Tulip Mania of 1637

• The Tulip mania was one of the first recorded speculative bubbles in history,

• It all started in the late 1500s when a local botanist named Carolus Clusius started to notice that some of the petal colors of the tulip flower began to change colors and this created unique patterns that were quite interesting in shape.

• As word got out, more and more people were intrigued and eventually Tulip brokerages were formed in an effort to facilitate trade for investors.

• The prices for these tulips started to rise to extraordinary levels by the mid 1620’s. In fact, some investors where trading their real estate holdings in exchange for certain highly sought after Tulip bulbs such as the Semper Ausustus.

• Later that year, as some individuals and investors began to take profit and sell their tulip holdings, prices started to fall. As prices fell, more people began to sell their stock of tulips. In addition to those who sold for profit, late investors started to get nervous and they too fearing a decline in price of tulips fueled the collapse.

South Sea Bubble of 1720

• The South Sea Bubble involved an international British trading firm that was given exclusive authority to trade with the Spanish colonies in the West Indies and South America as part of an agreement with the British government after the War of the Spanish Succession.

• The South Sea company was able to sell shares to the public and in addition to the highly lucrative trading profits, investors would also earn a 6% return on their capital which was to be paid directly by the British government.

• During this time, the stock price for the South Sea company was souring. In fact, by the summer of 1720, the share price of the company peaked to over £1000. But the company’s profits were nowhere in line with the public image it had created for itself.

• And so eventually as the promises made were not coming to fruition, selling ensured and prices began to drop. Within a span of a few months, the share price for the South Sea company fell by over 85%.

The Stock Market Crash of 1929

• The Stock Market Crash of 1929 was the worst stock market decline in percentage terms wiping away almost 90% of the value of the Dow Jones Index within four years.

• Prior to the share market crash of 1929, the economy was in full swing and booming. And with the advent of a concept called “margin”, many people who had never before invested in the stock market became active participants.

• Brokerage firms were now financing investment in the stock market with just 15 % or 20% down. Even banks joined in, and used depositors’ funds to buy stocks on margin. All of this frenzy led to share price overvaluations, as more and more investors jumped into the market.

• As soon as the stock market plunged it wiped out most if not all of the equity of leveraged investors and forced many to liquidate other assets to meet their obligations. In addition, many banks were bankrupt overnight, as they gambled their depositors’ funds in the market, and many only had 5% or 10% left to pay depositors’ claims

• It would not be until 25 years later, in 1954 that the Dow Jones would reach 383, the previous high prior to the Crash of 1929.

Black Monday – Stock Market Crash of 1987 • The infamous day Monday, October 19, 1987 is known as Black Monday. This is the day when equity markets around the world were shaken by a widespread selling frenzy.

• The Dow Jones plunged over 500 points, which account for a historic single day drop of 22%.

• And by the end of the month, most Stock Markets around the world were in disarray. The Australian market was down 41%, the Hong Kong market was down 45%, the United Kingdom market was down 26%, and the worst hit was the New Zealand market which had fell almost 60% from its recent high.

• Many professionals have put much of the blame on computerized programs that created large quantities of sell orders in the market, and triggering stop loss levels one after another, which eventually spiraled out of control.

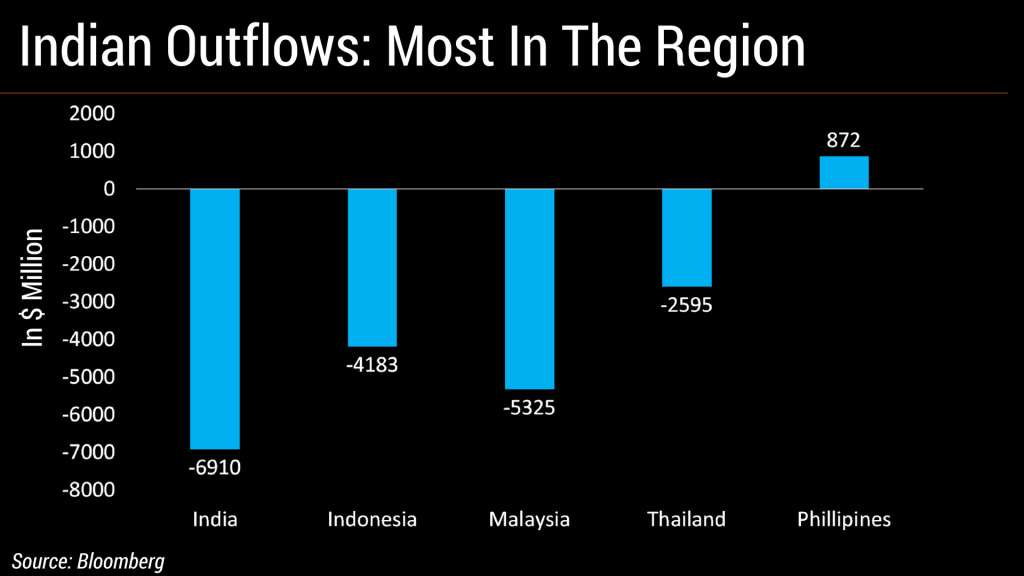

Asian Financial Crisis of 1997

• The Asian financial crisis began with the collapse of the Thai baht, resulting from the Thai government’s inability to support its currency peg to the US Dollar. The Thai baht became a floating currency and devalued sharply as the country was on the verge of bankruptcy.

