Some smart investors rarely give interviews and I am always on lookout for Felix Zulauf views on market. Below is summary of his latest interview……Via CMG wealth

Article by Lauren R. Rublin, October 5, 2018

Felix Zulauf was a member of the Barron’s Roundtable for about 30 years, until relinquishing his seat at our annual investment gathering in 2017. While his predictions were more right than wrong, it was the breadth of his knowledge and the depth of his analysis of global markets that won him devoted fans among his Roundtable peers, the crew at Barron’s, and beyond. Simply put, Felix, president of Zulauf Asset Management in Baar, Switzerland, always knew—and still knows—better than most how to connect the dots among central bankers’ actions, fiscal policies, currency gyrations, geopolitics, and the price of assets, hard and soft.

With interest rates rising, governments in flux, and the world’s two biggest economies facing off over trade, it seemed the right time to ask him how today’s turmoil will impact investors in the year ahead. Ever gracious, he shared his thoughts and best investment bets in an interview this past week.

Following is a selection of what I feel are the most important takeaways from the interview.

Zulauf believes we have left the world of free markets and entered the world of managed economies and said this is a major change in in his lifetime.

Central banks took over the running of economic policy after the financial crisis and run the show to this day.

He also said the move to globalization is now moving backwards and moving to regional economic and trade partnerships, which could create problems for multinational companies.

The past 30 years saw the biggest globalization process ever, with the integration of China into the world economy. With today’s trade conflict, that is changing.

He believes, the Northeast Asia economic model isn’t compatible with the Western model.

