Doug Noland writes….

China’s Aggregate Financing (approximately system Credit growth less government borrowings) jumped 2.860 billion yuan, or $427 billion – during the 31 days of March ($13.8bn/day or $5.0 TN annualized). This was 55% above estimates and a full 80% ahead of March 2018. A big March placed Q1 growth of Aggregate Financing at $1.224 TN – surely the strongest three-month Credit expansion in history. First quarter growth in Aggregate Financing was 40% above that from Q1 2018.

Over the past year, China’s Aggregate Financing expanded $3.224 TN, the strongest y-o-y growth since December 2017. According to Bloomberg, the 10.7% growth rate (to $31.11 TN) for Aggregate Financing was the strongest since August 2018. The PBOC announced that Total Financial Institution (banks, brokers and insurance companies) assets ended 2018 at $43.8 TN.

March New (Financial Institution) Loans increased $254 billion, 35% above estimates. Growth for the month was 52% larger than the amount of loans extended in March 2018. For the first quarter, New Loans expanded a record $867 billion, about 20% ahead of Q1 2018, with six-month growth running 23% above the comparable year ago level. New Loans expanded 13.7% over the past year, the strongest y-o-y growth since June 2016. New Loans grew 28.2% over two years and 90% over five years.

China’s consumer lending boom runs unabated. Consumer Loans expanded $133 billion during March, a 55% increase compared to March 2018 lending. This put six-month growth in Consumer Loans at $521 billion. Consumer Loans expanded 17.6% over the past year, 41% in two years, 76% in three years and 139% in five years.

China’s M2 Money Supply expanded at an 8.6% pace during March, compared to estimates of 8.2% and up from February’s 8.0%. It was the strongest pace of M2 growth since February 2018’s 8.8%.

South China Morning Post headline: “China Issues Record New Loans in the First Quarter of 2019 as Beijing Battles Slowing Economy Amid Trade War.” Faltering markets and slowing growth put China at a competitive disadvantage in last year’s U.S. trade negotiations. With the Shanghai Composite up 28% in early-2019 and economic growth seemingly stabilized, Chinese officials are in a stronger position to hammer out a deal. But at what cost to financial and economic stability?

