Rohit Srivastava at Indiacharts explains brilliantly the correlation in society mood, Tallest statue and fate of markets

“Yesterday – the Indian Newspapers were splashed with advertisements of the Inauguration of the tallest Statue in the World constructed in the State of Gujarat. A big feat and it was undertaken by this regime in the midst of booming stock market. What can it tell us about the state of the mood in India and what lies ahead for the Indian stock market? At 182 meters this is now the Tallest Statue in the world

This was accompanied by a list of all the previous Statues that held this claim providing an interesting ground for R&D into the importance of these events.

This brought to my mind memories of the multiple articles on social mood written by Robert Prechter on the relationship between stock market peaks and construction of the words tallest buildings. He noted it was not the date of construction alone but the period when it was constructed that was important to know where we are in the long term. Without putting words in his mouth here is what he said in his Elliott Wave Theorist publication.

An interesting chart of the history of buildings near peaks is also below.

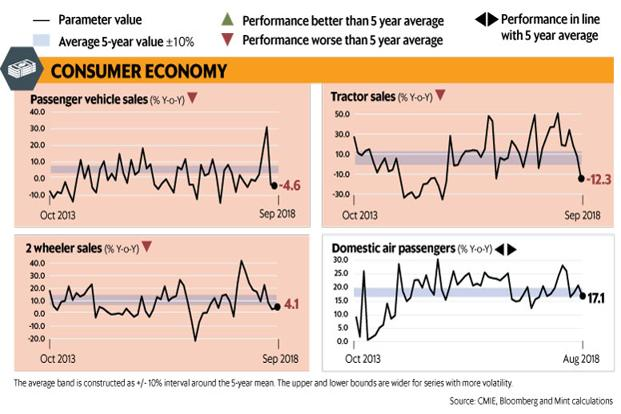

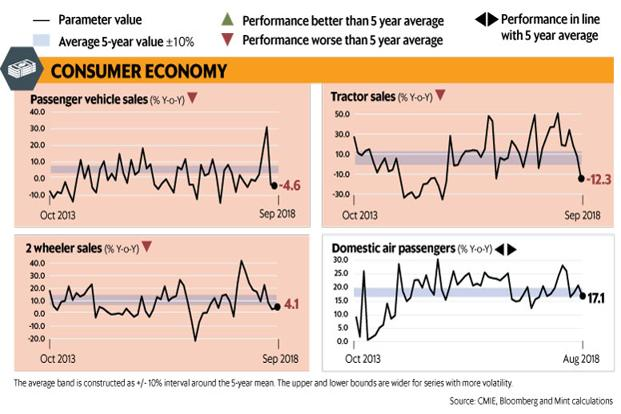

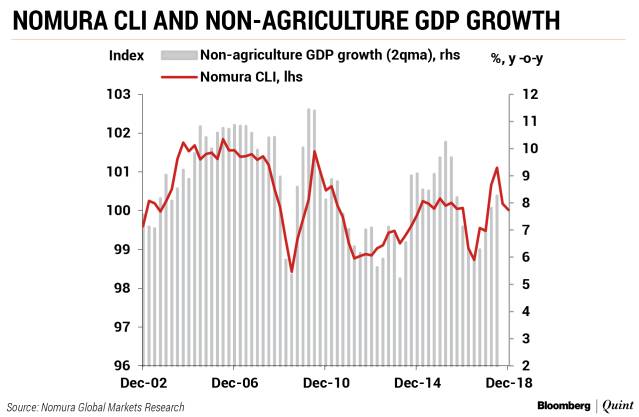

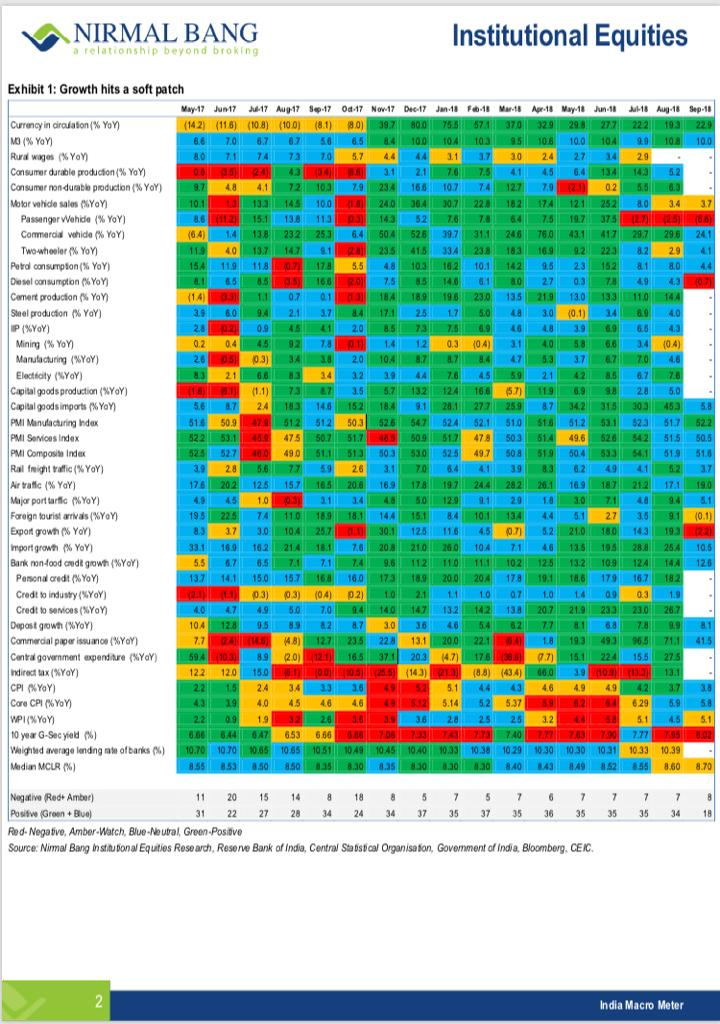

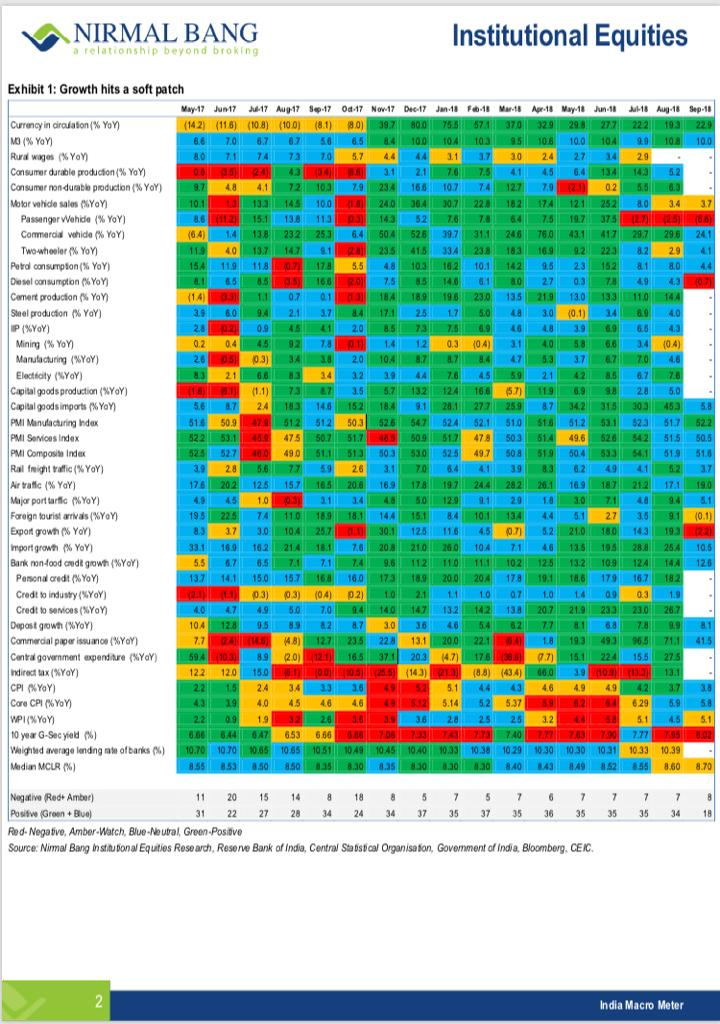

With that, let us see where we are with respect to the largest Statues in the World. It is my belief based on the work already done by the Socioeconomics Institute on the subject that the decision to construct the largest Statue in the world by Shri Narendra Modi, marks the strong social mood of the times in India. The confidence that all is well based on what has been a 15 year advance in stock prices. It also marks the final bubble phase of the Indian stock market, and based on my long term chart of the Nifty the 5th wave, in the form of an ending diagonal at the end of a Supercycle degree bull market. That it was completed yesterday is less important than that is was in construction for the past 56 months. The bids started in Oct 2013 and awarded in Oct 2014.

So now the big question is when was the second biggest statue constructed? Right into the peak of 2008 and completed by Sept 2008. The Spring Temple of Buddha though took 10 years to complete. But here is the big catch 3 of the tallest statues were completed in 2008 in months of each other and are all Buddha statues. A lot of tall buildings were getting constructed at the same time as mood was reaching a peak. We seem to have seen that with the statues in 2008.