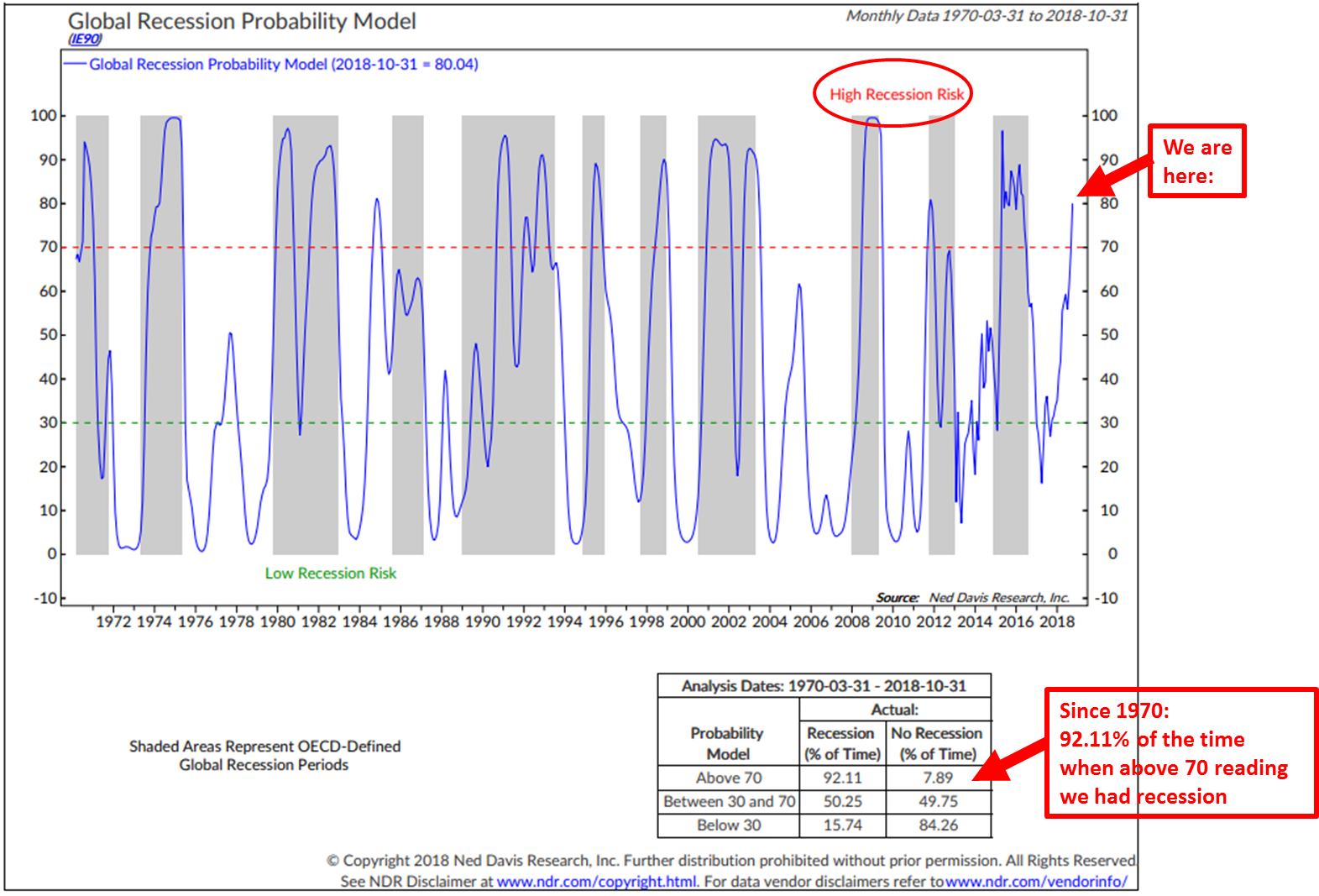

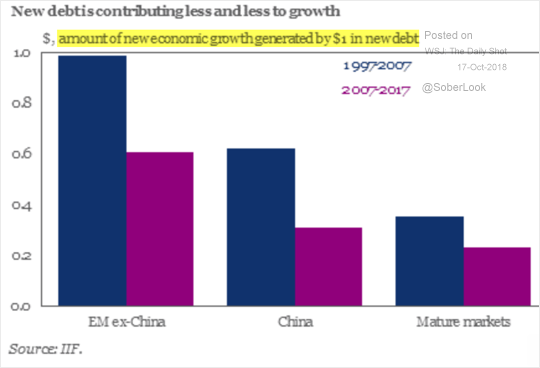

In the West, corporations are run for profit. In Northeast Asia, exports have been used to increase employment, income, and market share. In China, average export prices have been unchanged in U.S. dollar terms for the past 15 years, whereas the average wage has gone up six times. A company with such statistics goes bankrupt, but China has escaped that outcome through the use of debt.

He believes the World Trade Organization should have sanctioned China for applying unfair trade practices, but didn’t. And added, Presidents Clinton, Bush, and Obama, and the Europeans, were asleep. President Trump has taken up the issue, as he was elected to do. Middle-class incomes in the U.S. and many European countries have been unchanged or down for the past 30 years in purchasing-power terms, while middle-class incomes in China and its satellite economies have risen tremendously.

He expects the China trade conflict to continue. 25% tariffs on everything within 12 months. Concluding, the Chinese will lose a few trade battles, but eventually win the war.

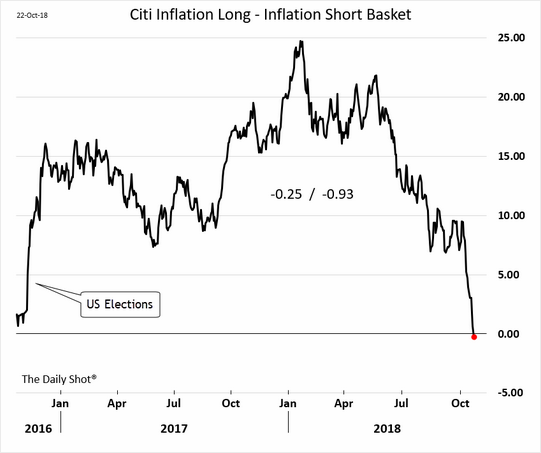

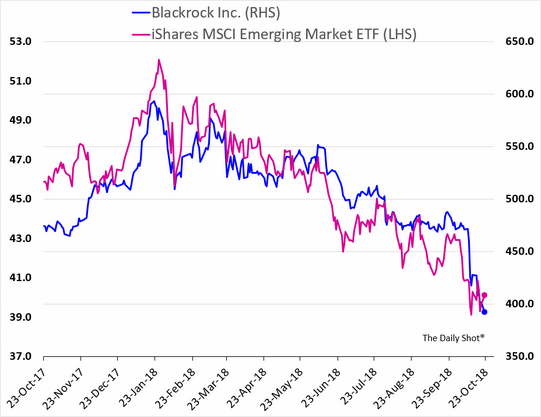

Investment picks: He favors oil and the U.S. dollar against certain currencies. He is short Emerging Markets. And also likes going long Japan via a currency hedged ETF and short the S&P 500 as a pair trade.

