Variant Perception writes in their blog “Gold has been in a narrow range since mid-August, and is down about 6% YTD in USD terms. It has had several opportunities to sell off more given a hawkish Fed, a rising USD and speculators going net short, but tellingly it has remained quite well supported. Today supply, demand and global liquidity conditions are lining up for a higher gold price over the next few months.

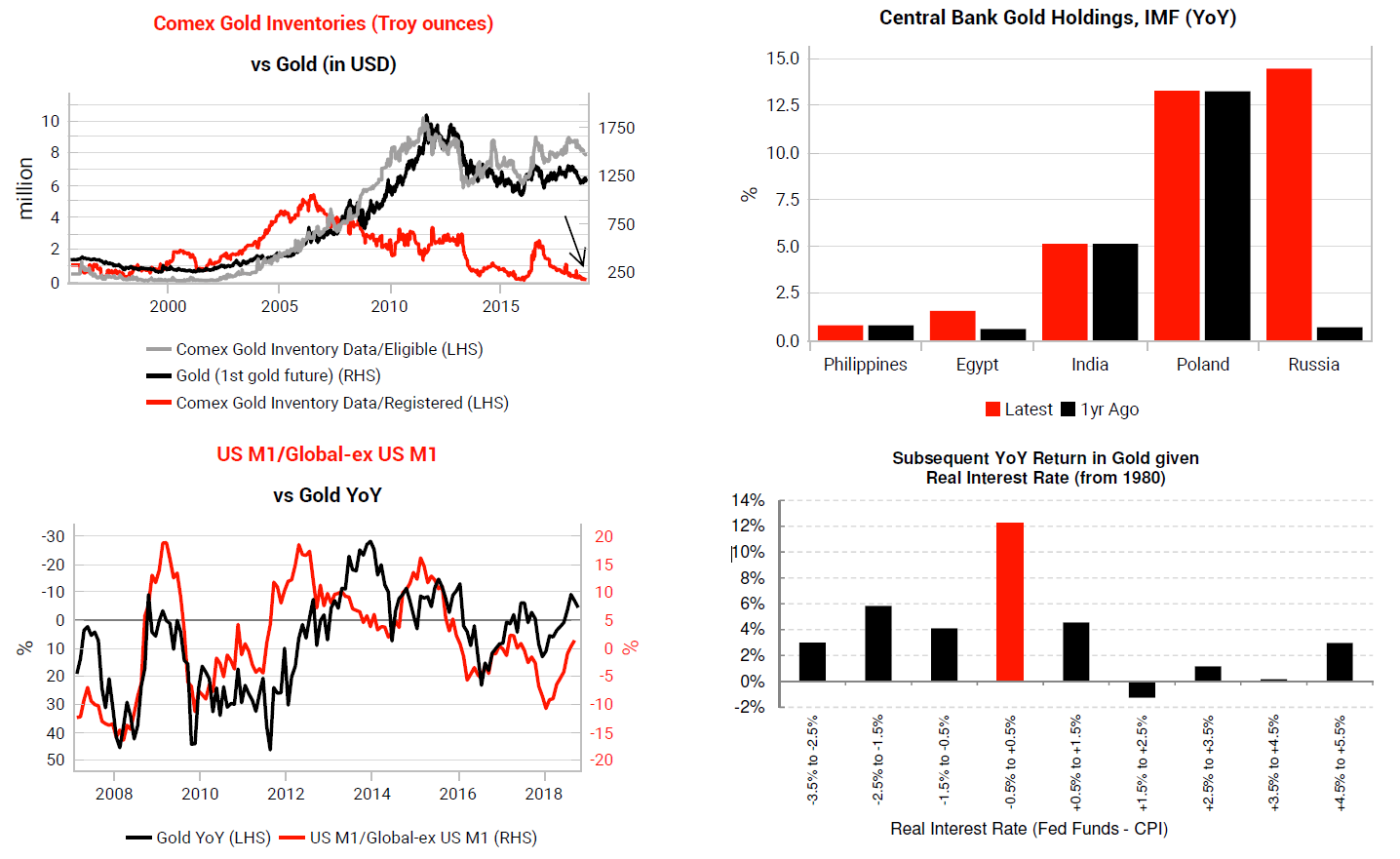

Comex, which is the futures market for gold, keeps track of its warehouse inventories. These inventories are split up into Eligible and Registered. Eligible metals are stored on behalf of banks or other parties and are not available for delivery on a futures contract. Registered inventories are available for delivery and it is these that have dropped close to their all-time lows – there are only about 4 metric tons of registered gold left in Comex warehouses, while the open interest in gold futures is equivalent to over 1,600 tons. On the demand side several central banks haven been buying gold to diversify away from the dollar (top-right chart). Liquidity conditions should also begin favouring gold, as we expect US M1 growth to soon begin lagging global-ex US M1 growth (bottom-left chart). Moreover, where real interest rates are today (last chart) are a sweet spot for gold. Finally, we think the dollar’s up move is done for now, which should also supply a tailwind for gold. ”