via themarket.ch

We are dedicating this week’s “Big Picture” to a special topic: Bitcoin.Specifically, we want to investigate the question of whether the cryptocurrency deserves a place in a diversified portfolio.Bitcoin is stirring emotions in the financial markets. It has increased by around 132% since the beginning of the year, albeit with considerable fluctuations. On January 1st, a Bitcoin cost $ 7200, in the panic wave in March it sank (intraday) just below $ 4000, rose to over $ 10,000, shot up by 80% within six weeks from mid-October and is now correcting violent for two days:

But this should not be about the short-term fluctuations, nor about speculation about how long the current correction will last – but about the question of whether Bitcoin deserves a place in a diversified portfolio.The answer is likely to frustrate you. But read for yourself.We approach the question in five chapters:

- The narrative

- Is Bitcoin an Investment?

- What is the fair value of bitcoin?

- Bitcoin in the portfolio

- The investment case – or: the meaning of jewelry insurance

display

Sponsored Content

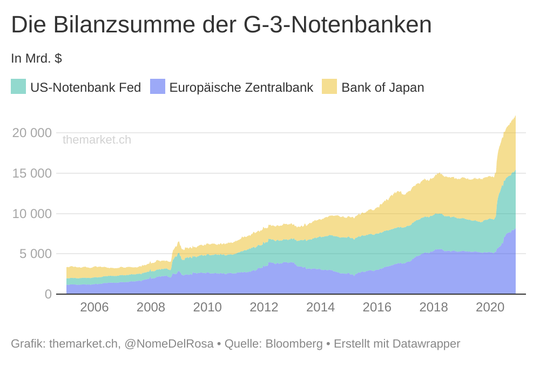

E-Sports & Gaming – the next professional sport? A market worth billions has emerged from the former niche market for gaming and e-sports. Learn more 1. The narrativeAt this point we refrain from spreading the history and the exact functionality of Bitcoin. For the purposes of this analysis, it is important that Bitcoin has existed for a little more than ten years and runs on a decentralized booking database – the blockchain. It is “money” (more on this later) that is neither controlled by a government nor a central bank.There are currently just over 18.5 million Bitcoins in circulation. The amount is limited to a maximum of 21 million bitcoins. Around 330,000 new Bitcoins are currently being added each year, with the number of existing Bitcoins rising in an asymptotic curve in the coming years until the last Bitcoin is “mined” in around 2140.Put simply, Bitcoin is a stateless currency whose money supply only grows according to strictly defined parameters and which has an upper limit. So it’s tight.That brings us to the narrative, which is why Bitcoin is coming into focus in 2020.According to calculations by Bank of America, states around the world have fiscal and monetary policy measures totaling 21 trillion to combat the economic consequences of the pandemic. $ decided. The three central banks alone, the Fed, the ECB and the Bank of Japan, have accumulated their total assets by more than 8 trillion since the beginning of 2020. $ expands.

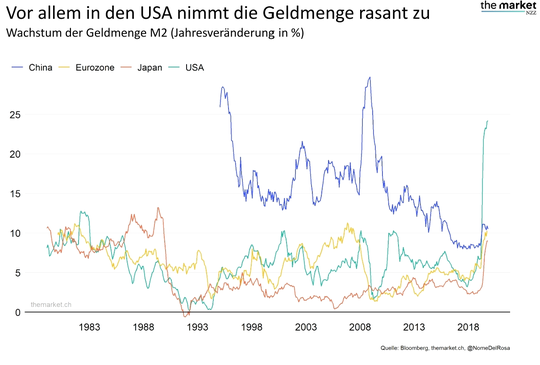

The broad money supply, defined as M2, is increasing in all major currency areas, in the USA currently with an annual expansion rate of more than 24%:

