Summary- Real Vision interview

Marko Papic and Mike Green — The Next Decade for Geopolitics and Markets

Geopolitical activities will be a cause for concern. But, the major driver is going to be domestic politics in US, China, Europe and around the globe. The reason is low growth, secular stagnation compounded by Covid-19.

The Great financial crisis was not like the great depression as post the depression, debt levels did not fall dramatically now were there high number of defaults. The 2008 seems more like the 1920s where it was a big financial crisis.

Investing based on macro means how would one look at today’s scenario 10 years from now. It all depends on the chart of the year and its directionality. So, we have covid 19 which lead to wartime level spending but no war.

Most important trend is shifting away from the 40 year old Washington consensus. The transition is happening towards a new consensus at a rapid speed. Investors who were bearish thought a great depression was coming. Great Depression was about policy. It was about going into a crisis. As Treasury Secretary Mellon said, liquidating everything. It’s like tightening the screws of pain on the American economy so as to cleanse the system. That was the obsession they had at the time. The recession was tackled with austerity and lowered government spending in the early years of the depression.

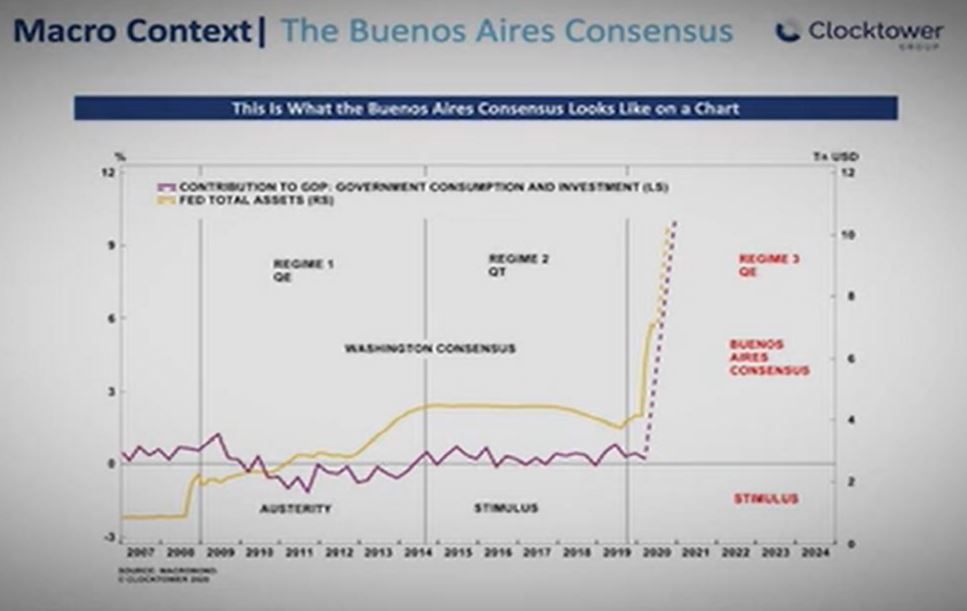

But, we have an extraordinary fiscal response which requires a new framework of thinking about politics. We are transitioning from Washington consensus to Buenos Aires consensus.

Washington consensus were about free trade, privatization, central bank independence, fiscal prudence and fiscal policy becoming apolitical.

Buenos Aires consensus is the opposite, it’s about democratizing the institutions related to Washington consensus. It means basically short term gain, long term pain.

Fiscal policy was not in the limelight a lot except for the 2013 fiscal cliff. While the federal reserve monetizing the debt is important whats different this time is that the previous we had a stimulus it was five months into the crisis to the tune of $850 billion and was passed completely along party lines.

After that within 18 months in wake of the 2010 midterm election, we had the tea party revolution where there was talk of usa ending up like Greece. The political revolution was based on fiscal prudence and austerity became the guardrails of monetary stimulus. If you’re going to stimulate fiscally, we’re going to pull back monetary support. You’re going to have huge monetary stimulus, we’re going to pull back fiscal.The reasons we did not have inflation was other than the balance sheet recession , it was the lack of fiscal policy. From 2010 to 2016, US had the most longest and deepest self imposed austerity, basically government was not contributing to GDP growth.

There is a revolt inside the republican party with regards to the tepid $1 trillion package passed. It doesn’t mean that Mitch McConnell or Rand Paul, or Republican senators whose constituencies might be still fiscally conservative, it doesn’t mean that they’re not going to put up a fight, but they’re going to lose.

Nancy Pelosi has sniffed out where the Median voter is in this country which is in favor of left leaning policies. What Nancy Pelosi did is she drove this incredible strategy of just saying more and more stimulus to trump to the extent that we now have trump campaigning against her.

If Mitch McConnell does not allow the stimulus to happen the unrelenting ads against trump regarding him cutting their unemployment benefits will cause him to lose massively. If Joe Biden wins, he is not going to allow a fiscal cliff to happen as he just now won because of these left leaning policies.

