Key Points

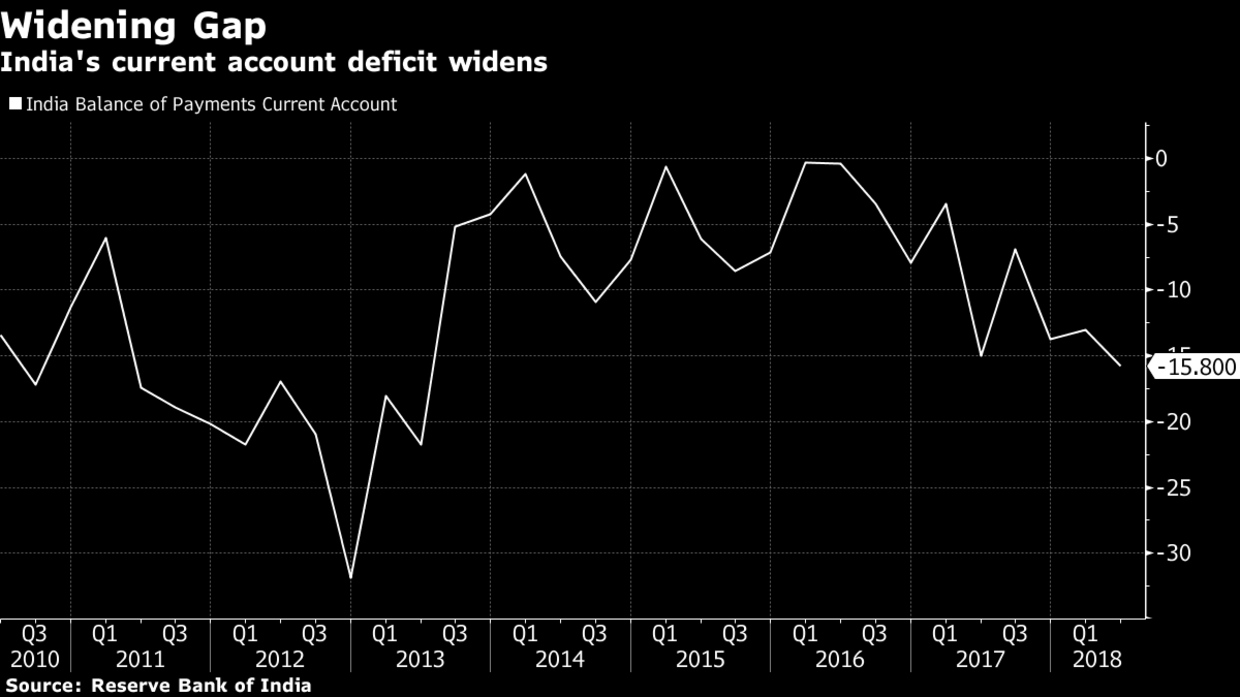

The shortfall represented 2.4 percent of gross domestic product, worse than January-March’s 1.9 percent of GDP, the Reserve Bank of India said in a statement in Mumbai on Friday. It was at $15 billion during the same period last year, or 2.5 percent of GDP

The widening of the CAD on a year-on-year basis was primarily on account of a higher trade deficit at $45.7 billion as compared with $41.9 billion a year ago, the RBI said

The better than expected reading was on account of higher remittances which grew 16.9%YoY and stood at US$18.8 bn. Higher remittances can be attributed to robust global growth and a pickup in crude oil prices. (remittances from Middle east will continue to be strong till oil prices remain high) Services receipts grew 2.1% YoY supported by software and financial services and stood at US$18.7 bn. Services receipts however declined from US$20.2 bn in the previous quarter.

The balance of payments deficit for Q1FY19 stood at US$11.3 bn largely on the back of FPI outflows of US$8.1 bn ( they are not going to return in a hurry unless US FED reverse course on balance sheet unwinding and stop raising rates) FDI stood at US$9.7 bn , up 36% YoY but still insufficient to offset portfolio outflows ( this is our weak spot and we realise the importance of FDI only when currency becomes volatile). Nirmal Bang expect the CAD for FY19 to be in the range of 2.6-3.0% of GDP, with a BoP deficit of over US$30 bn (too high in current global liquidity squeeze).

India’s twin deficits (fiscal and current account) are likely to keep the INR under pressure as EM contagion risks abound, in an era of quantitative tightening. Central bank might also have to raise the rates more than warranted at the current stage of economic cycle to slowdown the economy and curtail some imported demand

Current account surpluses are facing current account deficits of other countries, the indebtedness of which towards abroad therefore increases. According to Balances Mechanics by Wolfgang Stutzel this is described as surplus of expenses over the revenues. Increasing imbalances in foreign trade are critically discussed as a possible cause of the financial crisis since 2007.