The US budget deficit has risen to over 20% of gross domestic product, and the cumulative level of all debts worldwide should be 277 trillion at the end of the year. $ which is about 365% of world GDP.The list could be expanded at will, but the picture is clear: Debt is increasing, as is the amount of paper money. This feeds the fear of a devaluation of the paper currency.If the amount of money in monetary system A can be increased at will, while the amount of money in system B is fixed according to strict rules, it is obvious that the interest of investors and speculators in the currency of system B will increase.This explains the increased interest in Bitcoin and gold, the amount of which cannot be increased at will either.Another factor was added to the narrative for Bitcoin in 2020: Well-known “dinosaurs” from the hedge fund world, for example Paul Tudor Jones in May or Stanley Druckermiller in November , publicly said they had bought Bitcoin to protect against future inflation. Established financial institutions such as Fidelity and JPMorgan also expressed their confidence, and at the end of October the payment processor PayPal announced that its customers in the USA could now also trade Bitcoins.As Rino Borini puts it in this Fintool video , the cryptocurrency has “grown up”.2. Bitcoin an investment?We described Bitcoin above as “money” in quotation marks. Is Bitcoin money at all?Something is considered money if it fulfills the following three functions:

- Means of payment

- Store of value

- Arithmetic unit

Bitcoin fulfills these functions, even if – given its high volatility – not too efficiently.Studies, for example here , have repeatedly shown that far more than 90% of all transactions with Bitcoin are not of a commercial nature, but are carried out by speculators. In the concrete application, Bitcoin is not used as money for economic exchange transactions, but as an investment for investment or speculation purposes.That leads to the next question: is Bitcoin an investment?(Inset: Bitcoin is only one of more than 7000 cryptocurrencies. With a market share of more than 60%, however, it is by far the most important, which is why we limit ourselves to Bitcoin.)In short: yes. There is a market for Bitcoin in which around 350,000 transactions currently take place every day. There are enough market participants who attach a value to Bitcoin, which enables observable pricing (although this does not mean that this pricing is rational).An aggravating factor in any form of analyzing the quality of Bitcoin as an investment is the fact that it has only been around for a little over a decade. The first bitcoins were created in January 2009, and a time series of fairly reliably observable prices has existed since around May 2010.This is far too short a time series to provide reliable information about the behavior of Bitcoin as an investment. For example, during those ten years in the United States there was:

