Victor writes

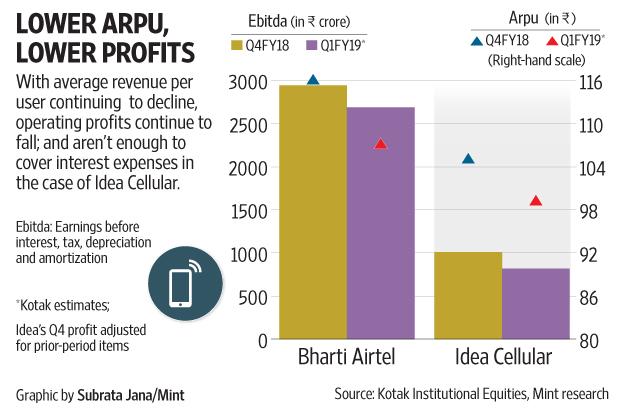

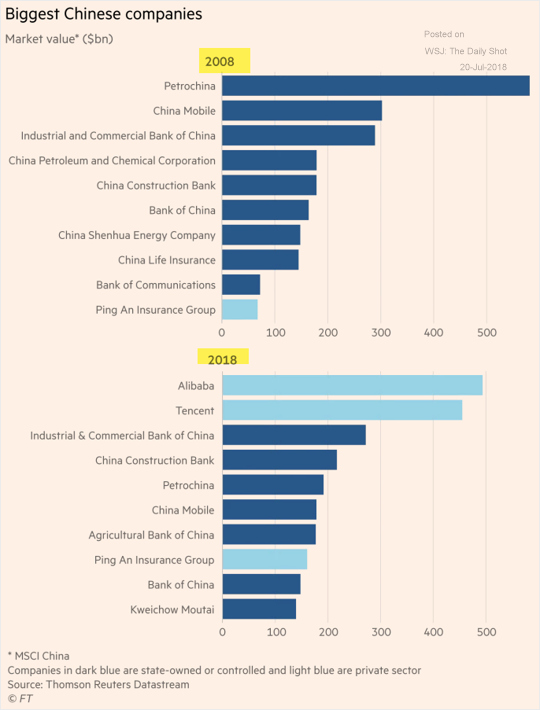

1.Most companies manage their own decline. It is fine until disruption hits.

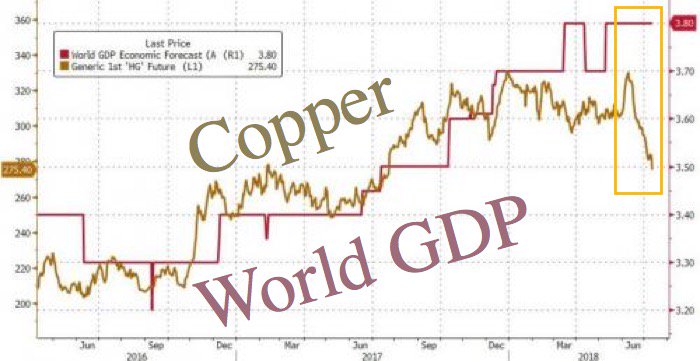

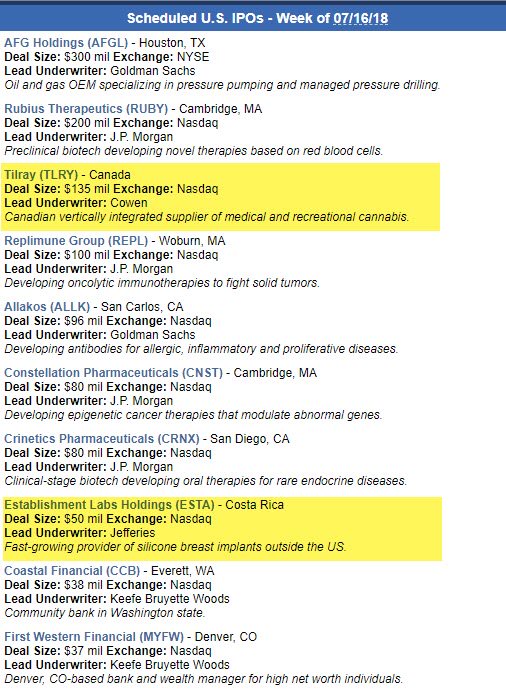

2.Innovators are different; they facilitate disruption & work with secular trends

