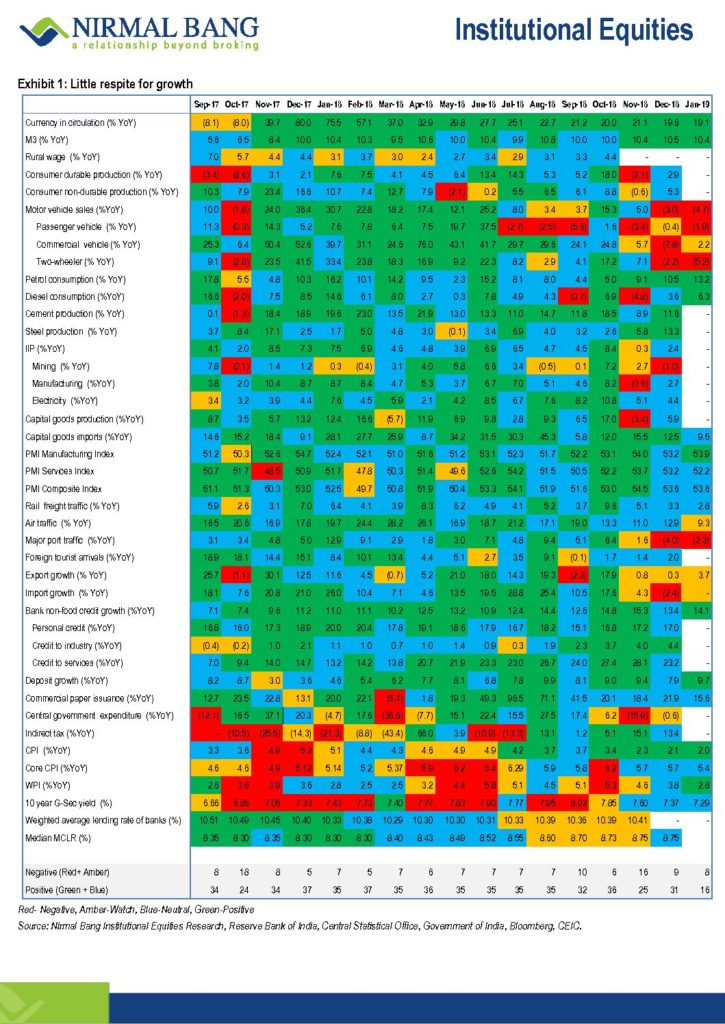

India Macro Economic Real indicators have been slowing down- as of Jan 19- Only 66.7% of indicators in positive territory in January down from 77% in December 2018.The govt is too indebted to do any meaning full capex. Corporate India is shying away from investing due to regulatory, political and technological uncertainity. Household were holding the forte till last year by going on a borrowing binge but that has also come to a halt.

Financial markets now believe that RBI will come out to rescue the economy by adding LIQUIDITY and cuting rates. I think they will try to experiment with easy money policies but the economy might not react so positively because India’s aggregate levels have been increasing faster than nominal GDP growth making it difficult for lower rates to provide meaning filip to the growth.