As Central Bank Balance sheets rise to newer highs, and uncertainty surrounding the extent and time period to which the economy comes back online creating third order effects, we need to understand what comes next.

If we were to consider the proposition that history repeats itself or rhymes in certain ways, a few insights can be garnered.

For instance, we are able to garner that the ability of debt to generate GDP growth seems to be severely diminishing.

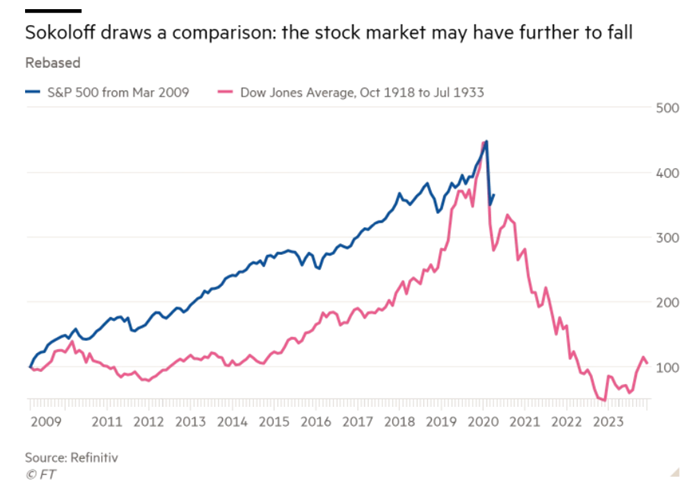

If history is a guide, stocks have further to go before they hit bottom. That’s Sokoloff’s view -Then as now, he says, “central bankers were pushing on a string”, trying in vain to whip up a real economic recovery with monetary policy.

“The more debt you add [via monetary and even some fiscal policy], the more unproductive the debt becomes,” says Sokoloff.

This fits in with the view that we are in a defining period of financial history as we were in the 1920’s. As the dollar is inflated away and purchasing power eroded, we will see that because it coincides with flight to safety towards dollar , the effect on dollar will observed with a certain lag.

“When you get debt above 90 per cent [of GDP], you reduce economic growth by one-third. And the velocity of money declines,” says Sokoloff. “So, the productivity in that debt declines too. A dollar of debt used to get you 40 cents of growth. Now, with all this stimulus, it’s about 25 per cent.”

One of the highlights of Sokoloff’s report is the list of timely historical quotes, such as this one from Montagu Norman, governor of the Bank of England between 1920 and 1944, which ran in an issue last year analysing whether the Fed rate cut of 1921 might have fuelled the boom-bust cycle of the Roaring Twenties: “We achieved absolutely nothing . . . nothing that I did, and very little that old Ben [Strong, head of the NY Fed] did, internationally produced any good effect — or indeed any effect at all except that we collected money from a lot of poor devils and gave it over to the four winds.”

As we see MMT rise to the foray where the limit to deficit financing is inflation rather than taxes, funding or any other fixed point. We will see the value of currency being eroded further which bodes positive for gold , as it captures the corresponding loss in purchasing power.

So are we heading for a default by loss of purchasing power of the currency in which it is denominated , Sokoloff concurs. As he states in fact, even with the stimulus, “there will have to be massive debt relief on both principal and interest”. Not that this is anything new; Sokoloff has been making comparisons between a previous debt-forgiving superpower — Rome — and the US for years.

https://www.ft.com/content/b8639ab6-8936-11ea-9dcb-fe6871f4145a