WSJ writes…..

Selling something for less than its sticker price is hardly new. But the tech industry has gone to new heights. You might get an ad-supported music subscription that still gives you the world’s music, a 100-night mattress trial or $50 for referring a friend to MealPal.

To grow, companies need to stand out in some way, said Robert Dolan, a professor at Harvard Business School. “There’s so much emphasis on growing their userbase,” all other considerations fade away.

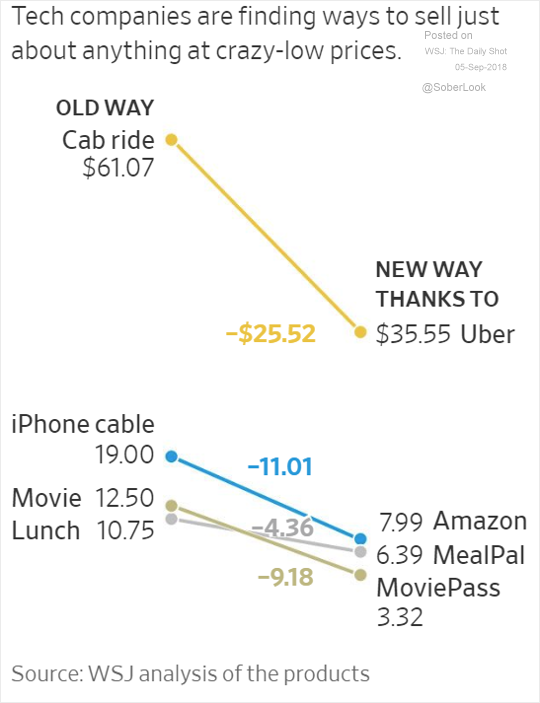

Tech companies are finding ways to sell just about anything at crazy-low prices.

If a product becomes indispensable, its creator can sometimes raise prices without losing customers. That’s why the prices of Amazon Prime and Netflix have risen lately: They’re betting that because I love two-day shipping and “Stranger Things,” I won’t cancel. (They’re right.)

Larger companies can also afford to make little or no money on some products, betting they will make it up elsewhere.

For smaller fries without a lot of money to lose, this is harder calculus. “Companies are very reluctant to raise their prices, especially in an era where everything you do automatically gets a reaction from the crowds on social media,” said Prof. Dolan. Spotify could become profitable by raising its prices, for example, but “the backlash would be huge.”