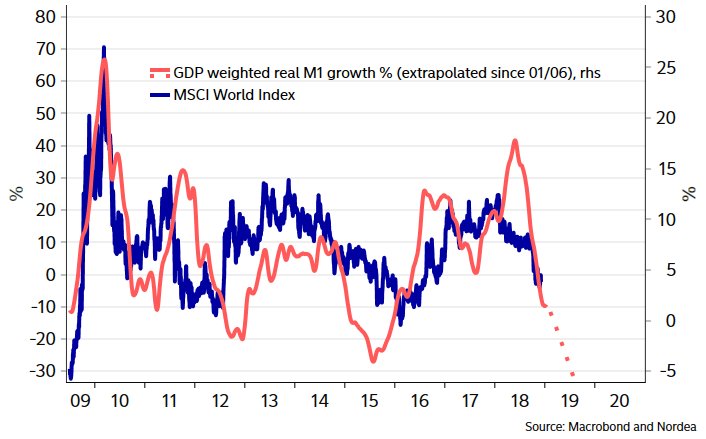

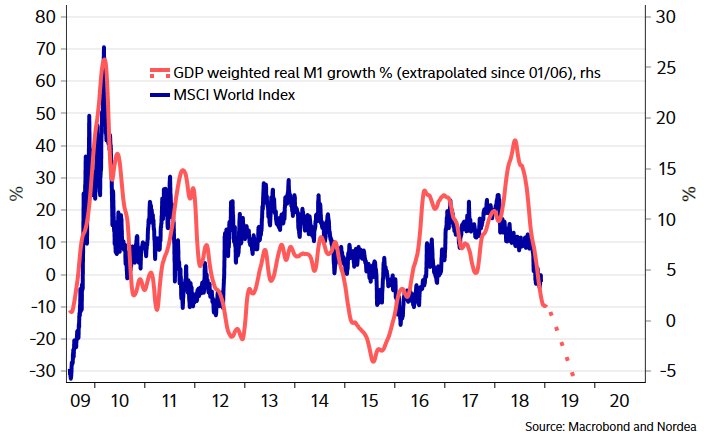

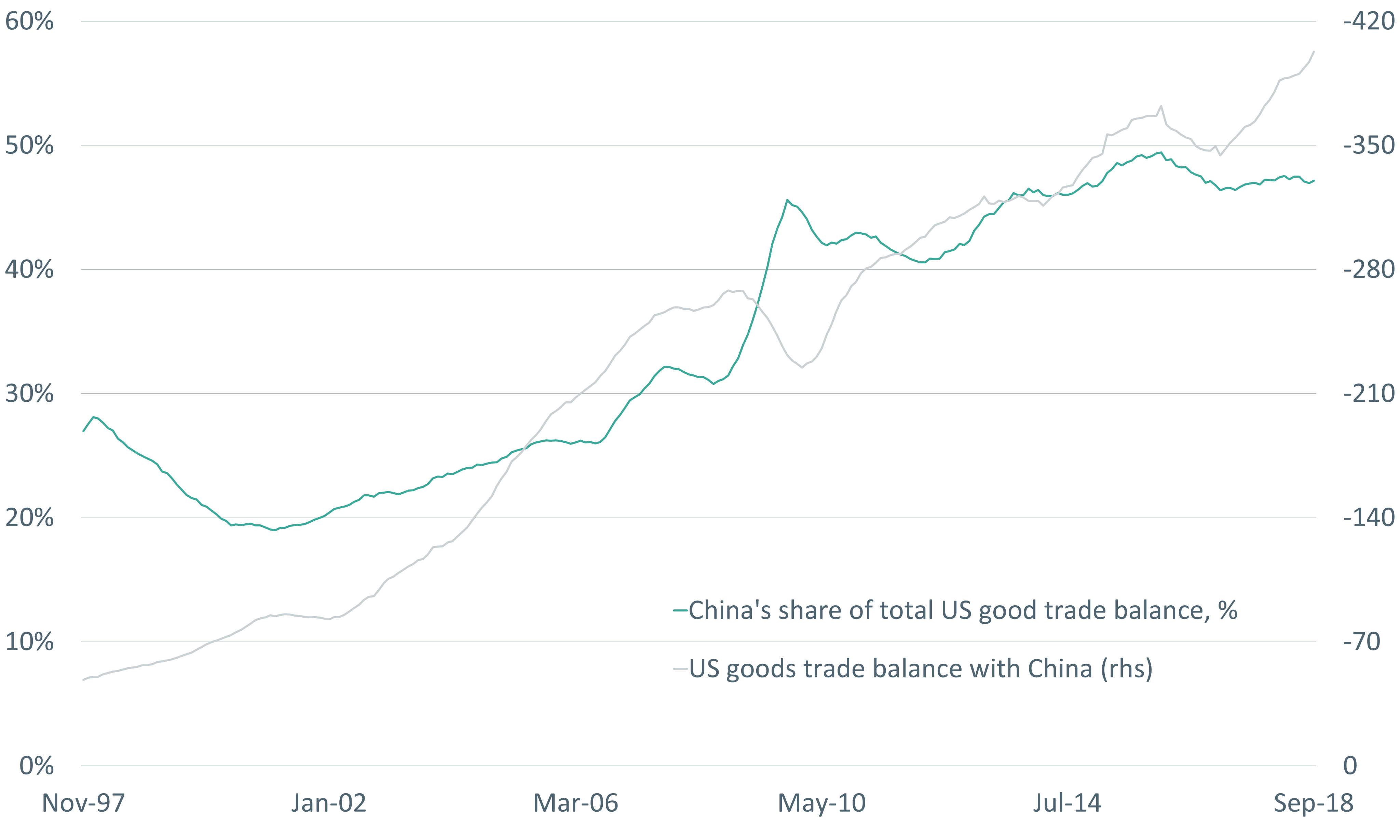

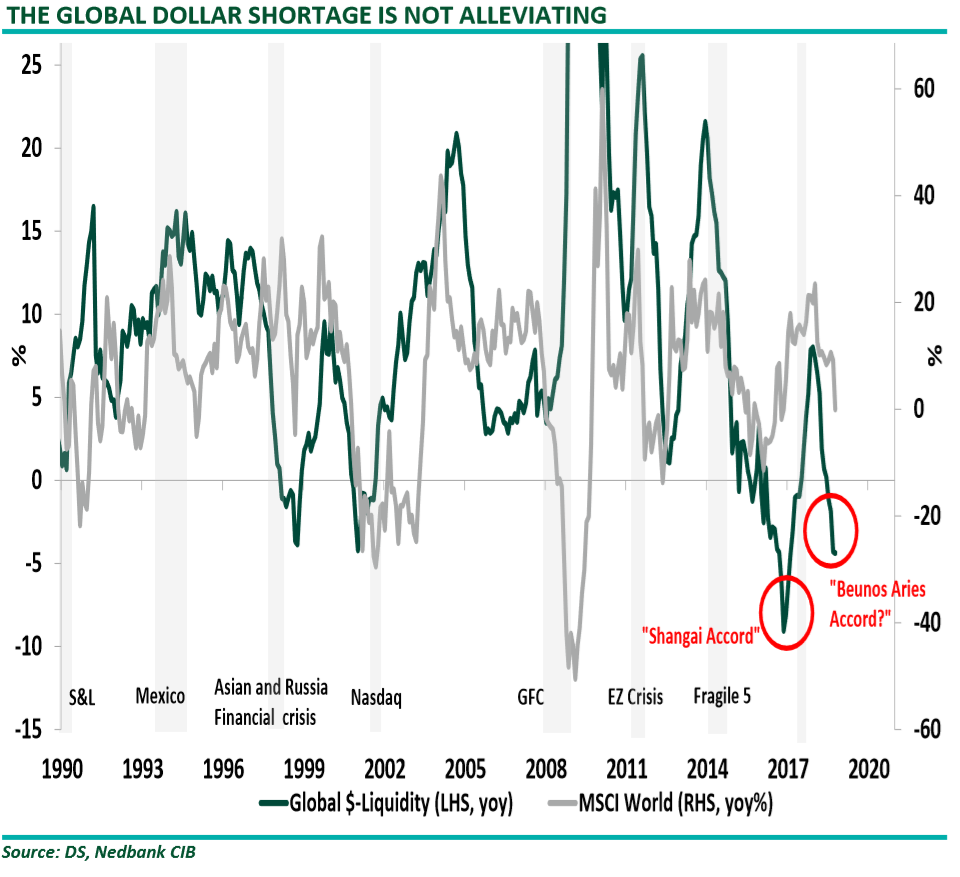

Throw those projections out. If you want to know where equity markets are headed , then look no further than the chart below which shows the correlation between M1 and MSCI world Index.Central banks probably need to do something to turn around real M1 growth, otherwise MSCI World will face another tough run in H1 of 2019.Do you think CBs will turn around? Oh yes they will..

