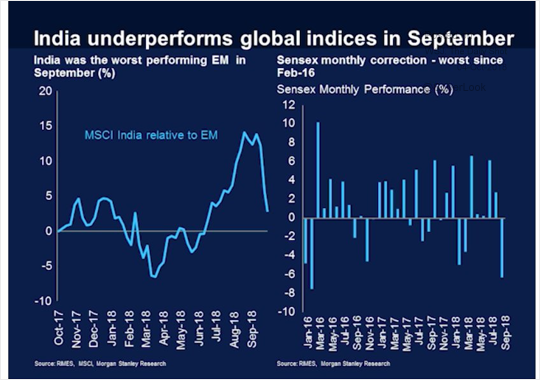

Emkay writes in a strategy report…Tightening global liquidity, rising rates, and weakening INR are coalescing into an

equity market correction, and is now challenging the perceived Teflon coating of local participation which have consistently challenged since mid-2017. We believe that our reflationary recovery thesis has peaked out due to emerging global and domestic headwinds. While our base case for the stands at 10400-11000, increased

volatility can potentially trigger a pessimistic scenario of sub-10000 levels. Even after the 19% decline in the mid-cap index, the trailing PE of 35x is still a 50% premium to the benchmark indices. The risk is that it can go back to an average discount of 12-15%, instead of a premium, as it existed prior to May’14.

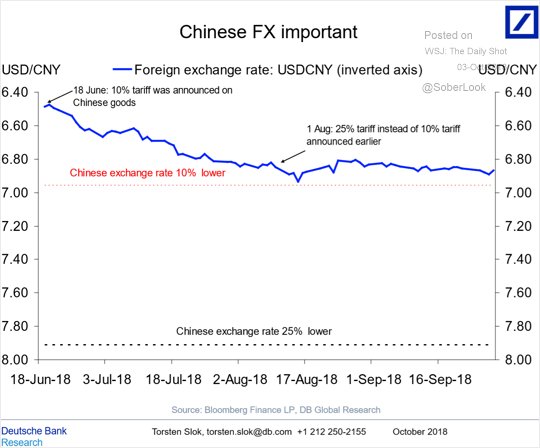

The INR/USD decline until now still partial; maintain near-term target of Rs75, but Rs80 is possible if strong USD sustain

Despite recent measures tightening liquidity conditions to intensify further; maintain 10 year Gsec at 8.4%:* a) we believe that carving out of SLR by 300bp for meeting LCR is irrelevant; banks are holding large excess SLR, b) Indicative OMO target of Rs 360bn in Oct’8 adds up to Rs 400bn already done. Our earlier estimate for FY19 was Rs 2tn; so more will be required. C) GoI has reduced the H2FY19 market borrowing target by Rs 700bn. We think it will be replaced by other forms of borrowing, Fiscal deficit remains unchanged with a high possibility of slippage.

Tapering domestic and global liquidity are risks to market multiples amid potential earnings downgrades:We believe that our reflationary recovery thesis has peaked out due to emerging global and domestic headwinds. Q1FY19 results look statistically robust, but they cannot be extrapolated for the full year. In our view, core earnings growth trajectory is ~10%, with a downside risk. Consensus earnings estimates for Nifty have undergone downgrade for FY19, and yet the expected growth stands at 25%, which is considerably optimistic. We expect earnings downgrades to continue.

Tightening liquidity to adversely affect valuations: We see a tapering of liquidity emanating from both portfolio flows of FII and mutual funds. In our assessment, the market is still fairly overvalued, and we maintain that the

capitulation in the broader market is still sometime away despite the recent sharp correction in the mid-small cap space. The 6.3% decline in the Nifty from the recent all-time peak is a fairly shallow correction.

While our base case for the Nifty stands at 10400-11000 for the next 12 months vs.the current 11000 levels, increased volatility can potentially trigger a pessimistic scenario of sub 10000 levels.

Sector impact-Margin pressure to emerge, prefer sectors gaining from weak INR & lenders with strong ALM* (pg 14-26): We assess the possible impact on various sectors from 1) rising commodity prices, including global crude oil; 2) currency depreciation; and 3) rising interest rates. Overall, within the risk-to-valuation outlook we anticipate, better positioned sectors are those that have visible exports or global revenue potential (Pharma, IT, and select Auto and Capital Goods companies). The sectors with natural hedge against INR depreciation such as metals also enjoy domestic trade policy support. Most other sectors will likely have an adverse impact of rising operating costs; consumers, autos, cement, agro chemicals are particularly susceptible. Rising interest rates are a risk for rate-sensitive sectors such as capital goods, BFSI, and infrastructure. We like banks and lenders with robust growth capital and solid asset-liability management outlook .

Full report Below

http://research.emkayglobal.com/ResearchDownload.aspx?Pid=WAhUVvIWw6c%3d&Cid=Vf2Bhqab77w%3d&fName=YIP155GNl2Wq7zXjc%2f8ARUH9d%2byH%2fQpjlU1iWgP%2btAHUEoIhobB3RtkjsfIIK7D0obCRaYjbAc8%3d&typ=APSSeVhmQ%2b8%3d