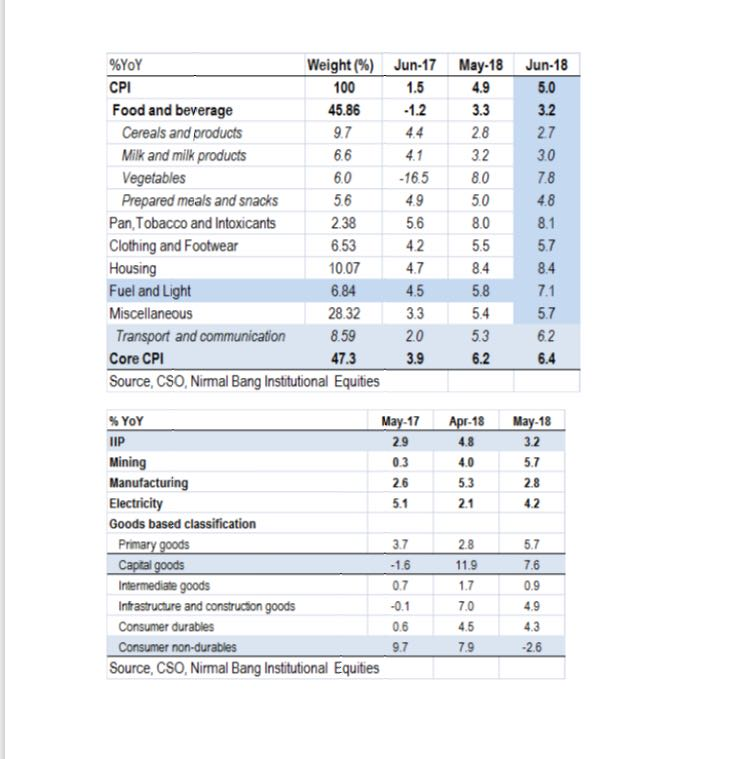

1.India CPI rises to 5% & IIP slows to 3.2%. The downside surprise came from Food inflation whereas core inflation stood at 6.45%.The IIP slowdown can be attributed to consumer non durables.Expect one more rate hike in H2 2018 but MPC to stay on hold in August policy.

