via Morning Porridge

“Speculation may be indulged when based on facts..”

This Morning: Markets are full of noise about everything from inflation, risk, leverage and politics, but the reality is we are approaching “Peak Speculation”. It doesn’t mean a crash is imminent, but that investment strategies and approaches are going to have to factor in a new reality, and be far more suspicious, questioning and smart as a new reality takes hold. The consequences of QE and other factors that fuelled the speculative age could be with us for decades.

Forgive me if this morning’s comment is disconnected, but I’m still catching up and trying to get to grips with what turned out to be the worst week for markets, oh, since the last worst week for markets, (back in Feb). There are just so many data-points, multiplicities of opinions, bear-traps, rumours and sighs, to consider…

What do they collectively mean?

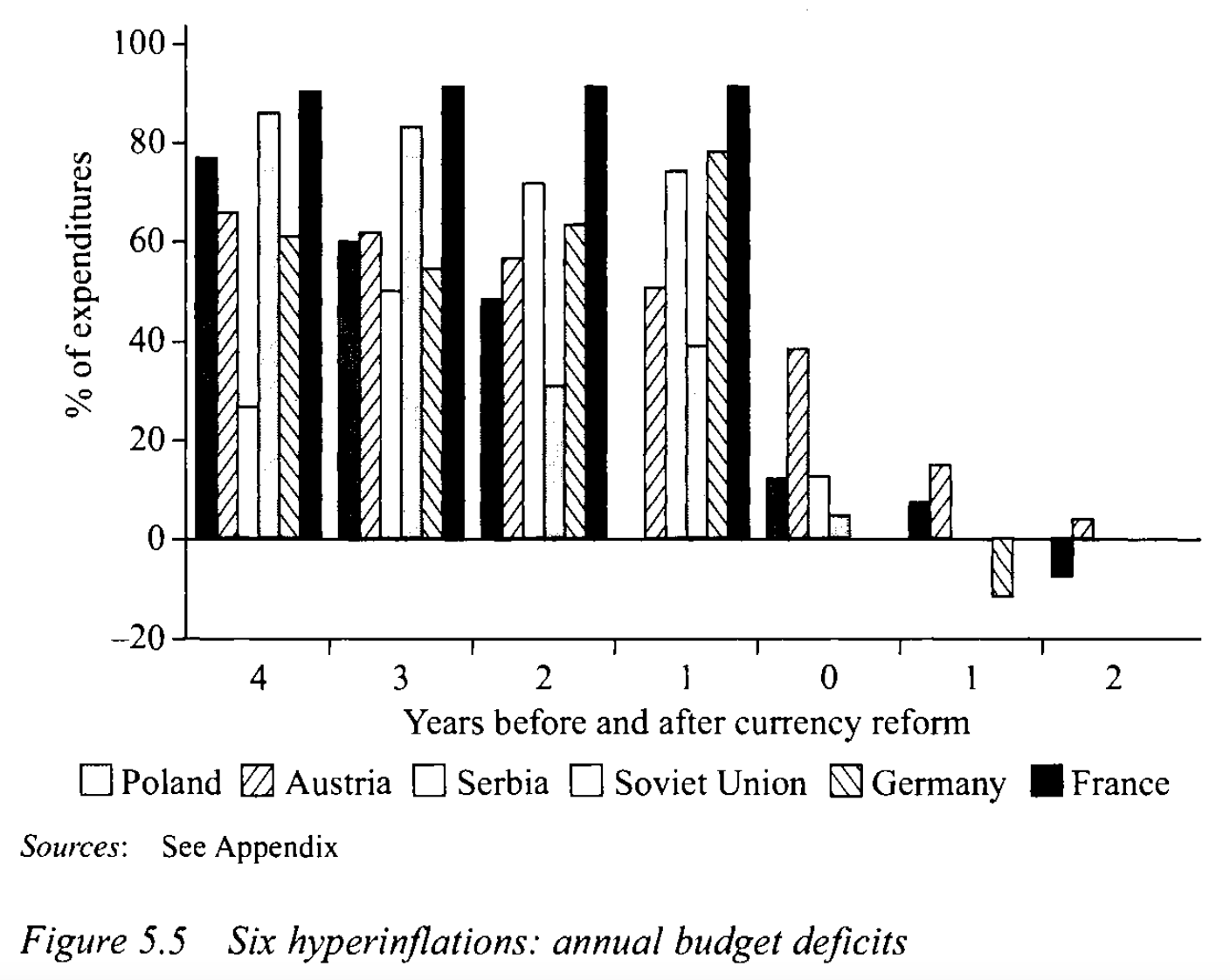

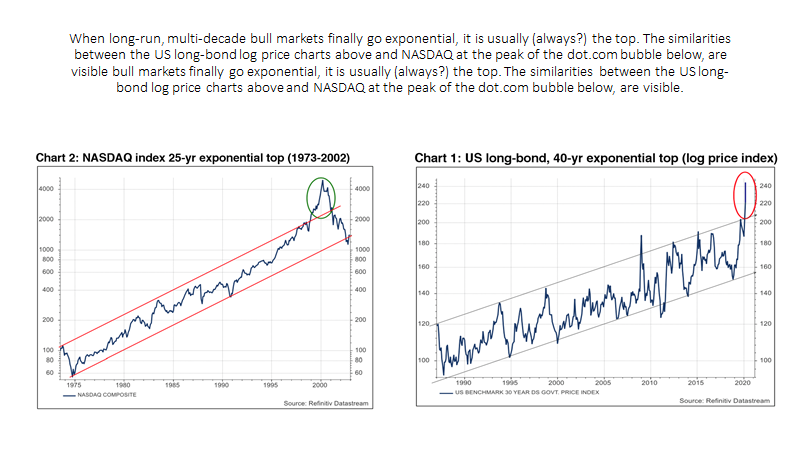

Let’s start with the view from up high. I reckon we’re approaching the top of a particular phase in a very long-term distortion cycle that began back in the ruin of the Global Financial Crisis (“GFC”) in 2008. Let’s call the current stage the “Speculation Phase”. The dominant factor on markets these past 12 years has been increasingly speculative behaviour, fuelled by rabid financial asset inflation and crashing yields as monetary experimentation in the wake of the GFC kicked in.

