Trends across Asset classes

Summary

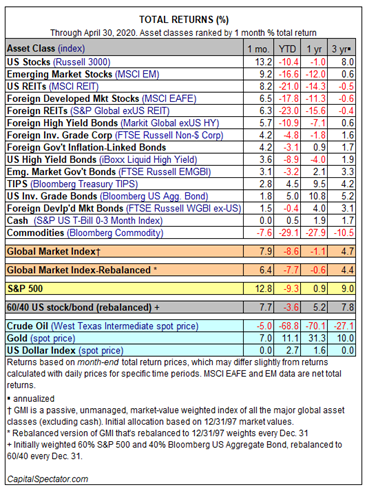

After March’s deep sea of red ink, April dispensed a relief rally in no small degree. The biggest winner last month: US equities, which surged 13.2% (Russell 3000 Index). That still leaves American shares under water by more than 10% year to date, but as rebounds go, the April bounce was the strongest monthly gain for stocks in decades.

For the year so far, losses still dominate. The exceptions: cash, inflation-indexed Treasuries and a broad measure of US investment-grade debt, primarily due to Treasuries. Gold is also in the winner’s circle so far in 2020: the precious metal is posting a solid 11.1% year-to-date gain.

Happy couple of the month and as they say one picture can say a thousand words.

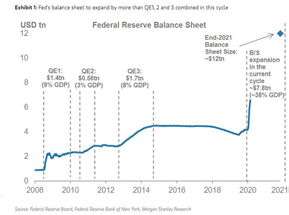

Analysts and former government officials see an erosion of the Fed’s traditional independence from politicians in the White House and Congress, as well as a central bank straying from monetary policy — the supply of dollars — into tax-and-spend fiscal policy. The risk is that “fiscal dominance” of the Fed could raise inflation or create currency and banking crises down the road, said Mark Sobel, who was a civil servant at Treasury for more than 40 years. “This crisis is blurring the boundaries between fiscal and monetary policy,” he said.-(BnnBloomberg.ca)

What lays ahead for the Federal Reserve

The rapid decline in stock prices that we just saw was a large deflationary impulse. The Federal Reserve’s primary purpose is to address and solve this type of problem. The Fed is tasked with providing liquidity and fighting deflation

The only thing holding it all together is the Fed and its ability to expand credit. Chairman Bernanke assured us that a determined Fed could always address and solve the issue of deflation with Helicopter money. The problem is the amount being printed will get bigger and bigger because all the new debt needs to be serviced. Furthermore, if buyers and holders of US Government debt decide they have better places to put their money other than US Treasuries, then interest rates will rise (i.e., less bond demand combined with greater US Treasuries supplied = lower bond prices & higher yields). But this is a real problem because higher interest rates increase the deficit requiring even MORE DEBT. So, the FED will have to buy even more of the government bond market (e.g., issue more credit/print more money) in order to keep interest rates in check. Can you see where this is leading? This is a classic doom loop. Printing money leads to more inflation, which leads bond holders to sell, which leads to the need for more printing. Eventually, when the Fed is printing money so rapidly that its value is disappearing daily then they will have another problem: hyperinflation, but that will be the hot topic of discussion late next year

This is why I say the Fed is trapped – it’s a pick your poison game for them of

(i) Doing nothing = deflation & bad recessions

vs.

(ii) Monetizing deficits but at the risk of debasing the dollar and runaway inflation

The US Government’s solution to every problem is spend money/run deficits, issue more US Treasury Bonds, and as necessary have the Fed “print more money” to monetize deficits in the absence of institutional and foreign US Treasury buyers. The perception is that this is cost free. And for a while, that has appeared to be somewhat correct. But there will surely be a cost. We just have not seen it yet. That moment will occur when everyone becomes aware that the only policy choice is to print money and that it will never be reversed. Then the cost will show up in the purchasing power of the dollar.

Printing money, in extremis, will lead to the dollar becoming worthless. Then the “music will stop”, and the rush out of the dollar will be on. Just like the German Reichsmark in 1923. In my opinion, the dollar still has value only because of tradition and recency bias.

If and when faith in the dollar begins to wane, the best indicators will be the dollar price of gold, which has been rising at 11% pa since 2015. Now at ~ $1,700 per ounce, it will achieve an important level when it takes out the 2011 high of $1,900.

Outlook

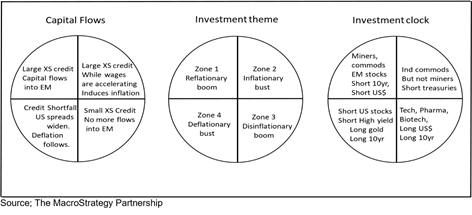

In the forthcoming cycle, the US authorities have a choice; inflation or bust? In my view, they are choosing inflation. Global excess US$ liquidity is now approaching ‘reflationary boom’ territory

The Fed’s balance sheet will expand by 38 % of GDP, more than the 20 percentage points during QE1, 2 and 3 combined.

But ultimately inflation is never caused by just one thing. It is a concatenation of supply side shocks that undermine the welfare of the median worker. It is the series of government driven demand side shocks that seek to offset those effects. And it is the impact of all of those on investor, corporate and consumer psychology that sets off a self-reinforcing inflationary process.