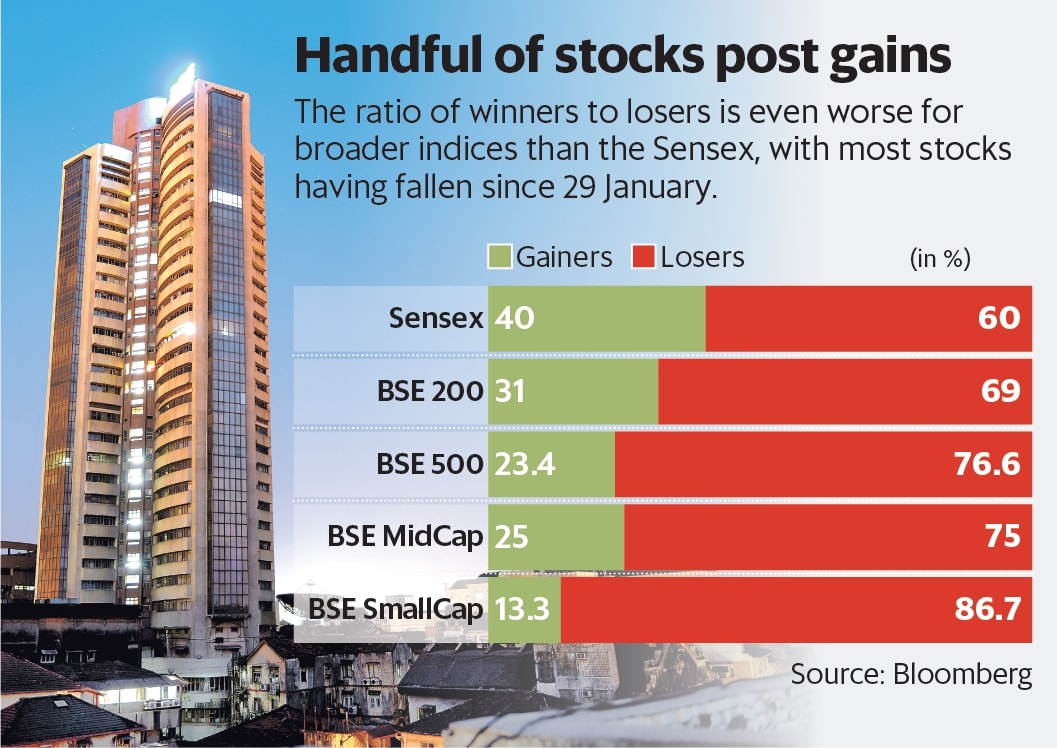

2.Indian benchmark equity indices recorded new highs on Thursday, but the rally is tilted in favour of a handful of stocks, and is far from being a broad-based one. This is classic sign of late stage bull market

