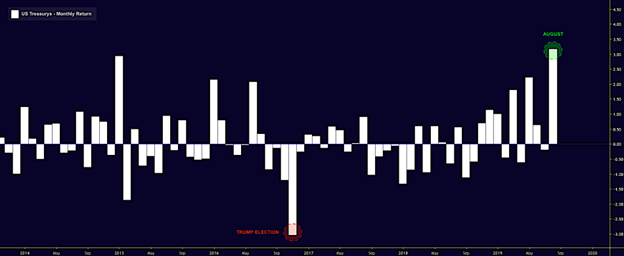

Congrats are for anyone who came into August convinced that the bond rally had (much) further to run, despite 10-year US yields having already fallen some 80bps in the first seven months of 2019. When it was all said and done, US Treasury’s posted their best monthly gain since the Lehman crisis in August, spurred along by the intensification of global growth fears, trade escalations, Brexit jitters and hedging flows into a thin market.

A benchmark index for US debt returned more than 3% for the month. I mean WOW

Central Bank Actions in August… Hong Kong: 25 bps cut New Zealand: 50 bps cut India: 35 bps cut Thailand: 25 bps cut Philippines: 25 bps cut Peru: 25 bps cut Mexico: 25 bps cut Paraguay: 25 bps cut Indonesia: 25 bps cut Jamaica: 25 bps cut Iceland: 25 bps cut Global easing……as if interest rate cuts is going to help the indebted economies get out of stagnation The world’s reserve currency (USD) also strengthened against all but one major emerging-market peers since the Federal Reserve cut interest rates in July. The trade-weighted dollar index (which is broader based than just dollar index) touched an all-time high, pushing past a peak seen in 2002.

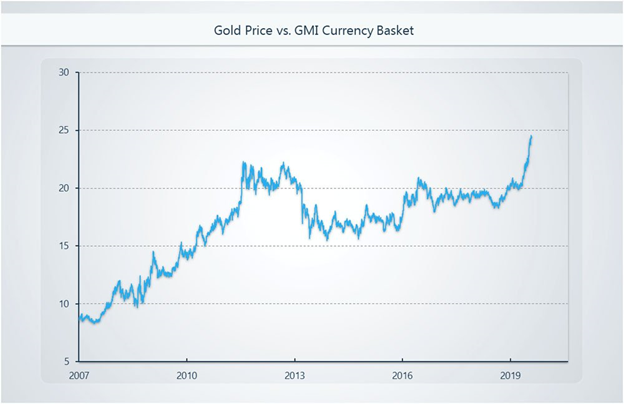

And we thought Dollar is the only reserve currency. Gold prices denominated in 27 major countries (including INR) touched an all-time high.

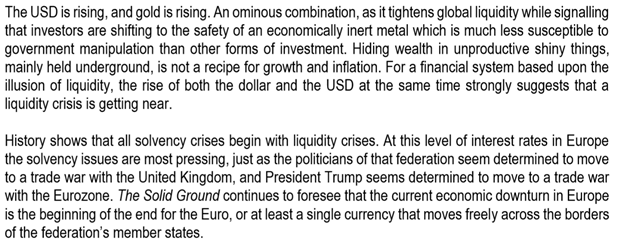

This is surprising because Gold and Dollar generally have negative correlation, but I will again reproduce an excerpt from my favorite analyst Russell Napier below.

So if you read the above you will realise the importance of Dollar and Gold rising together.

There is an added headwind of China. I don’t trust any data coming out of china, but it is an undeniable fact that Developed world assets (Bonds and Properties) over last 10 years has seen a huge influx of Chinese money looking to diversify. So, the following news from Chinese regulator along with depreciating currency just add one more dimension to the problem Global economy face at the current moment.

Market outlook

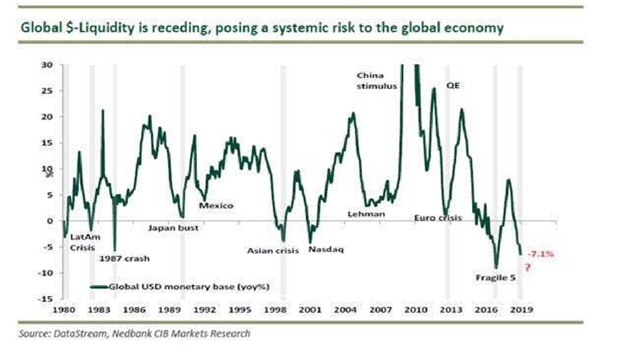

Every asset is a function of Dollar Liquidity (more dollar are good for risk assets and less dollar bad for risk assets) and as Mehul at Nedbank writes “Global $-Liquidity indicator (US $-Liquidity + Proxy for Offshore $-Liquidity) remains in negative territory and will keep on declining (deflationary bust) – the world needs liquidity”

We are at the cusp of a big change in market characteristics and it has already started with Central bankers admitting that lowering interest rates is not working anymore. There is just too much debt in the world and interest rates alone will not pull the global economy out of stagnation. What is needed is a fiscal spending to kickstart the global economy. The murmurs of spending are already getting louder in the most fiscally conservative economy in the world i.e. Germany. I think in more and more countries burden of growth will shift to Govt from central bankers.

I look at markets from Capital flow perspective and not from technical or fundamental point of view. I continue to believe that US is the cleanest dirty shirt in the world and Capital will flow from rest of the world (periphery) to US (Core). US does not see any benefits in sharing its GDP with any other country and hence picking fight wherever it has trade deficit. This only increases the allure of Dollar in the short term because most countries and corporates outside US have dollar denominated debt and global trade is still settled mostly in US Dollar.