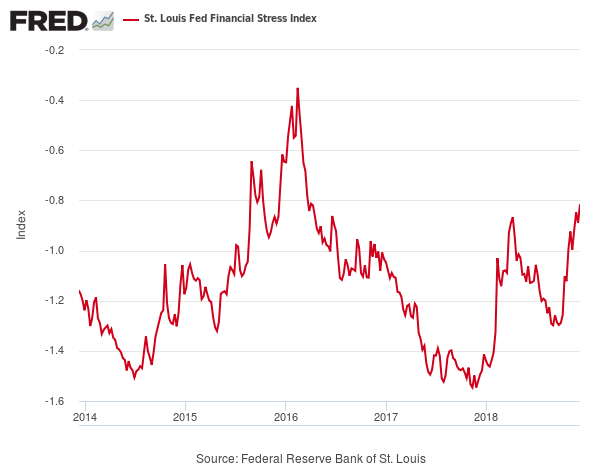

Markets are at crossroads and the most Discussed FOMC meeting in years will take place.The FED has put itself into a box through its use of forward guidance and of the DOT PLOTS to direct investor sentiment.

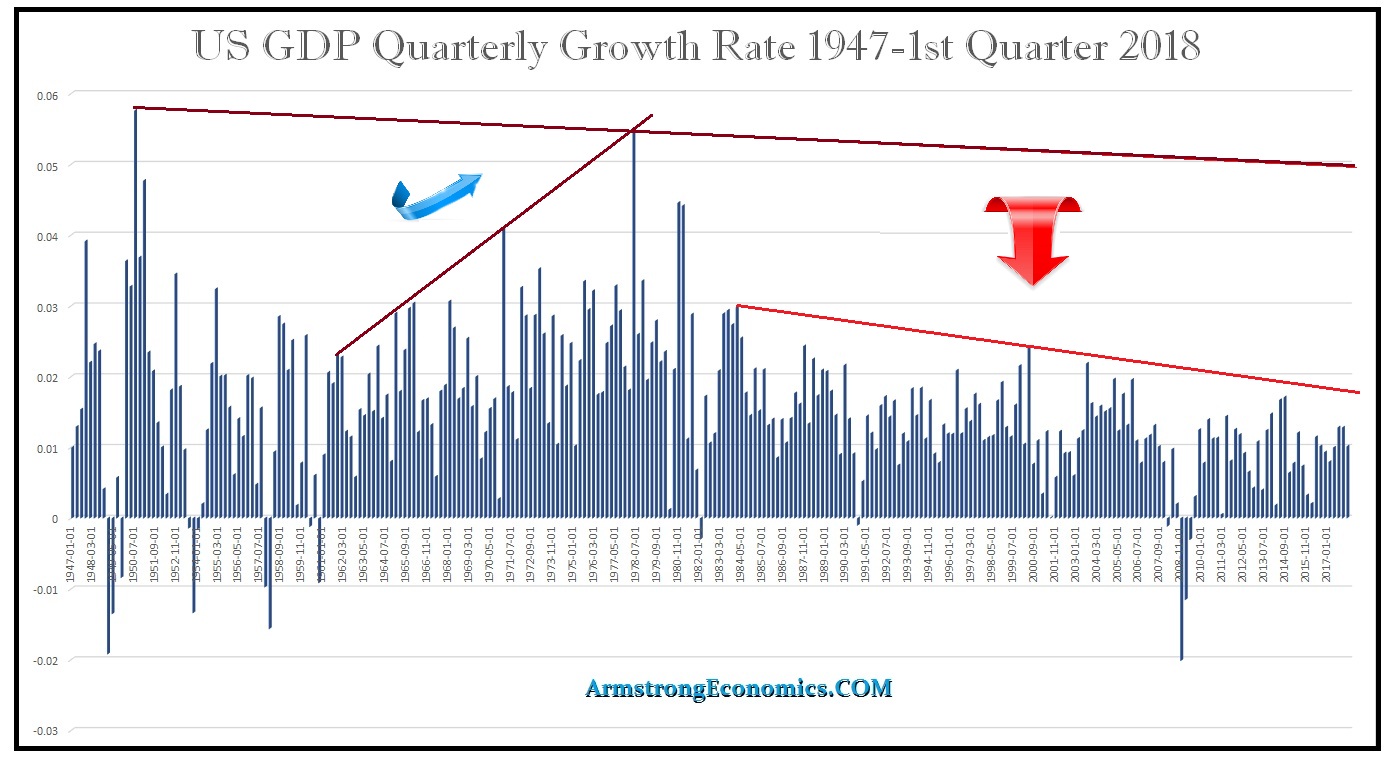

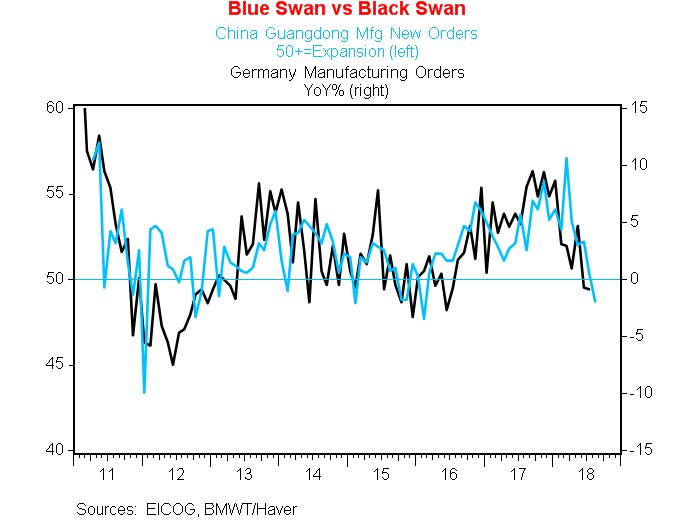

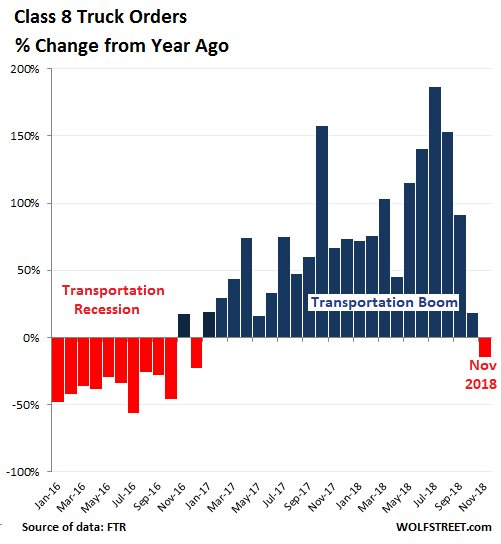

and the economic data has changed for the worse from the last FED meeting with Morgan Stanley writing the following based on FedEx shocking outlook which was raised just three months back

“We recognize that global growth has slowed but we are very surprised by the magnitude of the headwind, which is what might be seen in a severe recession,”

