The US payroll data came out today and it was bad. Although Jobless rate is still respectable at 3.6% the new Job creation has virtually come to a halt. Markets are now pricing three FED rate cuts this year with some investment bankers sticking their neck out for a rate cut as early as this month. In LIGHT of weakening US data I thought I should put down some thoughts on “ The next recession”

The next recession

DoubleLine Capital CEO Jeffrey Gundlach held a recent webcast with investors in which the self-described “Bond King” said U.S. GDP growth relies almost “exclusively” on rising government, corporate and mortgage debt, and there is a 50% chance the economy sinks into recession in the next year. “Nominal GDP growth over the past five years would have been negative if U.S. public debt had not increased,” Gundlach said. Over the past five years, the nominal GDP grew by 4.3%, while public debt grew by 4.7%, higher than the entire country’s GDP.

Condition Comparison

Conditions today are radically different than in 2007 and 2000.

The Fed re-blew a housing price bubble but the number of jobs tied to construction, sales, CDOs, agents and even the impact on banks is a shell of what happened in previous recession.Technology is bubbly, but not like 2000.

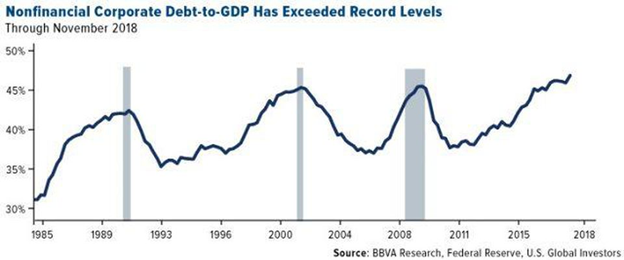

Just like subprime mortgage debt triggered the last recession, in my view corporate debt will trigger the next one. This may start a liquidity crisis and create havoc in all sorts of “unrelated” markets.

The chart below explains the weakening credit profile of US corporate sector.

Few Pointers on Impact

- We will not have bank failures in the US although Canadian Banks balance sheet are relatively weaker and are more tied to housing markets than ever before.

- There will be major bank failures or bail-ins in Europe with Deutsche Bank being the frontrunner to fail. Its stock price has collapsed 40% in last one year

- Housing will not have a major role but may strengthen the recession.

- Millennials simply cannot afford houses so housing will not lead a Fed attempt at a recovery even if interest rates plunge.

- Low interest rates and easy LIQUIDITY will keep zombie companies alive for a while longer. This problem is more acute in Europe or China than US

- Recession always bring higher unemployment, on top of technology-driven job losses.

- Retail sales will plunge because consumer debt is at an all time high

- The impact of the above is very weak profits but not massive labor disruption

- Stocks will get clobbered as earnings take a huge hit.

- Junk bonds also get clobbered on fears of rolling over debt.

- This malaise can potentially last for years unlike previous two recessions where central bankers had dry powder to bring back growth.

New tools to counter next recession

There is also a new economic theory taking shape to fight next recession i.e “MMT” Modern Monetary Theory. This theory talks about increasing government spending to fight the next recession but with a twist that all government borrowing will be funded by Central Bank printing (effectively creating money out of thin air). This radical step is already being discussed among economist because traditional monetary easing has failed in either lifting GDP or Inflation.