- no cyclical recession

- no structurally rising inflation

- no structural bear market on the stock market

- no structural bear market on the bond market

- no completed rate hike cycle by the US Federal Reserve

- not a systemic financial crisis

The history of Bitcoin so far has taken place in a generally good-natured environment, in which pretty much every asset class has gained in value and there were only short phases of shock – for example in December 2018 or March 2020.This note is also important because ardent proponents of cryptocurrencies like to mention that Bitcoin is the “most successful asset class of the last ten years”.It would be more appropriate and correct to state that Bitcoin had a market capitalization of zero in January 2009 and that it has increased to just under $ 315 billion to date – i.e. all existing Bitcoins multiplied by the current value of $ 17,000 each.Bitcoin has therefore grown from a startup to a small cap and now a large cap, as Tesla, for example, succeeded in doing over a similar period of time. No more and no less.Of course, this statement is not intended to diminish the revolutionary character of Bitcoin as an alternative to paper currency or its success in global distribution. Bitcoin has prevailed among thousands of cryptocurrencies and has increased its market share from 48% to 66% in the last three years, according to Statista . The network effect works. As it becomes more widespread, the likelihood that Bitcoin will no longer disappear also increases.In summary: Bitcoin is now an accepted investment, the market capitalization of which is in the range of an American blue chip share. Everything we know about pricing and the behavior of participants in the Bitcoin market is based on an observation period of just ten years, which was characterized by a structural bull market in most asset classes.That brings us to the next question.3. What is the fair value of Bitcoin?An asset – a share, bond, property – usually generates an annual cash flow that can be used to determine an “intrinsic” value for the investment. This value is subject to uncertainties in the estimate – what are the future cash flows? With what interest should they be discounted? -, but at least a guideline can be established.With established currencies issued by central banks, things get more complicated because their value fluctuates in the form of exchange rates in relation to other currencies. With tools such as interest or purchasing power parity, however, it is at least possible to determine approximately “fair” valuations of a currency.Bitcoin does not have such an anchor. Because Bitcoin is stateless, parity calculations are not an option, and because Bitcoin does not generate any income, no intrinsic value can be determined.This is also gold’s dilemma, but gold has a history of several thousand years as an accepted store of value.To put it in the extreme: A Bitcoin is only ever as much as the next buyer is willing to pay for it. This is one of the reasons why speculative excesses repeatedly occur in the Bitcoin price (more on this in Chapter 5).Speculating in an investment with no intrinsic value always contains an element of the “greater fool” theory: I buy the investment assuming that I can later sell it to a bigger idiot at a higher price.However, it would be wrong to say that Bitcoin is worthless. First, the observation applies that the value of all Bitcoins in circulation is currently around $ 315 billion. Second, like for gold, the marginal production costs can be used to define a kind of minimum value: It currently costs, depending on the estimate, $ 4,000 to $ 7,500 in hardware and energy to “mine” a new Bitcoin. If the market price falls below this, it is no longer worthwhile for the provider to mine more Bitcoins.Thirdly, a possible value can be approximated: As the investment strategist Lyn Alden calculates , the total value of all investments worldwide (stocks, bonds, real estate, etc.) is around 400 trillion. $. The total value of the around 200,000 tonnes of gold that has already been mined in the world is a little less than 10 trillion. $.Gold’s share of total world wealth is 2.5%, Bitcoin’s share ($ 315 billion) is less than 0.08%. The value of Bitcoin can therefore be viewed as a function of the question of what proportion of their wealth the world’s population would like to invest in Bitcoin. If no one wants to hold Bitcoin, the value is zero. If the Bitcoin share rises to a third of the gold allocation (i.e. 0.8%), then the value should rise to ten times its current level.Of course, all of this is of no use in answering the question of whether the current Bitcoin price of $ 17,000 is “fair”. No, it’s not him. Or: It’s just as fair as $ 7,000 or $ 70,000.This is important for the next question: What role can Bitcoin play in the portfolio? Sponsored Content

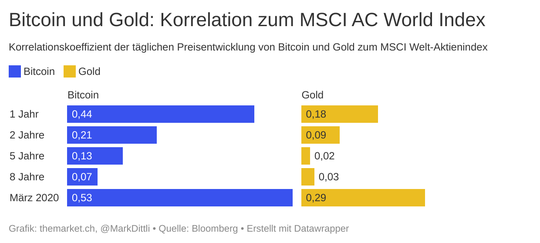

Three myths about responsible investing sports & gaming – the next professional sport? For most long-term investors, future capital growth is a top priority.Learn more 4. Bitcoin in the portfolioThe purpose of portfolio diversification is to combine different assets, the price development of which correlates differently with one another. In a portfolio with, say, 60% international stocks, it is therefore particularly interesting to add assets that do not correlate – or even negatively – with stocks.So how does the price development of Bitcoin relate to the price development of stocks?Here, of course, the problem arises again that the time series for Bitcoin with ten years is too short for a reasonable statistical statement.With this reservation, we carried out a correlation analysis of Bitcoin and gold to the MSCI All Country World Index based on Bloomberg data. The following graphic shows the result:

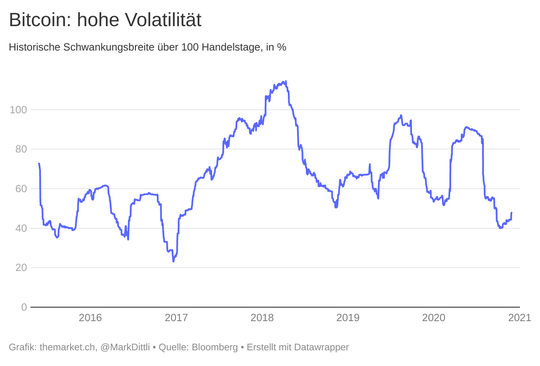

Bitcoin shows a weak positive correlation to the stock market over the period of two, five and eight years, comparable to gold. Viewed over the short period of one year, the correlation is significantly higher. In March 2020, when a wave of panic swept the markets and the exchanges crashed, the correlation between Bitcoin and the MSCI AC World skyrocketed.From this – very rudimentary – analysis it can be concluded that Bitcoin plays a similar role in the portfolio context as gold and only has a slightly positive correlation to stocks. However, Bitcoin clearly did not show anti-fragile qualities under stress conditions (March 2020).The volatility of Bitcoin is also significantly higher: the gold price fluctuated between 10 and 20% around its average over the past six years in a 100-day perspective.