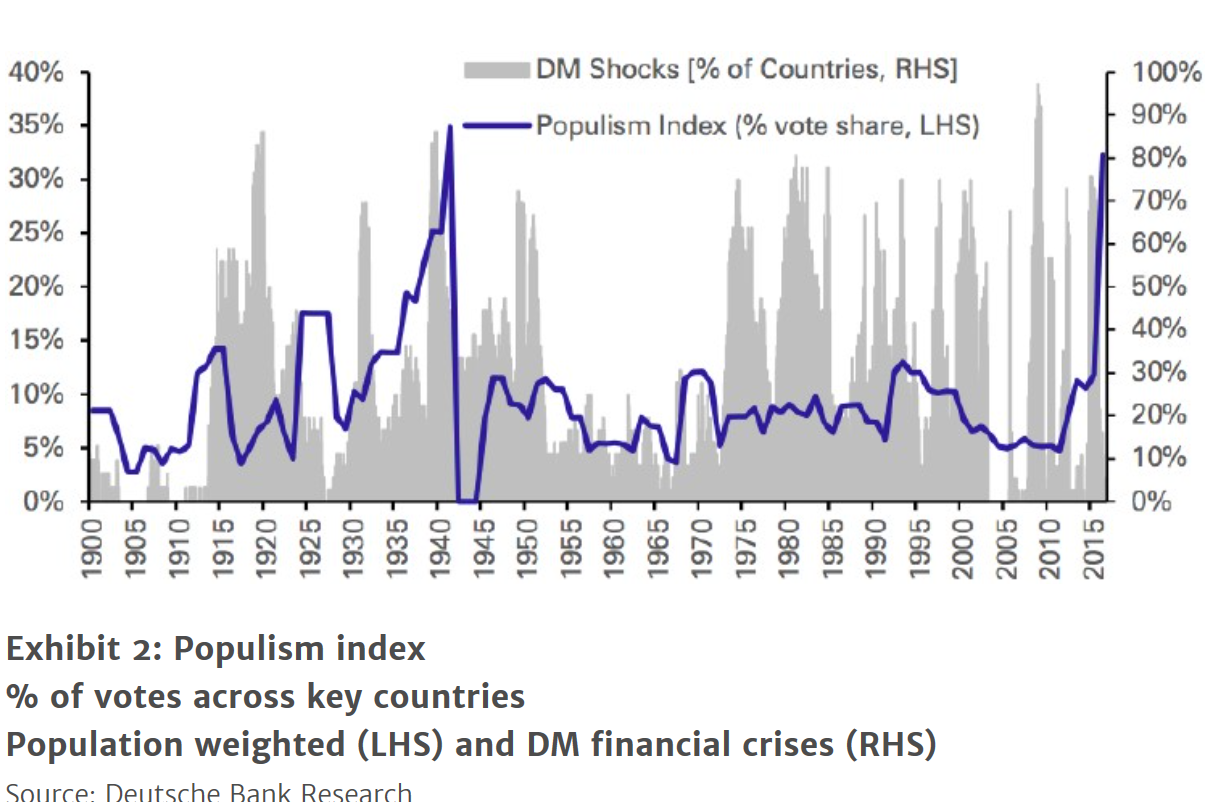

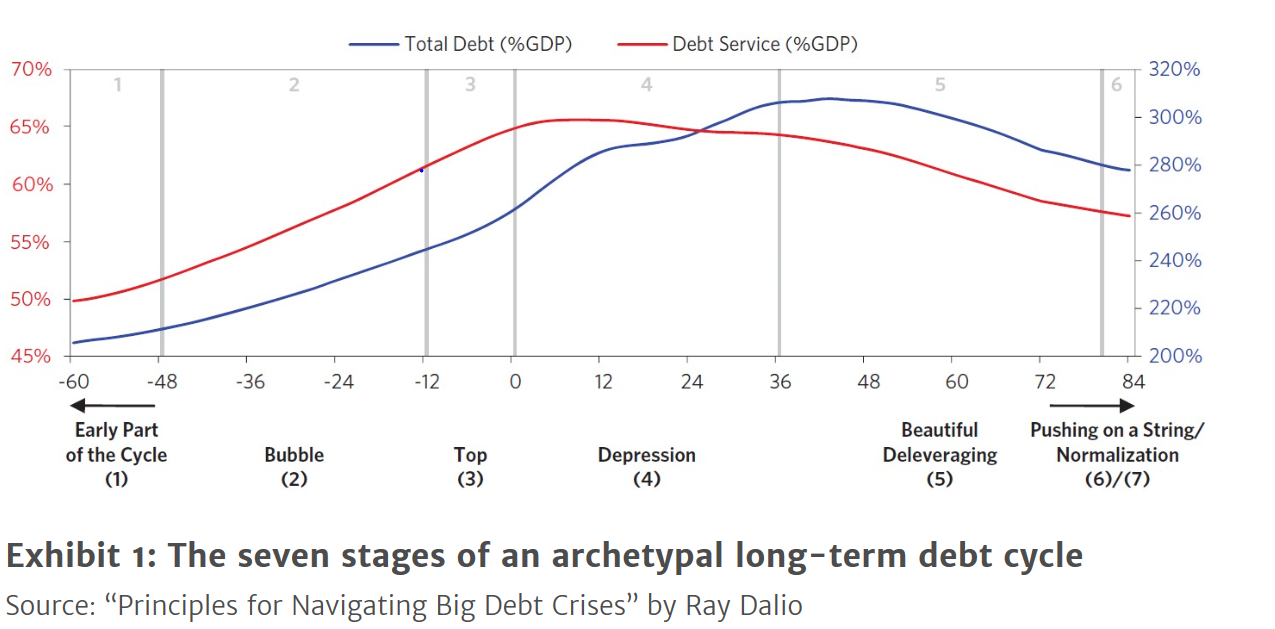

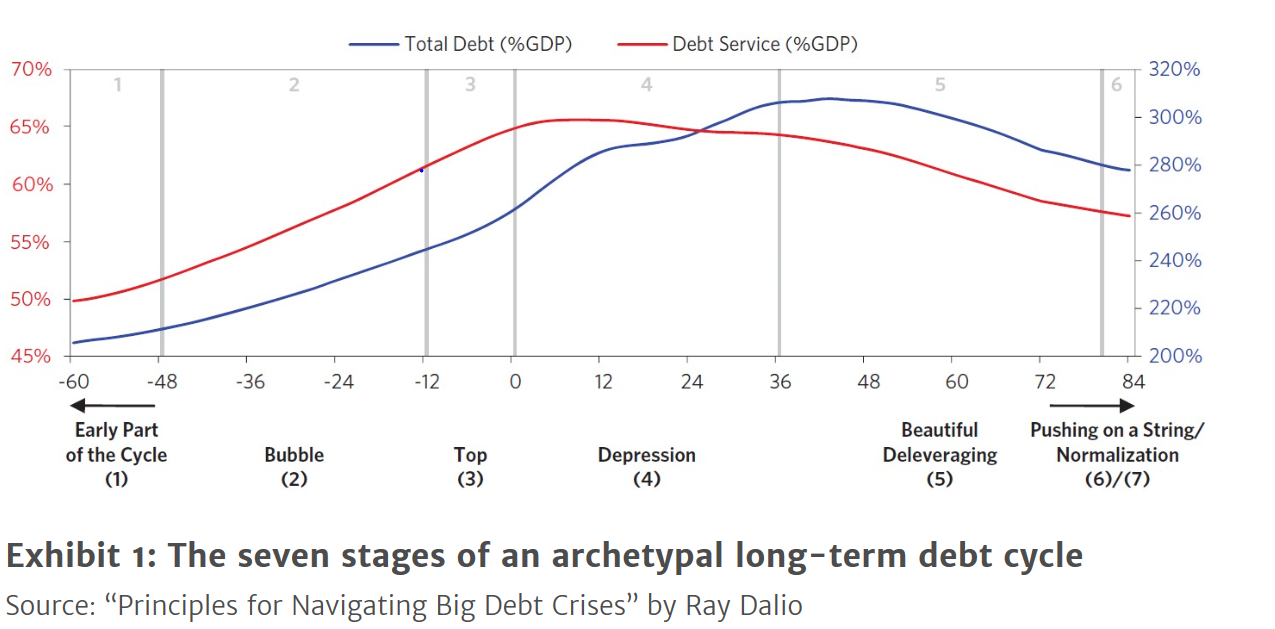

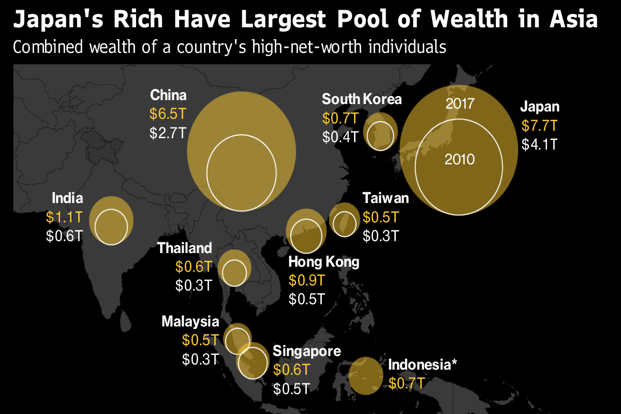

If we compare the current debt super-cycle to the previous one, which ended with the outbreak of World War II in 1939, 2007-09 were similar in nature to 1929-32, and the phase we are going through now is similar to 1935-39, where a sharply rising gap between poor and rich led to a monumental rise in monster like Adolf Hitler