The Ushiku Daibutsu in japan was completed in 1993 after 10 years of work and within that occurred the Supercycle degree peak in mood and the Nikkei stock index. So work started on it in the midst of the Japanese bubble that popped in 1989 but was completed only years later.

Now the Russian statue The Motherland Calls put up in 1967 a time when there was no RTSI index so it is hard to point to the stock market there. But the Statue of Liberty 1887, USA started construction in the early 1870s. It was a gift from France. That said the stock market rallied into the 1870s and then went into a long consolidation phase. What makes 1870 important is not the US stock market performance alone but that it was at the end of a global boom in railroads. So while US stocks peaked after the 1870s and consolidated for many years it was the UK charts that might be more compelling. As that period was marked by overinvestment in railroads and then banking failures. So here is a chart of the UK market cap performance from 1825-1870. Not the clearest view of the period but a zoom into what happened after 1873 for US stocks.

The next and final chart shows the US from 1950 to date

Lastly what did the railroad boom look like? The pre 1970 UK market boom was put together in one paper by Graeme G Acheson, probably written for Cambridge University but I found it online listed on many websites and am picking the chart from there so you know what it was like before the Statue was gifted to the US.

Now you may consider the evidence here coincidental and you can also think that the start dates of building are way before the bubble peaks. However, the moment I laid my eyes on an advertisement that spawned across the newspapers it appeared as a reflection of the positive mood of the times and it was worth the effort digging into it this morning. I am especially taken up by it because it comes at the end of India’s Supercycle degree bull market that is ending with an ending diagonal in my opinion. And if this tallest statue is a red flag then we have held it up wide and loud for the world to see and note. While most would see it as a sign of confidence socionomic studies see it as the point of maximum confidence just as the tide is about to turn

My two cents

I spend a lot of time understanding society mood and Pessimism leads to skepticism. Skepticism leads to optimism. Optimism leads to euphoria and the cycle repeat itself. The statue is a sign of late Euphoria