High yield issuance relative to total issuance at a decade low. it seems the Party is getting over..

US inflation about to surprise negatively. In my view US bonds are quite cheap compared to US equities

Leading indicators still point to a significant global slowdown. ECRI Weekly Leading Index Update: YoY at 6+ Year Low

Global Industrial Slowdown to Worsen With Chinese industrial growth prospects fading further, a disinflationary drag will continue to propagate through international supply chains.

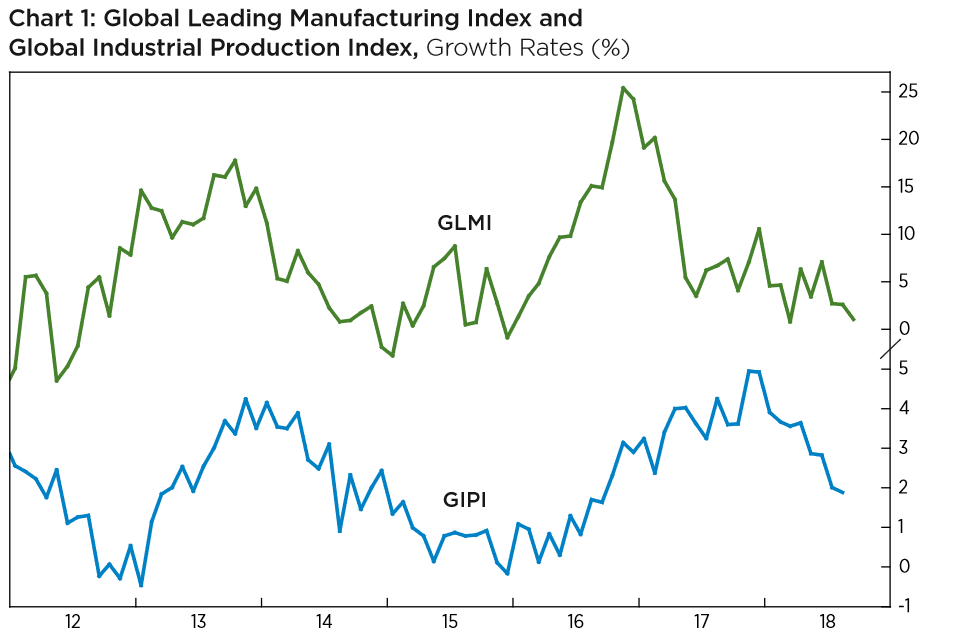

Plunging Pace of Production The global industrial slowdown we first forecast a year ago is in full swing and set to worsen. Meanwhile, with purchasing managers indexes actually lagging last November’s peak in global industrial production growth, the consensus was caught behind the curve. Since then, growth in the Global Industrial Production Index (GIPI) has plummeted to its lowest reading in nearly two years (Chart 1, bottom line). But, with Global Leading Manufacturing Index (GLMI) growth approaching its lowest reading since late 2015 (top line), GIPI growth is poised to fall further still. In other words, the global industrial slowdown is set to intensify in the coming months. In line with this cyclical downturn, growth in ECRI’s Industrial Price Index (IPI) – a measure of commodity price inflation – has nosedived deep into negative territory, having dropped to its worst reading in more than 2½ years (not shown). Given the downturn in GLMI growth, there is still more downside risk for IPI growth. Notably, this is a broadbased decline in IPI growth. Specifically, growth in the IPI’s Petroleum Products Sub-Index, having turned tail a couple weeks ago, is now approaching the lows that followed the abortive supply-driven spurt early this year. Growth in the IPI’s Textiles Sub-Index plummeted recently to its lowest reading since early 2015. Finally, growth in the IPI’s Metals and Miscellaneous Products SubIndexes tumbled lately to their lowest readings since early 2016