Today’s supply side shocks are individually less obvious than the oil crisis in the 70s. But, collectively, monopoly, globalisation, the end of Moore’s law and the costs of the green agenda etc have, in my view, delivered an even greater blow to the median Western worker’s welfare than the ‘70s oil shock. Lockdowns have accelerated the effect. The global authorities’ response to the supply shocks and the lockdowns is extreme.

I estimate that the Fed’s QE, its various loan & credit facilities and the Treasury’s forthcoming fiscal spend, will together inject liquidity equivalent to five QE1s & a QE2 in just one year. This will not be business as usual; in the coming cycle, I anticipate sustained reflationary policy from the Fed, a handover of Fed control of money supply to the US Treasury, persistent structural deficit spending, a debasement of the dollar and a redistribution of global income growth from the ‘billionaire class’ to the ‘US$10k worker’. All are inflationary. (Julien Garren Macrostrategy partnership)

History shows that once a bull market in the gold stocks gets started it often has a long way to run. Note where we are in the current bull market should be adjusted up about 35% since this chart was compiled before the Summer 2019 rally. Nevertheless, all gold bull markets post 1942 have provided returns of 300-700%. I believe the gold bull market we are currently in will outperform all of these prior examples.

More Concentration, Large Size and more Monopoly in the fray?

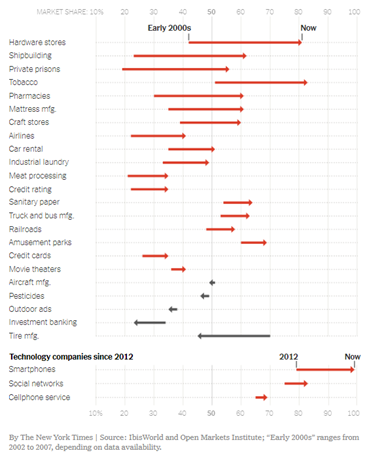

In the coming years we will deal with another side effect of Fed’s loose monetary policies, which can be seen as the Cantillon effect resulting in more mergers and buybacks.

Amazon, Facebook, Microsoft, Google maybe the poster boys of monopolisation of America but it is a wide and deep phenomenon across industries.

1. As Organizations grow larger, they become more bureaucratic, less agile and driven by cannibalization as evidenced by IBM’s buyback record driving share prices higher while the organizations core revenue and business suffers.

2. Monopolies lower productivity across the economy by reducing the amount of credit being available as a whole to newer business models and being less agile as they seek to entrench their rent seeking positions.

3. Take the word of google which finds it easier to buy in new capabilities by acquiring firms rather than developing it inhouse.

4. They ultimately sap out Medium and Small Business which lowers the overall employment levels and thereby their demand base.

Now why does all of this matter ?

It’s because we have very highly concentrated rallies in equity markets and as the productivity effects of these organisations catches up with them, along with public opinion against them we will see a step function decrease in their earning levels along with drum roll of antitrust weighing in on these stocks.

One fifth of the S&P 500’s market cap is accounted for by five big tech companies, marking the highest level of concentration for the index since the 2000 tech bubble, when equity market concentration stood at 18%, according to a note published by Goldman Sachs.

We also had Mr Larry Fink raising the spectre of higher corporate tax rates as he forecasts that only corporations will have the relatively stronger balance sheet as opposed to the Broke general public and overburdened balance sheets elsewhere.

So, while Coronavirus has driven these stocks to newer highs, cycles have a tendency to regularly break these patterns in ways that makes people look like fools every decade.

But, to estimate where we are regarding the monopolisation peaks one may have to look at anecdotal evidence which tend to become flashpoints in history. The recent handling of coronavirus related outbreaks and conditions in Amazon, Tyson foods etc seem to indicate that this trend has peaked, as labour movements are starting to pick up and the proverbial cycle will now turn in favour of labour.

To Oil or not to Oil ?

Oil is trading in a range which will bankrupt and close down a lot of supply from shale and other sources. Once the demand destruction takes hold properly, we expect just in time supply demand mechanics to kick in to equilibrate supply and demand.

On various metrics, oil is undervalued and will rise back up again in terms of price as demand picks up. But, not before making a lot of oil supply unable to come online when demand increases even modestly.

This dynamic and its current range provides significant value in the future taking into account low to moderate demand expectations as well.

What we are thereby going to see is further consolidation among all the large players who will be very well placed for when the demand comes back and other capacities shut off.

I will close with a quote from Stanley Druckmiller for the people who are getting surprised at the rebound in equities

The major thing we look at is liquidity, meaning as a combination of an economic overview. Contrary to what a lot of the financial press has stated, looking at the great bull markets of this century, the best environment for stocks is a very dull, slow economy that the Federal Reserve is trying to get going… Once an economy reaches a certain level of acceleration… the Fed is no longer with you… The Fed, instead of trying to get the economy moving, reverts to acting like the central bankers they are and starts worrying about inflation and things getting too hot. So it tries to cool things off… shrinking liquidity… [While at the same time] The corporations start having to build inventory, which again takes money out of the financial assets… finally, if things get really heated, companies start engaging in capital spending… All three of these things, tend to shrink the overall money available for investing in stocks and stock prices go down…

Druck has also said:

Earnings do not move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.

8th May 2020