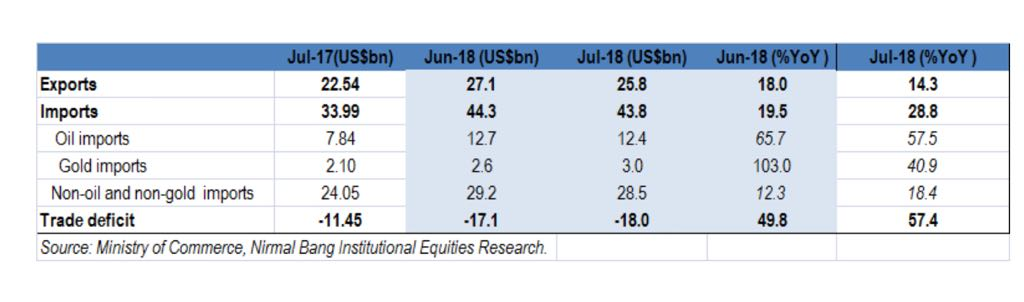

The trade deficit widened to US$18 bn in July 2018, up from a revised US$17.1 bn in the previous month and came in above expectations. The widening of the trade deficit was on account of slower export growth, and higher non-oil non gold imports. Exports slowed a shocking 14.3%YoY in July 2018, down from 18% in the previous month. NONGI grew 18.4%YoY, up from 12.3% in June 2018. Crude oil imports were up over 57% YoY, but slowed from the previous month as crude oil prices

moderated.

The trade deficit is coinciding with a sudden dip in export orders globally, brought about by an escalating trade war between the two largest economies – the US and China, and has led to the World Trade Organization (WTO) dimming its prospects for trade growth in the third quarter of 2018 calendar year.

The Geneva-based body brings out its quarterly forecast of global trade growth through the World Trade Outlook Indicator (WTOI) index which on Thursday showed a sudden slowdown in global export orders, stemming from slow growth in crucial sectors.

GlobalExport volume actually picked up ahead of implementation of trade and tariff barriers and will slow down dramatically over next few months. This will add further pressure on our trade deficit unless oil prices moderate sharply from current levels.

Given a strong dollar bias , I expect the INR to trade with a depreciation bias on the back of a strong dollar , tightening global liquidity, and widening trade deficit .