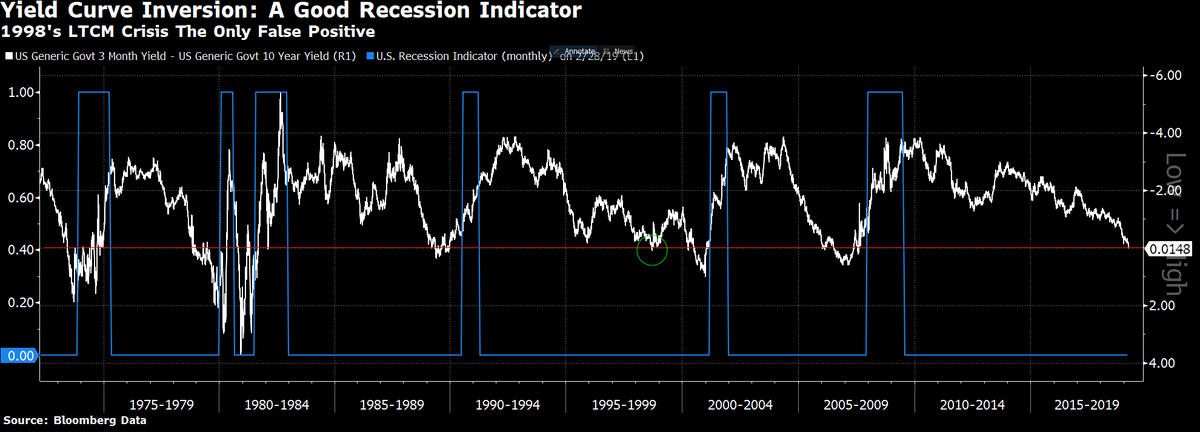

The prior 3 occurrences, 3m/10Y stayed inverted for an average of 7 months.

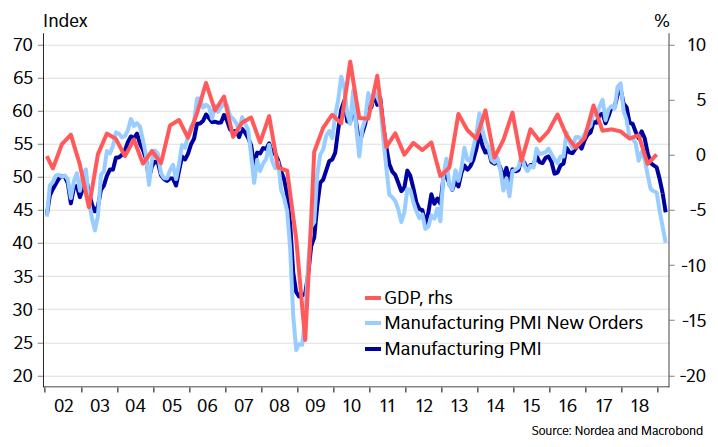

Weakest PMI New Orders in Germany since the Financial Crisis

For those asking if 3month-10year inversion is a good recession indicator – yes it is. In the post-Bretton Woods era, no false negatives, and the only possible false positive came briefly in the extreme conditions of the 1998 LTCM crisis:

Chinese economy may be nearly one-seventh smaller than officially reported (Economist)

Investors are fleeing tech: only thing keeping tech stocks higher are record buybacks