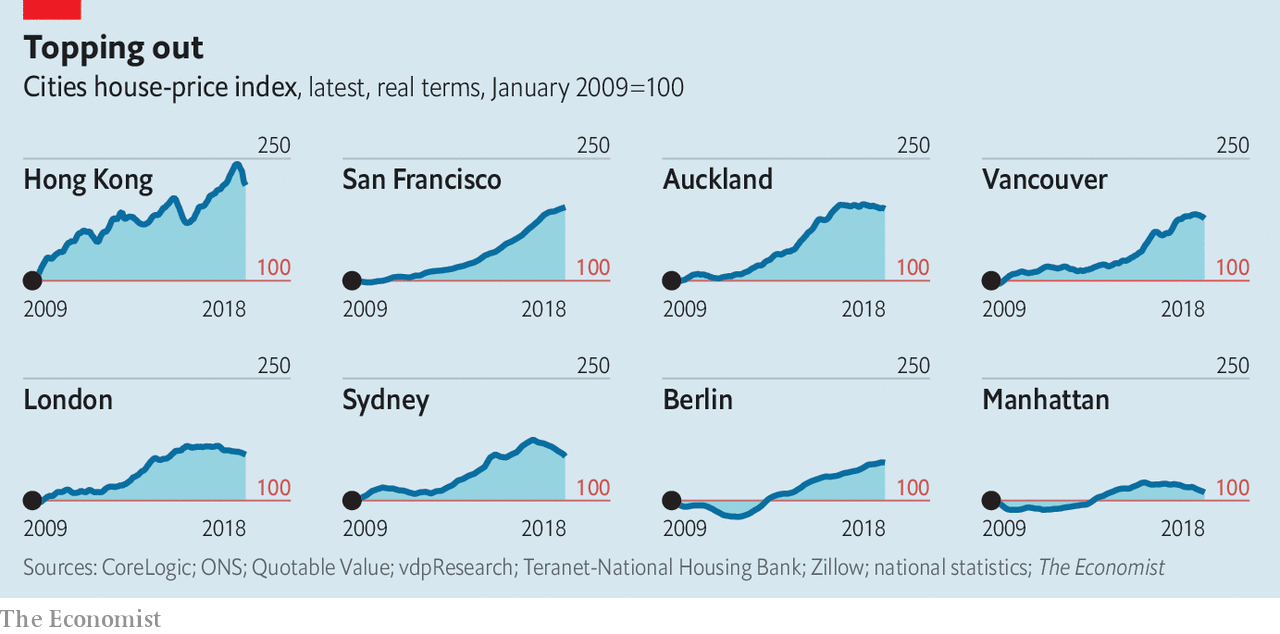

Beijing has become the poster child for Stop and Go stimulus measures. China employed massive stimulus measures a decade ago to counteract the effects of the global crisis. Officials have employed various measures over the years to restrain Credit and speculative excess, while attempting to suppress inflating apartment and real estate Bubbles. Timid tightening measures were unsuccessful – and the Bubble rages on. When China’s currency and markets faltered in late-2015/early-2016, Beijing backed away from tightening measures and was again compelled to aggressively engage the accelerator.

Credit boomed, “shadow banking” turned manic, China’s apartment Bubble gathered further momentum and the economy overheated. Aggregate Financing expanded $3.35 TN during 2017, followed by an at the time record month ($460bn) in January 2018. Beijing then finally moved decisively to rein in “shadow banking” and restrain Credit growth more generally. Credit growth slowed somewhat during 2018, as the clampdown on “shadow” lending hit small and medium-sized businesses. Bank lending accelerated later in the year, a boom notable for rapid growth in Consumer lending (largely financing apartment purchases). And, as noted above, Credit growth surged by a record amount during 2019’s first quarter.

China now has the largest banking system in the world and by far the greatest Credit expansion. The Fed’s dovish U-turn – along with a more dovish global central bank community – get Credit for resuscitating global markets. Don’t, however, underestimate the impact of booming Chinese Credit on global financial markets. The emerging markets recovery, in particular, is an upshot of the Chinese Credit surge. Booming Credit is viewed as ensuring another year of at least 6.0% Chinese GDP expansion, growth that reverberates throughout EM and the global economy more generally.

So, has Beijing made the decision to embrace Credit and financial excess in the name of sustaining Chinese growth and global influence? No more Stop, only Go? Will they now look the other way from record lending, highly speculative markets and reenergized housing Bubbles? Has the priority shifted to a global financial and economic arms race against its increasingly antagonistic U.S. rival?

Chinese officials surely recognize many of the risks associated with financial excess and asset Bubbles. I would not bet on the conclusion of Stop and Go. And don’t be surprised if Beijing begins the process of letting up on the accelerator, with perhaps more dramatic restraining efforts commencing after a trade deal is consummated. Has the PBOC already initiated the process?

April 12 – Bloomberg (Livia Yap): “The People’s Bank of China refrained from injecting cash into the financial system for a 17th consecutive day, the longest stretch this year. China’s overnight repurchase rate is on track for the biggest weekly advance in more than five years amid tight liquidity conditions.”

It’s worth noting that the Shanghai Composite declined 1.8% this week, with the CSI 500 down 2.7%. The growth stock ChiNext index sank 4.6%. Hong Kong’s Hang Seng Financials index fell 1.8%.

Despite this week’s pullback, Chinese equities markets are off to a roaring start to 2019. The view is that Beijing won’t risk the domestic and geopolitical consequences associated with a tightening of conditions. Globally, ebullient markets see a loose backdrop fueled by the combination of a resurgent Chinese Credit boom and dovish global central bankers. Rates and yields will remain low for as far as the eye can see, with economic recovery surely coming later in the year. In short, myriad risks associated with protracted Bubbles have trapped Beijing and global central bankers alike.

The resurgent global Bubble has me pondering Bubble Analysis. I often refer to the late-cycle “Terminal Phase” of excess, and how much damage that can be wrought by rapid growth of increasingly risky Credit. Dangerous asset Bubbles, resource misallocation, economic imbalances, structural maladjustment, inequitable wealth redistribution, etc. In China and globally, we’re deep into uncharted territory.

I had the good fortune to subscribe to the German economist Dr. Kurt Richebacher’s newsletter for years – and the honor of assisting with “The Richebacher Letter” between 1996 and 2001. I was blessed with a tremendous learning opportunity.

My analytical framework has drawn heavily from Dr. Richebacher’s analysis. This week, I thought about a particular comment he made regarding the “middle class” suffering disproportionately from inflation and Bubbles: The wealthy find various means of safeguarding their wealth from inflationary effects. The poor really don’t have much to protect. They don’t gain much from the boom, and later have little wealth to lose during the bust. It is the vast middle class, however, that is left greatly exposed. They – society’s bedrock – tend to accumulate relatively high debt levels throughout the boom, believing their wealth is rising and the future is bright. They perceive benefits from home and market inflation, with rising net worth encouraging overconsumption and over-borrowing. Meanwhile, inflation works insidiously on real incomes.

