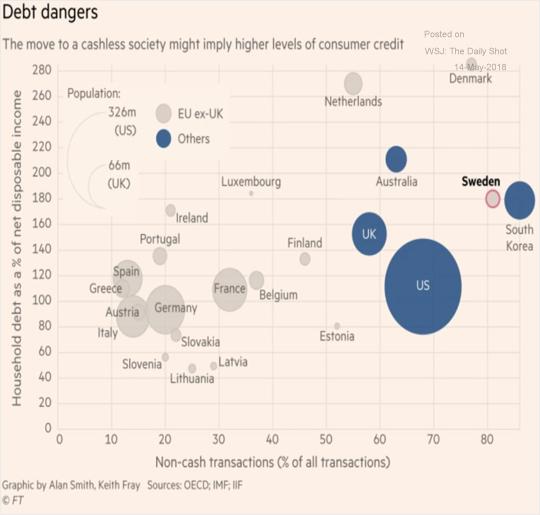

Household leverage appears to be correlated with the prevalence of non-cash transactions and we have just given it a boost with demonetisation. so it is a reasonable assumption that Cashless society will leverage faster than the one still using cash

Making sense out of Chaos

Household leverage appears to be correlated with the prevalence of non-cash transactions and we have just given it a boost with demonetisation. so it is a reasonable assumption that Cashless society will leverage faster than the one still using cash

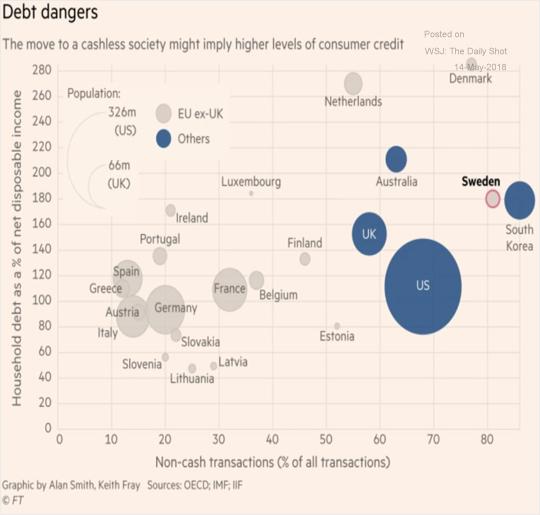

Unemployment down, small business which generate employment….booming, order backlog at 14 years high….wages are still contained, consumer spending weak but business spending rising and on top of that Corporates lining up to buy back USD 1 trillion of their own stock. If u look at these charts ….US economy has never looked stronger compared to Emerging markets Capital is always fungible and mobile so why shouldn’t the capital move back to US from Emerging markets

