With sizeable increase in individuals who put their faith in central bank and corporates by investing in bond mutual funds to earn regular income or capital appreciation ,have been given a warning recently by Fitch explicitly mentioning that these bond funds are ‘a potential source of financial instability’.

The causes for the instability and probable crash in credit markets are designated by terms “global QE, prolonged low yields, technology and a wave of regulation”. The daunting new reality of dramatic fall in bond markets LIQUIDITY is yet to be learned by markets and investors.

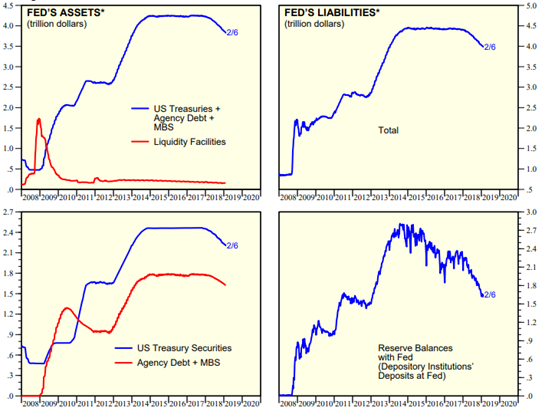

All these fancy terms hide the fact that there have been shocks in the market since Federal Reserve released a statement in 2014 about its expected approach to its Balance Sheet Shrinkage after which followed the global QE or commonly said as ‘normalization of interest rates’.

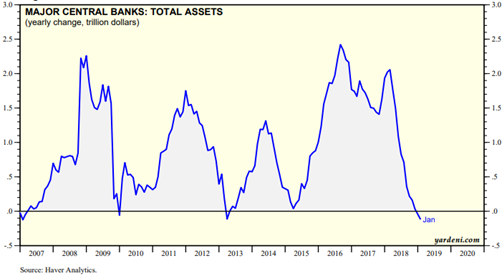

Goldman Sachs economists wrote at the start of QT that “FOMC will begin to reduce the Balance Sheet at the end of 2017. They assume that the Fed will allow two thirds of maturing debt to run off in 2018 and rest all of it in 2019. If this happens in hawkish manner it may indicate that the total Balance Sheet assets of global central banks will start to fall as a percentage of world GDP for first time since the Financial Crisis of 2009. It would be crucial at this time that the markets and investors learn to get along without massive bond purchases from central banks.“. Goldman it seems turned out to be right on mark as markets are yet to come to terms with shrinking bond market liquidity

With falling interest rates and lower yields to investors from the bond funds, the run on the fund is evitable which will complicate market health thereby leading to instability.As more and more fund managers increase their share of holding in technological companies (FAANG +M) as investors desire returns at least equivalent to market return, the more is the market overvaluing those corporates leading to bigger increase in stock prices but time is not far when the wave to invest in corporate bonds and irrationality among investors having blind faith in system and managers who are passively managing funds yet again will come crashing down.

Fitch pointed out, “Bonds of higher quality liquid issuers in recent times have traded down a percentage point or two, whereas lower quality, less- liquid names dropped three to five points…”

They further explains, “…while previous periods of micro – level stresses in bond fund universe did not threaten financial stability, the rapid growth in open end credit – funds and the significant distortions to credit market caused by QE mean that market conditions look very different now.” And indeed they do. With the crash of Third Avenue’s bond fund in late 2015, markets did react but it did not lead to tumbling down which is now the fear among most.

Conclusion

Knowing when to exit is the most fundamental aspect that people miss and they find themselves in bed with the rocks when they could have plucked flowers and walked away. Climate is changing and you’d be better off by acknowledging that this might be necessary on a macro scale and by taking responsibility by not being a part of contagion that has begun but by taking calculated risks and investing intelligently.

Bibliography:

- https://wolfstreet.com/2019/02/11/bond-funds-are-potential-source-of-financial-instability-after-years-of-global-qe-and-low-interest-rates-fitch/

- https://www.yardeni.com/pub/peacockfedecbassets.pdf

- https://www.federalreserve.gov/newsevents/pressreleases/monetary20140917c.htm

https://www.ft.com/content/603e6955-31f6-312a-a143-f70614879ec0 000000000000