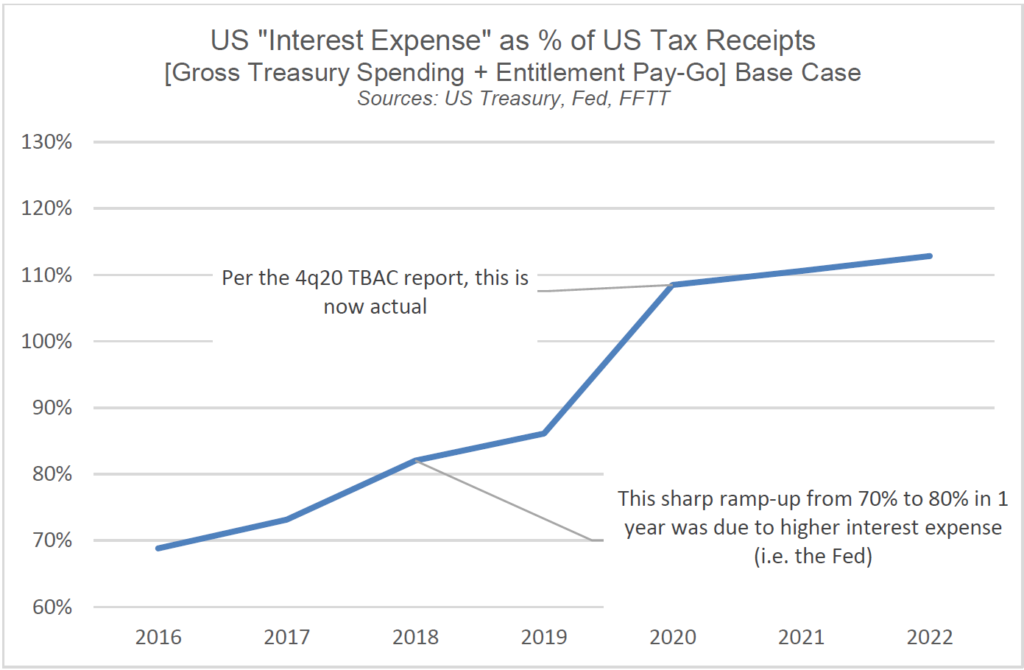

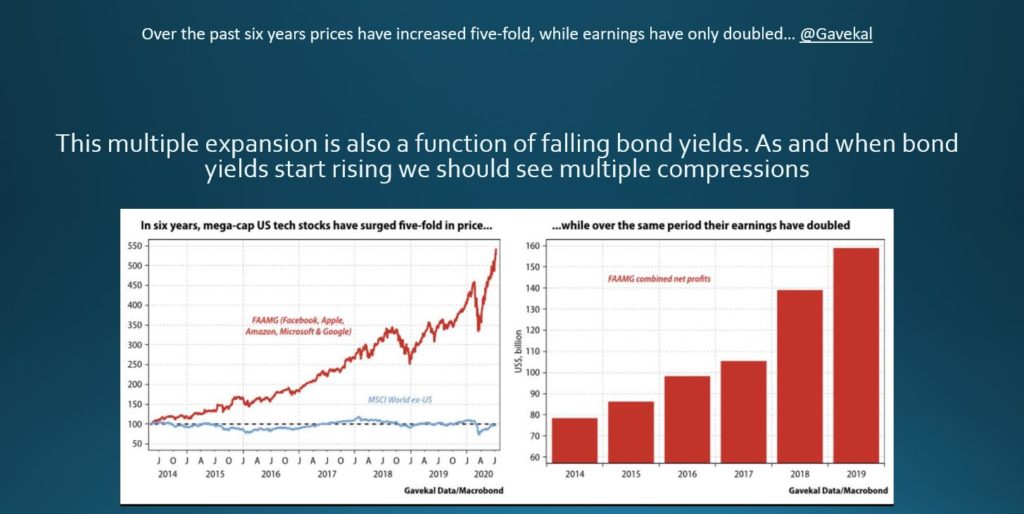

I must calculate exactly how much money the Big Four Central Banks and the rest have pumped into markets through bank bailouts, easy short-term money like TLTROs, and quantitative easing since 2008. It’s a lot. It has not been matched by a commensurate rise in the stock of real assets like infrastructure, factories and offices… Nope. All that money has gone somewhere… the only thing that has risen is the price of financial assets: equity prices soared and bond yields crashed. Companies are worth far more today than in 2008, but their actual tangible footprint in terms of jobs and presence hasn’t changed that much.