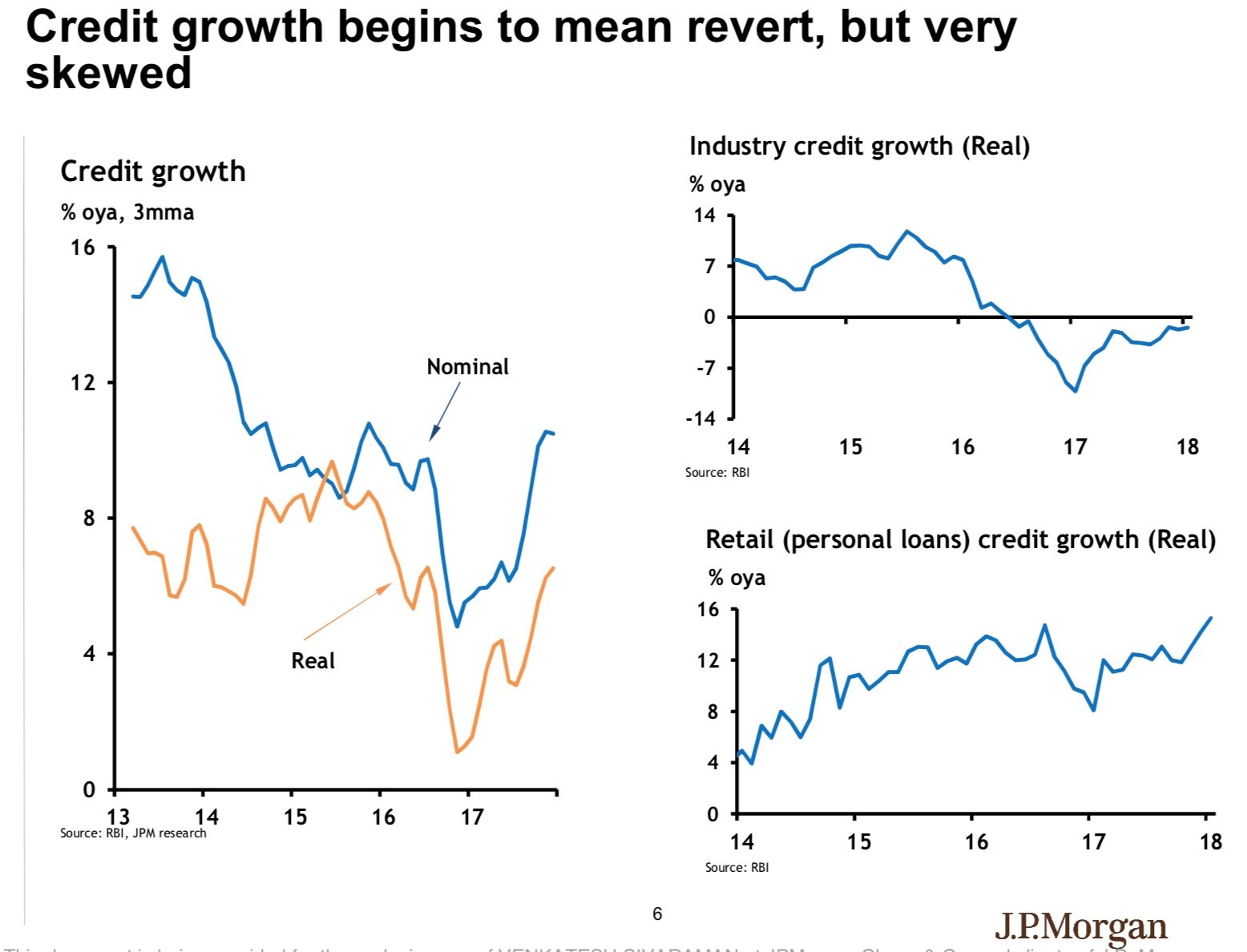

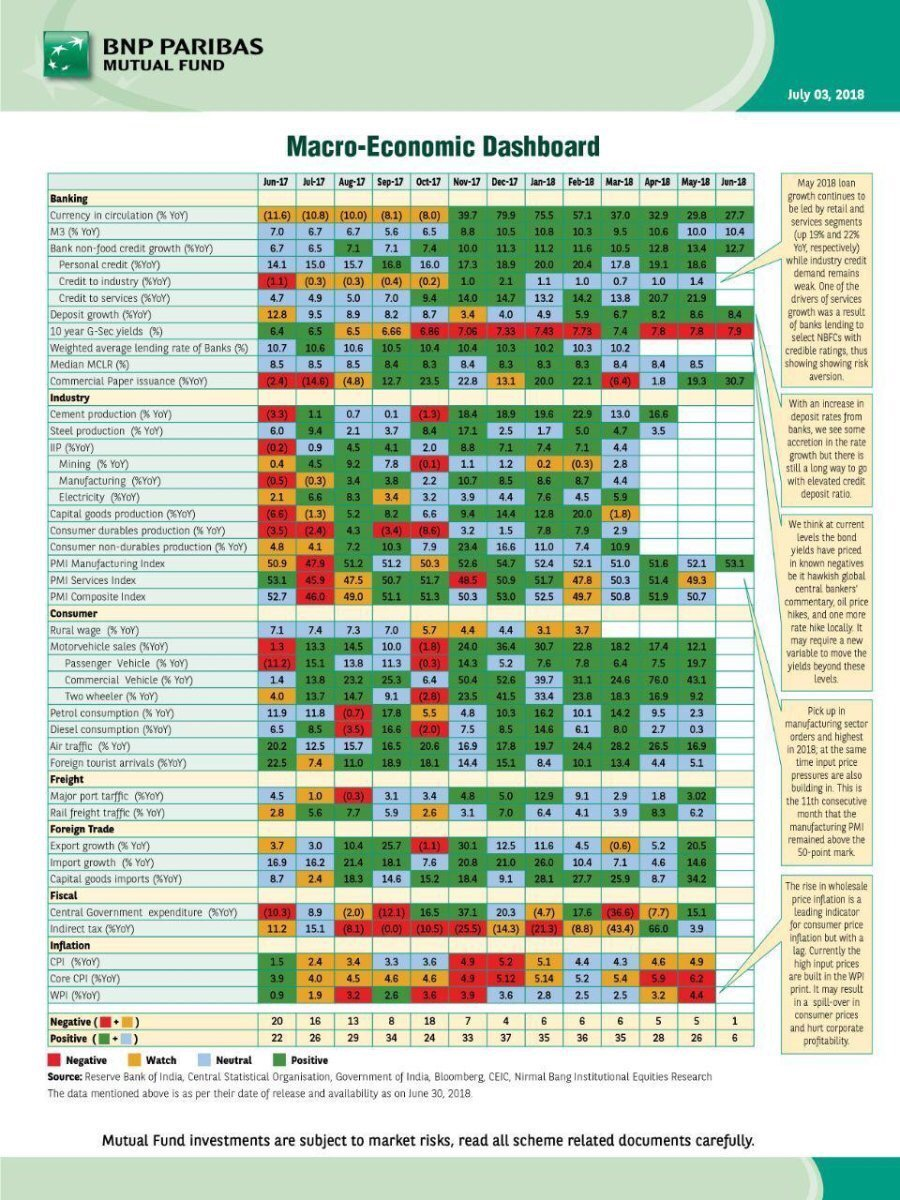

3.India credit growth is still retail driven, Household continue to leverage . Corporate credit growth still restricted to working capital

4.Macro-Economic Dashboard – Most indicators continue to be in green

5.India outperforming other EMs. A strong dollar favors India over other EMs. Oil falling is cherry on top.

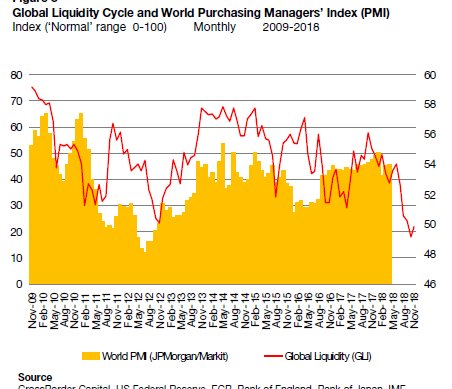

6.Global Liquidity Latest: The Risk Cycle Has Peaked…Are Economies Next? as PMI and Liquidity dips

