I have maintained that “gold is nothing but a hedge against political stupidity “ and the live example is Gold priced in Turkish lira .. it is up 50% in last one year and 250% in last five years. When bad economics is mixed with bad politics fake money( paper currency) looses its value against real money (gold)

Sands are shifting

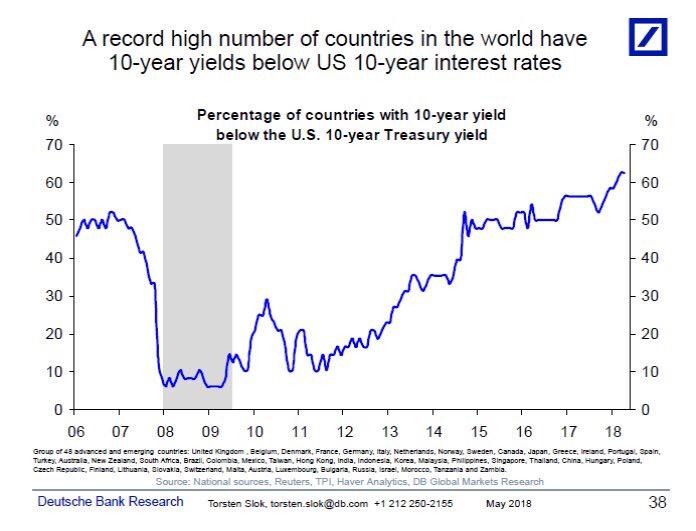

The more US yields rise ….more US bonds will become attractive compared to rest of the world simply because US enjoys reserve currency status . The sell off in EM in last few days was just a glimpse of damage due to US dollar and US yields. ……. interestingly even US small cap index broke to new all time high last week

The social credit system

This is simply amazing…… this is why citizen database is so important “In the case of transportation, China is using the social credit system to punish citizens for bad behavior in various categories—from bad behavior on planes and trains, trying to get a free ride by using an expired ticket, contempt of court, or even getting caught smoking where they shouldn’t.”

Trend coming to end

…..flows to turn unfavourable for MF and insurance There is a retail bond issue slated to hit the market offering attractive rates ….. demonetisation led to cash coming back to financial assets including MF ,Insurance , CASA of banking system This led to banks reducing their deposit rates The reduced rates made deposits unattractive which further led to banking deposits moving to MF and insurance ( MF industry almost double in last 3 years) During the same time money also started moving out of banks as currency with public started rising Now with system getting remonetised and inflation rising banking system finds itself short of deposits Hence we will have more retail issue leading to money moving out from financial assets,MF flows and insurance to these retail issues which are offering higher fixed rates ( a rate at which Indians always prefer deposits over other assets) Those who have extrapolated the past two years inflows into Financial assets as a trend will be disappointed because as more rates rise more money will leave other financial assets like MF and insurance to retail deposit issues A simple case of CAPITAL FLOWS

Market Summary for week ended May 18

selling picked up in emerging markets this week signalling global liquidity is tightening up. EM 10-year yields higher across the board from Mexico up 20 bps to Turkey up 125 bps…( Indian yields stable for time being) Euro periphery spreads blow out. Italy 34 bps wider ( arrival of populist government), EM currencies hit hard: Argentina peso down another 5 percent, now down almost 20 percent in May; sends government back to the IMF( these guys sold 100 years dollar bond last year to oversubscribed to YEH DIL MANGE MORE global investors) Turkish lira down over 4 percent( they have one of the highest dollar debt in EM) Dollar index up 1.19 percent ( main culprit) France CAC up 1.31 percent ( is it capital flows out of Italy ?) S&P500 down about ½ percent (basically directionless) Russell 2000 ( US small caps)making new highs…..hmmm interesting Grains move higher ( extreme weather) Crude continues to march higher ( by now everybody is long crude) Gold back below $1300. ( forgotten asset but not for long)

Shrinkflation

Have you heard of SHRINKFLATION…. well as input prices rise the Firms will be able to pass on rising prices initially But after some time, stagflation will set in and it will be challenging to pass on the impact of rising crude oil prices . and some smart companies will resort to shrinkflation which is basically prices are not increased but quantity is reduced

India Credit Default Swap

India’s CDS ( credit default swap)spread, while still quite tight, has been widening in recent days although I must point out here that India does not have any outstanding dollar bond

