April 5 – New York Times (Dealbook): “’It doesn’t take a genius’ to know capitalism needs fixing. Capitalism helped Ray Dalio build his investment empire. But in a lengthy LinkedIn post, the Bridgewater Associates founder says that it isn’t working anymore. Mr. Dalio writes that he has seen capitalism ‘evolve in a way that it is not working well for the majority of Americans because it’s producing self-reinforcing spirals up for the haves and down for the have-nots.’ ‘Disparity in wealth, especially when accompanied by disparity in values, leads to increasing conflict and, in the government, that manifests itself in the form of populism of the left and populism of the right and often in revolutions of one sort or another.’ ‘The problem is that capitalists typically don’t know how to divide the pie well and socialists typically don’t know how to grow it well.’ ‘We are now seeing conflicts between populists of the left and populists of the right increasing around the world in much the same way as they did in the 1930s when the income and wealth gaps were comparably large.’ ‘It doesn’t take a genius to know that when a system is producing outcomes that are so inconsistent with its goals, it needs to be reformed.’ Stay tuned: Mr. Dalio says that he’ll offer his solutions in another essay.”

I’m reminded of back in 2007 when Pimco’s Paul McCulley coined the term “shadow banking” – and the world finally began taking notice of the dangerous new financial structure that had over years come to dominate system Credit. Okay, but by then the damage was done. As someone that began posting the “Credit Bubble Bulletin” in 1999 and had chronicled the prevailing role of non-bank Credit in fueling the “mortgage finance Bubble” fiasco (on a weekly basis), I found it all frustrating.

Why wasn’t the discussion started in 2001/02 when mortgage Credit began expanding at double-digit rates, and there were clear signs of Bubble formation? Oh yea, that’s right. There was desperation to reflate the system and fight the “scourge of deflation” after the bursting of the “tech” Bubble. Excess was welcomed early on – and later, when things got really heated up, nobody dared risk bursting the Bubble.

Reading Mr. Dalio’s latest, I have to ask, “What ever happened to ‘beautiful deleveraging’?” And I’m not on the edge of my seat waiting for his “solutions.”

There was a window of opportunity early in the mortgage financial Bubble period for “statesmen” to rise up and call out the recklessness of the Fed spurring mortgage Credit excess and house price inflation in the name of system reflation. Statesmen and women should have excoriated governor Bernanke for suggesting the “government printing press” and “helicopter money” – the type of crazy talk that should disqualify one for a position of responsibility at the Federal Reserve. Fed chairman? You’ve got to be kidding.

There was a window of opportunity to rein the Fed in after QE1. The Federal Reserve should have been held to their 2011 monetary stimulus “exit strategy.” Instead they doubled down – literally – as the Fed’s balance sheet doubled in about three years to $4.5 TN. Mr. Dalio – along with virtually everyone – didn’t seem to have any issues. Indeed, an unprecedented expansion of non-productive debt (certainly including central bank Credit and Treasury borrowings) somehow equated with “beautiful deleveraging.” It was ridiculous analysis in the face of the greatest global Bubble in human history.

Central banks aren’t fully to blame, but it’s an awfully good place to start. Three decades of “activist” monetary management has left a horrible legacy. The Institute for International Finance reported this week that global debt ended 2018 at a record $243 TN. This debt mountain simply would not have been possible without “activist” central banking. Despite a lengthening list of risks, global stocks have powered higher in 2019 to near all-time highs. A relentless speculative Bubble has only been possible because of central bank policies.

I’m not all that interested in Dalio’s “solutions.” In my book, he missed what was an exceptional opportunity for statesmanship. Bridgewater’s investors were the priority and have been rewarded handsomely. Pro-central bank “activism” has been the right call for compounding wealth for the past decade (or three). But no amount of ingenuity will resolve the historic predicament the world finds itself in today. Markets are broken, global imbalances the most extreme ever, and structural impairment unprecedented – and worsening, all of them.