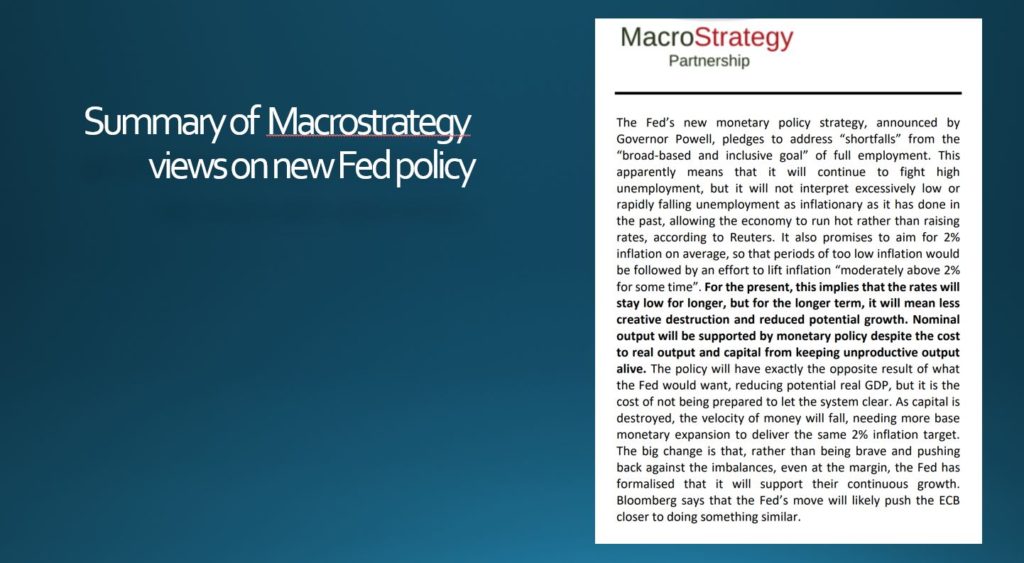

If the purpose of QE was to kick start economies, then it’s D- report cards for Central Banks. The post GFC global recovery over the last decade has been pretty anaemic – with the exception of China. All that’s happened is companies are worth more, meaning their owners are wealthier – on the back of financial asset inflation.

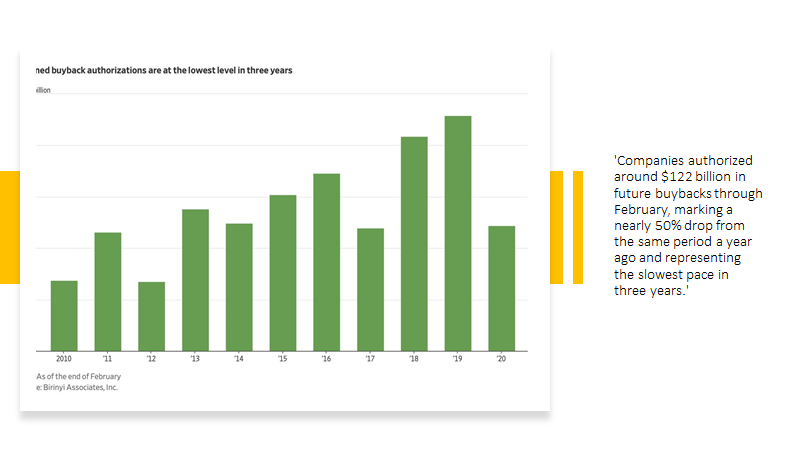

QE policies have had a devastating distorting effect on markets and investment. The consequences are still barely understood across social and commercial behaviours. For instance, corporates have been incentivised to buy back stock (to reward executives), savings have been gutted, the wealthy have thrived, while austerity to pay for QE has driven declines in living standards and expectations for the vast majority of workers.