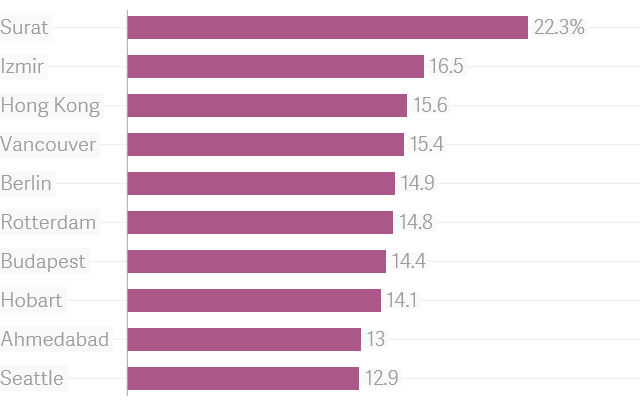

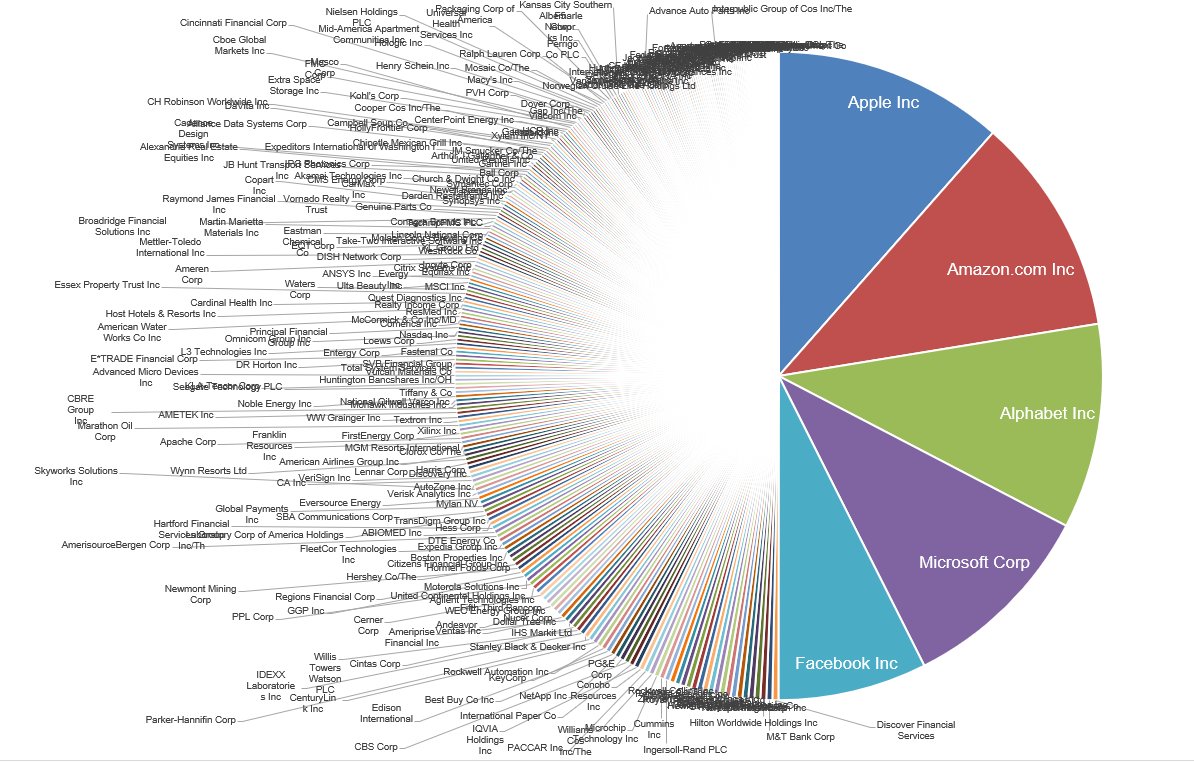

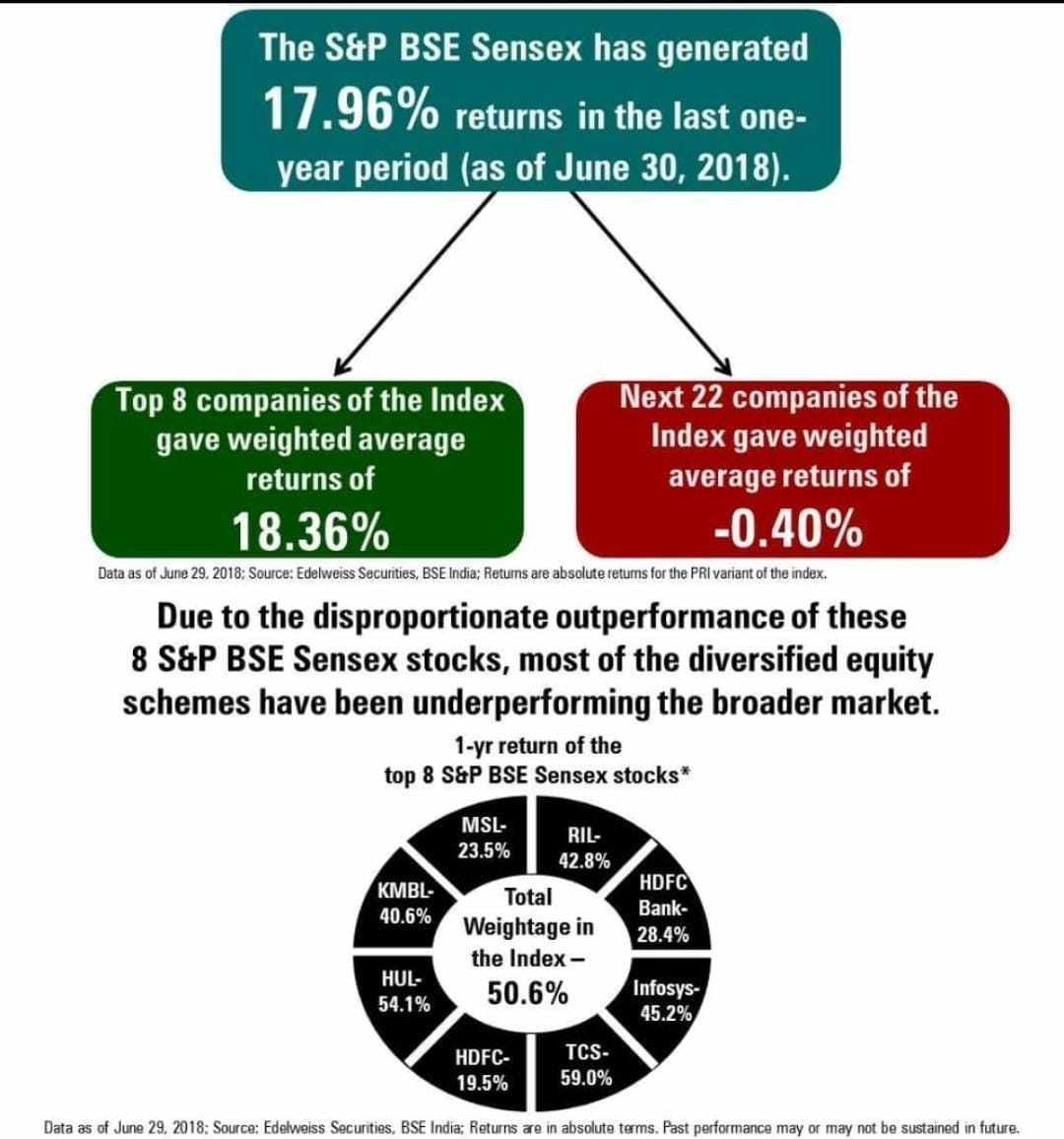

3.Irrespective of industry,the gap between winners and the average is widening.

Steve Jobs argued in one memorable quote that “any company run by sales department is basically managing its own decline. In other words, it has reached the stage in its evolution where the objective is essentially to re-package what are essentially undifferentiated and commoditized products to create extra ‘stickiness’ or an illusion of customer value. In another quote he stated that ‘it is hard to design products by focus groups; a lot of times, people don’t know what they want until you show it to them’. This is not dissimilar to Henry Ford quote that ‘if I had asked people what they wanted, they would have said faster horses’. He did not give them faster horses; instead he delivered affordable cars that people did not know they needed.

These two quotes from pioneering innovators (not inventors), highlight the difference between excellence and managing businesses. It is what differentiates Innovators from average run-of-the-mill corporates trying to survive by yielding responsibility to sales departments and marketers to ‘move the needle’. The next step for these ‘average’ corporates is usually inviting management consultants to advice on cost controls and either M&A or divestments as means of prolonging the agony. What makes innovators special is not just that they are good but that the average is just average.

