Global investing….Thought process for investing over next couple of months

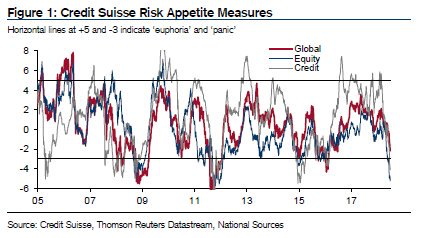

The CSFB Risk appetite has completely collapsed.

The first scare of trade war behind us ………more will be coming but later .

US Market action on Friday was positive with huge positive breadth, the day trade war was actually implemented

…. Sell the rumor ….Buy the fact

Dollar Index has successfully tested 95 zone but not breached it…..it will breach ,but not yet. Any fall in dollar index towards 91-92 will give breather to equity markets.

US and European bond yields have also retraced from high leading to easy monetary condition.

Emerging Markets could be bottoming near term http://blog.knowledgeleaderscapital.com/?p=14473. US markets including US small Cap (Russell 2000) and Nasdaq may see a new high as capital continues to move back top to US. (Small cap and Tech stocks relatively unhurt by trade war hence taking the market lead)

Inflation is building….

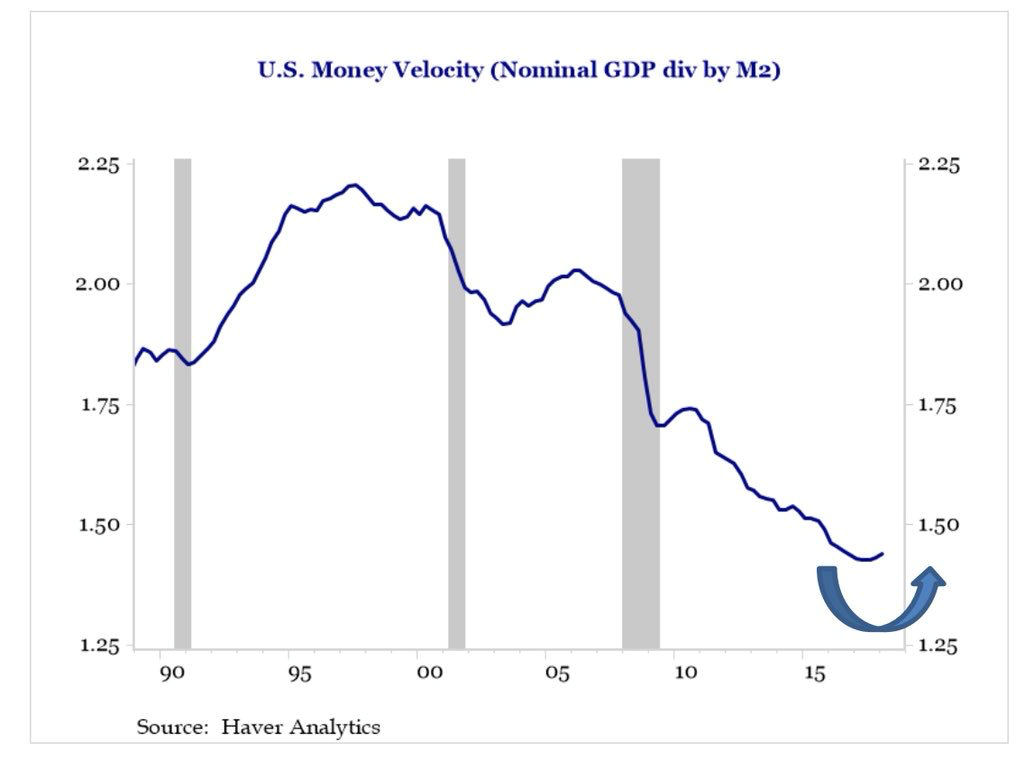

Velocity of money rising in US leading to easier monetary condition .Good sign of growth and Dollar funding

Japanese nominal wage growth at 24 years high

Orders for heavy trucks that haul trailers loaded with anything from junk food to oil-field equipment across the US skyrocketed 141% in June compared to a year ago, to 41,800 orders, making it the highest June ever recorded, according to transportation data provider FTR.

https://wolfstreet.com/2018/07/06/class-8-heavy-truck-orders-2018/.

Initial stages of inflation is good for equities.

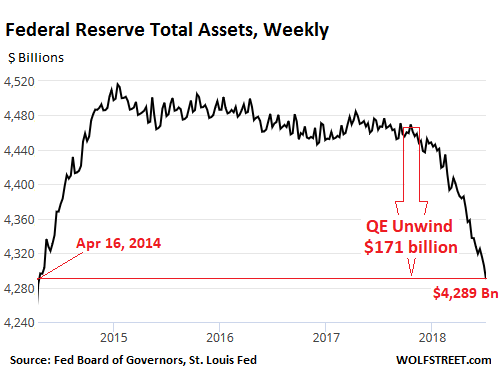

The only concern I have is FED continuing Quantitative tightening….but there is no taper for couple of weeks

when I combine various indicators,sentiment, market positioning and fear index, it looks like world equity markets and precious metals are putting a trade able bottom. As long dollar trade unwinds Emerging equities and Emerging market bonds will get a breather and probably both will rally together.

The above is just a tactical view. My medium to long term view ( 1-5 years) on assets outside US is universally negative. I believe capital is headed back to US ( more on this later)and it will lead to significant selloff in global equities and global bonds. This capital reallocation will be positive for US Dollar and I expect dollar index to rally by 110-120 from current levels of 95 .

Hence any coming weakness in dollar is an opportunity for investors to reduce risk , illiquid assets and move back to safety of Cash.