Macro Summary Feb 2017

Global growth is expected to come in at 2.6% in 2016 as a result of a better than expected outturn for Q3 and continued momentum in Q4. The growth forecast for 2017 has been upgraded to 2.8%, led by a more optimistic view on the emerging markets, the UK (smaller Brexit effect than expected) and the US (boost from fiscal loosening). Inflation rises modestly due to higher oil prices. In 2018, global growth is expected to accelerate to 3% thanks to the full impact from fiscal loosening in the US, and falling inflation in Europe helping to boost demand.

The US Fed is expected to raise rates twice in 2017 taking fed funds to 1.25% by end year. With growth strengthening and inflation rising, the pace of tightening is expected to increase in 2018 with four rate hikes taking the policy rate to 2.25% by end year.

UK inflation is set to rise sharply due to the fall in the pound, which will reduce disposable income of households and encourage cuts in spending. Investment is already weak, and has started to impact employment. The BoE is expected to remain on hold, constrained by higher inflation. Growth remains below trend in 2018 causing unemployment to rise.

Eurozone growth is set to ease in 2017 as a temporary rise in inflation constrains household spending. Political uncertainty will also weigh on business investment, though we assume the establishment holds on to power. The outlook for 2018 is more promising as inflation falls back, and external performance is boosted by better growth elsewhere. The ECB should maintain low rates and QE beyond the end of 2017, but will come under pressure to tighten.

Japanese growth forecast at 1.4% in 2017 and inflation at 0.8% supported by looser fiscal policy and a weaker yen. No further rate cuts from the BoJ, but more QE is expected as the central bank targets a zero yield for the 10 year government bond.

Emerging economies benefit from modest advanced economy demand growth and firmer commodity prices, but tighter US monetary policy weighs on activity. Concerns over China’s growth to persist, further fiscal support and easing from the PBoC is expected. Risks • Risks skewed towards weaker growth on fears of secular stagnation, political risk in Europe and a US recession. Inflationary risks stem from more aggressive Trump policy on tax cuts and trade.

economic-strategy-viewpoint-schroders-february2017

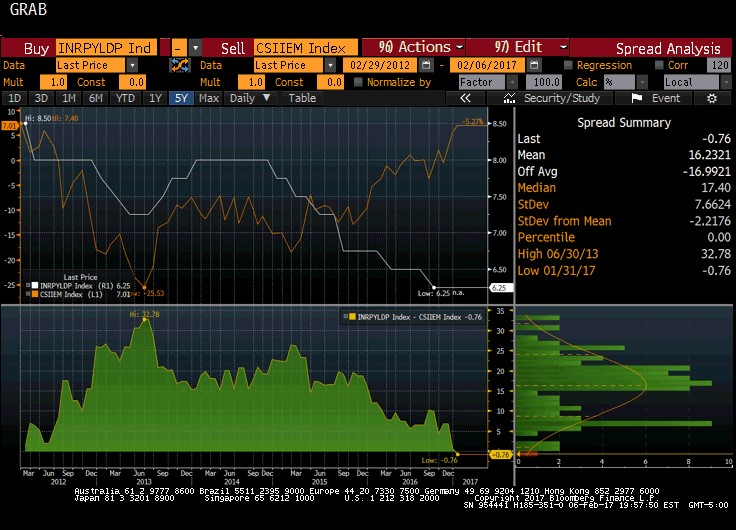

CITI EM Inflation surprise index at 5 year high and Market wants a rate cut

Citi publishes Emerging Market inflation suprise index every month . It measures price surprise relative to expectation . A positive reading means inflation is higher than expected and negative reading means that inflation has been lower than expected.This number which was benign at -0.59 as on 30th nov jumped to 7.01 in the latest january reading . This reading is at a 5 year high.India Repo rate has largely has a high correlation with this index till early months of 2016 when they started diverging, and this divergence also stands at all time high today.As i had discused in my previous article demonetisation led to agri commodities prices falling sharply as lack of money with traders resulted in dramatic fall in food prices in last three months dragging overall inflation down.This was at a time when world FAO food price index touched a two year high.

There is one more point which needs consideration. At the time of dollar strength it is important that countries running current account deficit like India should keep an extra margin of safety in the form of higher than normal interest rate differentials so as to protect currency volatility. The incoming Trump administration might not want strong dollar , the action on border tax, fiscal stimulus, lower taxes will all lead to stronger dollar in future.