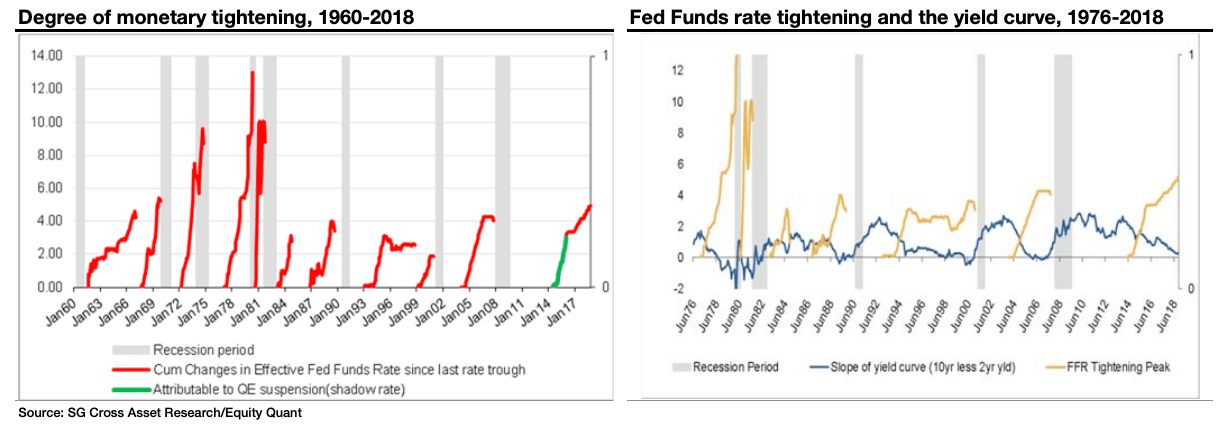

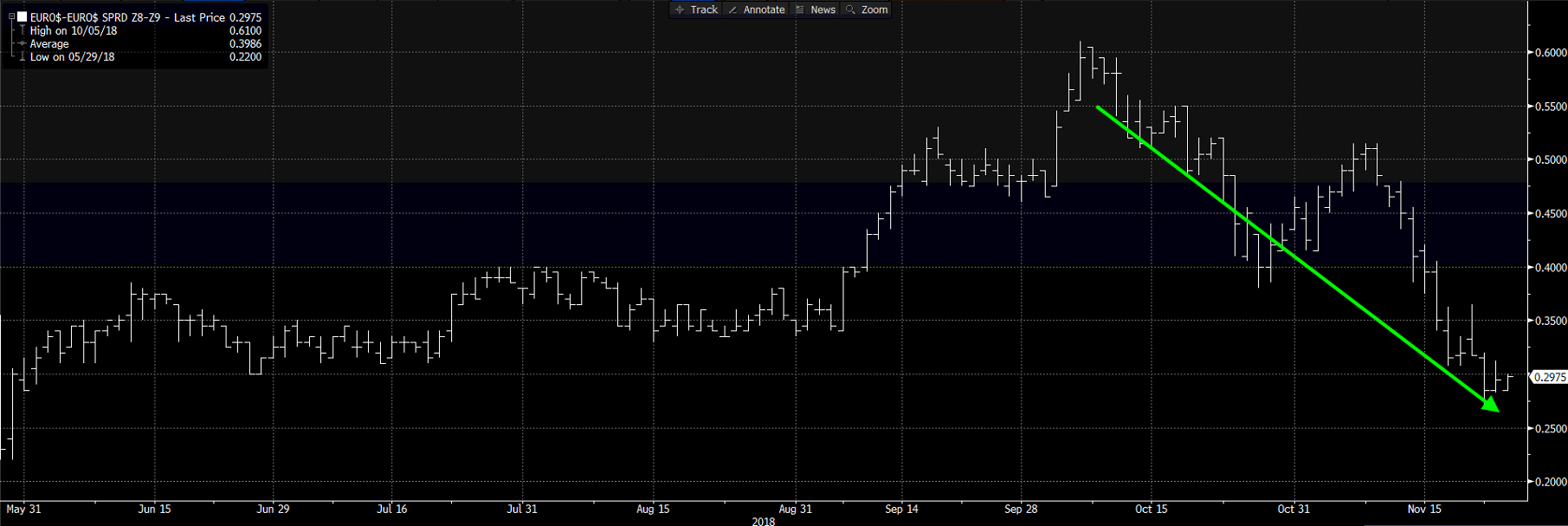

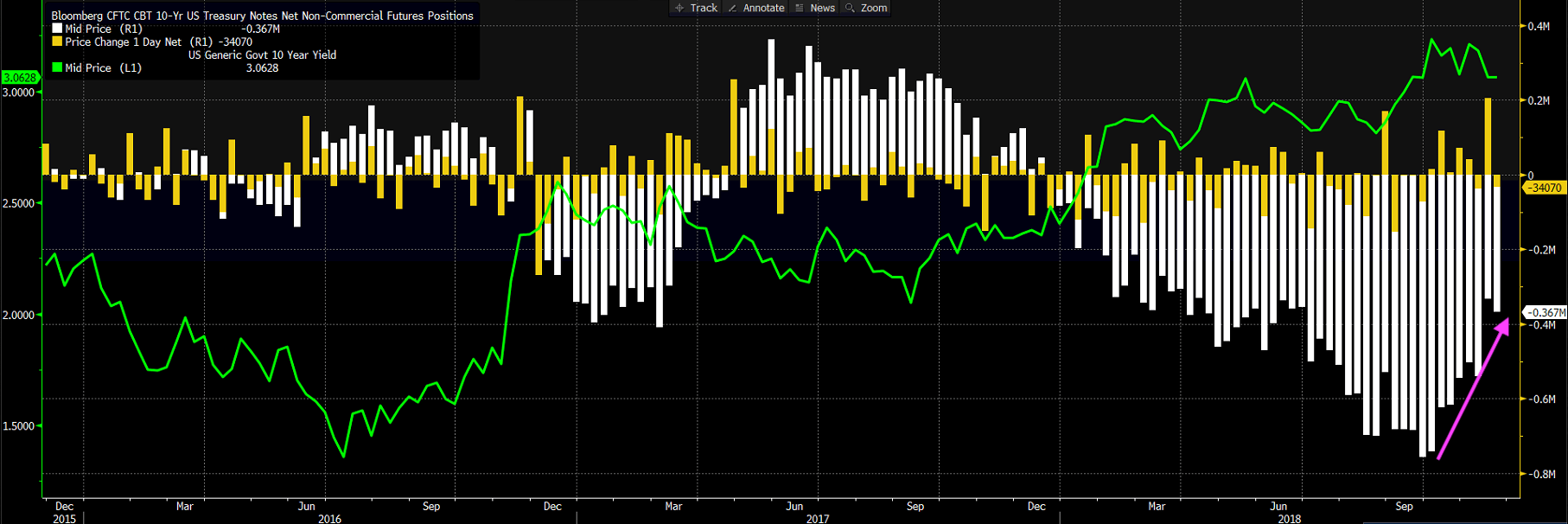

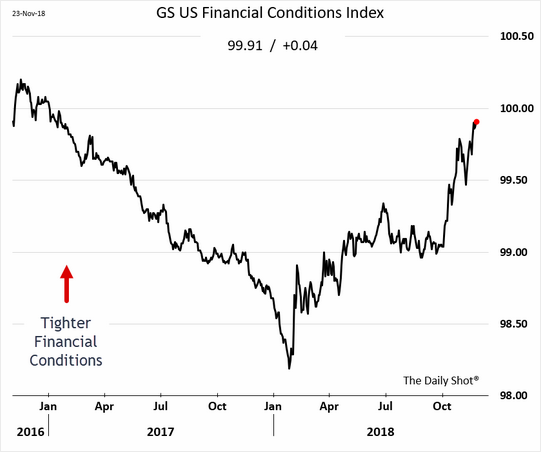

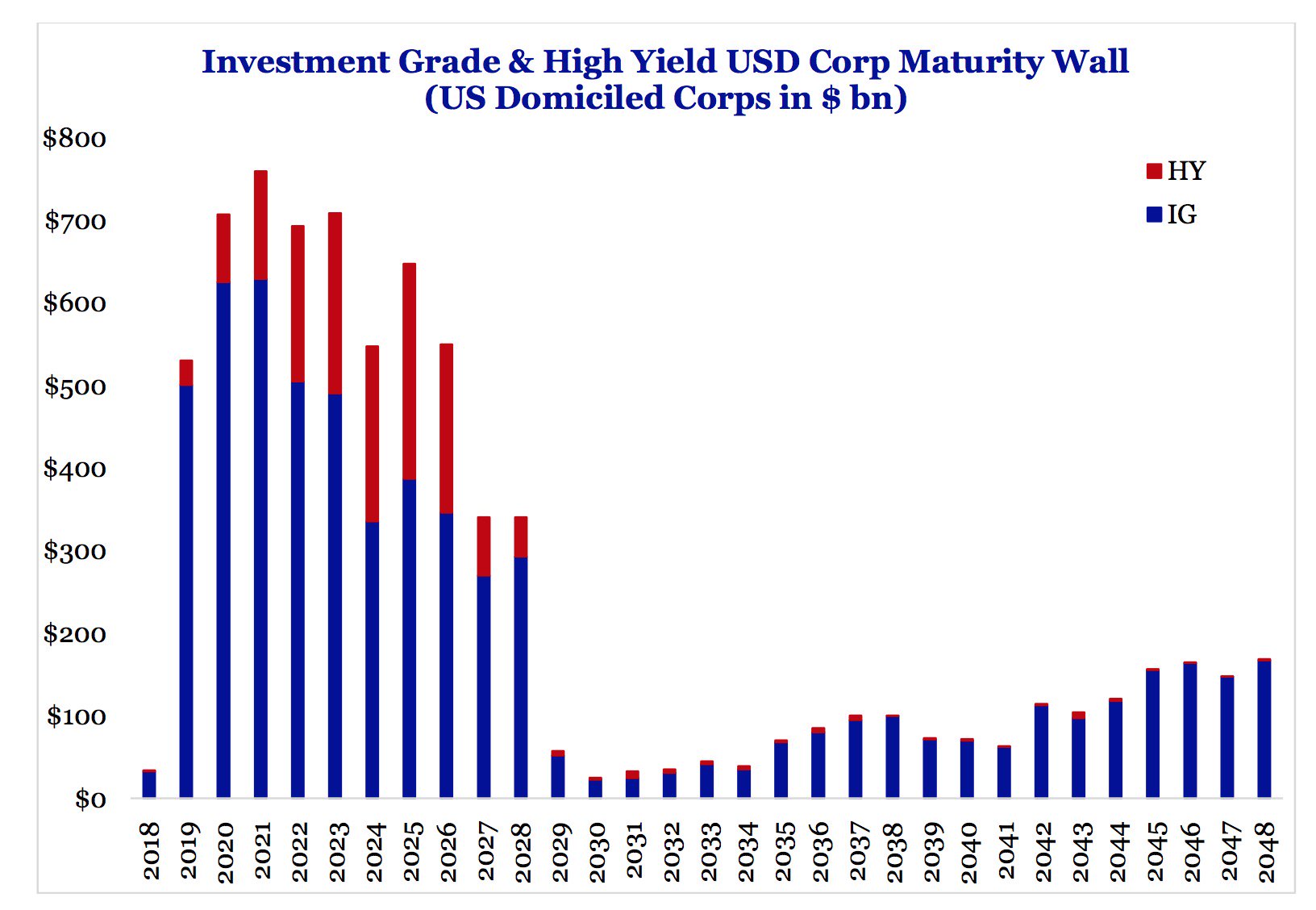

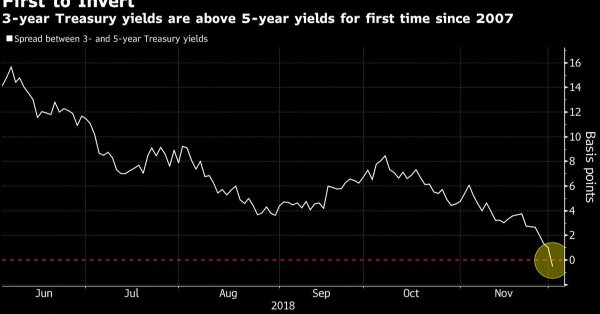

It looks like the US credit market is about to hit the wall. US wall of maturity is around 2020 to 2022, according to calculations by SRP boxing central bankers into the corner.

