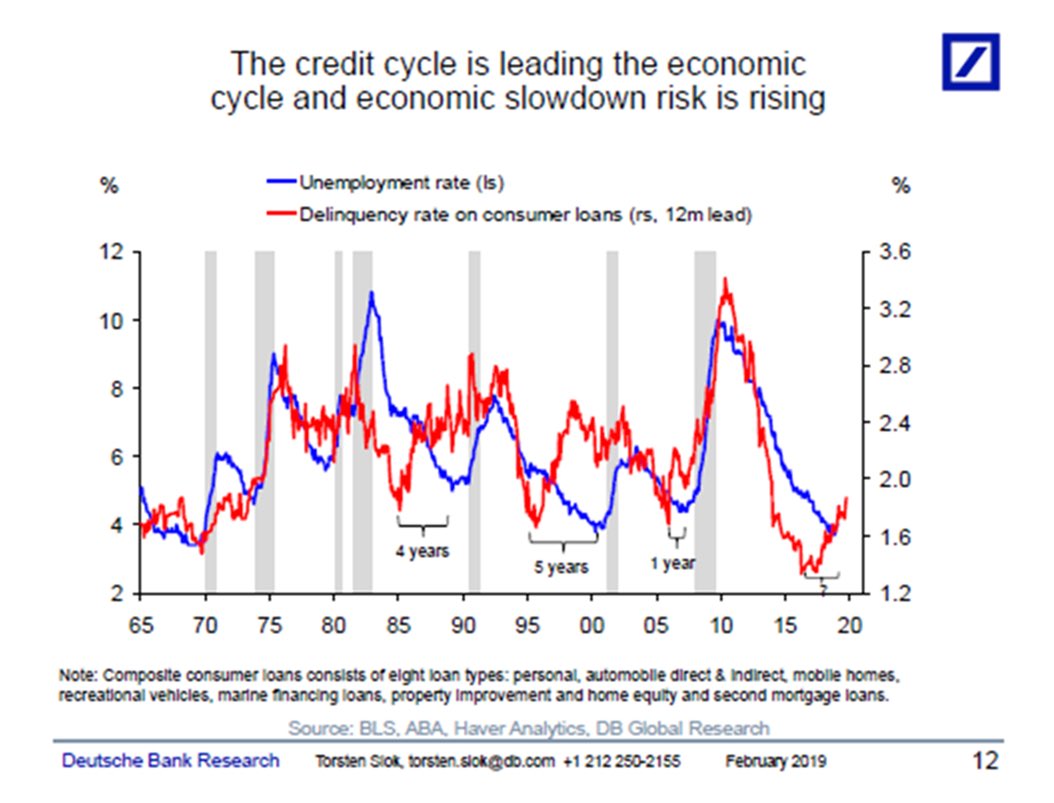

The credit cycle is not going to change because central banks keep rates low. Households and corporates see the real risk in the economy.

Dramatic rally in U.S. high-yield bonds so far this year has reduced the debt’s risk-reward proposition with stocks. Investors are earning the least extra yield to own junk bonds versus the earnings yield on the S&P 500 since October.

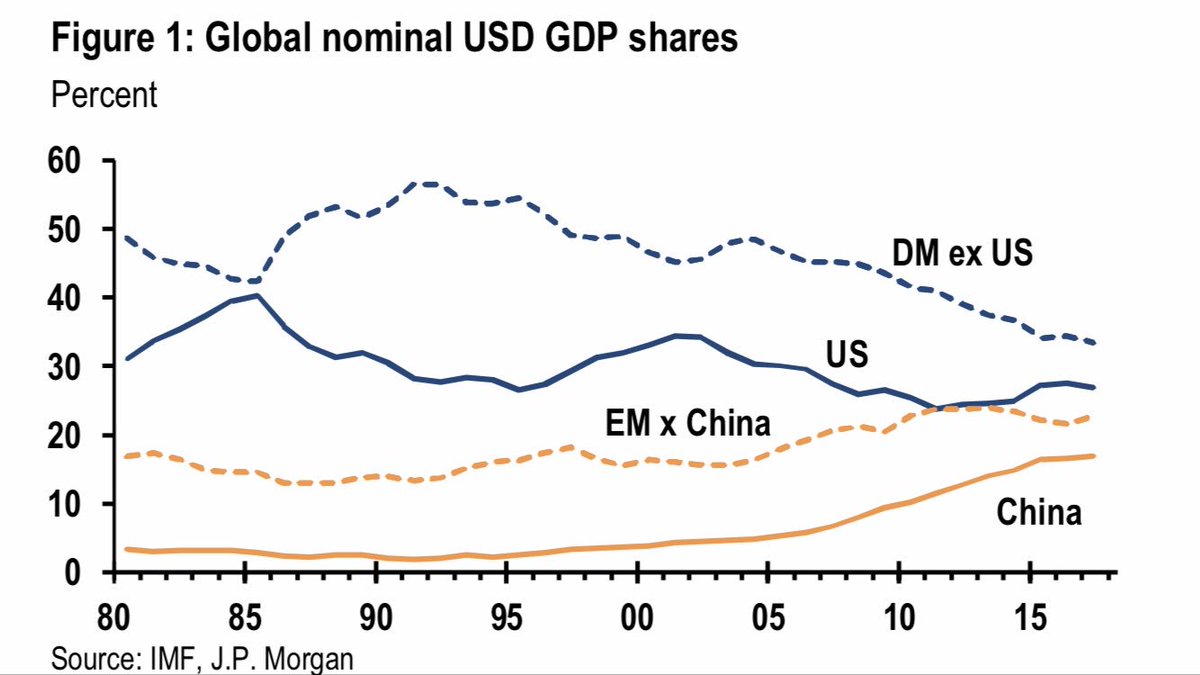

China’s share of global GDP has surged from ~3% to 17% over past 2 decades. China climb helped lift other EM economies their share of global activity rise from 16% in 2000 to 23% in 2017, JPM calculated. US lost some ground but rise of EMs largely at expense of other DMs like Japan

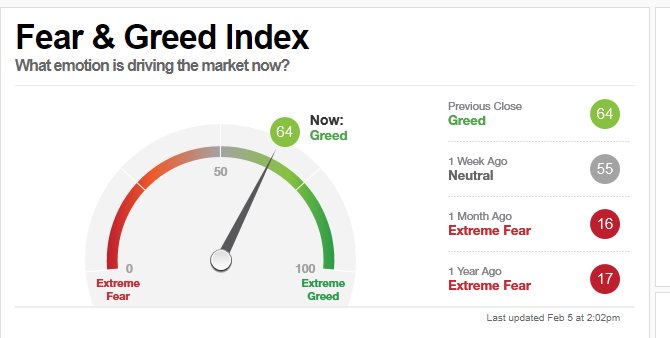

Fear and Greed. The interesting part is where it was 1 month ago and 1 yrs ago.