More on China:

China will build up its strategic partnerships around Asia, keep expanding in Africa, and try to convince Europe to join its trading bloc. If the U.S. continues to take an aggressive stance, it runs the risk of becoming isolated.

He’s looking out next six or seven years. A trade war might protect U.S. industries for a while, but protectionism weakens industries and economies.

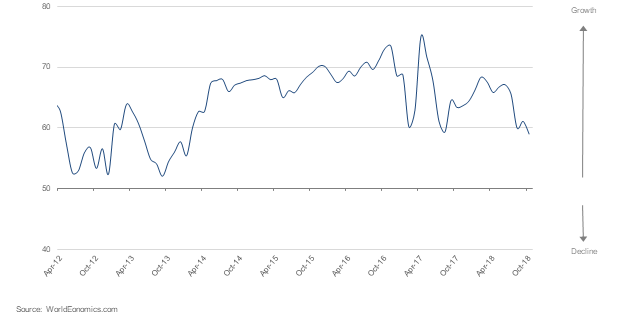

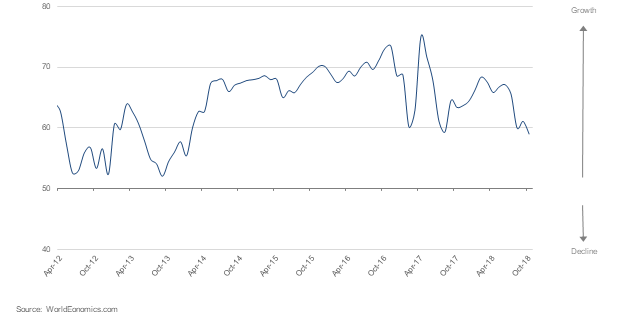

He said, at present, the world economy is desynchronized.

The U.S. economy is on steroids due to tax cuts and government spending and growing above trend.

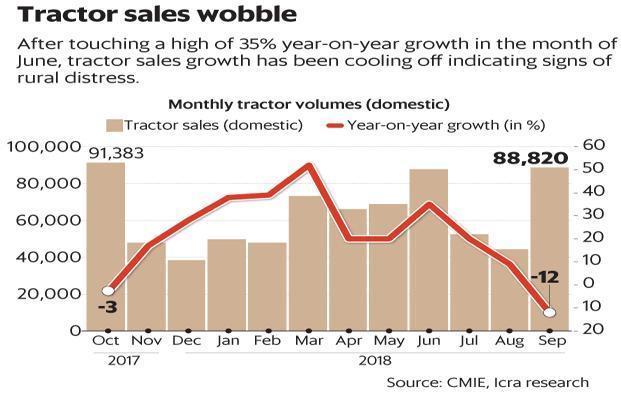

China is in a pronounced slowdown that could continue until the middle of next year, at least. The Chinese agenda is to have a strong economy in 2021, the 100th anniversary of the founding of the Communist Party of China, and 2022, the year of the next National Congress.

That is why China started to address major problems, such as pollution and financial excesses, in 2017. Cleaning things up led to a slowdown that could intensify in coming months as U.S. tariffs increase.

This totally got my attention:

China will launch another fiscal stimulus program, supported by monetary stimulus.

When it does, the currency will fall 15% or 20%. The Chinese will let the currency go because they know they can’t please President Trump on trade. They aren’t prepared to do what he’s asking for.

We’ll also see fiscal stimulus applied in emerging markets, which are largely dependent on China, and in Europe and maybe the U.S., where President Trump will launch a spending program to boost the economy ahead of the 2020 election.

