Because LIQUIDITY creates Fundamentals and not the other way round.

1987- US equity market crash led to Fed cutting rates – Dollar went down, and the capital moved into Japan and Japanese real estate.

At one-point Japanese imperial palace was valued more than the entire Manhattan. The bubble finally burst, and Japan has not seen those levels in equity markets even after 40 years

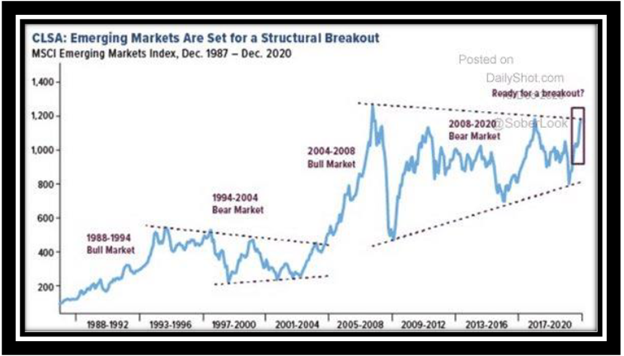

2001- Tech bubble crash led to Fed cutting the rates – Dollar went down and the capital moved into Emerging markets creating a bubble in EM

2008-9 crash led to Fed cutting the rates- Dollar did not go down and the money remained in US creating the US markets and US tech bubble (we are in late stage of this bubble)

2020- COVID-19 crash led to Fed cutting the rates- Dollar goes down and the money starts moving into Commodities and Emerging markets creating a bubble (we are in early stage of this bubble)