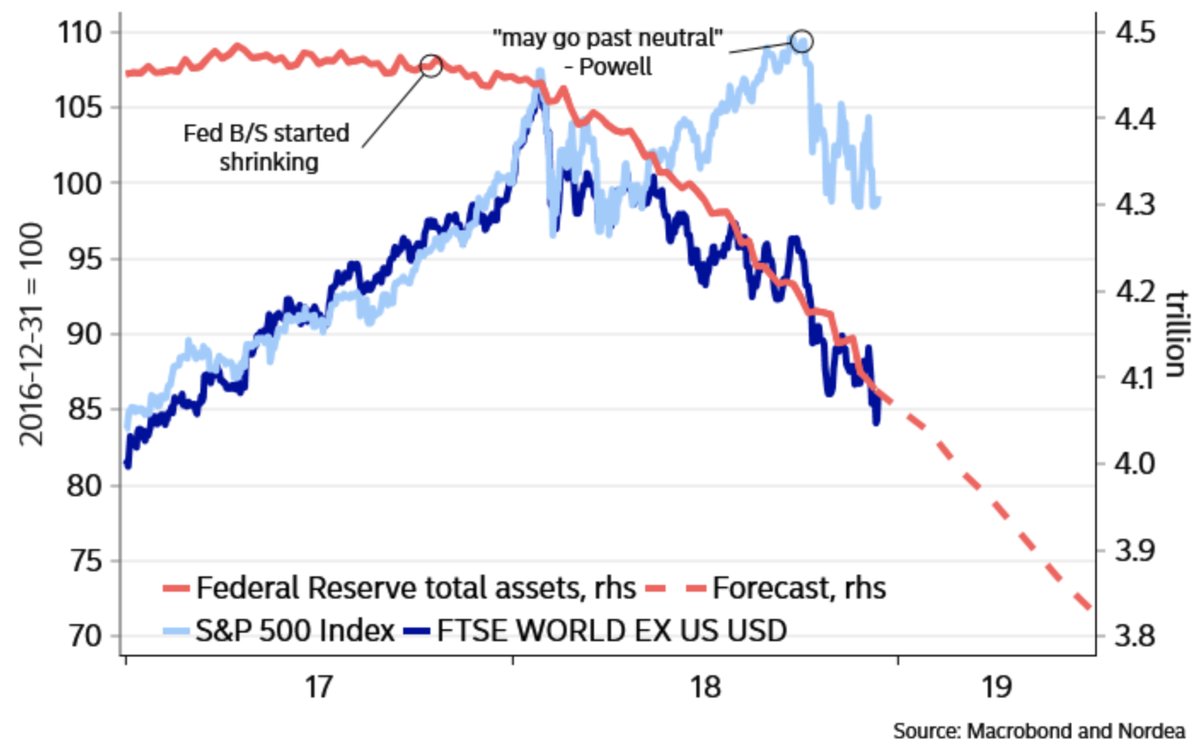

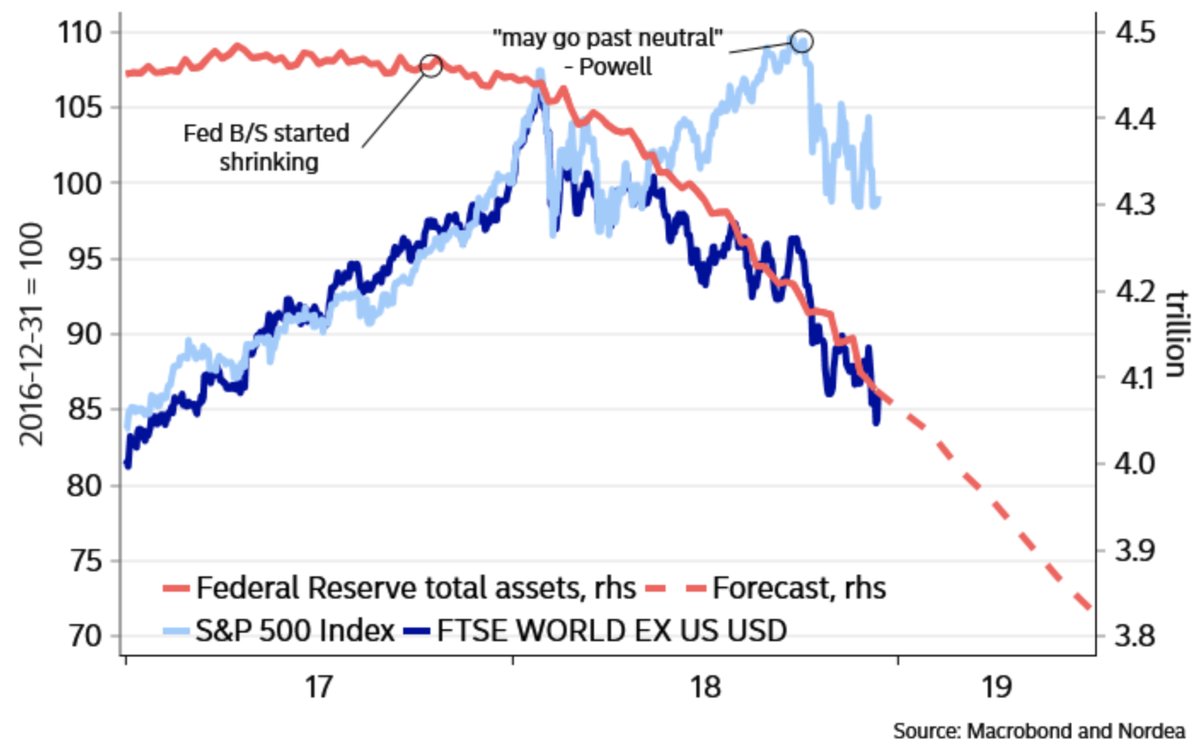

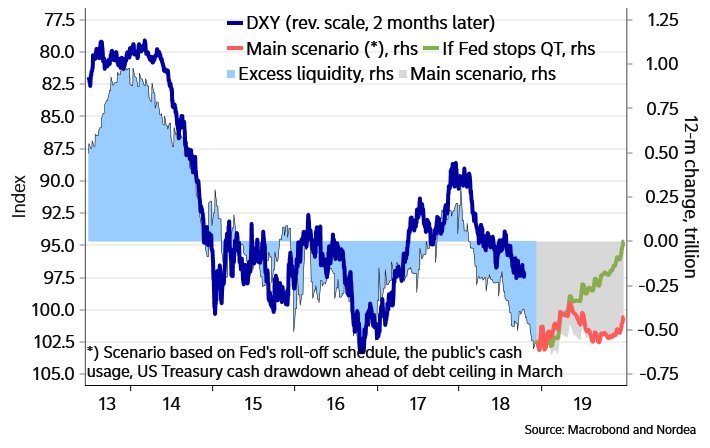

Noni prince writes for The daily reckoning “The Fed knows it is currently in a catch-22. That’s why over the last two weeks, it has barely sold any of its assets as volatility in the markets picked up.”

