Diana Choyleva of enodo economics is a long term china watcher and she has just written a report on

It will be harder for china to increase its share of global manufacturing and exports because of

-Rise in Productivity adjusted labor costs

-change of rules of engagement between US and China.

-Coronavirus causing countries to rethink their reliance on China.

A move towards localization away from globalization based on national security risks. This will lead to lower efficiency and higher costs.

From the Global Financial Crisis to 2016 the value added by China was one quarter now it is over one sixth.

The “Made in China 2025” plan it set out had a goal of increasing the domestic content of core components and materials from 40% in 2020 to 70% in 2025.

However, even as China’s was climbing up the value chain, the size of china’s economy was already proving to be a headwind. Even though china’s average standard of living was only one fifth of America’s Purchasing power parity.

Little countries can go on capturing shares in world markets until their income per head catches up. Big countries cannot, unless they make those markets commensurately bigger. China’s development has not made markets commensurately larger. Global consumption grew by just 2.7% a year in real terms in 2001-2018, down from 3.2% in 1971-2000. Instead, China’s economic policies contributed to a global savings glut that precipitated the GFC in2008 and shares the blame for the weak global recovery since then.

China’s pool of cheap labor allowed it to catch up regarding low value-added assembly of industrial processes. Within a decade it had saturated global output and capacity in low value-added industries.Since 2008, China’s share of global manufacturing value has risen at a slower pace, but china cannot make up for most of the world manufactures.With rise of 5G, the clash of Chinese and American ideologies is nowhere more fundamental than technology.

The Yuan-dollar peg has been a disaster for the global economy. For past 25 years yuan has been pegged or managed against the dollar, while being massively different in economic and political structure.

The peg was the foundation of imbalances that led to GFC, its rectification has led to this current decoupling.The peg allowed china to industrialize fast while protecting it from vagaries of international capital flows. China failed to understand the pegs usefulness was over as China became big. Initially Americas debt financed consumption of Chinese surplus products helped the peg chug along. But after the GFC, the adjustment of America consuming less and china consuming more and producing less did not happen.For both countries the fastest and most beneficial route to achieve this rebalancing would have been a big nominal exchange rate adjustment and the freeing-up of capital flows in and out of China. This did not happen though.The rebalancing did happen via increase of China’s relative labor cost eroding its competitive advantage with respect to USA. Wages in China rose four-fold with respect to to wages in USA which rose by only 34%. The effective revaluation of bilateral relative unit labor costs and the tariffs Trump has imposed on Chinese goods are now almost sufficient for US manufacturing to rise as a share of GDP, either through substituting imports for domestic products or gaining export share or both.

Wage and lower productivity growth have lifted china’s labor costs. While demographics have also reduced pool of cheap labor. The demographic trends cannot be reversed by China for the coming decades and China is not receptive to immigration. So, the demographic trend is going to exacerbate further.

Easy productivity gains from shifting workers from agriculture to low value but high productivity manufacturing has been exhausted.Although efforts have been made towards creating a skilled workforce it has not fructified and workers remain unequipped for automation and knowledge intensive manufacturing.The other major issue is that college graduates prefer to work for SOE’s than private sector enterprises where bulk of the jobs are.

Post 2011, China export led growth model had reached its end date. China however poured more money into investment with an increase of debt to GDP and structural growth decline.China’s development was premised on a closed capital account to accumulate large domestic savings and use them to subsidize its industrial rise with underpriced credit. This led to Chinas consumer spending as a % of GDP to fall to 34.4% in 2007.As migrant labor force declined, the share of wages in GDP increased. As medical care and social security provision improved, households savings rate started to decline. Chinese today have two thirds of their wealth in low interest-bearing deposits leading to booms in investment cycle at the cost of reduced returns on household wealth.Wealth management products and other shadow banking products provided few more percentage points than their savings accounts, which led to urban consumers to save less. Rural economy initiatives and E ecommerce was used to unlock pent up spending and lower household savings rate.Household Credit share of GDP rose in 2011 from low levels to dangerously high levels in 2016, after which Beijing started reining in shadow banking sector to reduce systemic financial risk. The once booming P2P lending industry crashed inflicting huge losses leading to a lot of protests.

In a potentially important reform unveiled in August 2019, the central bank replaced its benchmark lending rates with a market-based alternative. The PBOC has phased out its benchmark lending rate, but not its cornerstone deposit rate. Policymakers worry that competition among banks would raise deposit rates and damage government efforts to lower borrowing costs in order to help cushion the economic slowdown.

Property is one of the principal assets that Chinese hold and Xi’s attempt to arrest house price inflation while making sure house prices don’t crash meant household owners had to scale down future wealth expectations. His policies have a cumulative effect of sapping urban household wealth. tax and other measures to stimulate consumption are targeting rural Chinese and those on lower incomes, not urban high earners. But with towns and cities accounting for 80% of consumer spending, rural households, struggling to upgrade their skills, will find it hard to carry the economy on their shoulders.

Thus, the author sees three paths forward for Chinese policymakers –

- Financial liberalisation is good but means a higher cost of capital-

Full liberalisation of financial markets and interest rates would allow transition of cheap capital access to private firms as opposed to overcapacity creating SOE’s.

