JPMorgan reported growth of 1% from a year earlier in commercial and industrial loans, down from 4% in the prior quarter, which Chief Financial Officer Marianne Lake said was partly because the bank had pulled back from lending in particular areas and partly because of a general slowdown in the economy. The bank also increased loan-loss reserves in its commercial-banking book moderately. On a conference call, Ms. Lake characterized the reserve build as being in “a handful of names in a handful of sectors, nothing that points to a systematic deterioration in a particular sector.” Nonetheless, it signals increased caution by the bank that the credit cycle is set to turn following years of historically low defaults.

JPMorgan Chief Executive James Dimon was frank that the bank wouldn’t hesitate to pull back more on lending if needed. “We have no problem seeing the loan book shrink,” he told analysts. “We are not going to be stupid.”

(WSJ)

This tightly correlated chart would suggest that your forward equity returns are going to be very disappointing…

@TihoBrkan: High exposure by the US households towards equities — like we see today — has historically been a predictor of poor subsequent returns. The correlation between this indicator and $SPY 10-year annualized return is close to 90%.

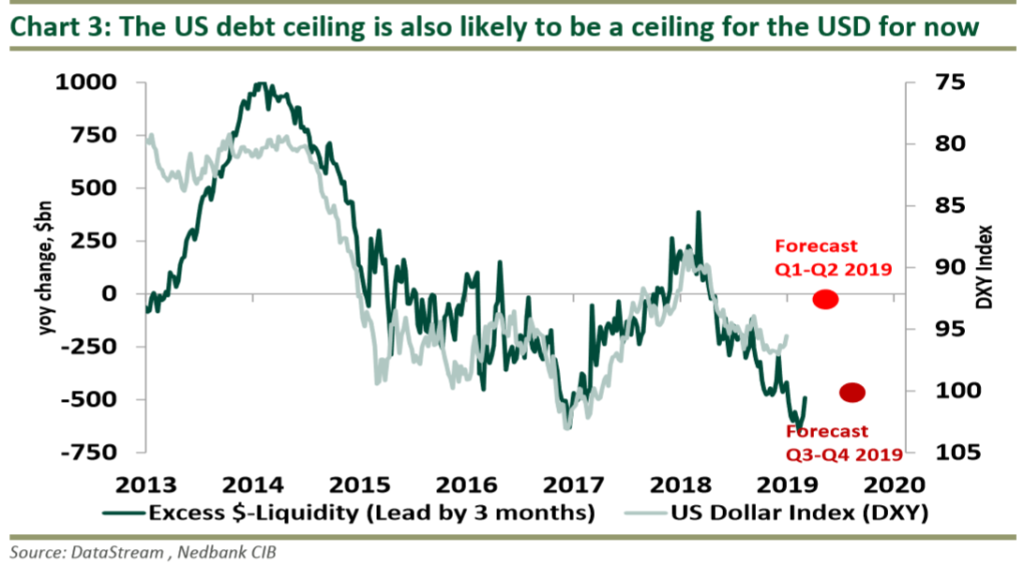

Nedbank writes…$-Liquidity is set to improve over the next three to six months amid reaching the US debt ceiling. We estimate that the excess $-Liquidity stemming from the US Treasury will offset the Fed’s “quantitative tightening” (QT) programme. This will likely be a temporary boost to $-Liquidity in the global financial system, which should ease financial conditions and support financial markets, particularly risk assets (EM) which are sensitive to the US Dollar.

The US debt ceiling (USD22tn) is a legislative debt limit on the amount of national debt that can be incurred by the US Treasury, limiting how much money the government may borrow. When the debt ceiling is reached, the US Treasury cannot issue more debt. As a result, the US government would find it difficult to fulfil many of its obligations, with unintended negative consequences for the US economy. However, the US Treasury can utilise the TGA (US federal reserve and US treasury) to inject cash into the US economy only if there is no agreement on the debt ceiling between the Democrats and Republicans before the deadline: 1 March 2019. Rarely in history has an agreement been reached before the deadline. We believe this time will be no different given the current political environment in Washington. Therefore, we believe the US Treasury will have to inject dollars into the economy and banking system via its TGA . The rise in $-Liquidity should ease financial conditions and support risk sentiment towards risk assets inside and outside of the US.