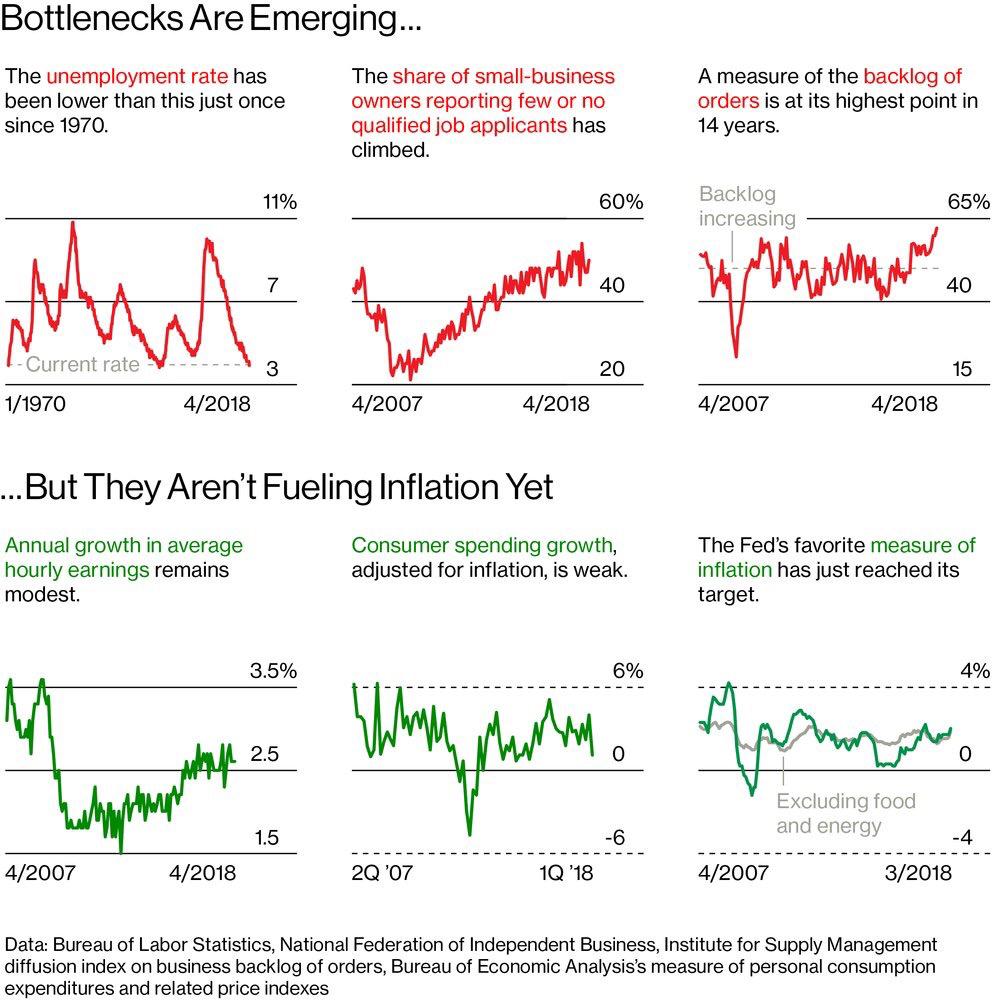

Dollar return is essentially what international investors see . In 2017, the average country ETF return was +28%. This year so far: -0.3% and India return in -5.3%

When most of the emerging economies entered into twin deficits -trade and fiscal deficits- and consensus praised “synchronized growth”, they were sealing their destiny: When the US dollar regains some strength, US rates rise due to an increase in inflation, the flow of cheap money to emerging markets is reversed. Synchronized indebted growth created the risk of synchronized collapse.

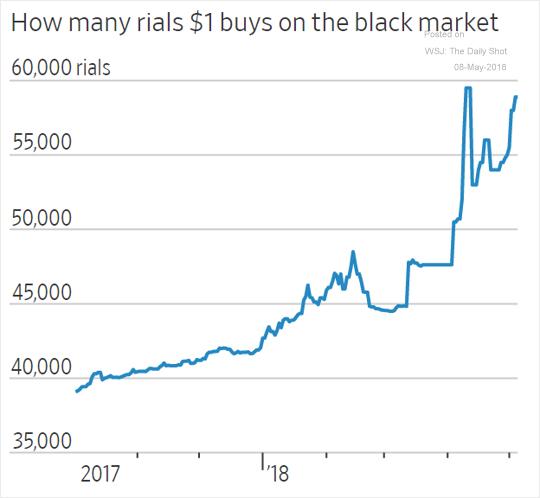

On the day when US prepares to collapse the nuclear accord, Iran find itself very vulnerable. The economy is in shambles, inflation and unemployment running high….regular public protest breaking out against government and currency collapsing . The official exchange rate is 1Usd=42000 rial but there is a serious shortage of dollar in Iran so the black market rate ( below graph) is running almost 40 % higher than official rate Needless to say Iran needs this deal more than ever

Indian households it seems are no longer happy with only credit card and personal loan so it was but natural that we will lap up any other way of leveraging. Payday loans is basically a western concept of discounting future wages/salaries and there are shops in prominent neighbourhood in US/UK etc because it is a very profitable business . India is seeing mushrooming of payday lenders backed by private equity money and NBFC are also becoming aggressive in lending The Advertisements for payday loans make them seem like a fast, easy, no-nonsense way to get money when you’re in a financial bind. They tell you getting as low as 1000 rupees is as easy as showing a recent pay stub, a copy of your driver’s license, and a blank check. Little do people realise this is one more way of getting into debt trap

