Victor has a very unique understanding of current investment cycle derived from income inequalities and thats why his investment recommendation is to be with just top 5% frontier companies.

He writes ……..The middle is eroding as asset-based finance drives inequality…

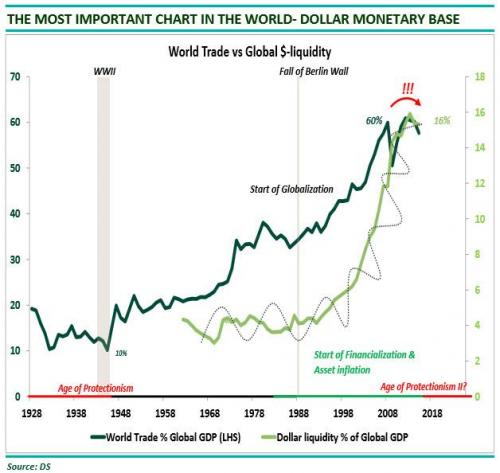

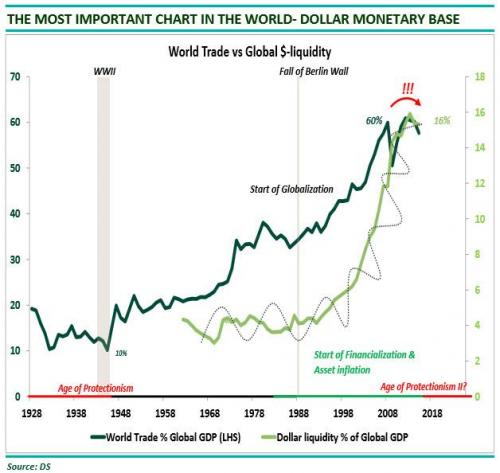

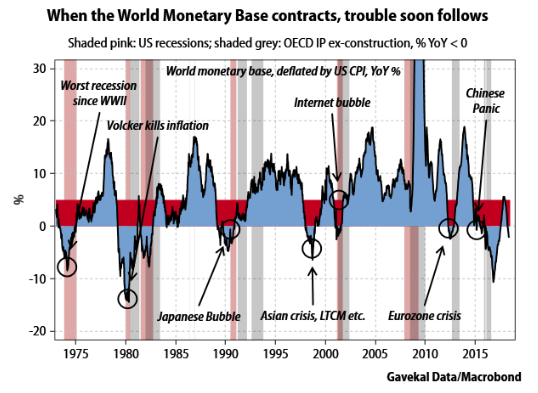

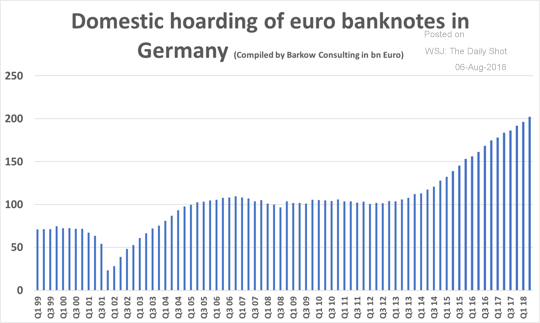

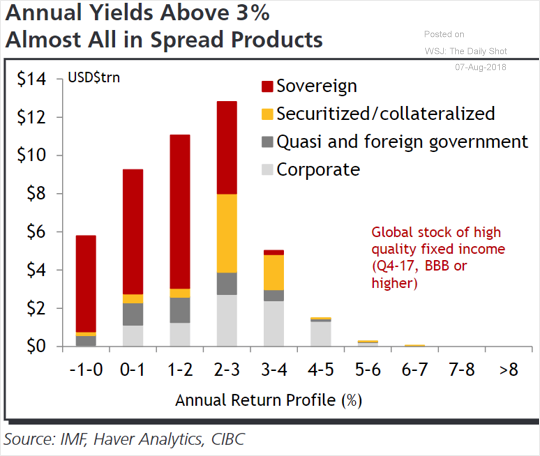

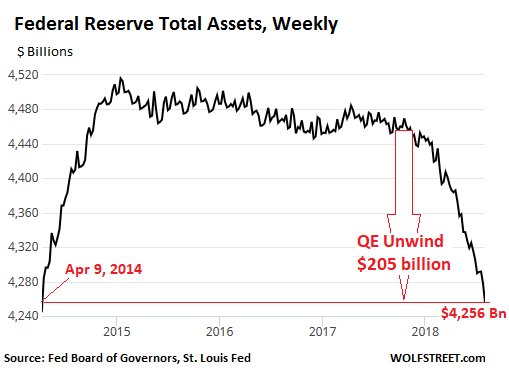

While it is accepted that we are in an era of some of the highest ever inequalities, there is a persistent belief that the right remedy is to generate faster growth rates. While true, it ignores the importance of asset classes in driving both growth & inequalities. In other words, financialized economies require constant flow of new debt to support asset values, which in turn make room for more debt to enable asset prices to rise even further. Over the last three decades asset prices have morphed into a lubricant, determining consumption & investment choices. Unfortunately, the same processes that drive values & growth are also responsible for inequalities. By stitching together historical data with the Fed’s recent surveys of consumer finances, authors confirmed what Saez, Piketty etc have already illustrated, i.e. financialization waves aggravate inequalities.