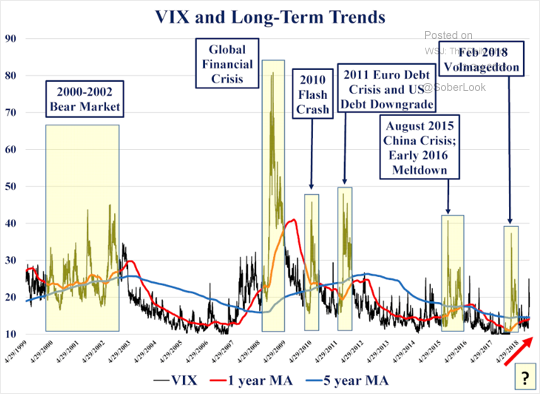

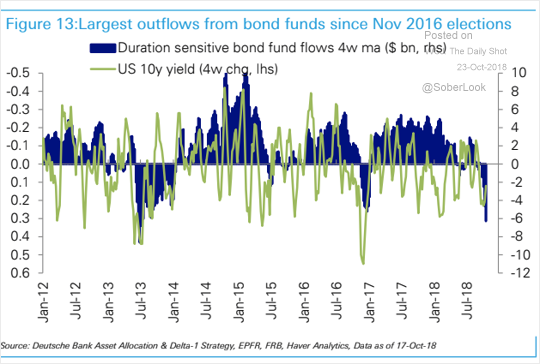

Bad for bonds – a decisive bear market in bonds

Global fiscal stimulus initiatives are poison for bond markets. Bond yields are rising around the world. After major new fiscal stimulus programs are announced, perhaps from mid-2019 onward, yields will rise quickly, resulting in a decisive bear market in bonds.

Treasury Bond – $1.3 trillion in Treasury paper must be issued in the next 12 months (to finance U.S. spending deficits) – More supply = higher interest rates

The U.S. economy is growing above trend, capacity utilization is high, and the intensifying trade conflict with China suggests disruption in some supply chains, which leads to higher prices.

The Federal Reserve is selling $50 billion of Treasurys per month, and the U.S. Treasury must issue $1.3 trillion of paper over the next 12 months. All these factors are pushing yields up.

On the Euro – Right on point! Watch the banks!

Introducing the euro led to forced centralization of the political organization, as imbalances created by the monetary union must be rebalanced through a centralized system. As nations have different needs, the people are revolting; established parties are in decisive decline, and anti-establishment organizations are rising.

The risk of a hard Brexit is high. Italy doesn’t listen to Brussels any longer. The March election brought anti-establishment parties to power that proposed a budget with a 2.4% deficit target. Eventually it will be closer to 4%. The Italian banking system holds €350 billion of government bonds. If 10-year government-bond yields hit 4%, banks’ equity capital will just about equal their nonperforming loans.

By the middle of next year, you’ll see more fiscal stimulation in Germany, Italy, France, and possibly Spain. Governments will not care about the EU’s directives. The EU will have to change, giving more sovereignty to individual nations. If Brussels remains dogmatic, the EU eventually will break apart.

The European Central Bank

ECB quantitative easing ends by the end of this year. The economy has been doing well, the inflation rate has risen, and yet the ECB has continued with aggressive monetary easing, primarily financing the weak governments. This is nonsense.

They are the worst-run central bank in the world. I expect the euro to weaken further, possibly to $1.06 from a current $1.15.

The U.S. Fed

The Federal Reserve is draining liquidity from the financial system [by not buying new bonds to replace maturing paper]. It will remove another $600 billion from the market in the next year.

The Treasury will issue $1.3 trillion of Treasury paper to finance the budget deficit.

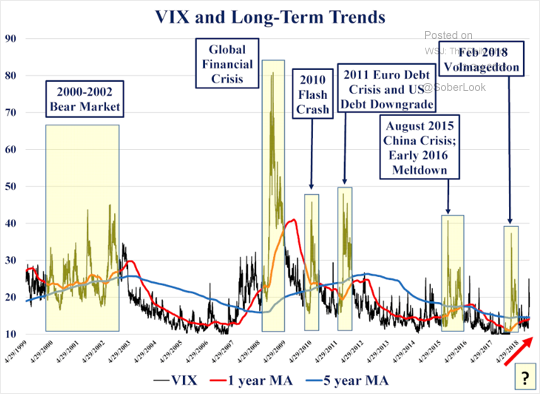

All of this means a lot of liquidity is being withdrawn from the market, which is bearish for financial assets.