The fluctuation range of Bitcoin in the same observation was meanwhile between 50 and 100%.

In a direct comparison to gold, Bitcoin cannot score points in the context of a portfolio. The diversification effect, measured in terms of the correlation to the stock market, is slightly worse, the stress resistance is lower and the volatility is about a factor of 5 higher.But that doesn’t mean that Bitcoin has no place in the portfolio. Sponsored Content

Sustainable

investing in credits This framework gives credit investors access to the best of both worlds. Our SDG credit strategies 5. The investment case –

or: the meaning of jewelry insuranceBitcoin is a scarce asset in a world in which the amount of paper money is expected to continue to grow strongly over the years. Bitcoin has also clearly come out on top among a variety of other cryptocurrencies and is gaining popularity. This leads to a network effect in which the market leader becomes stronger and stronger.Bitcoin cannot be controlled by governments or central banks, and Bitcoin allows its owner to easily move wealth across national borders. It is therefore no coincidence that the demand for Bitcoin has increased in recent months, especially in countries such as Turkey and Argentina, as Dylan Grice from the London-based asset manager Calderwood Capital wrote in a customer letter.Now an important additional factor comes into play: The amount of new Bitcoins that are created every year halves roughly every four years. The supply of new Bitcoins that come onto the market is therefore constantly decreasing, which is expressed in the asymptotic quantity curve mentioned at the beginning.In jargon, one speaks of “halving” in this context. In the first halving cycle, from 2009 to the end of November 2012, the miners received 50 bitcoins for each new block on the blockchain. In the second cycle, from November 2012 to July 2016, there were 25 bitcoins. In the third cycle, from July 2016 to May 2020, the “prospect’s wage” halved to 12.5, and since May 11, 2020, when the fourth cycle began, there are still 6.25 bitcoins.This will continue in the next few years with further halvings.It is now interesting how the Bitcoin price has moved in each case. Here you can see the course graphs for each of the four cycles:

It is noticeable that in each cycle the Bitcoin price experienced a spectacular speculative bubble within 12 to 18 months of being halved before settling down at a higher level.Each cycle ended at a price level that was around 15 (3rd cycle) to 150 (1st cycle) times higher than at the beginning of the cycle.Here, too, the following applies: four observation periods are far too few to extract reliable findings. But the pattern of the first three cycles repeats itself in the current fourth cycle, then the Bitcoin price is currently only at the beginning of a speculative bubble formation. And in 2024, when the next halving is due, the price – again based on the last three cycles – would have to be many times higher than today.And that brings us to the core question: Should a “normal investor” buy Bitcoin?We cannot emphasize it enough: Ten years of history do not allow any reliable statements about the price behavior of Bitcoin. We just don’t know enough. Short-term statements are useless anyway in view of the volatility.Maybe the Bitcoin price will crash again. But there is also the possibility that it will follow its previous pattern and rise significantly higher in the coming years – as a scarce commodity in an inflationary environment. We do not know it.Therefore comes the train to what we at this point already once as jewelry Insurance have called ( “idiot insurance”): you buy for a reasonable amount, for example 2% of the total portfolio, Bitcoin. This can also be done using tracker certificates – in Switzerland for example from Leonteq, Vontobel or Seba.Then you are there with a small investment and don’t have to feel like jewelry when the price goes up. But the stake has to be small enough that it doesn’t hurt if it is halved or quartered. And please: don’t let the volatility drive you crazy.