April 10 – Financial Times (Valentina Romei): “The middle classes in developed nations are under pressure from stagnant income growth, rising lifestyle costs and unstable jobs, and this risks fuelling political instability, a new report by the OECD has warned. The club of 36 rich nations said middle-income workers had seen their standard of living stagnate over the past decade, while higher-income households had continued to accumulate income and wealth. The costs of housing and education were rising faster than inflation and middle-income jobs faced an increasing threat from automation, the OECD said. The squeezing of middle incomes was fertile ground for political instability as it pushed voters towards anti-establishment and protectionist policies, according to Gabriela Ramos, OECD chief of staff.”

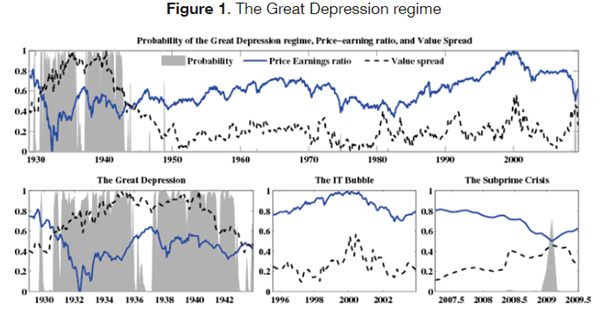

If Dr. Richebacher were alive today (he passed in 2007 at almost 90), he would draw a direct link between rising populism and central bank inflationism. Born in 1918, he lived through the horror of hyperinflation and its consequences. While he was appalled by the direction of economic analysis and policymaking, we would explain to me that he didn’t expect the world to experience another Great Depression. He had believed that global leaders learned from the Weimar hyperinflation, the Great Depression and WWII. His view changed after he saw the extent that policymakers were willing to Go to reflate the system following the “tech” Bubble collapse.

April 9 – Wall Street Journal (Heather Gillers): “Maine’s public pension fund earned double-digit returns in six of the past nine years. Yet the Maine Public Employees Retirement System is still $2.9 billion short of what it needs to afford all future benefits to all retirees. ‘If the market is doing better, where’s the money?’ said one of these retirees… The same pressures Maine faces are plaguing public retirement systems around the country. The pressures are coming from a slate of problems, and the longest bull market in U.S. history has failed to solve many of them. There is a simple reason why pensions are in such rough shape: The amount owed to retirees is accelerating faster than assets on hand to pay those future obligations. Liabilities of major U.S. public pensions are up 64% since 2007 while assets are up 30%…”

It was fundamental to Dr. Richebacher’s analysis that Bubbles destroy wealth. He spared no wrath when it came to central bankers believing wealth would be created through the aggressive expansion of “money” and Credit.

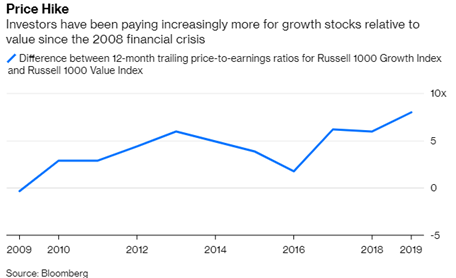

It should be frightening these days to see pension fund assets fall only further behind liabilities, despite a historic bull market and record stock values-to-GDP. When the Bubble bursts and Wealth Illusion dissipates, the true scope of economic wealth destruction will come into focus. Don’t expect the likes of Lyft, Uber, Pinterest – and scores of loss-making companies – to bail out our nation’s underfunded pension system. Positive earnings (and cash-flow) doesn’t matter much in today’s marketplace. It will matter tremendously in a post-Bubble landscape where real economic wealth will determine the benefits available to tens of millions of retirees.

At near record stock and bond prices, pensions appear much better funded than they are in reality. With stocks back near all-time highs, Total (equities and debt) Securities market value is approaching $100 TN, or 460% of GDP. This ratio was at 379% during cycle peak Q3 2007 and 359% for cycle peak Q1 2000.

This is an important reminder of a fundamental aspect of Bubble Analysis: Bubbles inflate underlying “fundamentals.” Bullish analysts argue that the market is not overvalued (“only” 16.6 times price-to-forward earnings) based on next year’s expected corporate profits. Yet forward earnings guidance is notoriously over-optimistic, while actual earnings are inflated by myriad Bubble-related factors (i.e. huge deficit spending; artificially low borrowing costs; share buybacks and financial engineering; revenues inflated by elevated Household Net Worth and loose borrowing conditions, etc.).