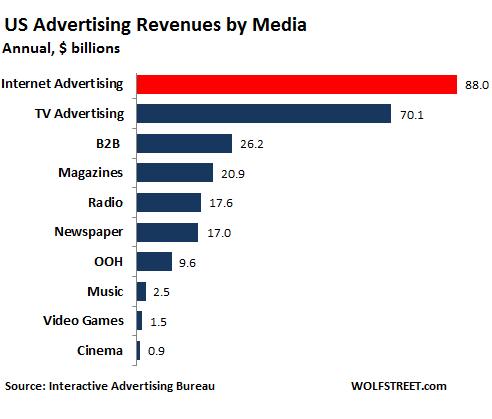

The trend is still in its infancy

…..where all advertising revenues are shifting Current technological advances in big data, predictive analytics, artificial intelligence, and robotic process automation (RPA) have all greatly impacted the industry and will continue to do so for the foreseeable future. The volume of digital data being created on the internet is increasing exponentially. Every year the digital universe doubles in size with many estimates indicating a 50X growth between 2010 and 2020 [“Inside Big Data, Exponential Growth of Data,” February 2017]. These large volumes of data provide the raw ingredients to enable greater advertising efficiency. The ability to apply analytics and AI to massive volumes of data enable marketers to target end users in ways not previously possible. Furthermore, these same advances when combined with RPA have allowed for increased automation throughout the ecosystem – driving further efficiencies.

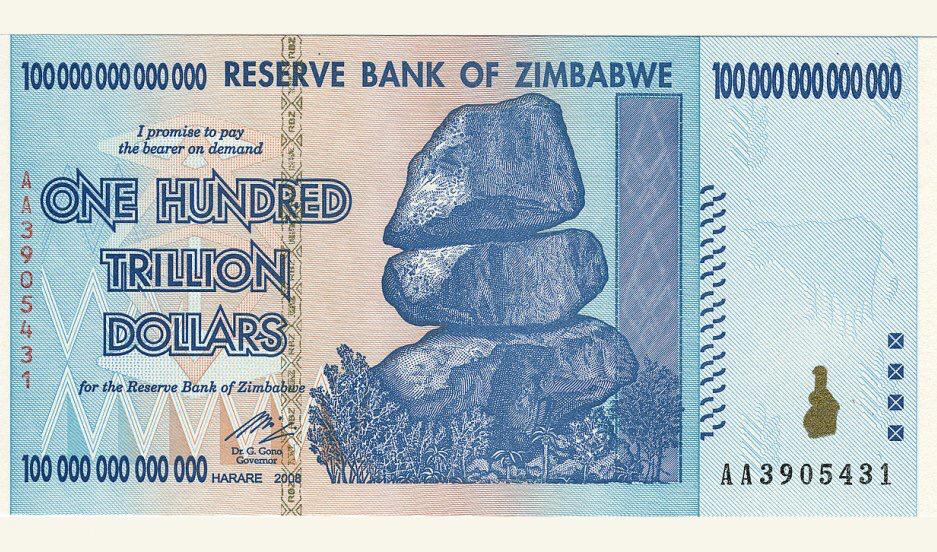

$100 trillion note worth only 40 cents

Zimbabwe’s $100 trillion note, worth around 40 US cents when last in circulation, a case of modern day hyperinflation. But you would have retained the purchasing power of currency if you were holding “GOLD” instead of paper currency. After all in my view GOLD in neither a deflation hedge or an inflation hedge……it is a hedge against political stupidity

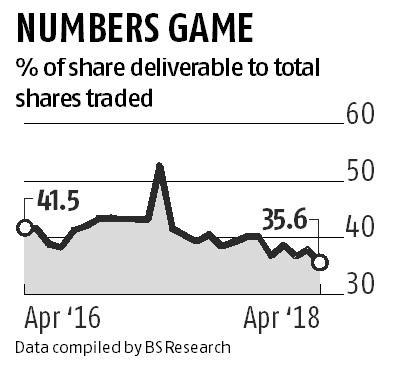

Sands are shifting

the delivery ratio—the percentage of shares actually changing hands in relation to the total traded quantity — was about 35.6 per cent in April, the lowest in nearly eight years. In March 2017, however, this ratio was at an all-time high with 52.6 per cent of the traded shares converted into delivery. (Data compiled by B.S. research)