumer prices drifting below the Fed’s 2% target. I’ll expect markets to play along. But without the shock effect of spurring a big market reversal – with attendant risk embracement and speculative leveraging – it’s likely that a 25 bps rate cut will have only ephemeral impact on marketplace liquidity. Markets will quickly demand more QE – and Chairman Powell is right back in the hot seat.

I’m getting ahead of myself here. But the reemployment of Fed QE should be expected to have unintended consequences depending on relative U.S. versus global growth dynamics and market performance. If, as was the case last year, king dollar and speculative flows to the “Core” temporarily boost U.S. output, it would be an “interesting” backdrop for restarting QE.

But let’s get back to the present. Happenings at the “Periphery of the Periphery” seem to support the Global Liquidity Inflection Point Hypothesis. The Turkish lira fell 2.1% this week, with 12-month losses up to 31.5%. Turkey’s 10-year lira bond yields surged 30 bps to 17.75%, the high since October. Turkey sovereign CDS jumped 24 bps this week to 461 bps, the high going back to September 13th. Turkey’s 10-year dollar bond yields surged a notable 51 bps this week to 8.08% – the high also since mid-September instability. Turkey is sliding into serious crisis.

April 26 – Financial Times (Adam Samson and Caroline Grady): “Turkey’s central bank has confirmed it began engaging in billions of dollars in short-term borrowing last month, bulking out its reserves during a time when the lira was wobbling amid contentious local elections and concerns were growing over its financial defences. The central bank said… its borrowing from swaps with a maturity of up to one month was $9.6bn at the end of March. Friday’s report precisely matches figures first revealed last week by the Financial Times, which intensified concerns among investors about what they say is a highly unusual practice for a country’s reserve position. Turkey’s use of these transactions, in which it borrows dollars from local banks, ramped up dramatically following a sharp fall in the country’s foreign currency reserve position during the week of March 22.”

Also this week at the “Periphery of the Periphery,” Argentina’s peso sank 8.8% to an all-time low versus the dollar (y-t-d losses 17.9%). Argentine 10-year dollar bond yields jumped 26 bps Friday and 73 bps for the week to a multi-year high 11.53%. As the market increasingly fears default, short-term Argentine dollar bond yields jumped to 20%. Argentina’s sovereign CDS spiked a notable 263 bps this week to 1,234, a three-year high. A whiff of contagion was seen in the 10 bps rise in El Salvador and Costa Rica CDS. The MSCI Emerging Markets Equities Index declined 1.3% this week.

For the week, the Colombian peso dropped 2.4%, the South African rand 2.3%, the South Korean won 2.1%, the Chilean peso 1.8%, the Hungarian forint 1.5%, the Iceland krona 1.3%, and the Polish zloty 1.2%. The Russian ruble, Indonesian rupiah and Czech koruna all declined about 1% against the dollar. Problem child Lebanon saw 10-year domestic yields surge 31 bps to 9.84%.

Hong Kong’s Hang Seng Financial Index dropped 2.4% this week. China’s CSI 300 Financials Index sank 5.0%. China Construction Bank dropped 4.7%, and Industrial and Commercial Bank of China fell 4.5%. Japan’s TOPIX Bank index declined 1.3%. European bank stocks (STOXX 600) dropped 2.3%, led by a 3.2% fall in Italian banks. Deutsche Bank sank 6.7% on the breakdown of merger talks with Commerzbank. Deutsche Bank CDS jumped 12 bps this week to near two-month highs.

Reminiscent of about this time last year, U.S. bank stocks were content this week to ignore weak financial stocks elsewhere. US banks (BKX) jumped 1.6% this week, trading near the high since early December. Powered by fund inflows of a notable $5.8bn, investment-grade corporate bonds (LQD) closed the week at highs going back to February 2018. High-yield bonds similarly added to recent gains, also ending Friday at 14-month highs.

With animal spirits running high and financial conditions remaining loose, the “Core” has remained comfortably numb. But we’re now Officially on “Periphery” Contagion Watch. No reason at this point to expect much risk aversion in exuberant “Core” U.S. securities markets. Indeed, the drop in Treasury yields has been feeding through into corporate Credit, in the process loosening financial conditions. But I would expect risk aversion to begin gathering some momentum globally, with De-Risking/Deleveraging Dynamics ensuring waning liquidity and contagion for the more vulnerable currencies and markets.

April 26 – Bloomberg (Sarah Ponczek): “As equities surge to all-time highs, volatility has all but vanished. Hedge funds are betting the calm will last, shorting the Cboe Volatility Index, or VIX, at rates not seen in at least 15 years. Large speculators, mostly hedge funds, were net short about 178,000 VIX futures contracts on April 23, the largest such position on record, weekly CFTC data that dates back to 2004 show. Commonly known as the stock market fear gauge, aggressive bets against the VIX are, depending on your worldview, evidence of either confidence or complacency.”

When “risk off” does make its return to the “Core,” don’t be surprised by market fireworks. “Short Vol” Blowup 2.0 – compliments of the dovish U-turn? It’s always fascinating to observe how speculative cycles work. Writing/selling put options has been free “money” since Powell’s January 4th about face. Crowded Trade/“tinder” And if we’re now at an inflection point for global market liquidity, those gleefully “selling flood insurance during the drought” should be mindful of a decided shift in global weather patterns.

read full article

http://creditbubblebulletin.blogspot.com/2019/04/weekly-commentary-officially-on.html