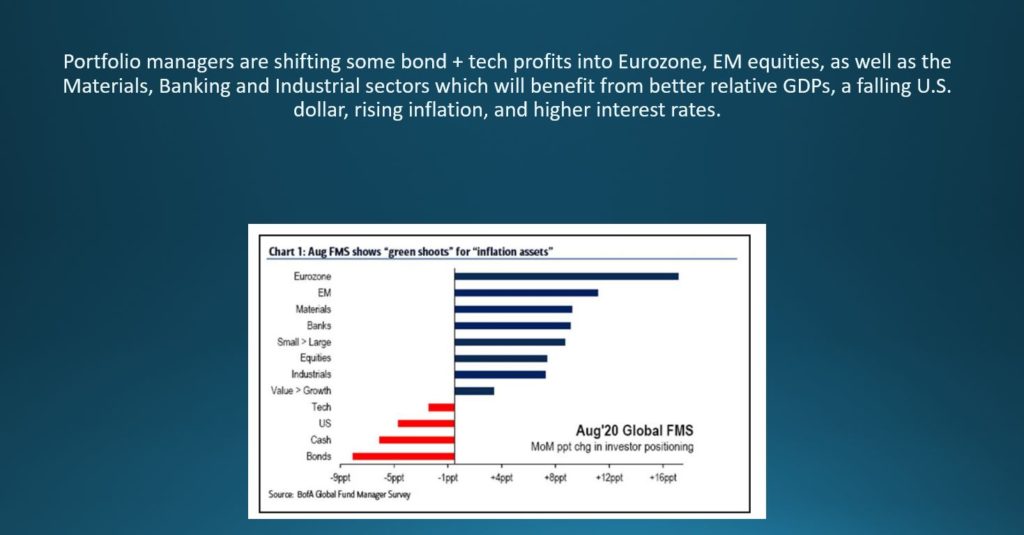

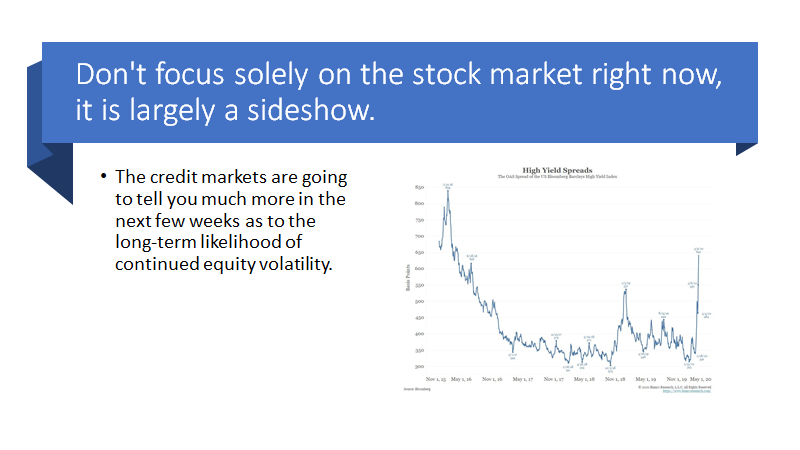

Central bank money and keeping rates artificially low has resulted in a scramble for yields of any kind – which is why every investor is exposed to greater risks. Government bond investors have dug down into junk corporate debt in search of returns, while equity investors have increasingly bought into increasingly improbable new tech disruptive visions. This is why it’s the Speculative Phase – investors increasingly betting on imagined possibilities, dreams, visions and claims, rather than fundamental analysis and future income streams.

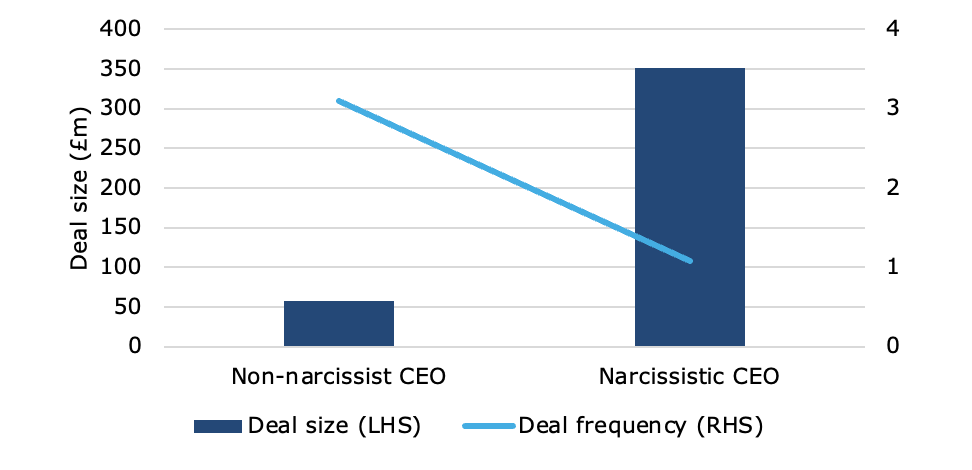

Speculation has fuelled the SPAC craze – betting smart entrepreneurs can identify not so much the next money-making machine, but the next stock the market will pile into. It becomes self-fulfilling. What do the current spate of lacklustre IPOs, a multitude of SPACs scrabbling to find acquisition targets really mean? (Clue: desperation to get it done before it’s too late.)