FED is getting serious with unwinding and dollar index has finally got a tailwind with DXY up by 5% from its low. And it has already created havoc in ATM markets ATM …..which is Argentina Turkey and Mexico why? these markets are the most impacted by FED QT because their fundamentals are the weakest in Emerging Markets Trouble always start at the periphery

….a country which has defaulted on its foreign obligations time and again and have also seen currency devaluation and hyperinflation raised 100 years money from international bond markets last year around 8% . The liquidity coming into EM was so strong last year that this issue was oversubscribed and the bond even traded at premium. Now the liquidity is turning away from Emerging Markets and as warren Buffett says You only come to know who is swimming naked when the tide turns

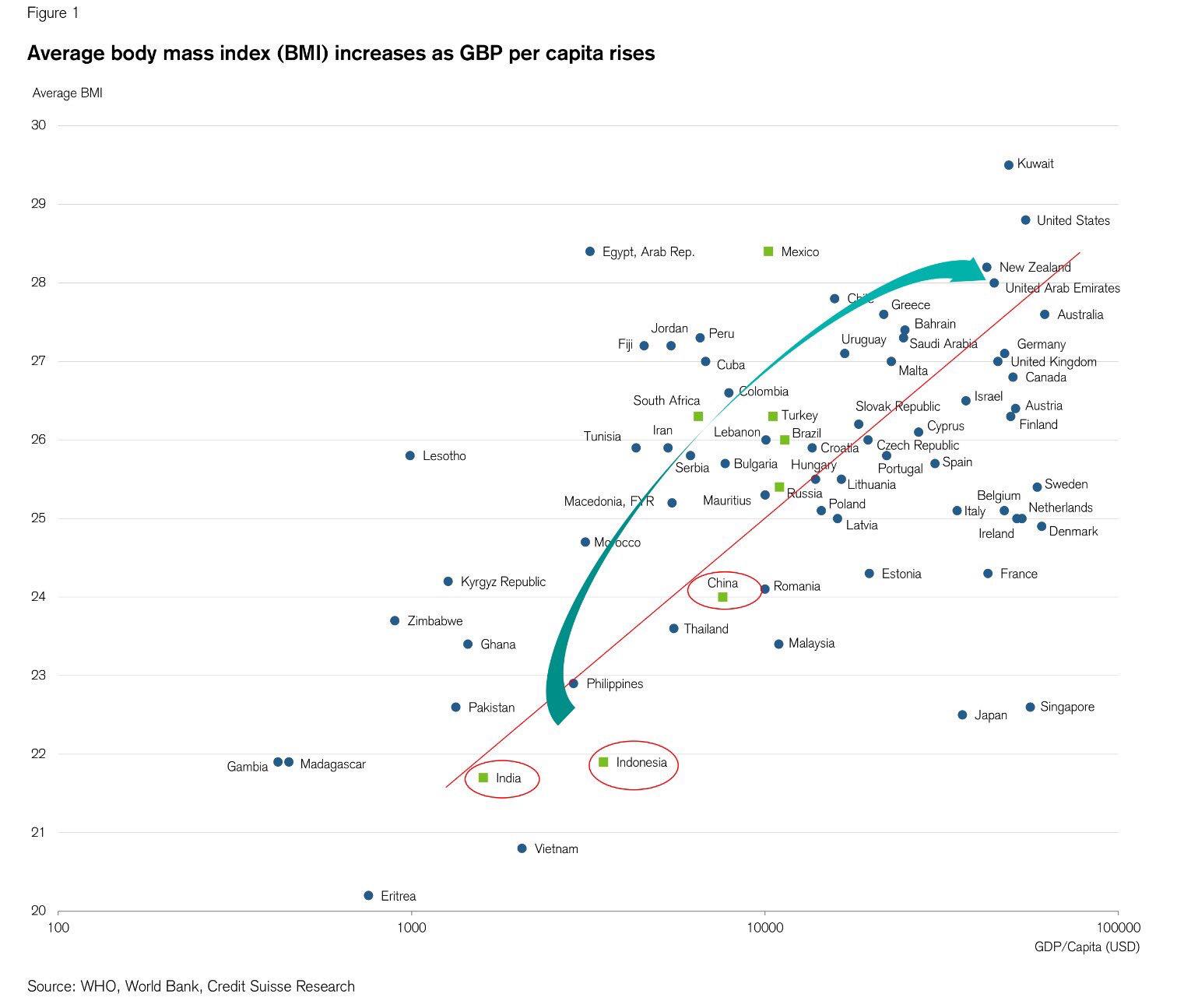

India has become rich but most Indians have not participated in this growth. Stark concentration of wealth in india represented by Body mass Index (poor state of nutrition)which is lower than Philippines, Pakistan and Morocco

This is probably the most thought provoking piece on markets I have read in long time .

