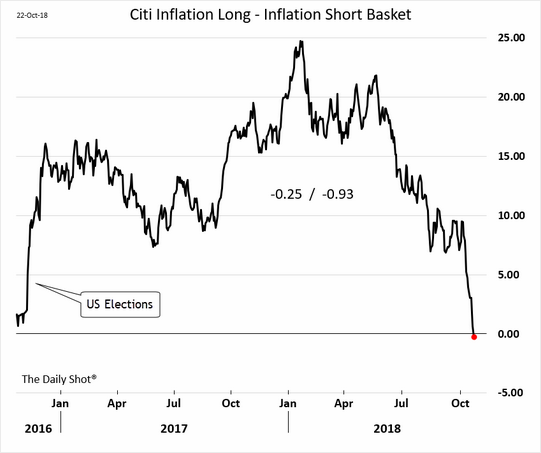

The chart shows the reflation bet gone wrong. It’s the spread between the Citi Inflation Long index (stocks that would benefit from higher inflation) and the Citi Inflation Short index (stocks that get hurt by higher inflation).

There goes the inflation trade ( I am still betting on STAGFLATION…. )

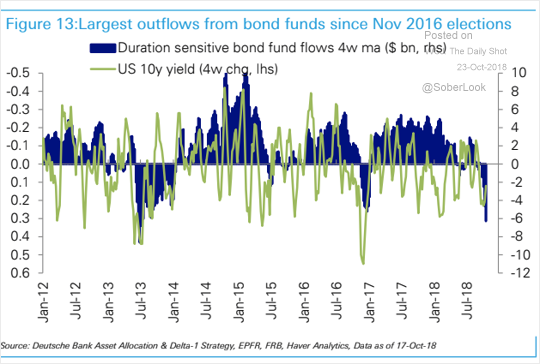

So if inflation bet is wrong then why are investors stampeding out of bond funds? Investors have not only reduced their duration in US bonds but they also have highest amount of net short position in US long bond.

I expect US yield curve to INVERT going into next year and if India raises the rates one more time in 2018 then even Indian yield curve is headed for inversion….

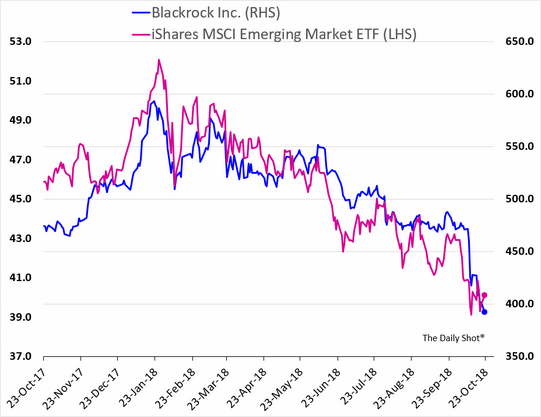

No other organization is as leveraged to FINANCIAL ASSET as much as BLACKROCK. The stock price is down 35% this year …. in line with Emerging Markets….

Keep an eye on this chart …

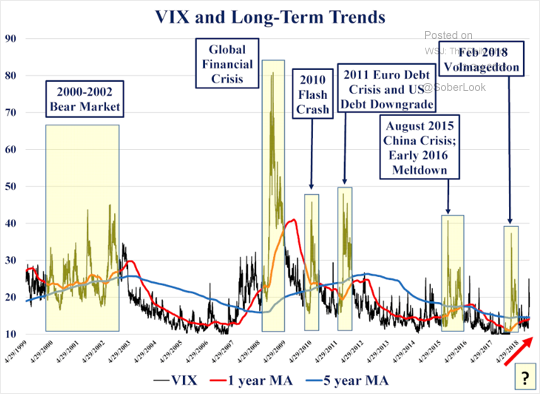

Now that we have some fear in Equity markets, lets see how high this fear has gone in past. below is the 20 year chart of VIX (volatility) …. so not much fear as of now.

Unless there is a crash like scenario I don’t expect VIX to go beyond 28 in this correction…we are at 22 now