The Speculation Phase finds its ultimate expression in the invention of a completely new and invisible asset class that only very clever people can understand. If you haven’t read the Emperor’s New Clothes – then I suggest you do. My Coinbase account was up 50% at one point last week…. I have no idea why… When the only basis for investing in an entirely new but “serious” asset class is the expectation the price will rise, thus allowing its sale to a “greater fool” – the whole basis of Dogecoin et al… well it’s a Casino and you got lucky.

We’ve been approaching the top of the Speculative Phase for some time… all that noise in 2020 about switching out of tech stocks that promise much but fail to deliver profits, into dull, boring and predictable stocks that produce steady dividend streams and trade at realistic price/earnings. It’s happening. This is the year when we are likely to find out how many tech evangelists are swimming sans bikini bottoms.

The trick for markets is spotting how this Speculative Phase peaks.

It doesn’t necessarily mean a market crash is imminent, but that investors and traders are going to have to play a very different game – identifying real value versus the stocks fuelled by the speculative hype. They do exist – in fundamentals, in tech, in alternatives and even in bonds.

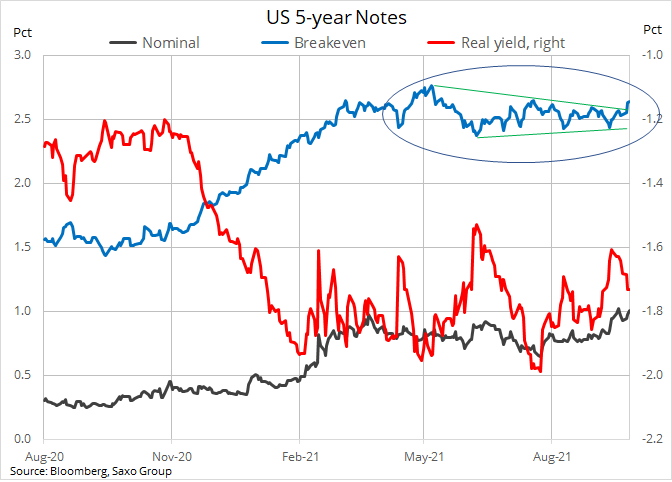

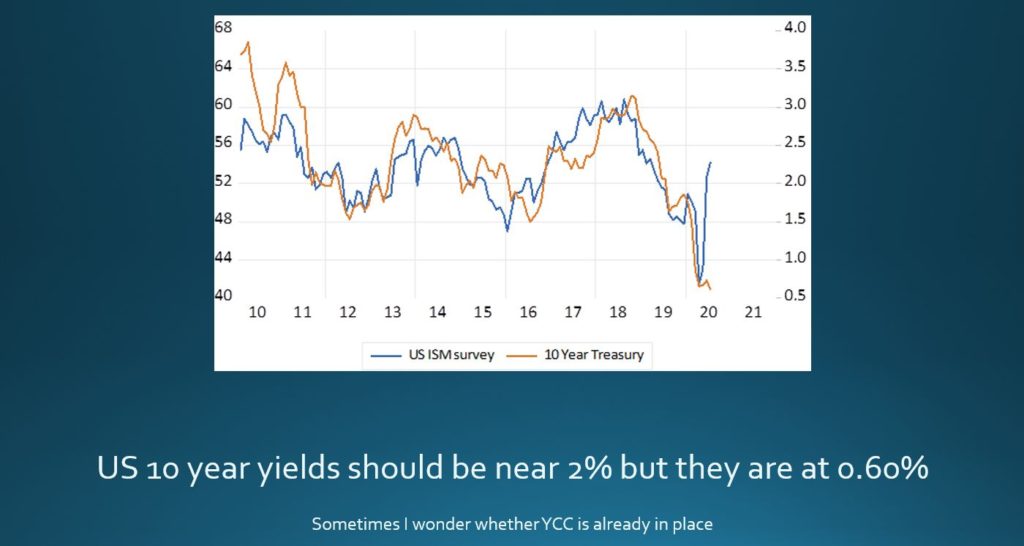

As always, uncertainty colours everything. We just don’t know how much longer the QE-fuelled financial asset binge is going to last; as inflation (short or long-term) kicks in, and long-term concerns on wealth, inequality, and environment become increasingly dominant – how will central banks and governments change direction?