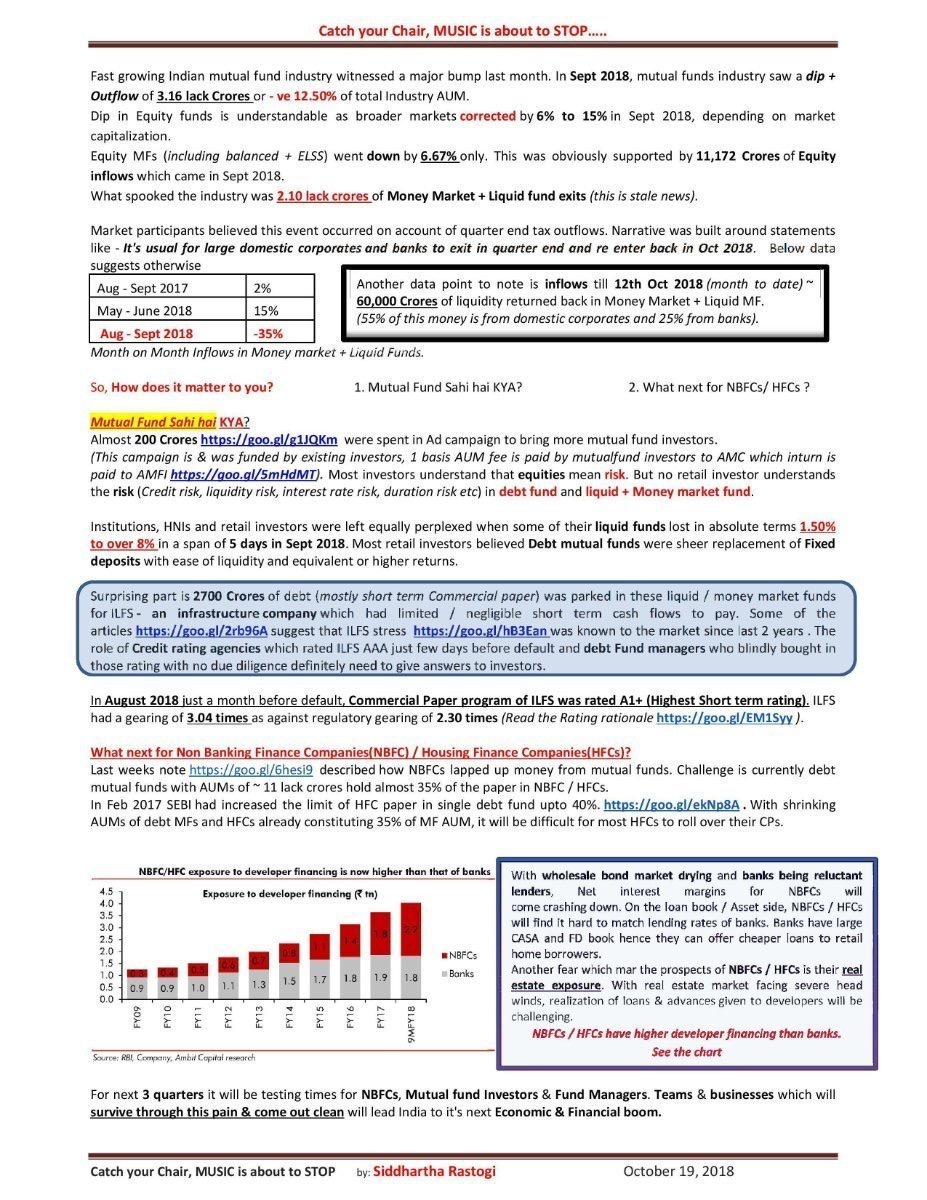

He expects U.S. stocks to slide into the middle of next year, falling maybe 25% to 30% from the top, taking nearly all other markets down with them.

Zulauf concludes:

When the declines are big enough, the central planners will come in. Central banks will ease monetary policy, buying assets if necessary.

You won’t earn a lot owning equities over the next 10 years, especially if you’re a passive investor in index funds.

It will be a much better time for traders and active investors who pick stocks and sectors and do exactly what hasn’t worked for the past 10 years.