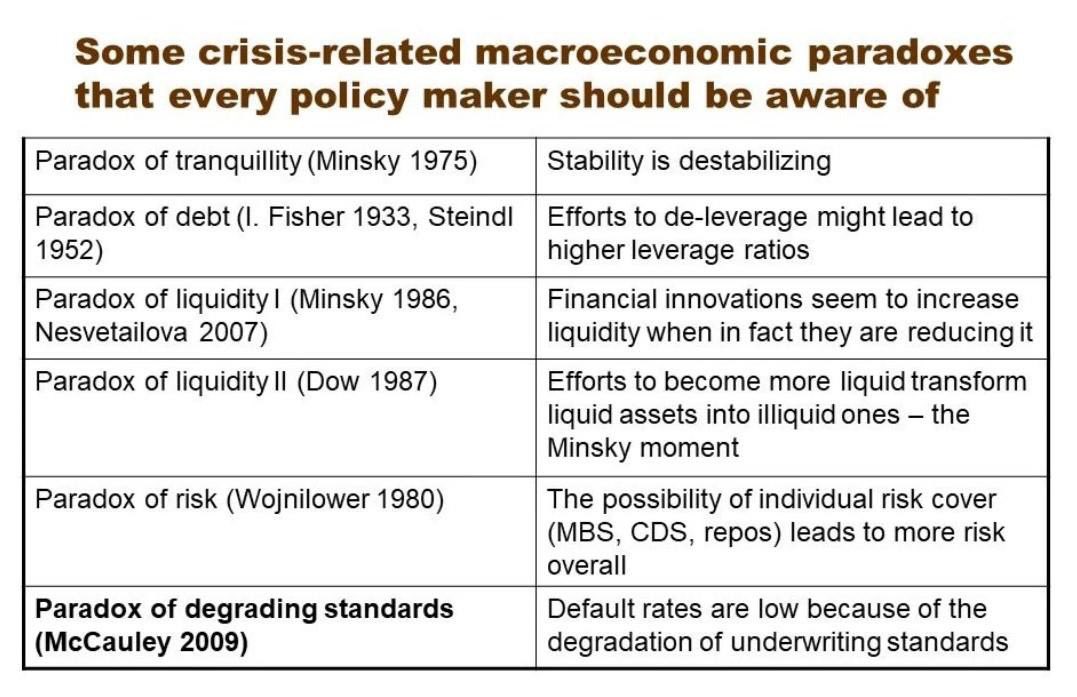

Some key paradoxes that investors don’t realise

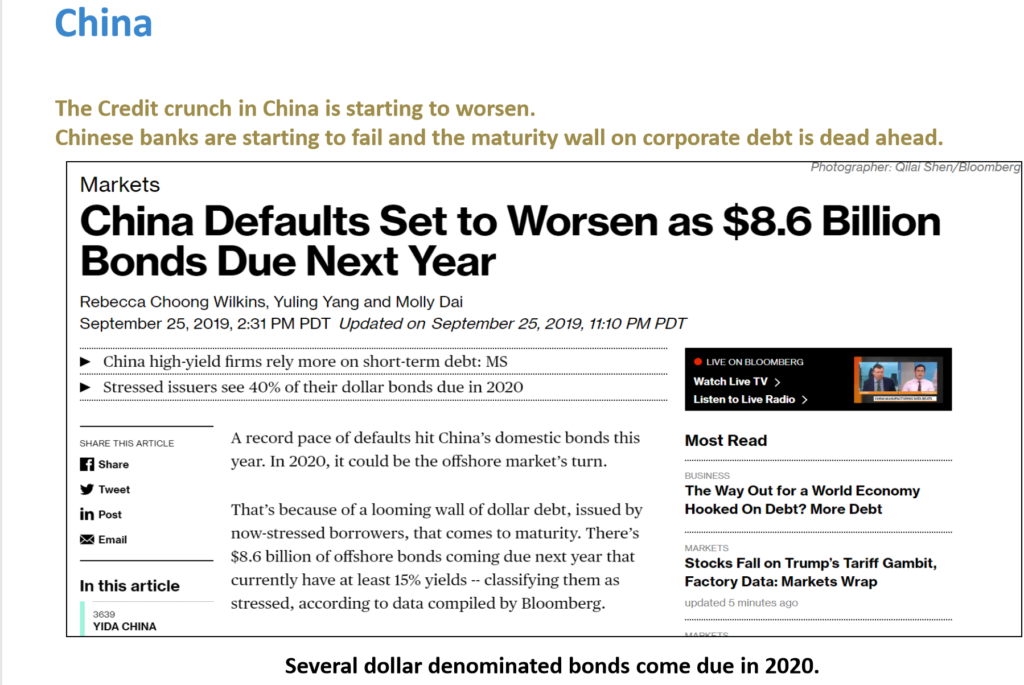

The China problem is just getting bigger

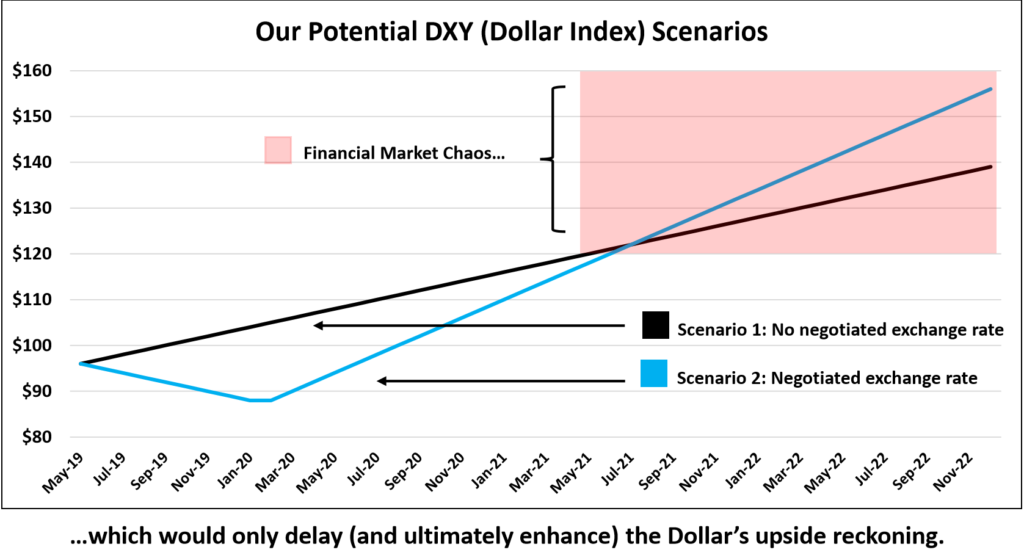

Two path for Dollar as per santiago Capital. I agree with the blue line

The Blackstone GSO credit fund is loaded with lower quality (B rated) leveraged loans. It’s interesting with stocks ripping to new highs, B rated loans are under meaningful selling pressure as downgrades mount. If credit is weakening at this pace with a U.S. economy near full employment, what will happen when stresses mount?