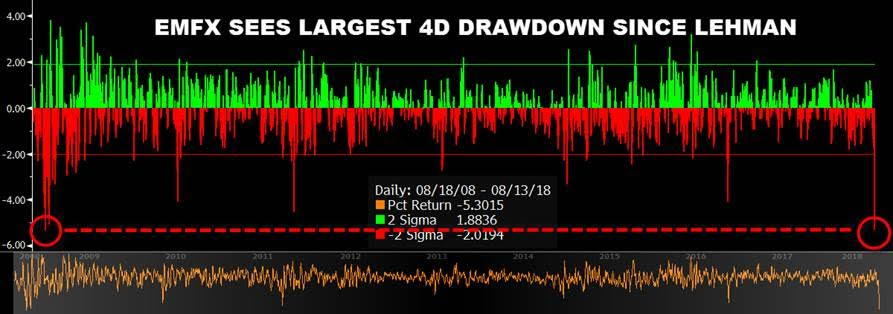

1.The emerging market foreign exchange basket just witnessed its largest 4D drawdown since Lehman. That’s -5.3% being a 5.2% standard deviation move over a ten year period.The structure of market is weakening with increase in volatility and it can turn into a contagion.

2.When push comes to shove will Turkey, Iran and other emerging market governments sell gold to raise US dollars? The future may not be like the past…and that is why GOLD is not responding as safe haven although in local currencies of these countries it has maintained its purchasing power

3.Citi’s views on global macro risks….. too many risks moving in

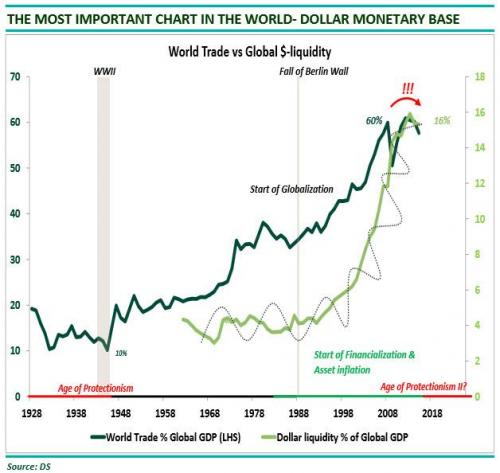

4.Ned Bank writes….The shrinking dollar monetary base will slow down the credit creation process because the economy is so highly geared. This shrinking pool of dollars will cause the dollar to rise. The strengthening USD means higher offshore

USD funding, this will hurt USD indebted nations/corporations.In this environment i.e. tighter global financial conditions, the infamous carry-trade will come under pressure and the misallocation of credit will be revealed. EMs will be at the centre

of the misallocation of credit.