7.One story about Turkey is the falling Lira and weak BoP. But in many respects that story is a symptom, not the cause. The real story is that 2017 saw a government-led lending boom, boosting growth big time. The credit impulse has now turned negative,weighing on growth big time.India is also doing some of that stuff to boost growth, if private sector does not pick up the slack we could also end up in trouble in 2019.

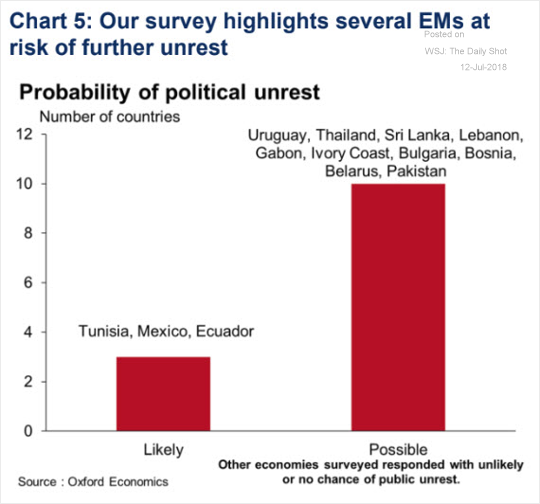

8.Two of our neighbours are on this list and one can actually create serious trouble to divert attention

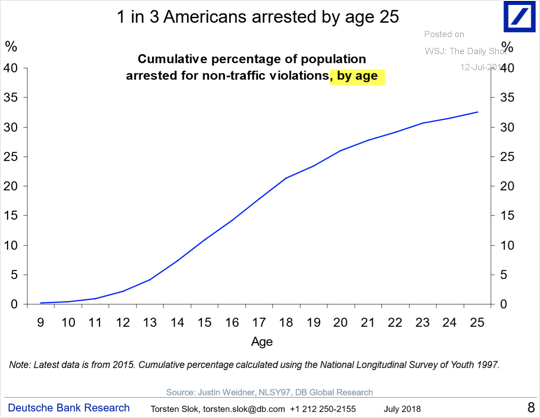

9.Speechless!!!!