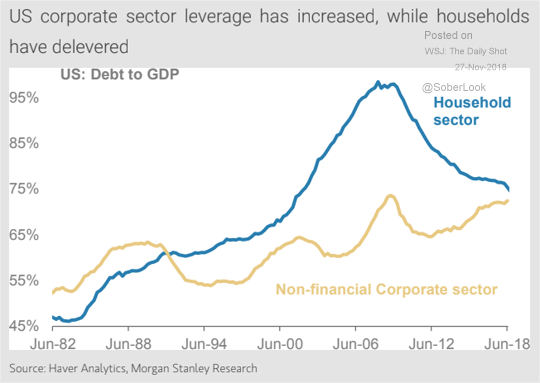

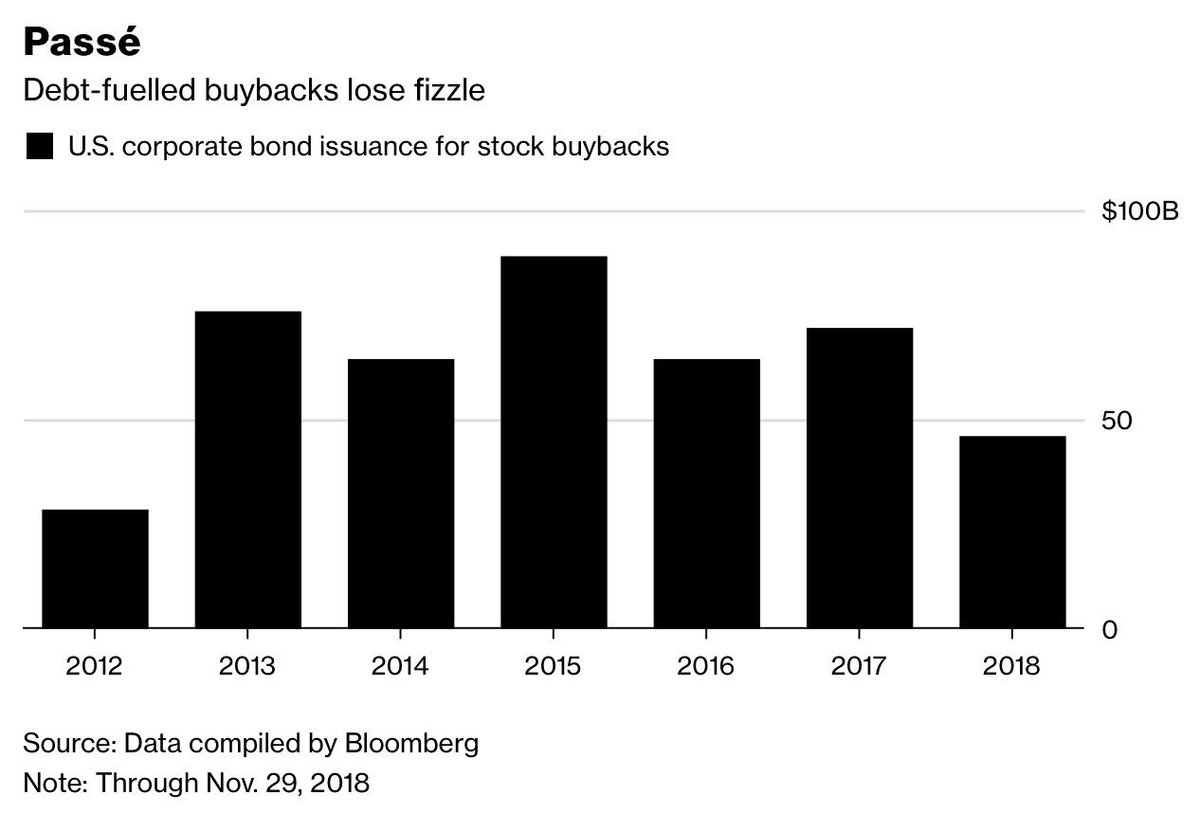

Debt-fuelled buybacks under threat as creditors get demanding ask GE or GM. Companies no longer ‘happy to use cash’ towards payouts. This was the significant tailwind for US stock market which is now under threat.