Such a precarious time in history. So much crazy talk has drowned out the reasonable. Deficits don’t matter, so why not a trillion or two for infrastructure? Our federal government posted a $691 billion deficit through the first six months of the fiscal year – running 15% above the year ago level. Yet no amount of supply will ever impact Treasury prices – period. A Federal Reserve governor nominee taking a shot at “growth phobiacs” within the Fed’s ‘temple of secrecy’, while saying growth can easily reach 3 to 4% (5% might be a “stretch”). Larry Kudlow saying the Fed might not raise rates again during his lifetime.

Little wonder highly speculative global markets have become obsessed with the plausible. Why can’t China’s boom continue for years – even decades – to come? Beijing has everything under control. Europe has structural issues, but that only ensures policy rates will remain negative indefinitely. Bund and JGB yields will be stuck near zero forever. The ECB and BOJ have everything under control. Bank of Japan assets can expand endlessly. Countries that can print their own currencies can’t go broke. And it’s only a matter of time until all central banks are purchasing stocks and corporate Credit.

Why can’t U.S. growth accelerate to 4%? High inflation is not and will not in the future be an issue. Disinflation is a permanent issue that the Fed and global central banks are now coming to recognize. With the Fed ready to cut rates and support equities, there’s no reason the decade-long bull market has to end. Old rules for how economies, markets and finance function – the cyclical nature of so many things – no longer apply.

It’s easy these days to forget about December. Let’s simply disregard the powerful confirmation of the global Bubble thesis. Bubbles are sustained only by ever increasing amounts of Credit. A mild slowdown in the Chinese Credit expansion saw markets falter, confidence wane and a Bubble Economy succumb to self-reinforcing downside momentum. And when synchronized global market Bubbles began to deflate, it suddenly mattered tremendously that global QE liquidity injections were no longer running at $200 billion a month.

As we are witnessing again in early-2019, when “risk on” is inciting leveraged speculation markets create their own self-reinforcing liquidity. It is when “risk off” de-risking/deleveraging takes hold that illiquidity quickly reemerges as a serious issue. And I would argue that it is the inescapable predicament of speculative Bubbles that they create ever-increasing vulnerability to downside reversals, illiquidity, dislocation and panic.

Beijing came to the markets’ and economy’s defense, once again. China’s problems – certainly including a historic speculative mania in apartments – are in the process of growing only more acute. China total 2019 Credit growth approaching $4.0 TN is clearly plausible.

The Fed came to the markets’ defense, once again. This ensures only greater speculative excess and more acute market and economic vulnerability – that markets view as ensuring lower rates and a resumption of QE. Moreover, the moves by China, the Fed and the global central bank community only exacerbate what has become a highly synchronized global speculative market Bubble.

Lurking fragility is not that difficult to discern, at least not in the eyes of safe haven debt markets. And sinking sovereign yields – as they did in 2007 – sure work to distract risk markets from troubling fundamental developments. Stop and Go turns rather perilous late in the cycle. Speculative Dynamics intensify – “risk on” and “risk off.” Beijing and the Fed (and global central banks) were compelled to avert downturns before they gathered momentum. But that only ensured highly energized “blow off” speculative dynamics and more problematic Bubbles.

The next serious bout of “risk off” will be problematic. Another dovish U-turn will not suffice. A significant de-risking/deleveraging event in highly synchronized global markets will only be (temporarily) countered with QE. And with the markets’ current ebullient mood, there’s no room for worry: of course central bankers will oblige with more liquidity injections. They basically signaled as much.

Timing is a major issue. Especially as speculative Bubbles turn actutely unstable, any delay with central bank liquidity injections will boost the odds things get out of hand. Central bankers, surely in awe of how briskly intense speculative excess has returned, may be hesitant to immediately accommodate. Heck, the way things are going, it may not be long before they question the wisdom of their dovish U-turn. I have a difficult time believing Chairman Powell – and at least some members of the FOMC – have discarded Financial Stability concerns.

The way things are setting up – intense political pressure, the election cycle and such – they will likely be reluctant to return to rate normalization. Yet the crazier things get in the markets the more cautious they will be next time in coming to a quick rescue. The Perils of Stop and Go.

Read More

http://creditbubblebulletin.blogspot.com/2019/04/weekly-commentary-perils-of-stop-and-go.html