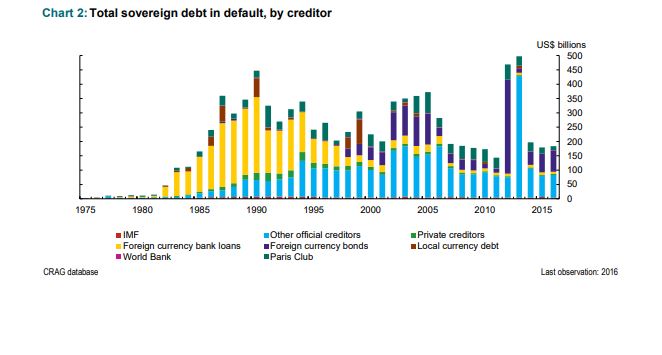

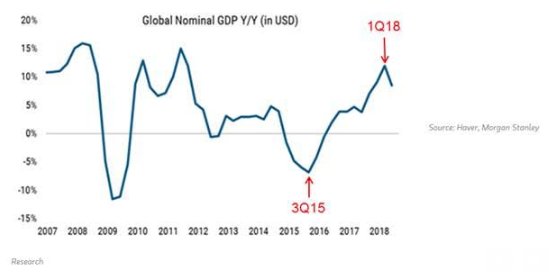

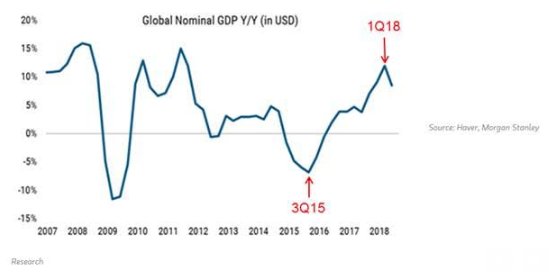

Jahangir Aziz writes in Indian Express… There is an entrenched and widespread belief among the same analysts and policymakers that India is a closed economy protected by its much vaunted regulatory and capital controls. Nothing can be further from the truth. Every time the world sneezes, India catches a cold. It happened in 2008 when Lehman collapsed; in 2011 during the European sovereign debt crisis; in 2013 when hit by the Taper Tantrum; and it is happening now.

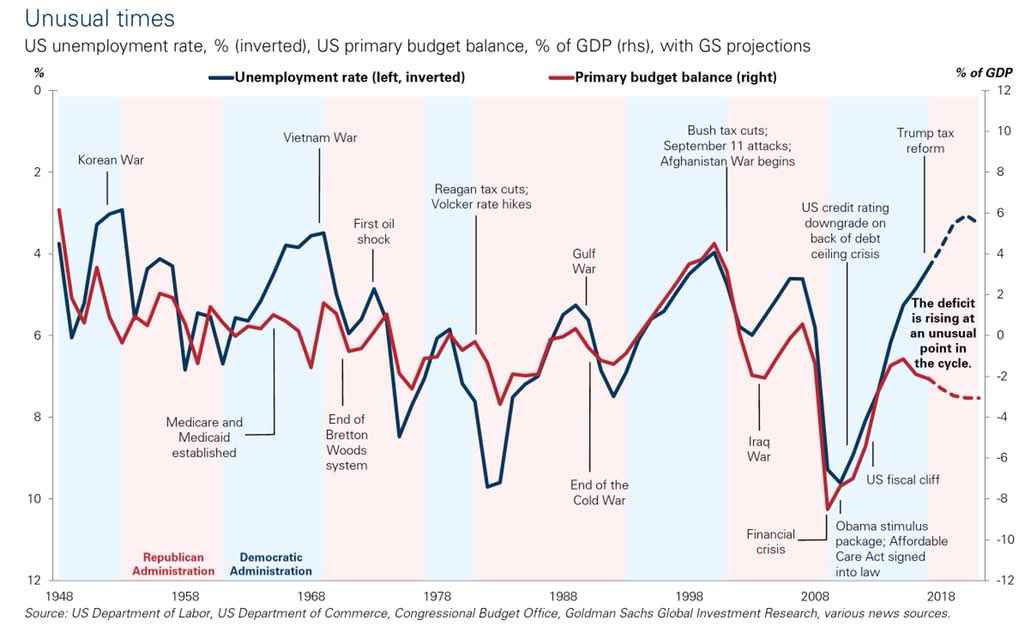

The crux of the problem is that India’s macroeconomic framework is based on an antiquated belief that the economy is closed when in reality it is far more open. For example, the RBI has rarely linked its policy decisions to changes in global interest rates even after shifting to an inflation-targeting framework. It is the same with fiscal policy. Every budget document begins with a perfunctory paragraph on “global developments” but neither taxes nor expenditure has been changed in response to what has happened outside of India except when forced by crises. The overall fiscal deficit has remained virtually unchanged around 7 per cent of GDP since 2013-14, the year of the Taper Tantrum, despite the global economy, financial conditions, and oil prices undergoing large cyclical changes.

Consequently, when faced with a global financial shock, neither fiscal nor monetary policy has, as matter of course, adjusted to safeguard the economy. Instead, we have scurried around for ad-hoc solutions, as is gaining currency now with suggestions for more NRI deposits or external bond issuance. I am sure we will come up with another clever scheme and then pat ourselves on the back on how that staved off a crisis. However, we will face the same challenge again the next time global conditions change.

https://indianexpress.com/article/opinion/columns/indian-economy-rupee-vs-dollar-gdp-5361304/