Victor shvets of Macquaire writes

“About working horses & people ‘There was a type of employee at the beginning of the industrial revolution whose job and livelihood largely vanished in the early 20th century. This was the horse. The population of working horses actually peaked long after the industrial revolution… there was always a wage at which these horses could have remained employed. But that wage was so low that it did not pay for their feed’, Brynjolfsson & McCaffe”.

we are residing in a world where return on labour is declining while returns on ‘superior brain, social capital and connectivity’ are rapidly rising. for e.g Robotics, automation, internet of things and AI is already responsible for 80%+ of global trading of financial instruments while rapidly destroying professions (ranging from paralegals to accountants) and starting to dominate the retail and wholesale sectors. The revolution is also now rapidly moving into manufacturing.Robotic factories, 3D printing and a decline in moving parts is starting to impact supply and

value chains. Just several examples would suffice. GE is planning to print as many as 100,000 parts of their aircraft engines; Divergent 3D is now able to print a super car in a garage in California whilst Apis Corp has recently 3D printed an entire house for $10,000 and within 24 hours. This is not to mention, robotic (or ‘dark’) factories that are springing up from the US to China. The Fujitsu (2016) survey projects that around 90% of manufacturing

companies expect a significant change in their business model within a decade or less.

And he concludes philosophically …In other words, in a somewhat callous fashion, the quote above by Brynjolfsson & McCaffe implies that humans today, are the equivalent of extinct working horses of late 19th -early 20th centuries. It is likely that within a decade or two, value would gravitate so strongly towards what Peter Thiel called ‘zero to one’, that only people with strong empathy and EQ (i.e. entertainment, priests, psychiatrists) as well as technocratic and some managerial elite,would continue to play a significant role. This also promises to be the world of even sharper income and wealth inequalities and quite likely a world of extreme political reaction against the trend of declining importance of human inputs, potentially rivalling a modern equivalent of 1789 French revolution.

What does it mean for INVESTOR.

‘There is nothing so disastrous as a rational investment policy in an irrational world’,John Maynard Keynes

The above quote from John Maynard Keynes, who apart from being an economist was also an exceptionally savvy investor, encapsulates dilemma facing investors. Current investment climate (and indeed for more than a decade) is the one of non-existent business and capital market cycles. This implies that any trading and investment strategies

based on conventional tools and variables (such as sector rotation, mean-reversion) are bound to fail.

Macquaire has and continue to recommended two complementary strategies – ‘Quality Sustainable Growth’ and ‘Thematics’. They particularly like Thematics,as these directly invest into dystopian trends of ‘declining returns on humans and capital’.

Qaulity and sustainable growth is easy to understand with relatively large universe of ideas investable ideas

what is included in Thematics is interesting.

Theme 1: “Replacing Humans”: Robots, Industrial Automation & AI

Theme 2: Asia’s High Technology niches

Theme 3: “Opium of the people”: Games, Casinos/Virtual Reality

Theme 4: “Bullets and Prisons”: Defense, Security,Prisons/Correction Centres

Theme 5: “Education & Skilling

Theme 6: “Demographics”: Funeral Parlours, Hospitals and Psychiatric Centres

The only way out is Loan waivers, basic minimum wages for majority of population and continue leveraging to continue to prepone consumption and yes it also means BIGGER GOVT and SHRINKING PRIVATE SECTOR. Peter Drucker once presciently remarked, the government is now increasingly in the business of not just ensuring that the climate is conducive to business, but instead it attempts to micro manage weather (i.e. not too cold; not too hot).Thus, they believe that a combination of rapidly evolving technology, a high degree of operating flexibility and limited demand visibility, there would be no break-out of wage pressures. Vicotr believe that it also implies that the global economy continues to reside in a deeply disinflationary climate hence invest in quality sustainable growth and Thematics