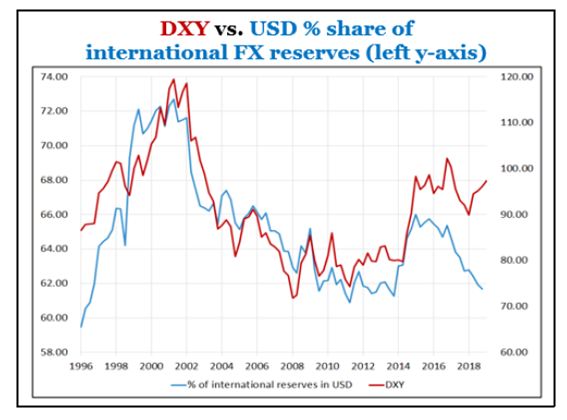

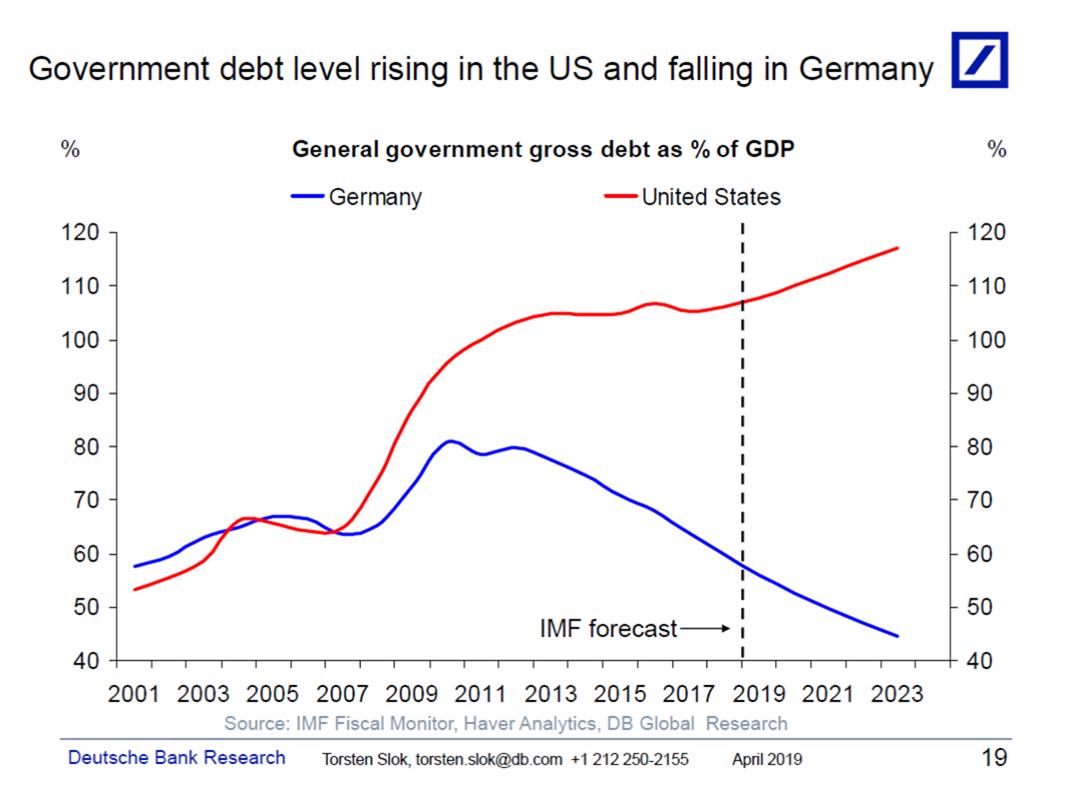

Most regrettably, the type of structural reform required will only arise from a severe crisis. The Fed and global central bankers have been reflating Bubbles for more than three decades. Highly speculative global markets at this point completely disregard risk. And with borrowing costs incredibly low, what government (ok, Germany) is going to impose some spending discipline and operate on a fiscally responsible trajectory? At this point, finance is hopelessly unsound – and, importantly, hopelessly destructive on an unprecedented global basis.

I had the great pleasure to spend part of my Friday with the University of Oregon Investment Group. I gave a talk, “Money, Credit, Inflation and the Markets.” Being with bright, intellectually curious and enthusiastic university students gives me hope – and a smile.

From my presentation: “And it just breaks my heart to see young people turn away from Capitalism. I anticipate spending the rest of my life trying to explain that the culprit is unsound finance and deeply flawed monetary management – and not the system of free-market Capitalism. History teaches us that credit is inherently unstable. I would argue that the experiment in New Age unfettered credit – with its serial booms and busts – evolved into a failed experiment in “activist” monetary management – another debacle in “inflationism.”

“The result has been a period of historic bubbles – in the markets and in economies – on a global scale. And protracted Bubbles become powerful mechanisms of wealth redistribution and destruction. Central banks readily creating new “money” and favoring the securities markets are fundamental to the problem. Such policies benefit the wealthy and worsen inequality. We’re witnessing the resulting rise of populism and a mounting crisis of confidence in our institutions. Even with 3.8% unemployment, near-record stock prices and one of the longest economic expansion on record, our country is deeply divided and resentful. I fear for the next downturn.”