My two cents

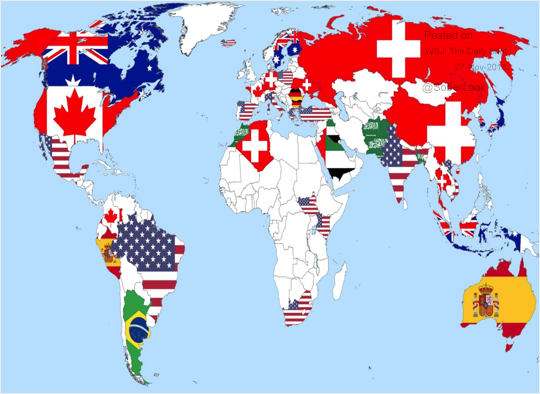

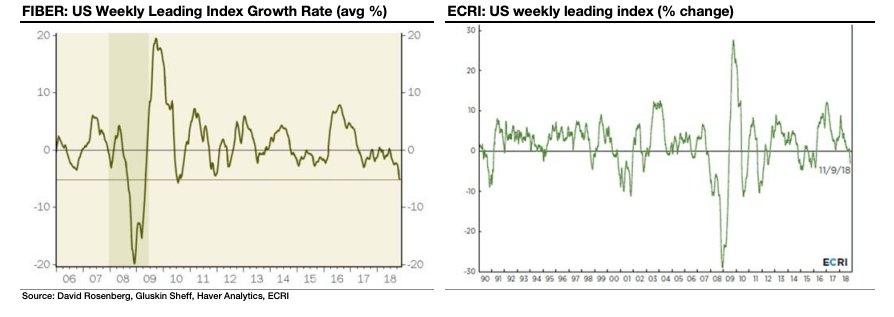

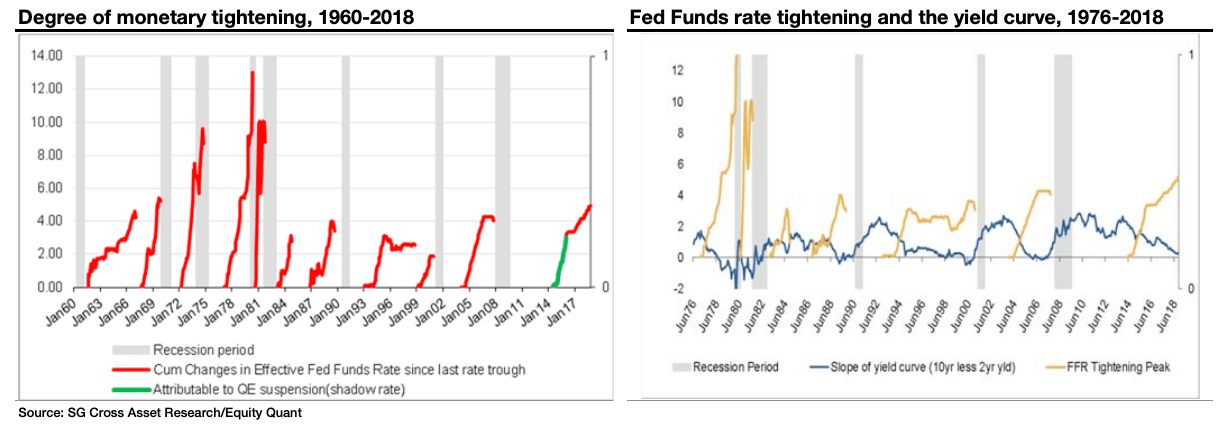

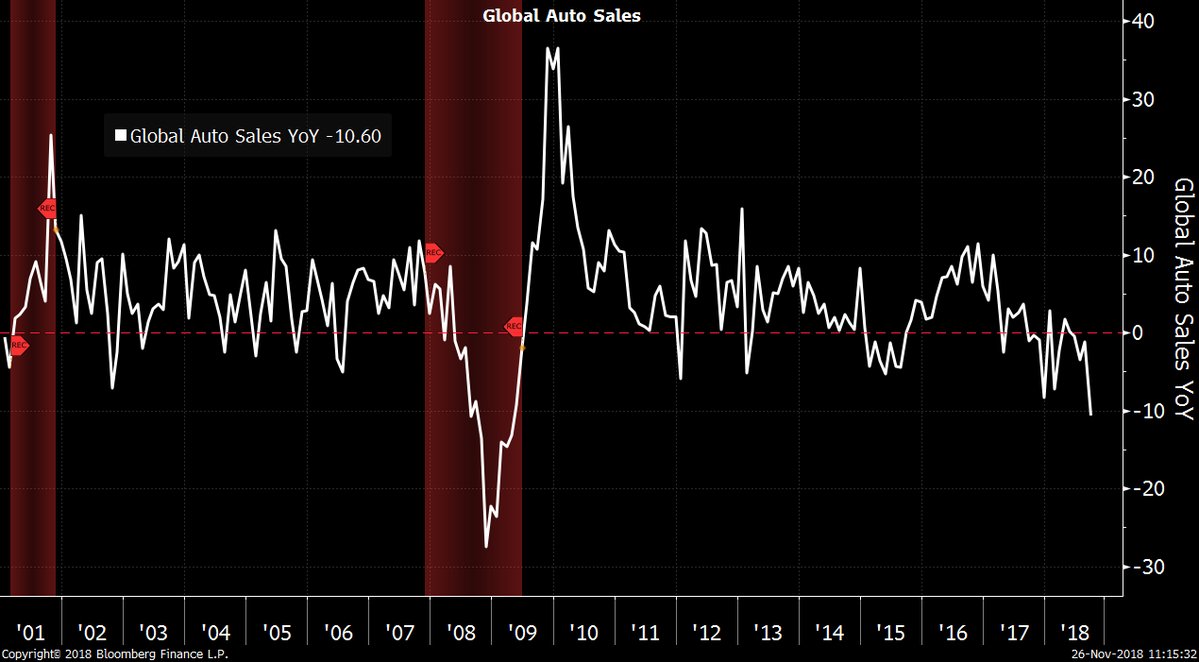

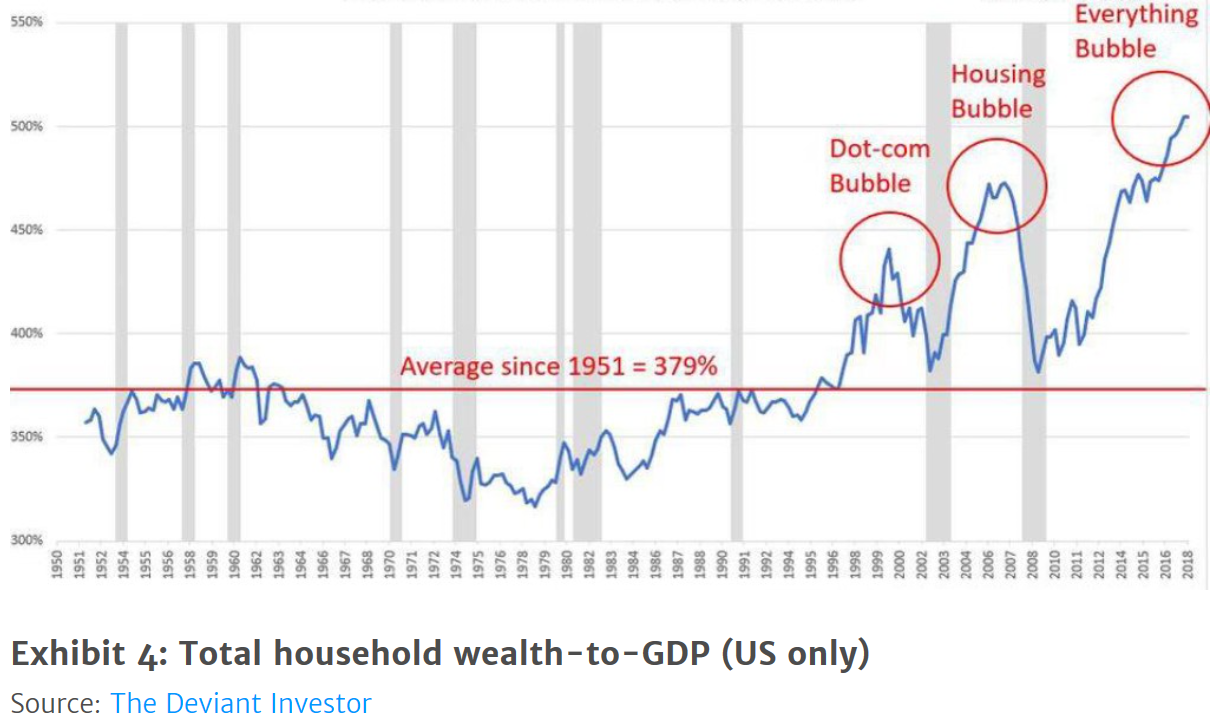

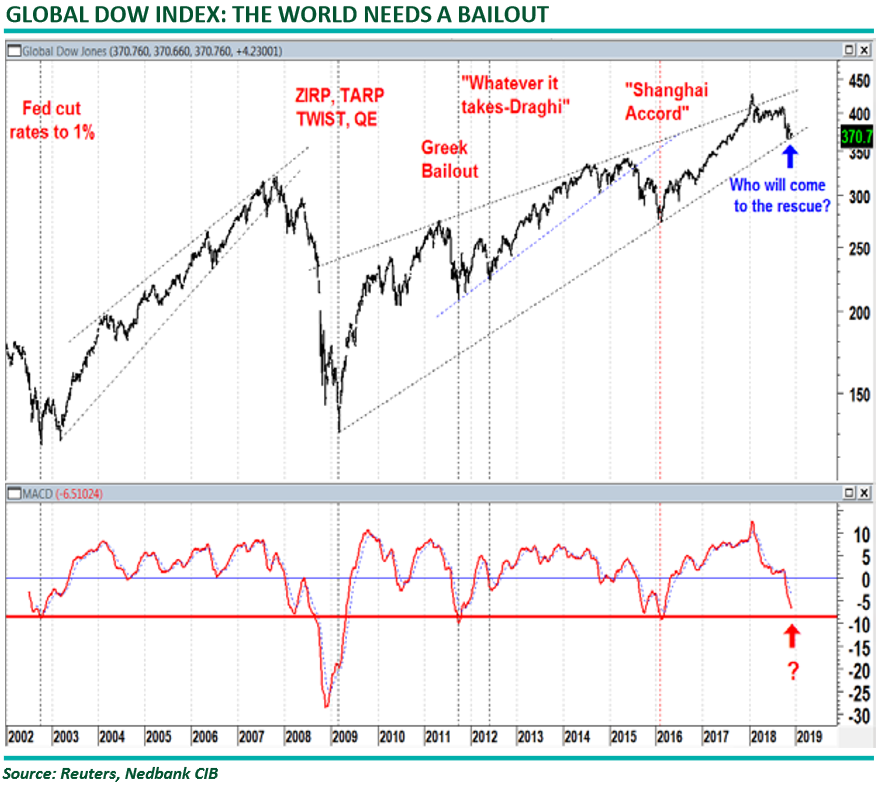

The charts above are signaling that investment landscape is shifting. I can easily put the blame on central bankers for cutting the rates so low that saving money amounted to stupidity and borrowing