Will RBI take into account strong dollar and look through the recent fall in inflation and instead prepare the market for end of easing?

Amazon’s Alexa: An Exasperated Parent’s Guide

I am not tech savvy and first time i heard about Alexa was in the series Mr Robot (i like those conspiracy type things) where a lonely FBI agent after a hard days work goes home and calls out Alexa http://Alexa,https://www.youtube.com/watch?v=TaY9zt_qx_c a round device needing a Wi-Fi access to give you an answer for anything which is not abstract…. so you have something to talk to incase you are feeling lonely.

I found this article in WSJ on the same. Very interesting ..

A FRIEND TOLD me about a recent playdate that took an unexpected turn. The 7-year-old boys thought it would be funny if they asked a burning question of Amazon’s Alexa, the voice-activated assistant built into the Echo speaker that the family had recently purchased. “Alexa, what is poop?” said one child.

After a pause, the speaker gamely replied: “Defecation is the final act of digestion, by which organisms eliminate solid, semisolid, and/or liquid waste material from the digestive tract via the anus.” (The definition comes from Wikipedia.). Analysts estimate that Amazon has sold six million Alexa-cabable since launch.

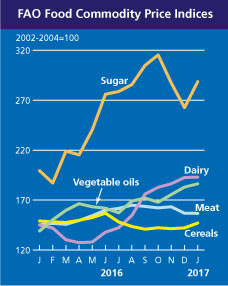

Global food prices on a sprint, up 16% in last one year, diverge from Indian prices

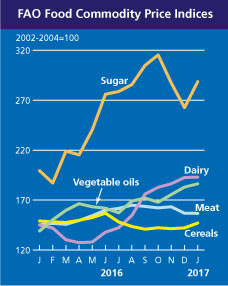

According to the Food and Agricultural organisation, The FAO Food Price Index* (FFPI) averaged 173.8 points in January 2017, up 3.7 points (2.1 percent) from the revised December 2016 value. At this level, the FFPI is at its highest value since February 2015 and as much as 24.5 points (16.4 percent) above its level in the corresponding period last year. The strong rebound in the January value of the FFPI was driven by a surge in international sugar prices and sharp increase in export prices of cereals as well as vegetable oils. Meat and dairy markets remained more stable. FAO’s Food Price Index is a trade-weighted index tracking international market prices for five major food commodity groups.

While 2016 marked the fifth consecutive year the index has fallen, January 2017 marked its sixth monthly increase in a row. Take the instance of wheat, where depressed prices till August led to one of the lowest planting worldwide.

(Money managers remain bearish — they’ve bet on lower prices for 17 months straight)

But there are signs the glut may not last much longer, or at least that supplies may tighten enough to halt the four-year slump in wheat futures.Farmers are planting less because many are losing money. At the same time, global consumption is at an all-time high. And the risk of crop-damaging weather lingers over key exporting countries this year. As Rabobank says there is a “real possibility” of a supply shock in the U.S. and Europe if farmers shift to more profitable crops.

An NIFPB research paper has found strong correlation between global and domestic food prices although the correlation is not as tight at individual commodity levels. The correlation broke down since Nov 2016, and the reason in my view is demonetisation. There is no denying the fact that good monsoon led to better planting but demonetisation led to perishable commodities getting dumped at throwaway prices as shortage of cash with traders led to sharply falling prices and hence low food inflation.

I think low food inflation in India is behind us and it is poised to rise and catch up to its correlation to world agri prices which are going through perfect storm of low planting, high global consumption and tight supplies.

Rural India has gone through rough phase in last few years, first depressed agri output prices and then demonetisation. Rising global food prices coupled with increased budgetary allocation for MNREGA and rural development bodes well for rural economy.

Bet on rural economy, rising soft commodity prices and higher inflation

“Poverty amidst plenty” and is “Made in India” failing – ET what i read

This week in Economic times i write about how chinese now own 50% of our mobile handset market inspite of made in India campaign. Severe drought conditions in southern India and effect of demonetisation which has increased farmers agony. Normal drug prices rising by upto 1200% in last five years which is clearly a nexus between drug manfucturer, insurance companies and lax regulation,and a little known company known as cambridge analytica which helped donald trump become US president

enjoy your weekend

Mega Trend favors inflation,PSU’s , and protectionism beneficiaries

I did an online chat with REUTERS http://bit.ly/2kYpLDG yesterday where i discussed my views on budget,mega trend in making and interest rate cycle.I see reversal of few established trends with bigger governments and expansion of PSU role, reversal of low interest rate regime, return of inflation and surprisingly beneficiaries of protectionism (PSU banks) in this chat.