A Friday Business Insider headline: “Hedge-fund billionaire Ray Dalio says the current state of capitalism poses ‘an existential threat for the US’”; Barron’s: “Hedge Fund Billionaire Ray Dalio Says Capitalism ‘Must Evolve or Die’”; and Vanity Fair: “Billionaire Hedge-Fund Manager Warns a ‘Revolution’ is Coming.” Observer: “Ray Dalio on Capitalism Gone Wrong: America May See Dire Consequences.” And CBS: “Billionaire investor Ray Dalio: Capitalism run amok is ‘economically stupid’”

I’m reminded of an analogy I’ve used in the past. One could make a reasonable argument that our eyeballs are flawed. How could something of such importance be so soft, delicate and vulnerable? Yet this vital organ is not flawed – imperfection is not a legitimate issue. It is the nature of its function that dictates its characteristics and vulnerabilities. It cannot sit within a protective ribcage like the heart, or within the hardened skull as the brain does.

To be able to see the world – looking at distant mountain ranges and then immediately shifting focus to the pages of a wonderful book – requires an exquisitely complex organ functioning right out there exposed to the elements and largely unprotected. Importantly, we recognize and accept our eyes’ sensitivities and vulnerabilities. We would not wander into a metal shop without wearing protective eye coverings. We don sunglasses on bright days – darkened snow goggles for spring skiing. We learn at a very young age not to stare into the sun.

I disagree with the increasingly popular view that Capitalism as flawed. At the same time, I have been long frustrated by those dogmatically preaching the virtues of Capitalism without accepting the reality of inherent delicacy, vulnerabilities and weaknesses. As we are with our eyes, we have to be on guard, take precautions, and definitely avoid doing anything stupid. Who is reckless with their eyes? There’s too much to lose. No one wants to contemplate being blind for the rest of their life.

How could we ever have allowed Capitalism to be so irreparably damaged? There are innate instabilities in Credit and finance that have been disregarded for way too long. Unsound “money” is a primary (and insidious) risk to capitalistic systems. I would further argue that persistent asset inflation and recurring speculative Bubbles pose a major risk to sound finance and, as such, to Capitalism more generally. Moreover, inflationism – “activist” central banking – with its asset market focus, manipulation and nurturing of speculative excess and inequality, is anathema to free-market Capitalism.

When the Fed slid down the slippery slope and implemented QE, the economics profession and investment community failed society. The case against QE shouldn’t have been primarily focused on inflation risk. The overarching danger was a corrosive impairment of markets and finance, with resulting dysfunction for Capitalism more generally. The risk was destabilizing inequality, insecurity and resulting societal stress. There was the peril of a fragmented society, divided nation, political dysfunction and waning trust in our institutions. Somehow, everyone was content to ignore the reality that unsound “money” reverberates throughout the markets, the economy, society, politics and geopolitics.

Over the years, I’ve referred to the “first law of holes.” If you find yourself in a hole, the first requirement is to stop digging. Similarly, I’ve repeatedly noted the long-ago recognized issue with discretionary monetary management: One mistake invariably leads to only bigger mistakes. And I’m fond of reminding readers that “things turn crazy at the end of cycles.” Historic cycle, historic “crazy.” I’ll repeat what I’ve written many times before: From my analytical perspective, things continue to follow the worst-case scenario.

It was yet another mistake for the Fed to go full U-Turn dovish. It was another blunder for the global central bank community to signal they were willing to move quickly and aggressively to bolster international markets. The 2019 speculative run in the markets only exacerbates underlying fragilities – worsens inequality – and sets the stage for an only deeper crisis.

I’ll be curious to see if Ray Dalio’s “solutions” include having the Fed disavow aggressive monetary stimulus, while letting markets begin functioning on their own. The biggest problem with Capitalism these days is that the system is not self-adjusting and correcting. Structurally distorted markets and deeply maladjusted economies are incapable of correction. Global imbalances only worsen every year. Speculative Bubbles inflate on further.

Global central banks are understandably distressed about the potential for market dislocation and crisis. Yet recurring efforts to forestall upheaval increasingly risk financial collapse. There is no real solution until deeply flawed monetary management is recognized and changed. The current course will only exacerbate inequality and foment Dalio’s “revolution.” Any soul-searching and scrutinizing of Capitalism must begin with central banking and monetary mismanagement. Where were the likes of Dalio, Dimon and Buffett when it could have made a difference? Faux Statesmanship.

Read Full Article below

http://creditbubblebulletin.blogspot.com/2019/04/market-commentary-faux-statesmanship.html