The world is awash in LIQUIDITY and till now there is no reason to reduce risk from portfolio.

The article below published in Zerohedge is a good indication of what happens if policy makers starts getting cold feet on keeping system awash in LIQUIDITY

Kiwi Soars After New Zealand Central Bank Asked To Add Home Prices To Monetary Policy

by Tyler Durden Tue, 11/24/2020

The New Zealand dollar soared overnight, reaching a two year high, bid up by shocked FX traders who learned that Finance Minister Grant Robertson sent a letter to the central bank expressing concerns over how low rates have stoked home prices.

In a stunning development, Robertson asked the Reserve Bank of New Zealand to add home prices to its monetary policy remit, a proposal which would crash any prospects for further rate cuts or additional bond-buying programs.

Remarkably, just two weeks ago traders had been pricing in over a 50% chance of a rate hike implying negative rates by the end of 2021; however then the central bank projected a more upbeat view of the economic recovery and added a lending program that led traders to price out the chance for negative rates. Following the Robertson letter, the odds of a rate cut tumbled to less than 25%.

“Today’s announcement just reinforces the notion that negative rates are less likely in New Zealand,” said Prashant Newnaha, senior rates strategist at TD Securities in Singapore. “The economy has held up remarkably well.”

In kneejerk response, the kiwi surged as much as 1.1%, briefly topping 70 U.S. cents, the highest level since June 2018. The currency has risen almost 6% this quarter, leading gains among the Group-of-10 peers against the dollar.

“We were already positive on the New Zealand dollar, largely reflecting a bearish U.S. dollar view, but more confirmation of the end of the easing cycle in New Zealand supports that prevailing view,” Jason Wong, strategist at Bank of New Zealand, told Bloomberg.

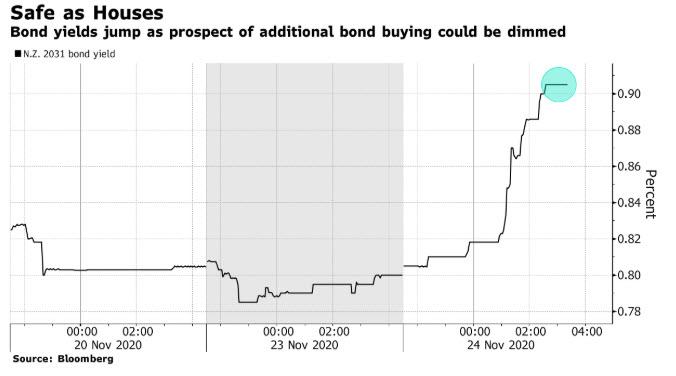

The dramatic reversal meant that while at the start of the month, the OIS market priced more than 40 bps of cuts by end of 2021, after the finance minister’s statement this tumbled to just 5bps. And as rates markets traded out the likelihood of rate cuts, New Zealand’s 10-year bond yields jumped over 10 basis points to 0.905%, more than double a low in September.

The turnaround in expectations has come swiftly, and surprised most traders. Consider that it was just one month ago, on Oct. 14, when Assistant Governor Christian Hawkesby said that the RBNZ wasn’t bluffing on the prospect of negative rates. The central bank’s ownership of the nation’s outstanding nominal sovereign bonds has also surged from 6% to just just under 40% in the seven months since it introduced an aggressive quantitative easing program.

The problem is that just like in the US, this has translated into runaway house inflation. Home prices, which were expected to drop in the pandemic, have jumped with a record low policy rate of 0.25%. Average prices gained an annual 8% in October, spurring Robertson to urge the RBNZ to consider how it may contribute to a stable housing market.

In short, at least one central bank is starting to realize that keeping rates lower for ever may not work in an economy where the housing market is already overheating. We wonder how far US home prices will rise before Powell (and Brainard after) decide that it’s time to do similar damage control in the US…