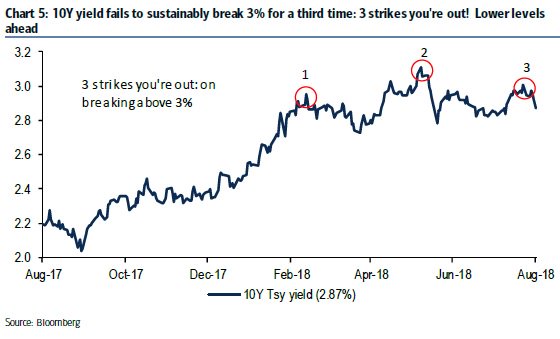

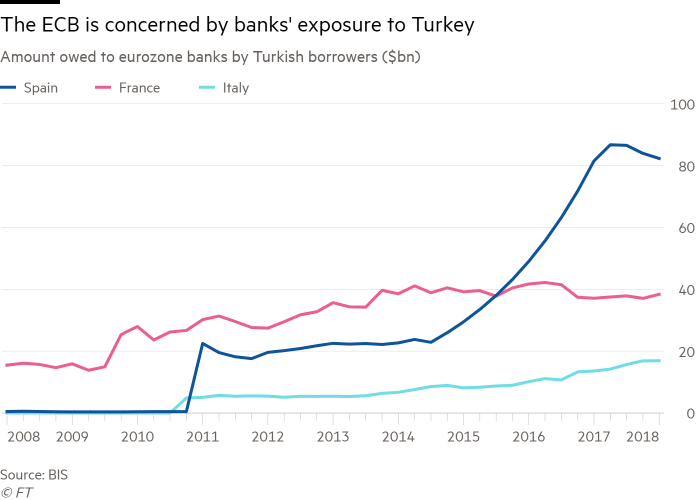

Top 10% have a much higher weighting in financial assets (~50%) and carry low leverage (4%), while the bottom 50% have the highest weighting in houses (~62%) & heavy debt burden (~75%). Inference from the above is that to avoid the pyramid toppling over, cost of capital must be kept very low & asset volatilities must be contained. There are no other choices. This is true not only for developed economies but the same is also seen across Emerging economies .

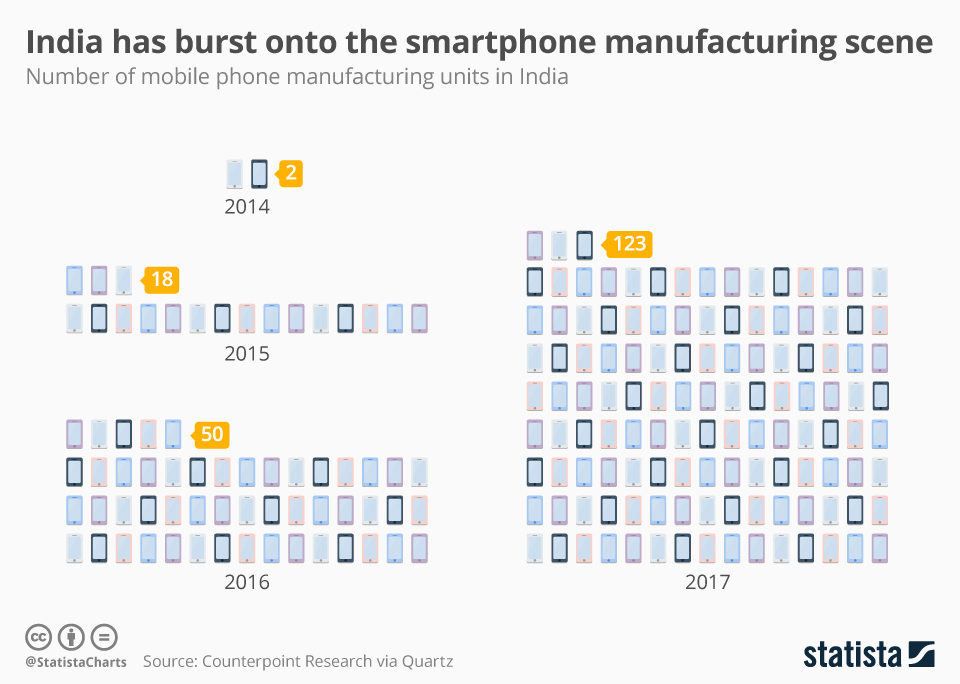

I would argue that India is also reaching that level of disparity otherwise how do you justify having 40% of your equity benchmarks represented by BFSI sector.

This has serious investment implications … sadly the omelette cannot be unscrambled; all solutions are tough

While there is a vibrant debate as to what can be done to relieve what are clearly severe social & political pressures, there is no consensus, other than blaming multinationals and foreigners. As convenient scapegoats, these would continue to be the prime targets. The most rational corporate response is to hide and prepare (‘going to the mattresses’ in ‘The Godfather’ terminology) and try to localize while reducing costs by aggressive use of technology. Societal responses are likely to include income transfer policies and wealth re-distribution strategies. None are likely to be easy and all would be controversial, thus further inflaming passions & solidifying extreme left and right, while the centre disintegrates.

Victor closes out by recommending staying with top 5% frontier firms… basically industry leaders.

The need to financialize implies further widening of inequalities and persistent social & political dislocations. From a corporate perspective, cost controls & innovation would be the only answers.

There would be few ‘Hail Mary passes’; we avoid purely cyclical stories, unless heavily discounted. The centre cannot hold.