Capital Economics writes on the Fed’s attempts to keep its benchmark rate close to the middle of its target range.

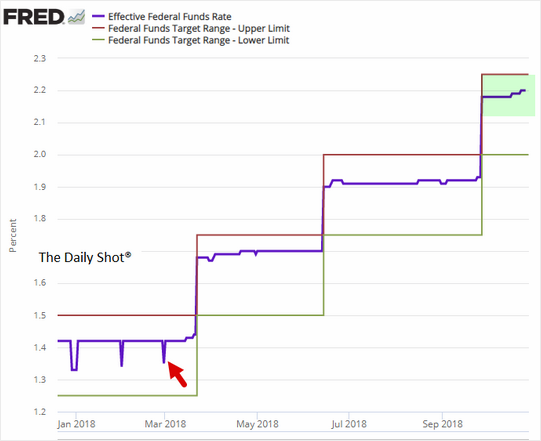

In the post-crisis world, the Fed maintains a target range for the effective federal funds rate by paying banks interest on reserves and absorbing broader liquidity via its reverse repo facility. This allowed the Fed to raise interest rates above zero with the system still flooded with reserves. Until this spring, the main challenge was preventing the fed funds rate falling below target during the end-month drop in demand for funds [red arrow in the chart below].

More recently, however, the Fed has lost control over rates in the other direction, with the effective rate drifting towards the top of its range. The Fed responded in June by raising the IOER rate, which was set in line with the upper bound of that range, by a smaller 20bp. That worked temporarily. But the effective rate has drifted up again and, at 2.20%, is now in line with the IOER rate.

My two cents

This is one of the main reason that FED is worried about overheating in the economy. When the banks have better use of money than giving it to FEDERAL RESERVE for temporary parking than the banks think money can be used to better use and at higher rates. This kickstarts the flow of money into real economy from confines of Federal Reserve, which not only leads to higher economic activity but can spill over into higher inflation.