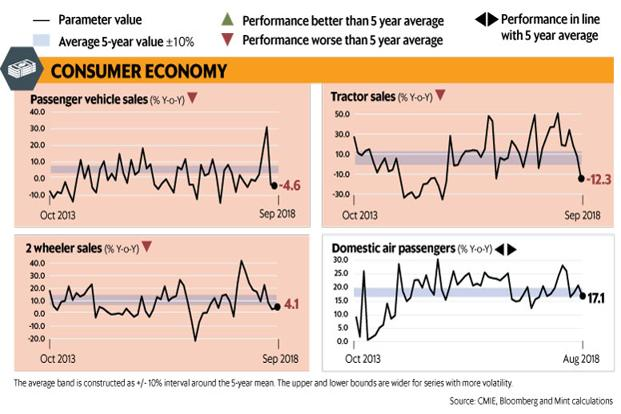

There is a Simultaneous Consumption slowdown in both Rural and Urban India

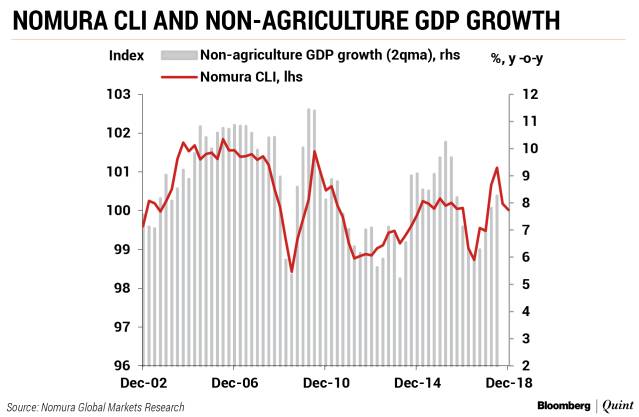

Nomura (leading index) also predict higher possibilities of negative data surprises and a policy pause by the Reserve Bank of India in the near term because of lower inflation and concerns of a global slowdown.

in equation C+I+G+(X-M)= GDP

consumption support for economic growth in recent years cannot be under stated .

Government capex and capital goods output were other indicators that declined in August, dragging down investment demand. Corporate India will not be undertaking capex in a hurry because of economic uncertainty and rapidly changing technologies. Govt is already done with 95% of budget deficit for this year, hence the onus of growth now lies on RBI expanding its balance sheet and indirectly monetising the govt deficit through aggressive Open Market Operations.

No wonder RBI autonomy is under threat because I gather they are reluctant to use their balance sheet to fund this waste full expenditure by govt which may give a kicker to growth and inflation in short term at the expense of long term growth.