This is the mechanism by which we end up in the new consensus where the size of fiscal stimulus is bid up. The new administration that comes into power next year will say if I stimulated earlier why can’t I stimulate again to avoid a fiscal cliff.

This is why the market is not worried about a blue wave, as a democrat next year would mean that capital gains and corporate taxes are going up. But the market is overlooking the tax and regulatory changes because of its addiction to fiscal policy.

Politicians don’t care about ideals only they just try to win, they feel if they win they can pursue their ideals. Therefore, the median voter is the price maker in the political marketplace and the politician is the price taker.

The great recession in 2008 exacerbated the inequalities, US has a very high median income but middle income as share of total population , but it is very low.

For the first time in history the millennial voter is the median voter and millennials and Gen Z cohort are the ones worst affected by this crisis. Policy makers will simply respond to their policy preferences and if they don’t. They are going to compete against someone who does respond to the policy preferences of the millennial. Last time there was the tea party revolution this time there wont be one.

Now, if US which is the bulwark of the Washington consensus does not back it up, everyone around the world will also abandon it and politicians all around the world are going to surprise us. The fiscal situation is going to last longer than people think and inflationary pressures will build up.

Shifting focus towards Europe , the perception that Europe wants to create a super state to rival US is overblown but so is the narrative that it is going to subjugate the common man to supranational sovereignty. The European union is uniting not out of arrogance or strength but weakness. This is a world in which European countries actually have a geopolitical imperative to continue to integrate. In a world of large states that protect their markets, suddenly scale really does matter. European Union is a protectionist economic bloc that has a geopolitical logic and that logic is strengthening not weakening.

Italy may have a bout of populism in the next 5 to 6 years, which will be an opportunity to buy risk assets as the Italians will renegotiate rather than leave. Long term Europe will stay together, so with china stimulating Europe is ahigh beta play. Euros role as the reserve currency could go from 20% to around 25 to 30%. But EU is not going to be the next global power. Europe is going to do well and one should have a skew towards cyclicals when investing. As Manufacturing shifts from china to Vietnam, Malaysia, Indonesia, East Africa they will need infrastructure and factory building which they will acquire from Europe. Europe probably stands to benefit from deglobalization because it gets to play both sides, and it’s going to be very difficult for the United States to enforce European compliance to its position on China. So, Europe will benefit from Chinese demand or the rewiring of supply chains that will again require some of these cyclical companies to get revenue from the rewiring. Rewiring of supply chains is not all negative for everyone. The last time in 2001-2008, when China entered the WTO, that was hugely beneficial for Europe, emerging markets and other cyclicals and commodities, the industrialization of China and the rewiring of supply chains to include China as a central cog in supply chains. Rewiring of supply chain may hurt S&P 500 as they will have to dip into the revenues profit margins to rewire their own supply chains. That’s not bad for Europe, which could participate in the rewiring.

A lot of countries took the last decade to be the decade of American decline. I think that there is something to say that China moved too quickly. There seems to a policy setting in China to not to respond to the Trump administration with any real increase in tensions. So, while there is the tit for tat policy occurring, its complying as much as it can to the phase one trade deal. China is opening up its domestic economy because it needs foreign investors to go in and professionalized capital markets. If that setting of Chinese policy persists most people will be surprised by how muted Chinese policy will be with respect to united states.

There are red lines like Hong Kong , Taiwan which they are not going to compromise on , but they are opening up to foreign investment. We are in a world that is not going to clearly bifurcate and instead we are entering a 19th century world where there’s still investment and trade going on between great powers. Most people think in terms of the us vs ussr cold war but that era was different as you had only two clear powers. Instead we are in this multipolar world. That multipolar context has real implications for how the enmity between China and the US will articulate itself from an investment perspective.

After 28 July and Mike Pompeo’s historical speech , the Australian delegation visited and while they were with us on some issues but they will keep trading with china. However, it requires American defense in order to properly protect its sovereignty given its close linkages with China. This is really important, because if America can’t keep its allies in line, it means that they will stab the US in the back in order to get revenues from China, Airbus will pick up the slack that Boeing leaves on the table by pulling out of China. the real critical issue because what we know from history is that when you have this multipolar context, where allies can’t keep each other in line, they capitulate and they trade with the enemy. The one from the 19th century shows that the United Kingdom traded with Germany right up until the start of World War I. I could have also shown you French trade with Germany, Russian trade with Germany. These were three countries , the triple entendre. They were allied defensively against Germany, and they all expected for 20 years before World War I that there would be a war. But , they still traded because if one partner like UK didn’t protect its commercial interests , then France would pick up the revenue left on the table. It’s going to be very difficult for the US to disentangle from China, because he can’t control its allies the way it did in a bipolar context. However, the probability of conflict in south china sea over Taiwan is a clear threat, but this is going to be a multi decade rivalry and that should not be a reason to stay way from S&P 500. However, because there are chances of conflict one needs to position themselves defensively and be in gold and defense stocks.

Source : Real Vision Interview