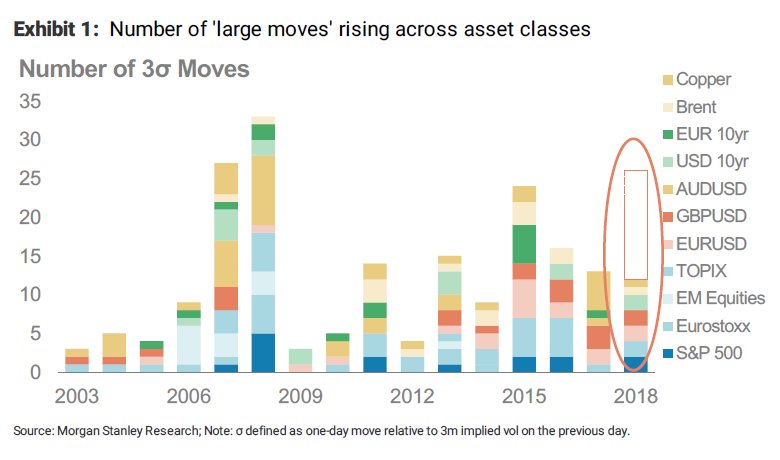

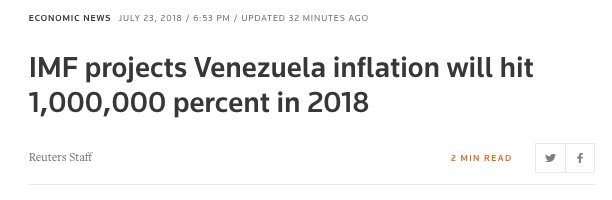

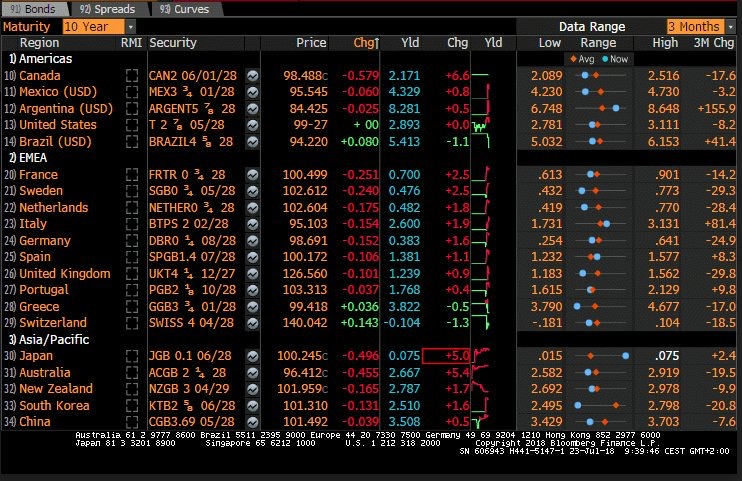

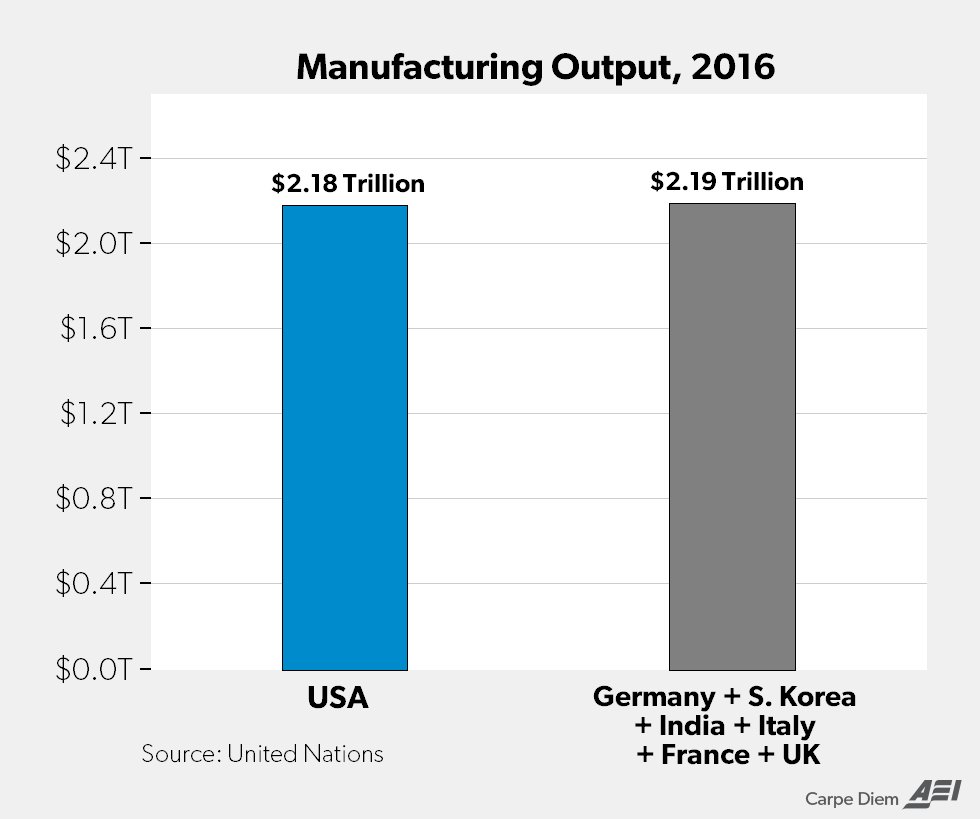

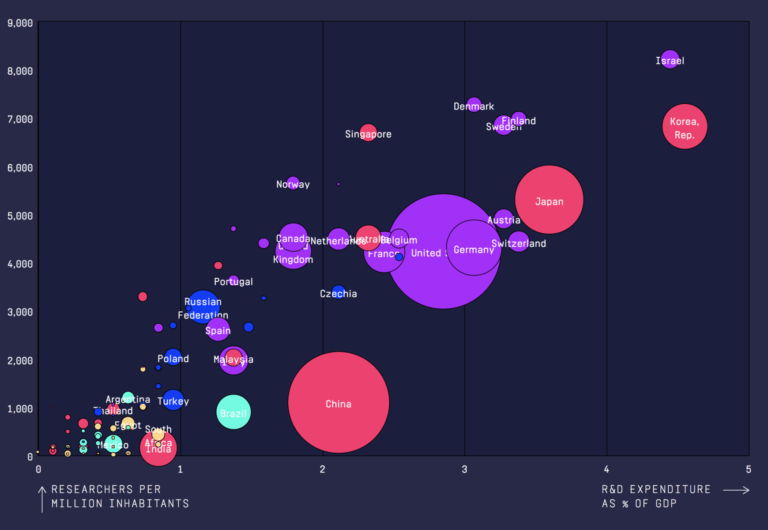

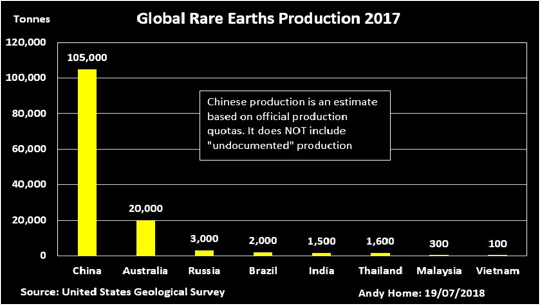

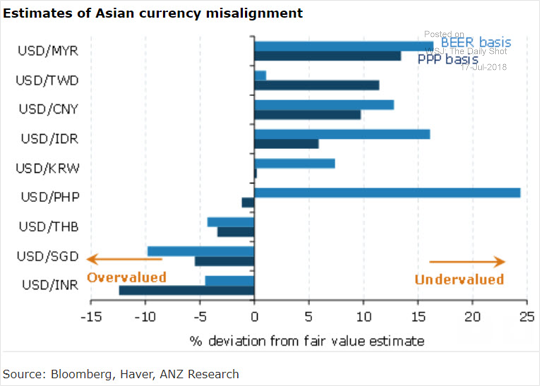

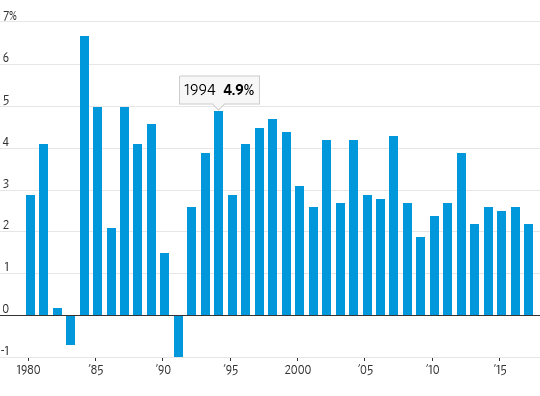

As the recent OECD study highlighted the productivity of top 5% of firms in any industry is now growing 4-5x faster than productivity of non-frontier firms. It is the process that has been evolving for at least 20 years but there is a noticeable acceleration. It is also not surprising that profits are becoming highly concentrated in select few niches and top profit generators. Technological disruption has already disintermediated a plethora of industries (from news, entertainment to retail) and is moving rapidly into new areas (education, financial services and manufacturing).

Although most investors associate disruptors with tech names (and being the conduits of disruption implies that tech is over represented), the most innovative firms do not need to be tech. In other words, these are companies that flow with the strong secular currents rather than just managing negative impacts.

The time for these thematics/disruptors is likely to persist for decades and as Victor concludes “we believe that Thematic-based investment is here to stay for years to come”.

( you can now subscribe to worldoutofwhack.com by just enetering your email id in the blog)