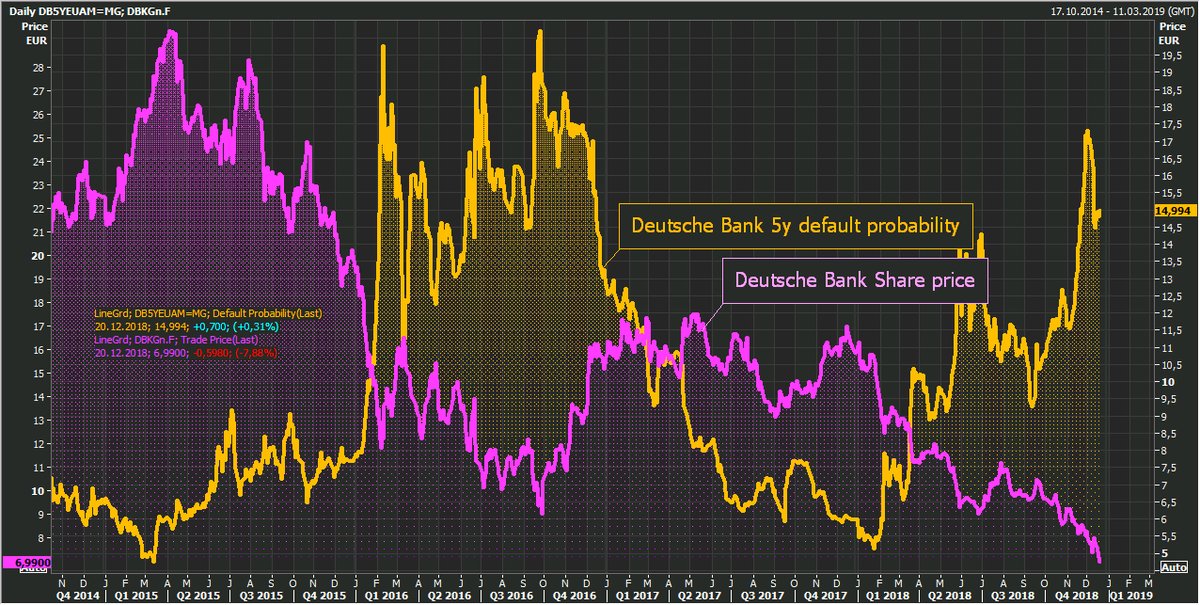

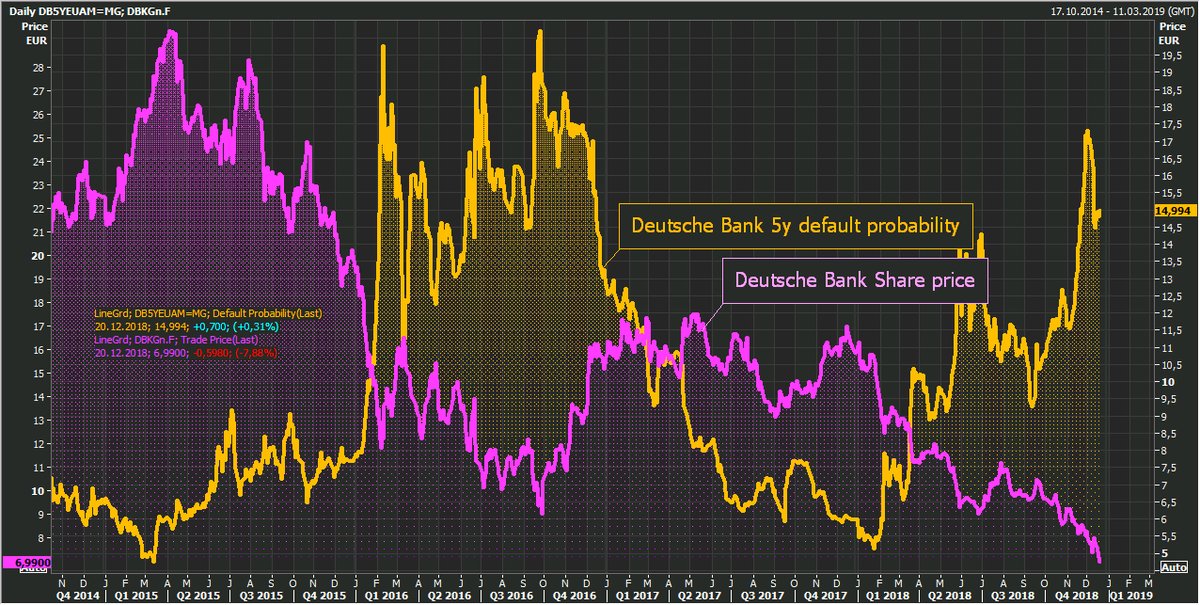

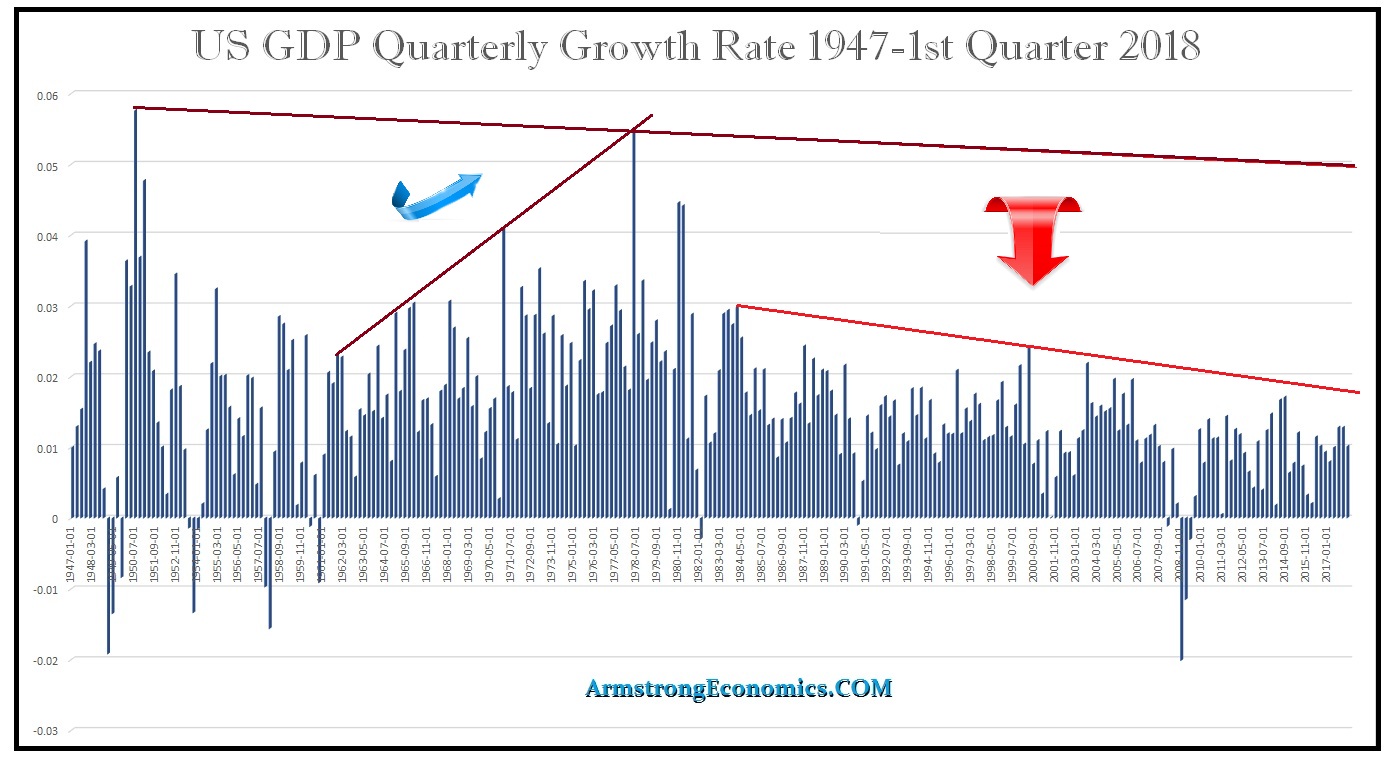

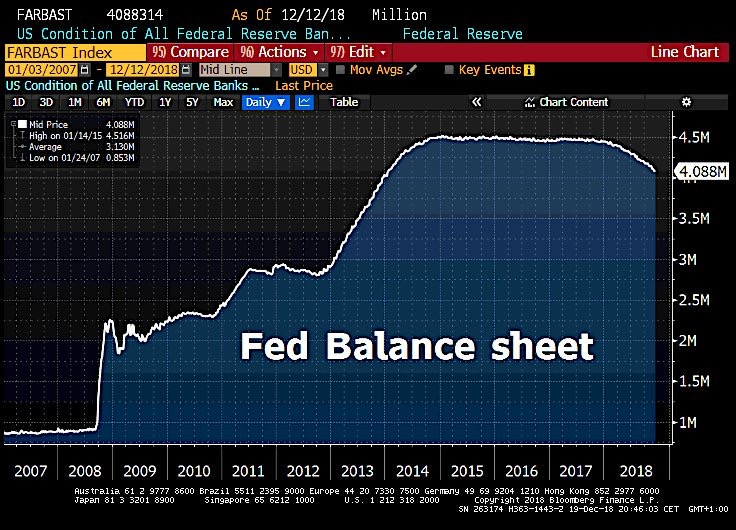

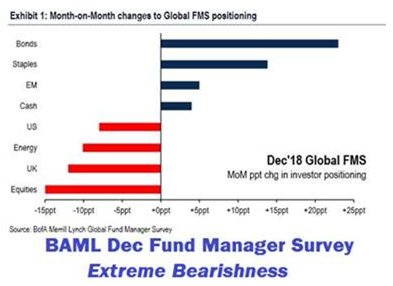

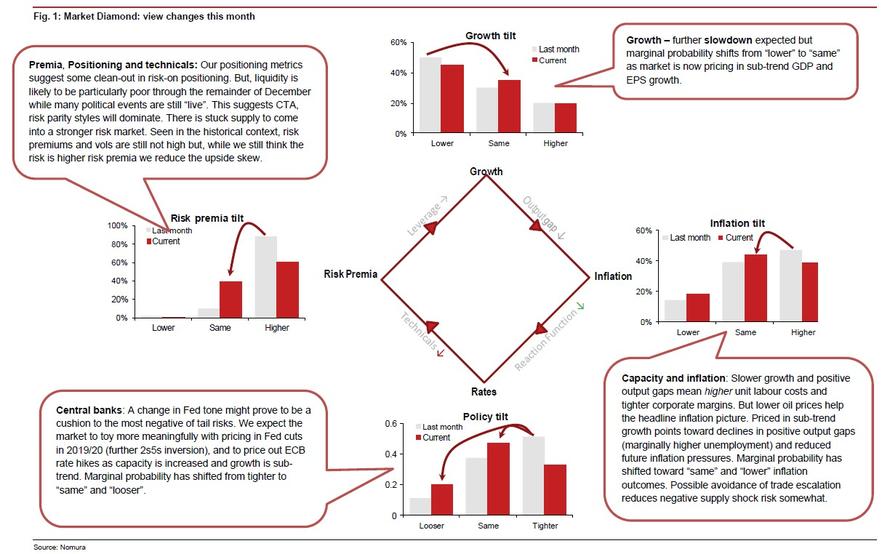

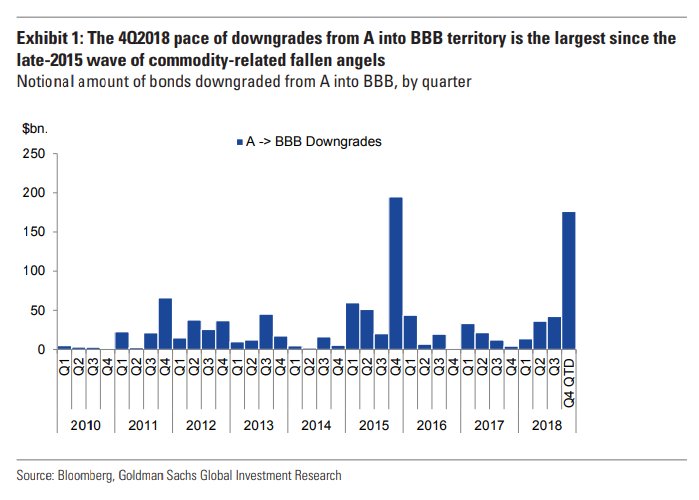

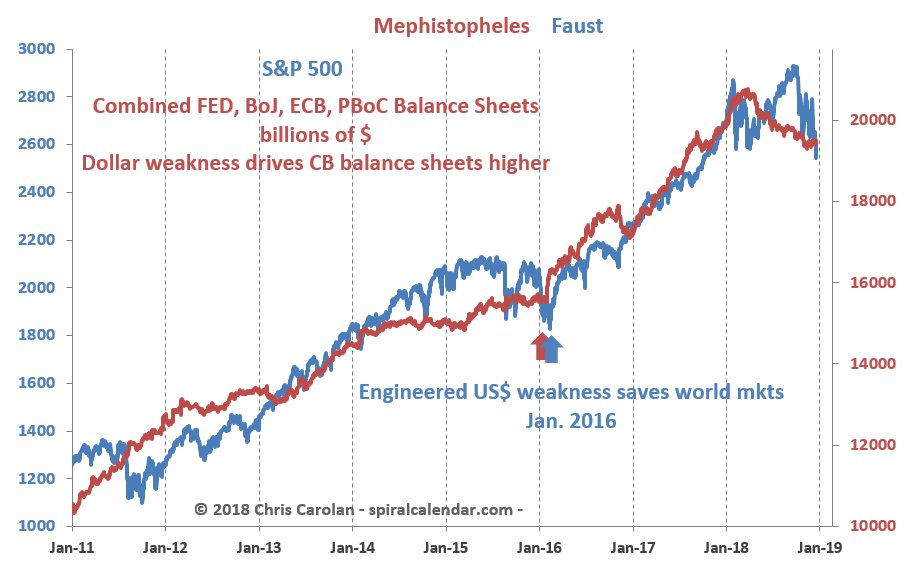

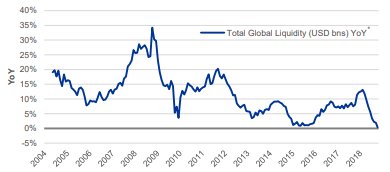

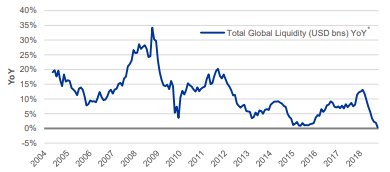

By skipping a rate hike at its November 8 meeting Chairman Powell put the burden on December with a heightened sense of a rate rise as it has a scheduled press conference. There is a murderers row of financial heavyweights arguing for the FED to ABSTAIN FROM A RISE IN RATES and wait for more data to ascertain whether the equity markets are signaling a genuine concern on economic problems, or are merely repricing risk that had premiums WAY TOO LOW during the halcyon days of harmonized QE. As the FED shrinks its balance sheet, the ECB is finished with liquidity. Once you add the BOJ dancing to the tune of a decimated bond market, global liquidity is being restrained.