- Household financial repression, supply-side changes and old-style investment-led growth will sap the availability of credit-

Continuation of investment led growth would mean ever more larger debt problems. losses as estimated by ENODO estimated for banks were around 19% of GDP. Chinese government leverage is at 50% of GDP which means these and further losses can be cushioned and will reach 75% of GDP. According to ENODO China has five years to wean itself off of its reliance on debt to power its development.

- The three Ds of dealing with excess debt – default, demand deflation and devaluation –

Since GFC China’s Current Account deteriorated while its capital account improved due to capital intervention. Similarly, the government can carry out a sharp devaluation in a short time. China has $3.1 Trillion stockpile of Foreign Exchange reserves and can withstand one or two years of Capital Outflow, while maintaining exchange rate. If China’s current account swings into the red, Beijing’s ability to keep its command-and-control show on the road will get that much harder

For foreign companies, the business climate is turning increasingly chilly as a result of Xi’s determination to strengthen the grip of the Communist Party in every sphere of Chinese life. The Party has been formally represented within foreign companies for years. A survey conducted by the Central

Organisation Department in 2016 found that 70% of them had a Party cell or a Party-controlled union. Under Xi, however, these bodies are becoming increasingly assertive. China is preparing a corporate version of the “social credit” system it is already using to punish people for anti-social behaviour. According to the EU chamber, companies are being rated by different agencies for their compliance with regulations; those found to have violated rules are blacklisted. Beijing plans to combine those ratings into a single database that could be up and running in 2020.

“The overall outlook has shifted from cautious optimism to cautious pessimism.” US firms, regularly criticised by Trump for manufacturing in China instead of back home, will be conscious of the need to stay on the right side of public opinion when they make their investment decisions.

Over the Years China has focussed on cutting electricity and logistics costs for its producers, however its current use of water resources is clearly unsustainable.

There was overcapacity in power generation and as the market liberalised prices fell along with government stepping in many times to slash prices. The National Development and Reform Commission, China’s state planning body, cut administered electricity prices by 10% in 2018, another 10% in 2019 and has pledged a further cut in 2020. Beijing’s focus has also been to wean itself off of coal and shifting to costly but less polluting sources of energy. Reducing overcapacity also means that 1.3 Million workers will have to find jobs as a result.

As a share of GDP logistics costs have already declined sharply in the past few years. The price of express parcels, the main delivery method for e-commerce firms, has fallen steadily. In May 2018 it halved the vehicle purchase tax for trailers carrying goods for a period of three years. It also halved the land-holding tax on bulk commodity storage facilities leased by logistics companies.

Overall water resources in China are not significantly more constrained than in the UK. But the problem is that 80% of the water is in the south, but 85% of China’s coal reserves are in water-scarce provinces in the north and 64% of arable land is also in the north. Agriculture accounts for 62% of China’s water consumption, power and industry for 22% and households for 14%. Twelve northern provinces suffer from water scarcity, eight of them acute, and they represent 38% of China’s agriculture, 50% of its power generation, 46% of its industry and 41% of its population. China has 20% of the world’s population but only 7% of its water. The water crisis puts the ambitions of Xi’s “Made in China 2025” strategy in an important light. A failure to set far higher water prices now, while understandable in terms of social stability, will exacerbate the water scarcity problem in the longer term.

ENODO Reshoring Index

China’s industrial sectors ranked by likelihood of a shift in production back to the US with 0 being most vulnerable to reshoring.

According to the Enodo Reshoring Index, the sectors most likely to move back to the US are automobiles, electrical machinery and equipment, wood processing and chemicals, rubber and plastics, along with the rail, ship and aircraft sector and pharmaceuticals

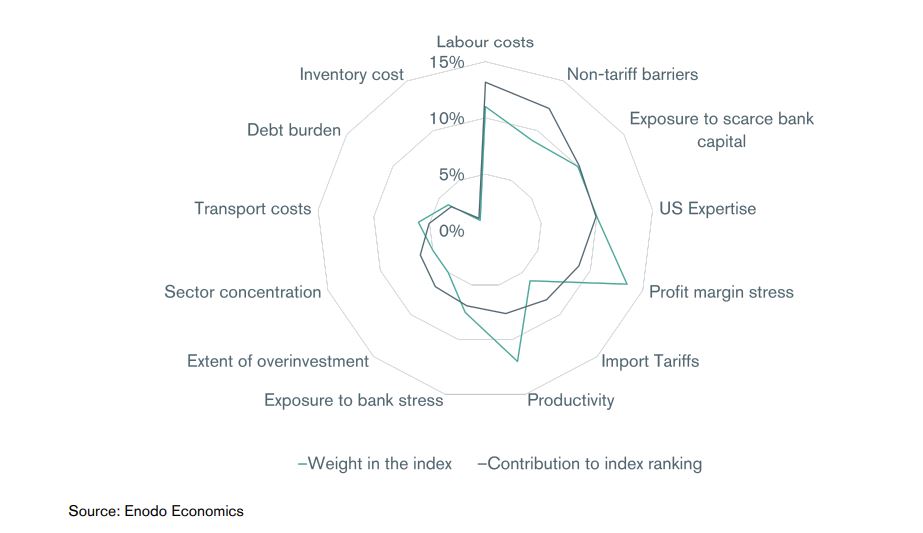

Enodo Reshoring Index category weights and the contribution of each category to the index ranking for

the top ten sectors most likely to reshore.

Link to the Full Report –