Air pollution causes a “huge” reduction in intelligence, according to new research, indicating that the damage to society of toxic air is far deeper than the well-known impacts on physical health.

The research was conducted in China but is relevant across the world, with 95% of the global population breathing unsafe air. It found that high pollution levels led to significant drops in test scores in language and arithmetic, with the average impact equivalent to having lost a year of the person’s education.

“Polluted air can cause everyone to reduce their level of education by one year, which is huge,” said Xi Chen at Yale School of Public Health in the US, a member of the research team. “But we know the effect is worse for the elderly, especially those over 64, and for men, and for those with low education. If we calculate [the loss] for those, it may be a few years of education.”

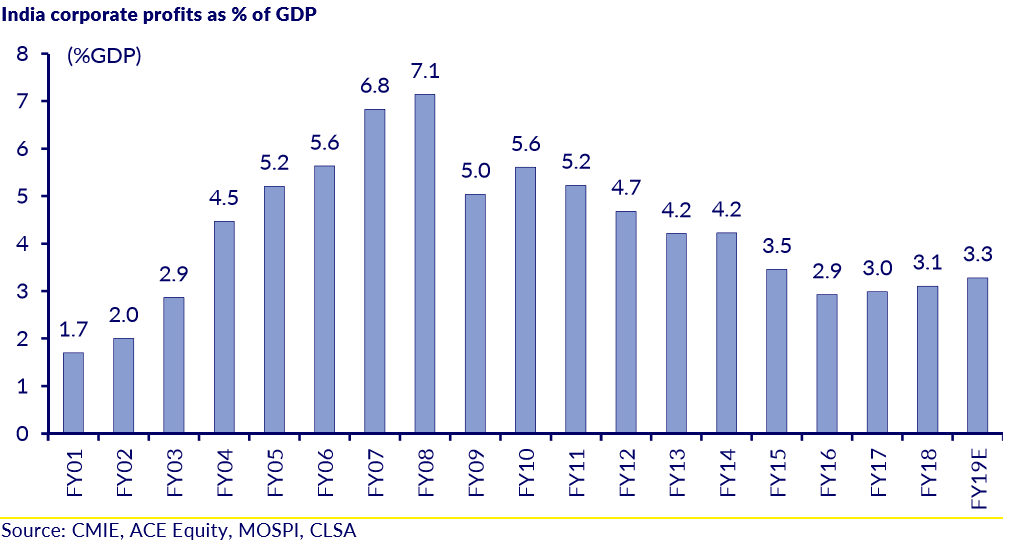

The problem is becoming chronic in India, in my view. Most parents don’t understand the long term effect of getting exposed to pollution. Most kids who are yet to develop immunity are especially vulnerable and the effects include asthama, stunted growth and even brain damage