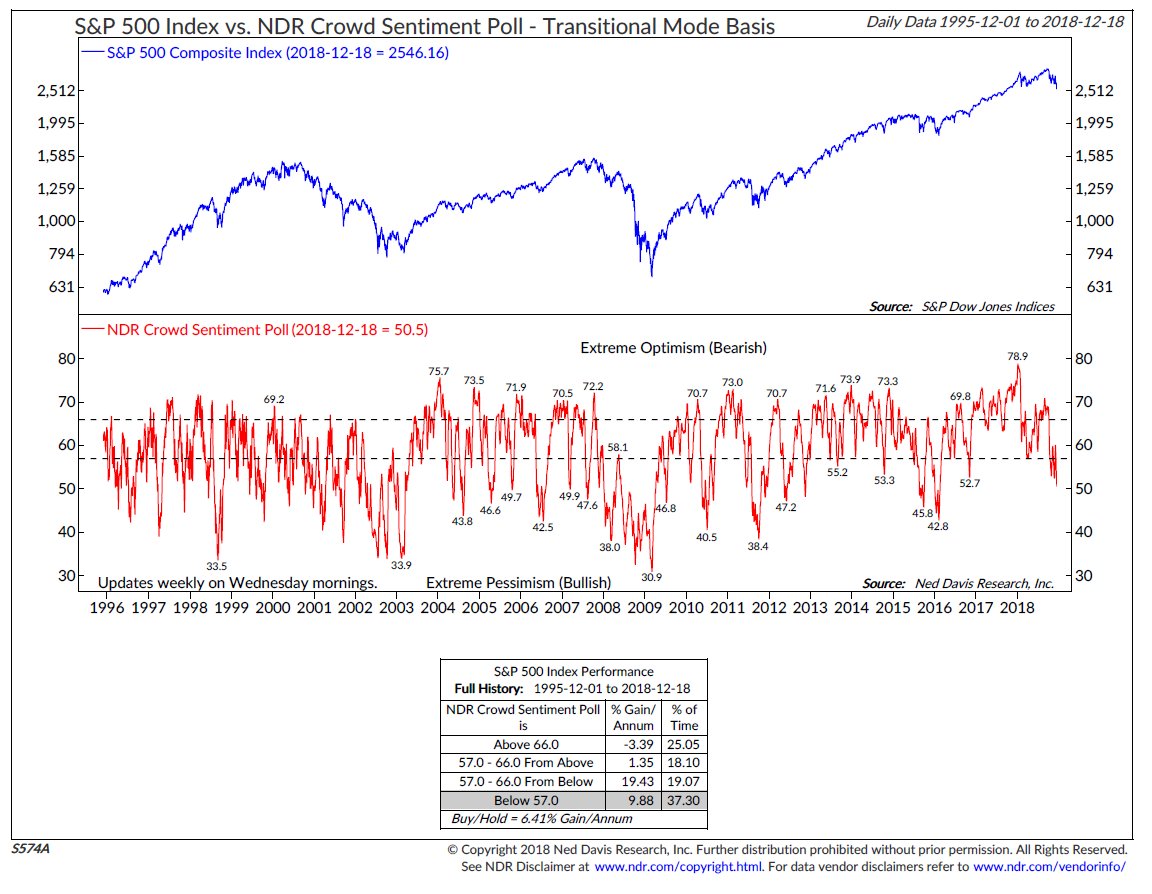

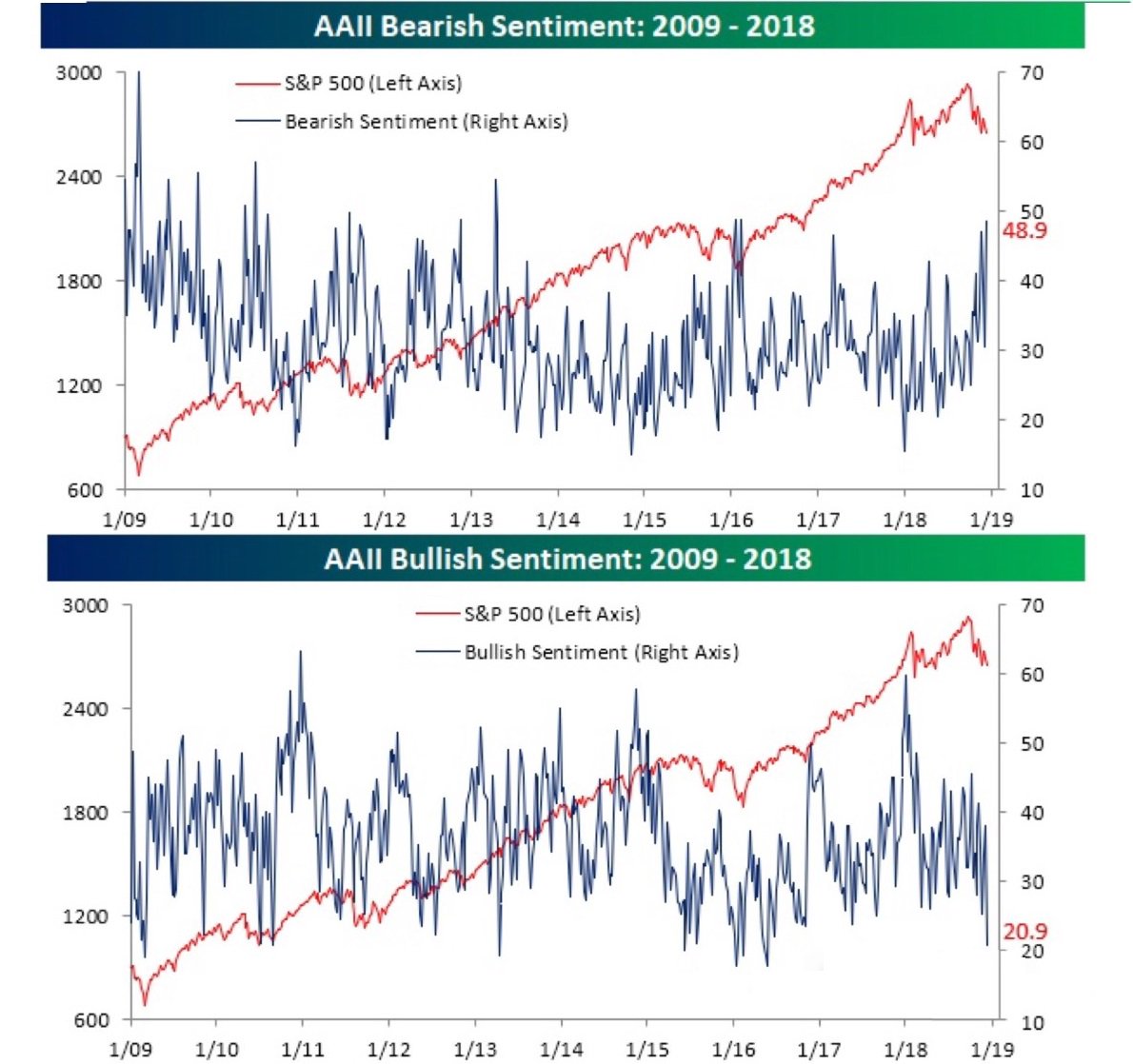

Has recent increased market volatility caused Chairman Powell to question the efficacy of the double-barreled approach to normalization? If the answer is yes then it will be a very dovish FOMC even if the FED FUNDS rate is increased 25 basis points .

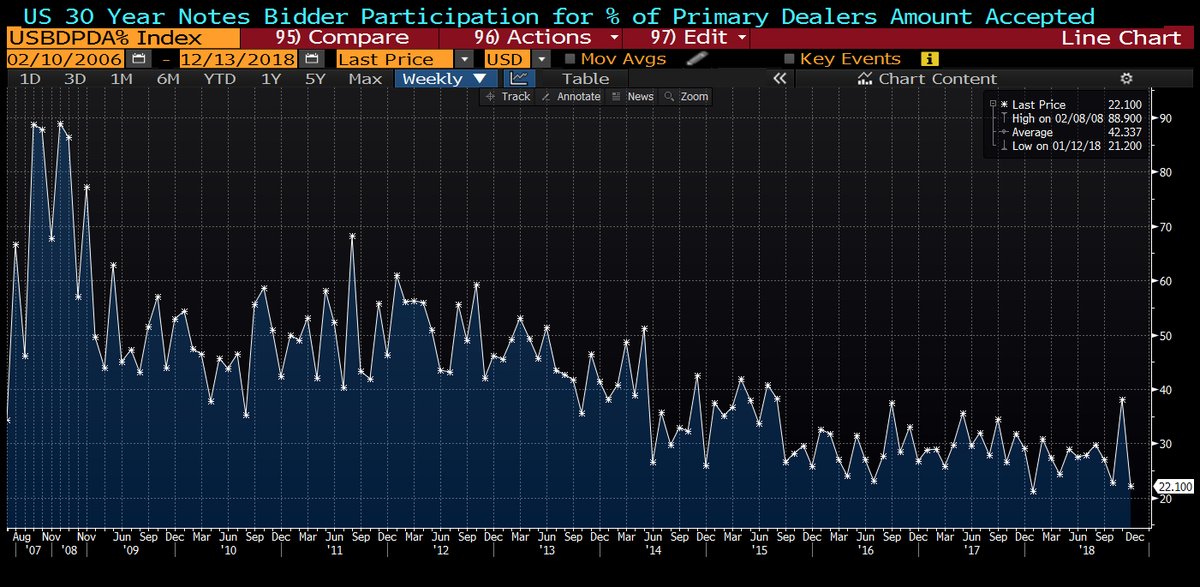

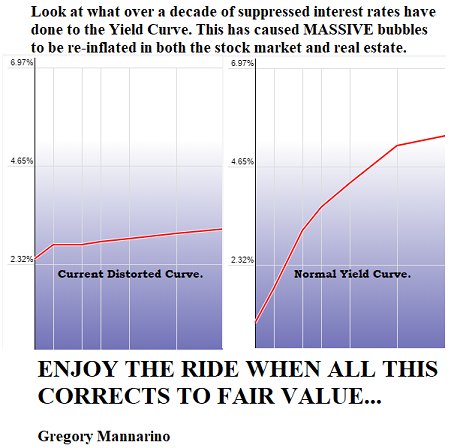

If the Fed decides not to hike the rates ( my preferred scenario) then I believe BOND MARKET will be unhappy and yield curve could steepen sharply along with selling the DOLLAR and buying precious metals against all fiat currencies. If the FED is suspect about its own QE exit strategy, think about the difficulty facing the ECB, BOJ and the BOE, not to mention the Swiss National Bank although the SNB has bought other nations equities with its newly printed FRANCS making them the ALCHEMISTS of the last thousand years.

if Chairman Powell defied the probabilities by not raising the FED FUNDS rate, Trump would be calling it a victory and a wonderful Christmas present for Americans. If the statement is DOVISH expect US Equity markets/ Emerging Markets/ Precious metals no doubt will rejoice but I don’t think this rally will last for more than few days simply because I expect bond markets to revolt for not paying a sufficient premium in the face of rising US deficit.

Watch the 10-year and 30-year bonds to see if a rally in the futures fail by the end of trading. That will be my indicator for a coming steepening.