to spend or buyback your own share was seen as the right thing. This led to higher level of indebtedness at household and corporate level along with rise in asset prices. Poor don’t have assets,so they were left behind in this orgy of asset bubble as seen below which is leading to rise in populism ( seen those yellow vest protests)

what will happen when this Everything Bubble burst’s? any guesses

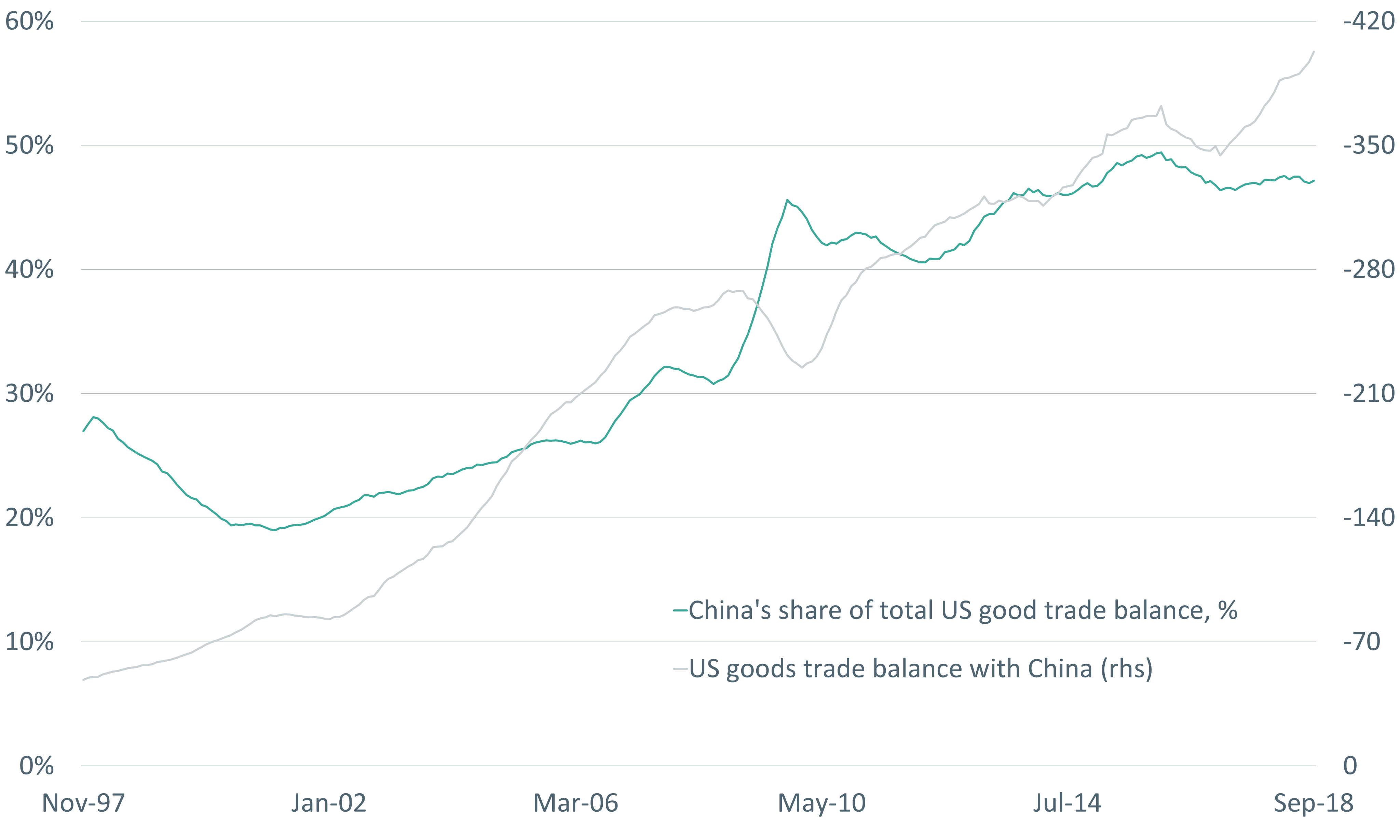

While US

While US