This crisis spread to other Southeast Asian nations as well including Indonesia, Philippines, Malaysia, and South Korea among others.

• The International Monetary Fund (IMF) was forced to deal with this ongoing crisis, and created a bailout package consisting of over $ 100 billion to help stabilize the region

Internet (Dot Com) Bubble of 2000

• During the mid 1990’s as the Internet was becoming mainstream, it created enormous opportunities for online companies. Both private and institutional money was pouring into online ventures like never before.

• Many internet startups were routinely being valued based on 75% or more growth over the coming 5 year period.

• By the end of first quarter of 2000, investors started to become wary of the exorbitant valuations, and things went downhill from there. Stocks began to fall, particularly in the technology sector, and the Dot Com dreams of many entrepreneurs came to an abrupt end.

• The majority of stocks and indices fell sharply until the market finally bottomed in 2002. During this period, the market wiped away over 5 trillion dollars in wealth, destroying the dreams and savings of many investors along the way.

Housing and Subprime Crisis of 2008

• The story begins back in the 1990’s when the US government started to create programs that would make buying a home more affordable, especially for those with less than perfect or troubled credit.

• As Main Street mortgage brokers were writing a historic number of new mortgages, Wall Street also got in on the action. They started to create and promote mortgage backed securities (MBS), which is a security comprised of a pool of mortgages.

• Wall Street introduced a new type of credit derivative called credit default swaps. Credit Default Swaps were similar to insurance policies. They were designed to protect against a company’s default. But a major flaw with CDS was that they were not regulated, and as such, premium writers were not required to segregate and allocate a reserve, as typical insurance companies are required to do.

• All of these factors lead to a highly over-leveraged environment that was susceptible to systemic risk.

• There was a period of 3 weeks between September and October 2008 wherein the Dow Jones Industrial Average sank more than 3500 points from its recent high. This was a huge stock market drop and accounted for more than a 30% decline in the value of the Dow.

The Biggest Bubble of all time……Bitcoin Bubble

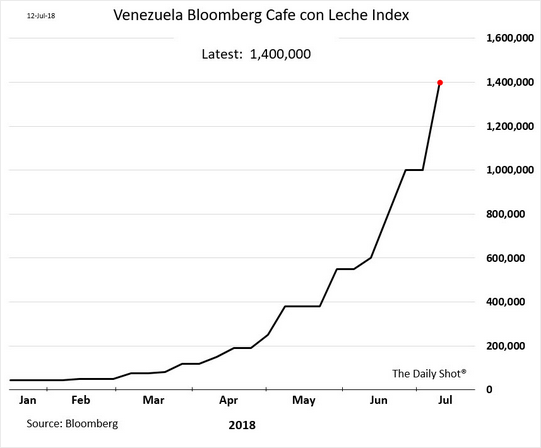

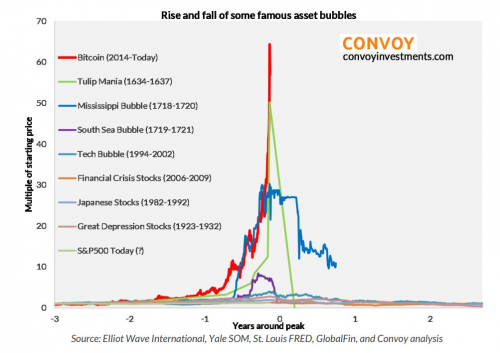

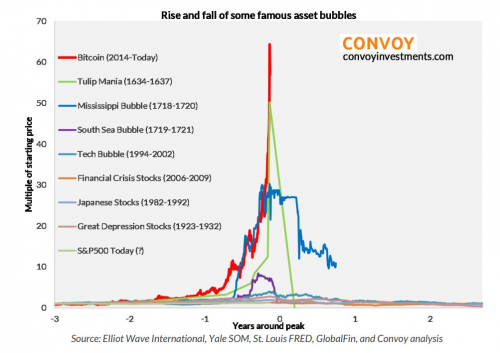

We witnessed the rise and fall of biggest bubble of all time as depicted by the almost vertical line in the chart at the top .

The concentration of money chasing an asset class and the resultant increase in supply of bubble asset determines the madness .

The supply constraint was responsible for this parabolic rise in Bitcoin .

The trigger for epic collapse was the regulatory overreach .

Bitcoin had threatened the monopoly of govt and its ability to print fiat money.