There is a 4% rule as it pertains to retirement. It goes like this: If you begin retirement, withdrawing 4% of your savings and adjust each following year’s withdrawals for inflation, your money should last 30 years. It may be the most widely accepted and most often cited rule of personal finance.

There is another relatively new 4% rule.

In January of 2017, Hendrik Bessembinder, who is in the finance department of Arizona State’s business school, released an initial draft of a whitepaper he titled, “Do Stocks Outperform Treasury Bills?”

From 1926 to 2015 the average monthly return on a T-Bill was 0.38%, or roughly 4.56% annually. Surely stocks do better than Treasury Bills, right? Turns out, most stocks fail to outperform T-Bills.

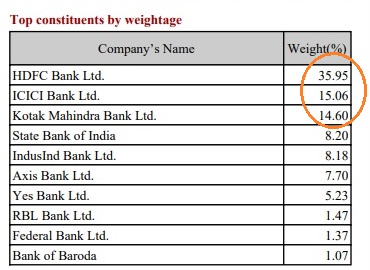

To reach this conclusion, Bessembinder looked at every single stock listed on all major exchanges .From 1926 through 2015. That’s over 26,000 stocks. He found that only 42.1% of them had returns that exceeded a T-Bill and that more than half had negative returns. The best 86 stocks, or roughly .33% of all stocks ever traded on one of the three major exchanges, accounted for half of all the gains in the stock market.

What’s more, all the gains generated by the stock market can be attributed to the best 1,000 stocks. That is, of the 26,000 stocks Bessembinder researched, just 4% account for every penny of wealth the stock market has ever created. The bottom 96%? Nothing. This is the other 4% rule.

As Bessembinder writes, “This study highlights that non-diversified stock investments are subject to the very real risk that they will fail to include the relatively few stocks that, ex post [based on actual results], generate very large cumulative returns.” Most education in the field of investing emphasizes diversification as a means of reducing risk. Bessembinder re-frames diversification as a means of capturing the full returns of the market. Fail to diversify and you could miss out on the small percentage of stocks that generate long-term wealth.

The implications of Bessembinder’s findings are many. It should make you think twice about how investing is depicted in the financial media. Most importantly, it should shift your focus from which stocks to pick to how you can capture the full returns of the market in as efficient a manner as possible.