Key takeaways

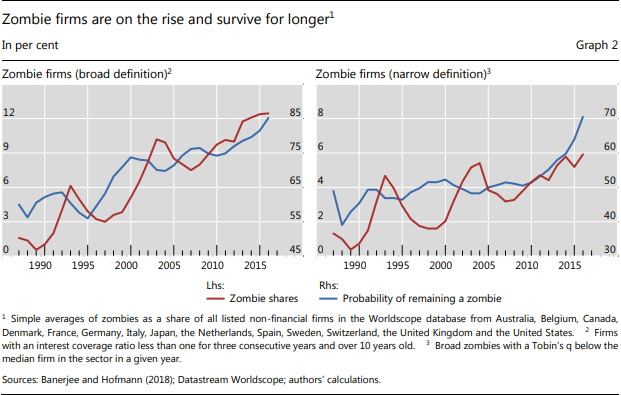

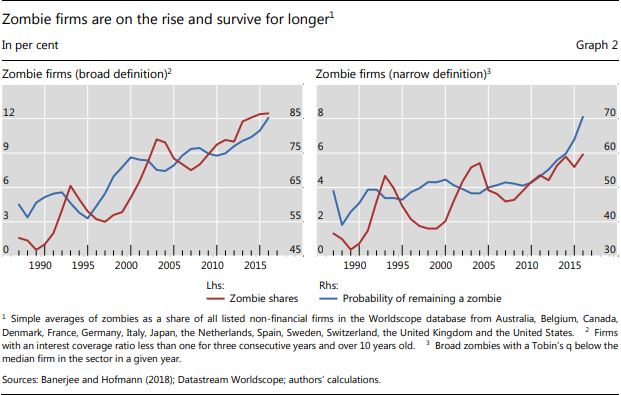

- The prevalence of zombie firms has ratcheted up since the late 1980s.

- This appears to be linked to reduced financial pressure, reflecting in part the effects of lower interest rates.

- Zombie firms are less productive and crowd out investment in and employment at more productive firms.

- When identifying zombie firms, it appears to be important to take into account expected future profitability in addition to weak past performance.

BIS writes in a paper….Zombie firms, meaning firms that are unable to cover debt servicing costs from current profits over an extended period, have recently attracted increasing attention in both academic and policy circles. Caballero et al (2008) coined the term in their analysis of the Japanese “lost decade” of the 1990s. More recently, Adalet McGowan et al (2017) have shown that the prevalence of such companies as a share of the total population of non-financial companies (the zombie share) has increased significantly in the wake of the Great Financial Crisis (GFC) across advanced economies more generally.

BIS analysis addresses three main questions:

First, are increases in the incidence of zombie firms just episodic, linked to major financial disruptions, or do they reflect a more general secular trend? Answering this question requires taking a sufficiently long perspective. Their database extends back to the 1980s and covers several business cycles. They find a ratcheting dynamic: the share of zombie companies has trended up over time through upward shifts in the wake of economic downturns that are not fully reversed in subsequent recoveries.

Second, what are the causes of the rise of zombie firms? Previous studies have focused on the role of weak banks that roll over loans to non-viable firms rather than writing them off (sounds familiar) . This keeps zombie companies on life support. A related but less explored factor is the drop in interest rates since the 1980s. The ratcheting-down in the level of interest rates after each cycle has potentially reduced the financial pressure on zombies to restructure or exit The results indeed suggest that lower rates tend to push up zombie shares, even after accounting for the impact of other factors.

Consequences of Rising Zombies

Previous studies have shown that zombies tend to be less productive. Therefore, the higher share of zombie companies could be weighing on aggregate productivity. BIS concludes….Moreover, the survival of zombie firms may crowd out investment in and employment at healthy firms .

The above article by BIS is very relevant in Indian context where banks and system had an incentive of propping up Zombie firms. India is in urgent need of investment cycle which will also aid in employment generation and the cycle cannot kick start till the financial system is able to tackle this monster of zombie firms.