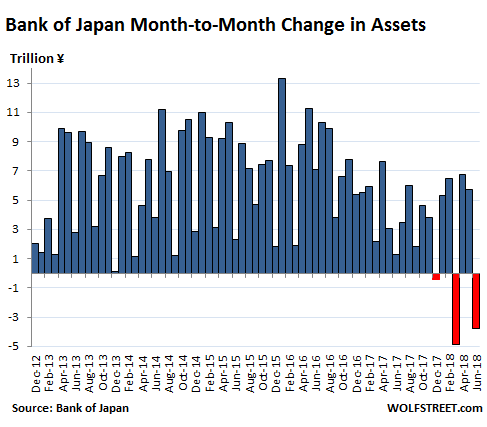

One more central banker takes away the punch bowl without any announcement.In June, total assets on the Bank of Japan’s balance sheet dropped by ¥3.79 trillion yen ($34 billion) from May, to ¥537 trillion ($4.87 trillion). It was the third month-over-month drop in seven months, and the first such drops since late 2012, when the Abenomics-designed blistering “QQE” (Qualitative and Quantitative Easing) kicked off.So three months out of last seven months BOJ has contracted its balancesheet

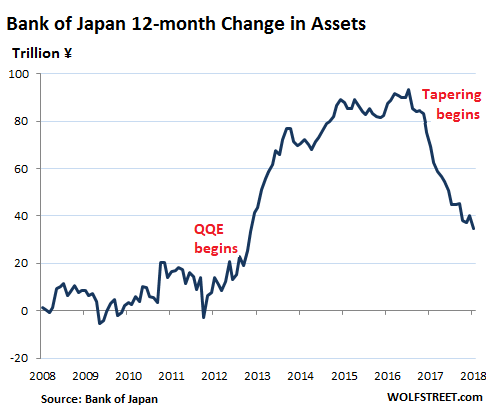

During peak QQE, in the 12-month period ended December 31, 2016, the BOJ added ¥93.4 trillion (about $846 billion) to its balance sheet. Over the 12-month period ended June 30, 2018, it added only ¥34.9 trillion to its balance sheet. That’s a 63% plunge from the peak.

This chart shows this rolling 12-month change in the balance sheet, going back to the Financial Crisis.In other words, the BOJ has started to let some government securities mature and roll off the balance sheet without replacement – much like the Fed’s QE unwind.

somewhere central bankers are realising that they are responsible for this inequality because their policies only helped rich becoming richer through asset markets and that is why its a matter of time we will see heightened volatility across asset markets as the central bank put ia wavering.