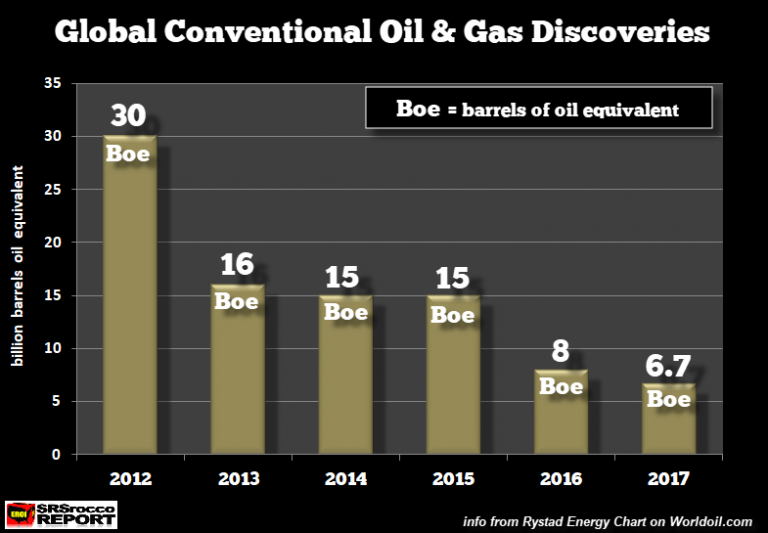

According to Rystad Energy, total global conventional oil and gas discoveries fell to a low of 6.7 billion barrels of oil equivalent (Boe). To arrive at a Boe, Rystad Energy converts natural gas to a barrel of oil equivalent. In 2012, the world discovered 30 billion Boe of oil and gas versus the 6.7 billion Boe last year:

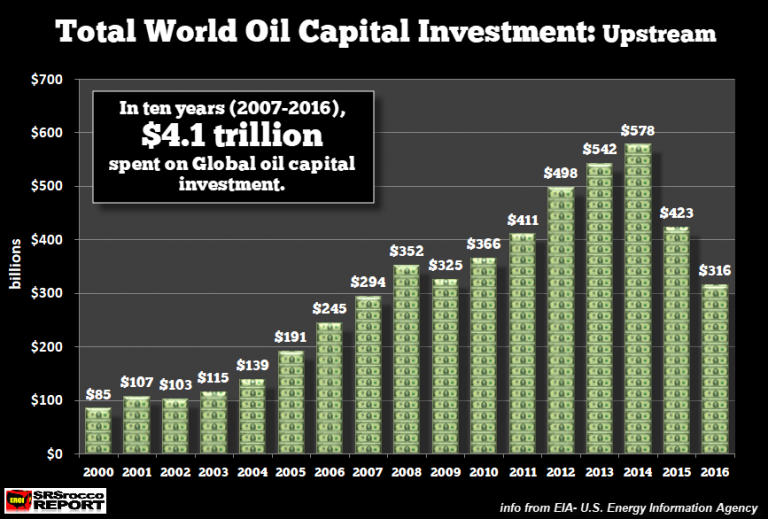

global oil capital investment has fallen right at the very time we need it the most. In the EIA’s International Energy Outlook 2017, world oil capital investment fell 45% to $316 billion in 2016 versus $578 billion in 2014

The major global oil companies have been forced to cut capital expenditures to remain profitable and to provide free cash flow. coupled with low discoveries and more than expected run down from shale will impact oil production in the coming years.

Thus, the world will be facing the Energy Cliff much sooner than later.