US treasury 5 year yield fell below US 2 year bond yield inverting the yield curve. Not a good sign for Us economy but as can be seen in the chart below stock market historically has continued to rally for 2 years after this inversion.

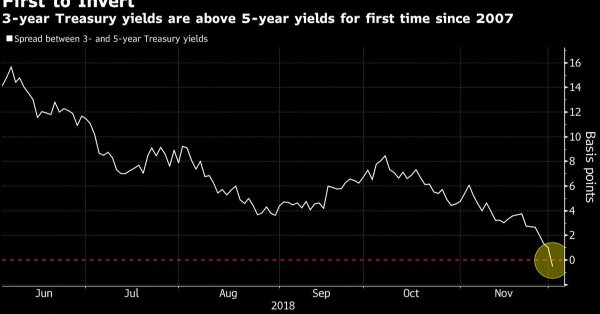

US treasury 3year over 5 year also inverted. Danielle Di Martino writes ” Courage of the Fed to raise rates on December 19 being put to the test by the market.”

US Treasury curve for 10 year also spells trouble as 2s/10s gap moved within ~14bps of going negative. If the Fed moves ahead with a 25bp hike in this month FOMC meeting, as is widely expected, the 2s/10s yield curve could easily outright invert.

if the inversion was not enough then Dr Copper also retraced all of the post US-China “truce” gains. Speaks volumes.

My two cents

Bond market is getting worried and Dr copper is not far behind in signaling that all is not well. There is no more inventory restocking led GDP to be created to beat the tariffs. It is early days but I think capital has started rotating back into Gold and US bonds as an insurance policy in spite of continued dollar strength. Any dollar weakness at this level will lead to some of this money finding its way into beaten down Emerging Markets