You, yes you my dear real estate investor

India has till 2007 seen a fair breakup of physical and financial savings at household level split evenly between physical (gold and real estate) and financial savings (mainly bank deposits). The trend took a turn in 2009 as government panicked post Lehman crash and pumped lot of money into the economy leading to high inflation in capacity constrained environment. Inflation spiked but RBI never increased the interest rates high enough to counter inflation. high inflation coupled with substantial increase of high denomination old notes (500 and 1000) in circulation led to two important trends

1. Overall savings started dropping

2. Financial savings losing ground to physical savings as inflation reduced the value of money and Indians being smart to maintain the value of money bought land and real estate. By 2013 at household level physical savings constituted 72% and financial savings came down to 28%.

Then Dr Rajan became RBI governor in 2013 and the first thing he did was to target inflation. Low inflation coupled with high interest rates to compensate savers for loss of purchasing power led to moderation in real estate price appreciation and start of shift to financial savings as money was not losing value anymore. But, what to do of black money which was sloshing in this industry? govt has come out with various measures over last couple of years to eliminate black money and most will agree that it has reduced substantially in all property transactions. So as chuck prince said, When the music stops, in terms of liquidity, things will be complicated. But as long as the music is playing, you’ve got to get up and dance. The music has stopped and with the measures announced in this budget the door to get out of the party has also closed.

Manish bhandari of valuenomics was the original bear of real estate way back in 2013 valuenomics-real-estate-2013

and this is what he had to say

The theme played out this budget has been stringent measures are the final nail in the coffin to deflate real estate prices. The Finance Minister has broken the malaise of closed loop of circular money circulation in Real Estate sector (sale of one real estate proceed going to purchase of another real estate to save capital gain) or sometimes half-heartedly trickling to NHAI/REC bonds with 3 years of lock in. It is noticeable that physical assets (Real Estate, Jewellery) accounts for 50% while equity allocation is less than two percent of households assets This is done by following policy measures:

Lowering the capital gain years threshold to 2 years for claiming capital gains, signal’s a genuine attempt to encourage people to exit their real estate holding at much faster pace than before and alternatively find more productive other investment avenues.

The budget has indicated that many more bonds will be opened to channelize money in financial instrument from sale of real estate proceeds. This will encourage big financial migration from the sector where investors are getting dissuaded by low investment returns over last two years.

Last attempt, in form of tax rebate for one year by persuading builders to liquidate inventory over one year cycle after receiving commencement certificate in order to augment supply in the system.

However, the final straw on investors back is limiting notional loss from house property to Rs 2 lacs per annum instead of unlimited tax shield created by misguided policy under Sec 71 of IT Act. I have written about misuse of this policy on various occasions as property investors have crowded the property markets for the last decade, pushing actual user far off. Now, this will push HNI investors out of property market for years to come. To my belief, no policy measure will have such a far reaching impact on driving down property prices than this one.

These stringent measures will have long term repercussion resulting in lower land prices, enhancing supply of land in the system and dissuading investors from hoarding of land, apartments.

Now the question remains why government has chosen to remain silent about taxation on Long term capital gain, despite the loud roar of our Prime Minister, in Jan 2017 at Mumbai. The answer lies in scanning through the recent history of Divestment program of the Government. We are running an ambitious divestment target (Rs 72,500 Crs.) and it was necessary to cheer the mood and set the stage right for the financial markets.

The byproduct of this exercise is an avalanche of investment flow into financial markets especially equities where tax incidence in long term capital creation is Nil. I have spoken about impending households savings to financial assets on various occasion, the policies in this budget has expedited the financial migration process.

