This crisis is about too many to fail, as opposed to too big to fail.

Well its been 20 years since I entered the exciting world of investments and nothing prepared me for what I saw in the month of March 2020. This current disruption has already eclipsed the 2008 chaos in some markets, as we suddenly find ourselves in a period in which some markets can move up and down more in one day than they did in an entire year. A bull and bear market can happen inside of a week. This cycle is even worse than past cycles because the current era of low and negative yields has seen a ‘reach for yield’ that forces market players further and further out on the risk curve and into super-illiquid financial assets such as private equity and high-risk corporate credit.

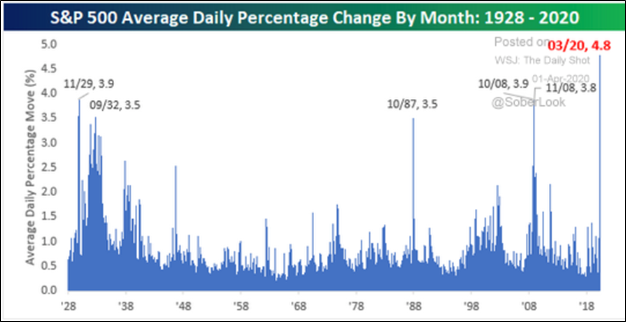

March was the most volatile period on record.

“The virus outbreak has set three major macro impulses in motion: a global demand shock, a global supply shock and an oil war that has forced prices to multi-year lows. This final development will result in an enormous destruction of capital and, soon, structural unemployment.” Saxo Bank

The Federal Reserve’s balance sheet has swelled by a historic $1.5 trillion since repo markets first blew out in September 2019, the fastest expansion in history. During the same period, the national debt has increased by ‘just’ $900 billion. In other words, the Fed has indirectly monetized every single penny that the Federal government has borrowed since September, and then some.

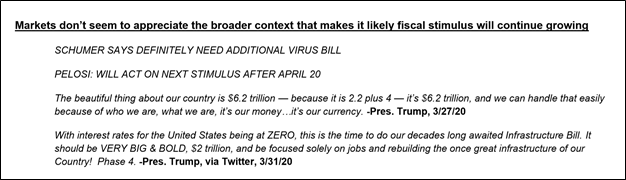

In spite of the efforts by Fed, the market is on a brink of spinning out of control as credit, which is everything in today’s market, has dried up — such that US mortgage yields are rising even though 30-year US treasury yields have collapsed. In other words, the market is tightening terms on credit even as the Fed tries to ease by cutting rates. With the central bank policy tool- box empty, I think we are on the verge of full Modern Monetary Theory (MMT), when politicians take the reins from obsolete central banks and expand spending, without constraint, from debt issuance (true money printing!). The UK budget announced by chancellor Rishi Sunak,was an early indication of this and was drawn up even before the coronavirus impacts began to crystallize. And the concept of the government filling the gap left behind on demand is now even accepted in Germany, which issued its own form of Mr. Draghi’s 2012 ‘whatever it takes’ speech in vowing infinite support to German businesses large and small through a government agency. Think of the Marshall Plan after WWII, where the US issued infinite credit to war-torn Europe in order to create demand and help to rebuild the destroyed continent. In economics, this is Say’s law: the idea that supply creates its own demand. And that will be the solution here because failure via debt deflation and a credit implosion is not an option. Governments will create money far beyond any on- or off-balance sheet constraint.

The first steps washed over the currency market with the usual patterns of risk-off behavior and squaring of crowded speculative positions. EM currencies have collapsed, the smaller G10 currencies are universally under pressure. Interestingly, the US dollar came under initial pressure against the Japanese Yen and Euro on the initial deleveraging, but later mounted a broader and more vicious rise akin to what we saw in the worst phase of the 2008-09 crash. This USD rise came even as the Fed, just as then, chopped rates to zero and launched all manner of QE and liquidity facilities.

Putting out deflationary fires = inflation?

We are convinced that the policy medicine of MMT will eventually be employed on sufficient scale to avoid deflationary outcomes. If so, and if inflation stages a sharp recovery and even begins to run hot, the key metric that many are likely to focus on for relative currency strength is the real interest rate — how much the CPI exceeds the policy rate at various points on the sovereign bond curve. Those countries overheating the printing press and running ugly, negative real rates will eventually find their currencies weakening rather than benefitting from the initial push of fiscal stimulus (I would see most emerging economies currency including India in this list).

“Never allow a good crisis to go waste”

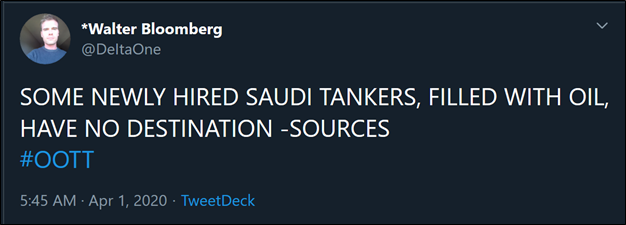

Saudis decided to take revenge on US shale when US economy was already under pressure from dealing with Covid 19 situation and they promptly opened the spigot of oil production in the world which was already in excess of 15 MBD of supply. This led to OIL prices briefly crashing below $20 per Barrel, lowest since 2002. Demand has collapsed due to Covid 19 and supply has gone up leading to a massive contango of $15 by March end ( 12 months forward crude price is trading $13-15 over spot as market expects that demand will start picking up in next few months as the current crisis dissipates) . This has led to a hilarious massively profitable investment opportunity where every VLCC is now being hired at 10 times the normal price to store the crude.

Outlook

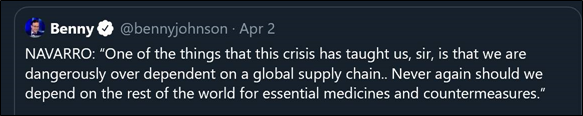

Vulnerabilities throughout global supply chains, ‘just in time’ manufacturing models and the pursuit of cost minimization above all else have been exposed by the virus outbreak. The crisis of confidence among has been perpetuated by political fragmentation, populism and pro-nationalist sentiment. This means the tailwind for the ongoing de-globalization shift has only grown — and with it, nationalism, protectionism and localization.

If low inflation has been perpetuated by globalization and a 30-year spate of deregulation, the opposite should be true down the line. But only once the global economy emerges from the deflationary demand shock the virus crisis and oil price war brings. The assumptions that have underpinned asset prices for many decades are shifting, which favors increased portfolio diversification to counter trend assets to achieve superior risk-adjusted returns. For example, by building long-term allocations to real assets that benefit from eventual higher growth and inflation — such as commodities and precious metals.

The extraordinary fiscal stimulus and a de-globalization tailwind is on the verge of overwhelming the markets and the only thing which can stop that is the rise in Dollar index. Any sustained rise in Dollar index beyond 103 on DXY will be massive deflationary and might result in equity markets breaking the low set in the month of March. We are in a battle for the dollar. It will decide whether the loss of income from rolling global lockdowns will metastasise into a debilitating credit crunch & a global depression, or instead, that we see the start of a global reflationary boom in H2 2020, and then the beginnings of an inflationary era.

The stakes couldn’t be higher. I am betting on the latter.

Ritesh Jain