The big issue is clearly the resurgent inflationary threat – is it real or not? I suspect that it rather depends on the market itself. If the market believes the inflation threat is real it will react accordingly. The latest data from the USA suggests inflationary expectations are rising among traders and consumers. (Last week, we scrambled to put in orders for materials for our redeveloped house after getting the heads-up Glass and Flooring prices will rise up to 40% this month!)

Meanwhile, the money faucet continues to pour. Since 2020 and the start of the COVID pandemic we’d seen an extraordinary shift from the Government from utter reliance on Central Banking QE to keep interest rates low and markets happy. Governments are now splurging as much in terms of fiscal carpet bombing of the global economy with cash as central banks did. How much of it will actually find its way into real economic activity, and how much will simply fuel a new outbreak of speculative market frenzy?

The noise about declining confidence in fiat currencies feeds libertarian thinking which fuels cryptos – which looks much like a frying pan into fire trade.

That’s why the current noise in markets is so important to follow. At the moment we’ve got a whole host of factors to watch:

US Inflation Numbers, tennis-ball bounce back recovery expectations, threats of renewed coronavirus lockdowns in Asia, a nascent commodities super-cycle, supply chain blockages, labour market inefficiencies, the retreat of retail investors, continuing minimal yields across asset classes, the rise of decentralised finance and cryptocurrencies, a tick-back in tech stocks, the less than astounding performance of recent IPOs and SPACs, rising political tensions, cyber attacks, Central Banks hedging themselves…. Etc, etc…

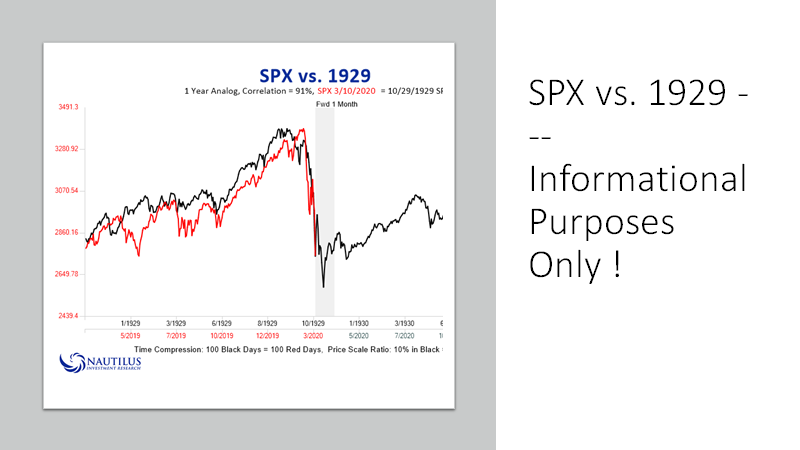

Serious money investors are nervous about volumes, leverage and liquidity. They are all aware of just how much distortion is out there. Understanding the risks for markets driven largely by FOMO (fear of missing out) is critical. Most folk think timing is a matter of luck, but the chartists are all out there talking about big shunts coming as delusional markets turn into traps.

It’s going to be fascinating to watch how UK restaurants fare as they reopen from today. Many are struggling to find workers – who have either left the UK because of Brexit or found better paid jobs during lockdown. There is an awful lot being written about the unwillingness of workers to return to low paying jobs as the economy reopens. The Right say it’s a demonstration of the evils of state handouts discouraging honest work. The Left believe it highlights how low-wages in mac-jobs is a form of wage-slavery. There is an element of truth in both. If jobs aren’t rewarding – both financially and in terms of satisfaction, then why would you not do something else?

Markets should be paying more attention to behavioural science – just how much Covid, and the increasing divides in wealth inequality, are changing the expectations and objectives of global consumers. These will change global commerce long-term. As an example, Starling Bank recently released research claiming 56% of 26-40 year olds (the Millennials) have refocused on their “life goals” like saving for a house versus avocado toast for breakfast.

Sell Avocados and expensive coffee shops?