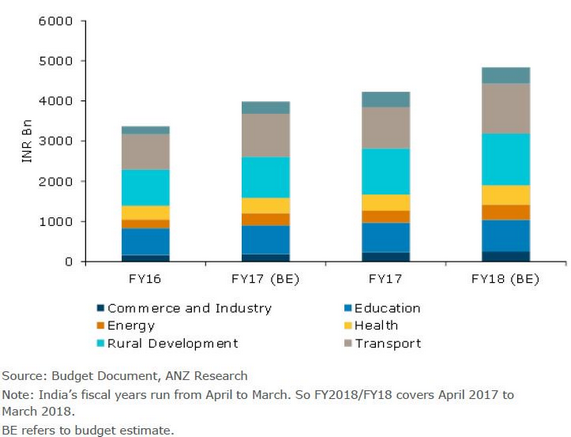

Infra development last hope to revive animal spirits

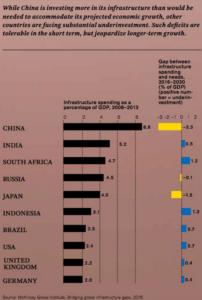

India is currently growing at 11% nominal GDP with high underinvestment in infra sector as per Mckinsey report.

Among various heads where allocations have increased in this budget, infra has the highest multiplier to growth. if the budgetary allocation to various infra agencies is properly mixed with market borrowing when interest rates ,credit growth( which mimicks M3) are probably the lowest in last few years the multiplier can be fairly large

if anybody thinks that recapitalisation and retail lending will solve indian banks problem they dont understand the importance of high nominal GDP

increased infra lending with safegaurds and clear laws,can easily push credit growth rates to digits which will be adequate to push capacity utilisation rates higher and in turn incentivise private sector to start new capex cycle. sounds easy i know but this is our last chance before India gets into debt trap

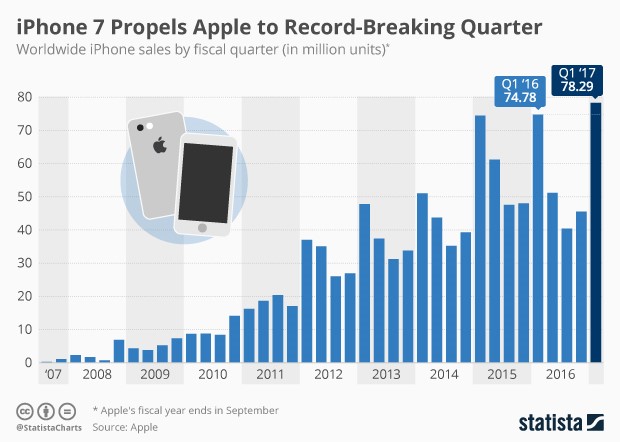

Apple gets a helping hand from demonetisation

Apple posted all time high global sales of 78.29 million units last quarter ,higher than analyst estimates in the results released yesterday .During October-December 2016, the iPhone maker also clocked an “all-time record revenue” from India, Apple CEO Tim Cook told analysts during a post-earnings call on Jan. 31. As per counterpoint research note iPhone achieved a landmark, crossing 2.5 Million units in a calendar year, with a 1/3 of its total shipment coming alone from the record fourth quarter driven by seasonality and the launch of iPhone 7. Apple had emerged as an unlikely beneficiary of the note ban as many consumers looking to do away with their stash reportedly bought expensive iPhones. In the three days following demonetisation, around 100,000 iPhones were sold in India, which is about three-fourth of the average monthly sales of the device in the country, The Economic Times reported.I doubt that Apple will get the same helping hand again

The Data that turned the world upside down

On November 9., Ashburner Nix CEO of Cambridge Analytica, then little-known British company based in London sent out a press release: “We are thrilled that our revolutionary approach to data-driven communication has played such an integral part in President-elect Trump’s extraordinary win,” His company wasn’t just integral to Trump’s online campaign, but also to Brexit. Anyone who has not spent the last five years living on another planet will be familiar with the term Big Data. Big Data means that everything we do, both on and offline, leaves digital traces. Every purchase we make with our cards, every search we type into Google, every movement we make when our mobile phone is in our pocket, every “like” is stored. Especially every “like.” For a long time, it was not entirely clear what use this data could have—except, perhaps, that we might find ads for high blood pressure remedies just after we’ve Googled “reduce blood pressure.”. Now you need to know Psychometric analysis. At Cambridge, they, “were able to form a model to predict the personality of every single adult in the United States of America”. Trump’s canvassers were provided with an app with which they could identify the political views and personality types of the inhabitants of a house. It was the same app provider used by Brexit campaigners. Trump’s people only rang at the doors of houses that the app rated as receptive to his messages. The canvassers came prepared with guidelines for conversations tailored to the personality type of the resident…. WOW