Middleman Pain is Farmer Gain

The dismantling of compulsory selling to APMC traders has led to the creation of weekly markets with farmers directly selling fruits and vegetables. News reports suggest that there are a few hundred of these markets across the state of Maharashtra. Farmers are very happy in being able to sell to the public directly. There are multiple reasons for the same. First, they get a better price for their produce with the middle men out of the way. Second, they get their money immediately instead of when they sold their produce to an agent at a mandi, up until last year. Third, lesser amount of vegetables and fruits are wasted given that what is produced is sold almost immediately This is also an excellent example of how any government can enable citizens to carry out their work honestly, by getting rid of provisions which hamper the ease of doing business. This is an impact of a decision that the Maharashtra government took in June last year. It basically allowed farmers to sell their produce in the open market. Up until then the farmers could only sell their produce to traders licensed by the Agriculture Produce Marketing Committees (APMCs). This is something that needs to happen throughout the length and the breadth of the country. Farmer markets need to bloom. Nevertheless, as a report in the Mint points out, only “15 states allowed the delisting of fruits and vegetables from APMCs, making it possible for farmers to sell these outside regulated markets.” This tells us that other states are still bowing to the pressure from the trader lobbies.i believe the dismantling of APMC act is a step in right direction will lead to more money reaching the farmer instead of filling the pocket of middleman.

Read More

https://www.equitymaster.com/diary/detail.asp?date=05/02/2017&story=2&title=One-Friday-the-Day-the-Cynic-in-Me-Died-Just-Briefly&utm_source=dr&utm_medium=website&utm_campaign=e-letter&utm_content=recent-articles

The last remaining cheap asset

What’s that line legendary strategist Don Coxe likes to use? “The most exciting returns are to be had from an asset class where those who know it best, love it least because they have been burnt the worst?” Grains and other agricultural commodities have been a vicious bear market in real terms. Technology has caused grain prices to resemble the price decline of a 80386 microprocessor chip. Whether it be from improvements in fertilizer and pesticides, to the introduction of self-driving farm equipment, the modern farmer has become dramatically more efficient over these past few decades. Maybe Monsanto will come up with even better super grain seeds to create the fountain of perpetual food. Maybe we will figure out ways to automate the remaining last few jobs left on the farm to squeeze costs even lower.I just don’t buy that progress can continue at this pace. I have no doubt that farmers will continue improving, but I suspect the large gains are behind us. The moves from here will be incrementally smaller. Great technicians like Peter Brandt are raising the possibility a long-term bottom might be forming. And then, shrewd macro traders like Raoul Pal, are advocating buying grains from a fundamental perspective. But few are talking about the real reason that grains offer a compelling risk reward from the long side. If this Central Bank experiment goes off the rails, we could have a return of 1970’s style inflation. That happens to coincide with the last great bull market in grains.

Read More

http://biiwii.com/wp/2017/04/28/the-last-remaining-cheap-asset/

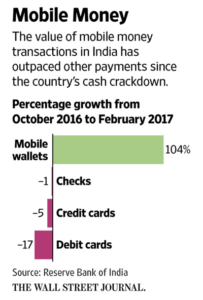

Cards and ATM to be redundant in India by 2020

The value of mobile money transactions have more than doubled since the nullification of 86 per cent of India’s cash in circulation in November, while those made with credit and debit cards has fallen, and cheque purchases have barely budged. Mobile payments still make up only a small percentage of overall transactions, but their surging popularity is being noticed.At this rate, cards and automated teller machines could be redundant in India by 2020, predicted Amitabh Kant, head of NITI Aayog.Mobile wallets could be the next example of countries pole-vaulting to the latest technology, in the same way that some emerging markets went directly to using cellphones. More merchants already accept payments from Paytm, India’s largest mobile-payment company, than accept credit or debit cards in India. There are only 2.5 million card-scanning machines in the country, while 5 million merchants accept Paytm through their smartphones.Paytm aims to more than double that number this year. “In the future, everything will be mobile,” said Vijay Shekhar Sharma, chief executive of Paytm parent company One97 Communications. Mobile payments will become “bigger than plastic,” he said.Indian shop owners and consumers can download any one of more than 10 competing apps, of which Paytm is the market leader, with 218 million mobile wallets.The company counts China’s online retail behemoth Alibaba among its backers and is set to receive a new investment of more than $US1.5 billion from SoftBank in a deal that could be announced as early as this week. ( again a case of winner takes all and a privately owned company),While many Indian families have access to a bank debit card, a vast majority only use it to get cash out of ATMs, if ever. Credit cards have been in India for decades, but there are still only 30 million in the country. In 2014, fewer than 5 per cent of Indians over 15 had credit cards, while 60 per cent of Americans did.“Cards had their time,” but they never took off in India, said Vivek Belgavi, partner and financial tech specialist at the Indian arm of PricewaterhouseCoopers.

Read More

https://www.wsj.com/articles/indias-cash-crackdown-prompts-more-to-pay-by-phone-1493467234

Hundreds of Lake but running out of water

When the IT industry exploded, though, the planning seemed to seize up. Or perhaps it simply couldn’t keep pace. In 2004 it was a trip to Bangalore that inspired New York Times columnist Thomas Friedman’s wide-eyed epiphany that “the world is flat.” The city—having raced from obscurity to compete handily with American tech hubs—became Friedman’s go-to mascot for globalization in overdrive. The question of stressed resources, however, rarely factored into Friedman’s columns, and it seemed to figure only casually in the city’s own calculus.BANGALORE once famous for hundreds of lake HAS A PROBLEM: It is running out of water, fast. Cities all over the world, from those in the American West to nearly every major Indian metropolis, have been struggling with drought and water deficits in recent years. But Bangalore is an extreme case. Last summer, a professor from the Indian Institute of Science declared that the city will be unlivable by 2020. He later backed off his prediction of the exact time of death—but even so, says P. N. Ravindra, an official at the Bangalore Water Supply and Sewerage Board, “the projections are relatively correct. Our groundwater levels are approaching zero.” Bangalore, once famous for its hundreds of lakes, now has only 81. The rest have been filled and paved over. Every year since 2012, Bangalore has been hit by drought; last year Karnataka, of which Bangalore is the capital, received its lowest rainfall level in four decades. But the changing climate is not exclusively to blame for Bangalore’s water problems. The city’s growth, hustled along by its tech sector, made it ripe for crisis. Echoing urban patterns around the world, Bangalore’s population nearly doubled from 5.7 million in 2001 to 10.5 million today. By 2020 more than 2 million IT professionals are expected to live here.

Read More

http://economictimes.indiatimes.com/markets/stocks/news/what-i-read-this-week-is-bangalore-becoming-unliveable-credit-cards-atms-to-be-dead-soon/articleshow/58559982.cms